In recent months, Sam Altman’s open-source protocol Worldcoin (WLD) has faced increasing legal challenges as Portugal and Spain cracked down on its biometric data collection practices. Argentina has joined the list, issuing an indictment against Worldcoin after detecting allegedly abusive clauses in user contracts.

Worldcoin Faces Legal Scrutiny In Buenos Aires

Buenos Aires authorities have identified discrepancies between Worldcoin’s reported data handling practices and findings from provincial inspections, raising concerns about the storage and deletion of biometric data and potential infringements on user rights.

The Ministry of Production, Science, and Technological Innovation of the province of Buenos Aires ordered the indictment of Worldcoin following an investigation by the Provincial Directorate for the Defense of Consumer Rights.

The investigation revealed the inclusion of “abusive clauses” in the company’s accession contracts, which were allegedly in violation of the National Consumer Protection Law.

Undersecretary Ariel Aguilar, responsible for Commercial Development and Promotion of Investments in the province, expressed concerns about the lack of transparency surrounding Worldcoin’s data processing procedures.

Aguilar questioned whether biometric data was being stored or immediately deleted, the existence of databases storing personal data of Argentine users, and the complexity of the contracts and operation of the entire system.

The province’s inspections uncovered multiple violations in the adhesion contracts, including the “Terms and Conditions of Use,” “Privacy Notice,” and “Data Consent Form.”

Notably, the company failed to display signs indicating the minimum age requirement of 18 for accessing the service, potentially leading to the scanning of the personal data of minors.

Contradictions In Worldcoin’s Handling Of Biometric Data

Contradictions were also found between the company’s reported use, protection, and storage of biometric data collected from the faces and eyes of Argentine users. It appears that this private information is being stored in Brazil.

Additionally, abusive clauses were identified that allowed the company to interrupt the service without providing any repair or refund.

The contracts also allegedly forced users to waive collective redress claims and subjected them to foreign laws, specifically those of the Cayman Islands, with disputes to be resolved by arbitration in California, United States, violating Argentina’s Civil and Commercial Code. Worldcoin now faces potential fines of up to 1 billion pesos or $1.2 million.

The company had been operating in various cities in Buenos Aires. Worldcoin collected personal biometric data, such as iris and facial scans, in these locations through its Orb technology device.

In exchange, users were offered the World App financial application on their phones and received cryptocurrency from Worldcoin’s native token, WLD.

Unexpected Upswing

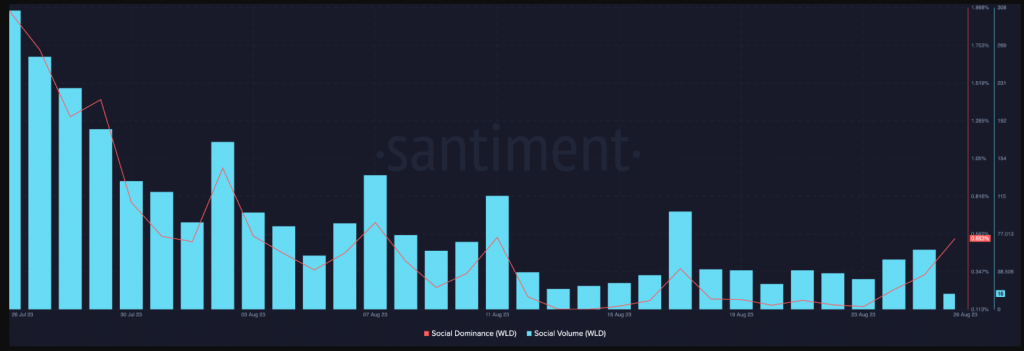

Despite facing increasing legal scrutiny in recent months, including the latest development in Argentina, the token associated with the Worldcoin protocol, WLD, has experienced an unexpected surge of 2.6% within the past 24 hours, currently trading at $4.80.

However, when examining key metrics, it becomes evident that the overall market correction has impacted WLD. CoinGecko data reveals that WLD’s trading volume in the last 24 hours amounts to $319,113,250, indicating a decrease of 7.10% compared to the previous day.

Additionally, WLD has witnessed a significant decline of over 58% from its all-time high of $11.74, reached on March 10.

Moreover, the token’s market capitalization has experienced a notable decrease. Since its peak of $1.4 billion recorded on March 17, the market cap has fallen below the billion-dollar level, currently standing at $920 million as of the time of writing.

Featured image from Shutterstock, chart from TradingView.com