Traditional financial firms are increasingly connecting services, portfolios and operations with digital assets.

Cryptocurrency Financial News

Traditional financial firms are increasingly connecting services, portfolios and operations with digital assets.

In this week’s issue of The Protocol newsletter, we’re covering Worldcoin’s latest update, airdrop season, the new Bitcoin wallet from Jack Dorsey’s company and the “data availability” network Celestia’s market-moving plan to plug into Polygon’s blockchain development kit.

In this week’s issue of The Protocol newsletter, we’re covering Worldcoin’s latest update, airdrop season, the new Bitcoin wallet from Jack Dorsey’s company and the “data availability” network Celestia’s market-moving plan to plug into Polygon’s blockchain development kit.

Worldcoin released a new version of its World ID feature with multiple app integrations.

Shopify, Minecraft, and Reddit will begin using World ID to identify some users.

Shopify, Minecraft, and Reddit will begin using World ID to identify some users.

Shopify, Minecraft, and Reddit will begin using World ID to identify some users.

The grants are supposed to give developers a “focus on building resilient technology and more equitable systems.”

The artist made an NFT of the Worldcoin co-founder and OpenAI CEO for our Most Influential package.

