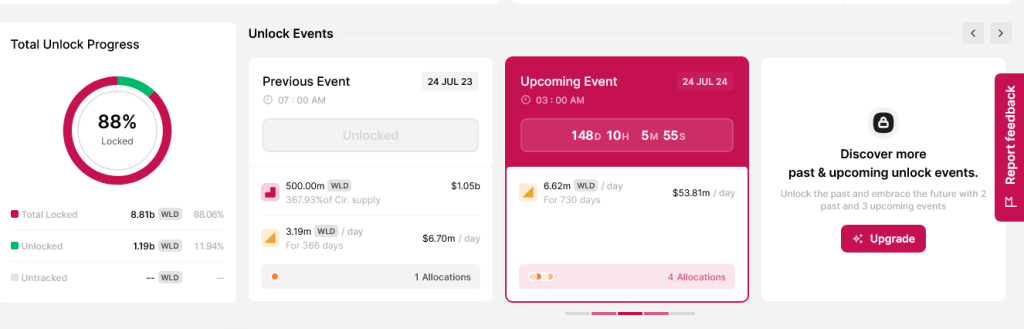

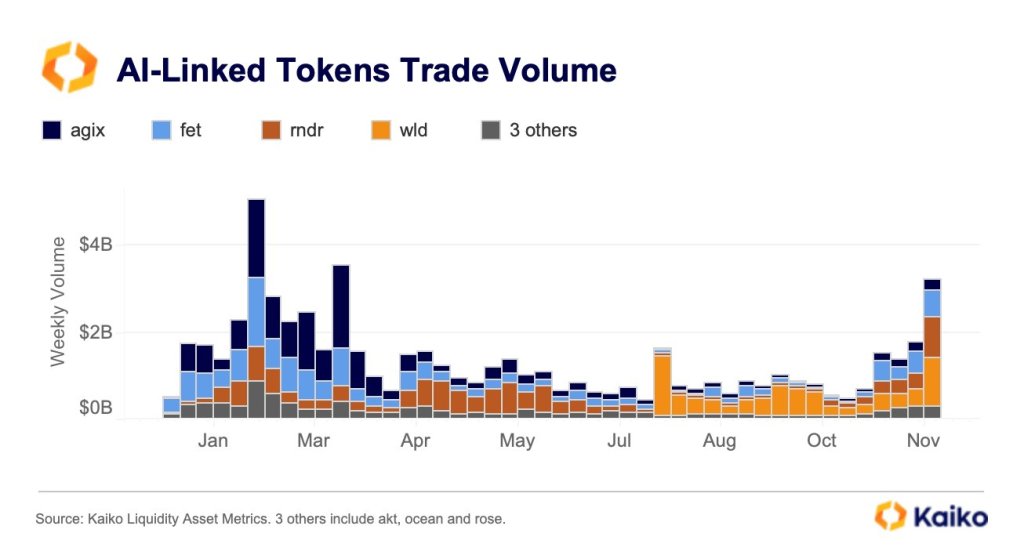

Worldcoin (WLD) could be the victim of a significant downtrend in the coming weeks. The team plans to sell as many as 1.5 million WLD tokens over the next six months, which could bring about massive selling pressure and affect the token’s price.

Details About The Proposed WLD Token Sale

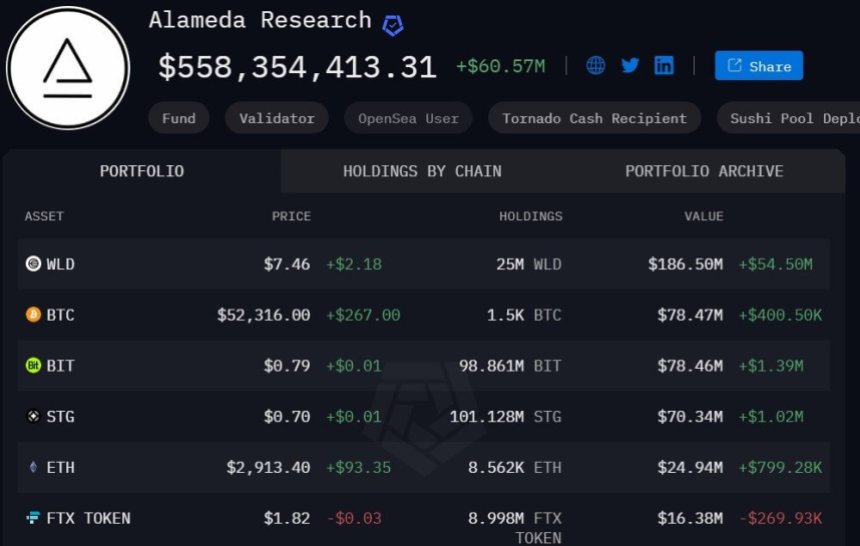

Worldcoin revealed in a blog post that World Assets (a subsidiary of the Worldcoin Foundation) will sell between 500,000 and 1.5 million Worldcoin tokens weekly to a group of institutional trading firms outside the United States. This token sale will be done through private placements and is expected to last up to six months.

Therefore, as many as 36 million WLD tokens could be sold under this arrangement. Interestingly, these tokens do not form part of the current circulating supply, as Worldcoin stated that “the circulating supply of WLD will thus increase correspondingly” as the token sales progress. That means Worldcoin’s circulating supply could see an 18.6% increase to over 229 million WLD tokens once the private sale is done.

This development is undoubtedly a cause for concern for WLD holders, given the impact it could have on the crypto token’s price action. However, Worldcoin tried to downplay the effect of this token sale, noting that a weekly sale of between 500,000 and 1.5 million WLD tokens represents “less than 0.1% to 0.4% of the current weekly trading volume.

Meanwhile, World Assets “may seek to include a 40-day lock-up period restricting the resale of WLD by trading firms,” Worldcoin remarked. This could also help reduce the high volatility that could arise from an immediate sell-off by these trading firms.

The Worldcoin Ecosystem

WLD is the native token of Worldcoin, a project that focuses on the digital verification of humans. Users in the Worldcoin ecosystem get verified through a device called the “Orb.” Since launching last year, the project, co-founded by Open AI’s CEO Sam Altman, has drawn criticism, with many, including Ethereum’s co-founder Vitalik Buterin, raising privacy and legal concerns.

Authorities in different countries have investigated the project as they believe its data collection method may have breached certain privacy laws. NewsBTC also recently reported that Worldcoin faces a potential fine of $1.2 million in Argentina for violating the country’s National Consumer Protection Law.

Despite the regulatory scrutiny, the team is still looking to expand. In the blog post, they hinted that the proceeds from this token sale will be directed towards meeting the “increasing demand for orb-verified World IDs around the world.”

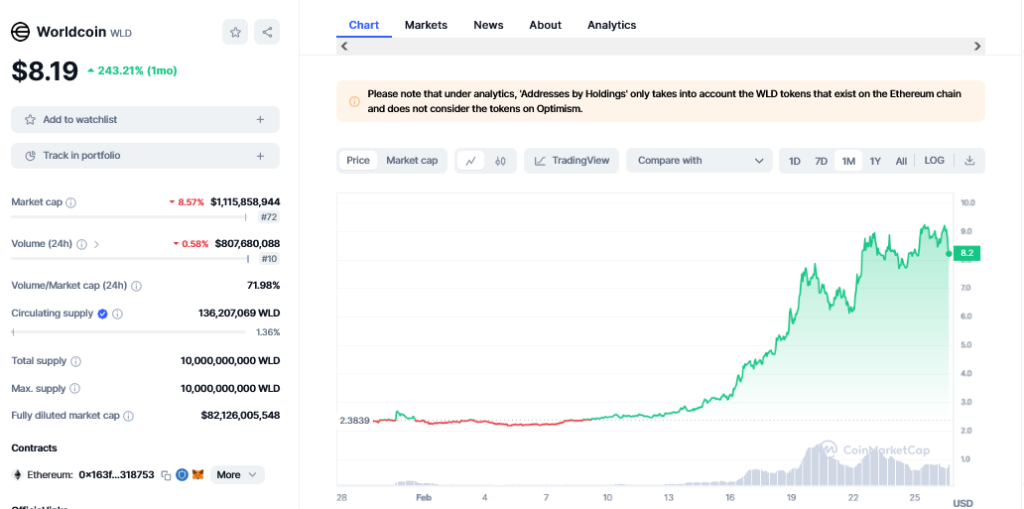

At the time of writing, Worldcoin is trading at around $5.4, down over 6% in the last 24 hours, according to data from CoinMarketCap.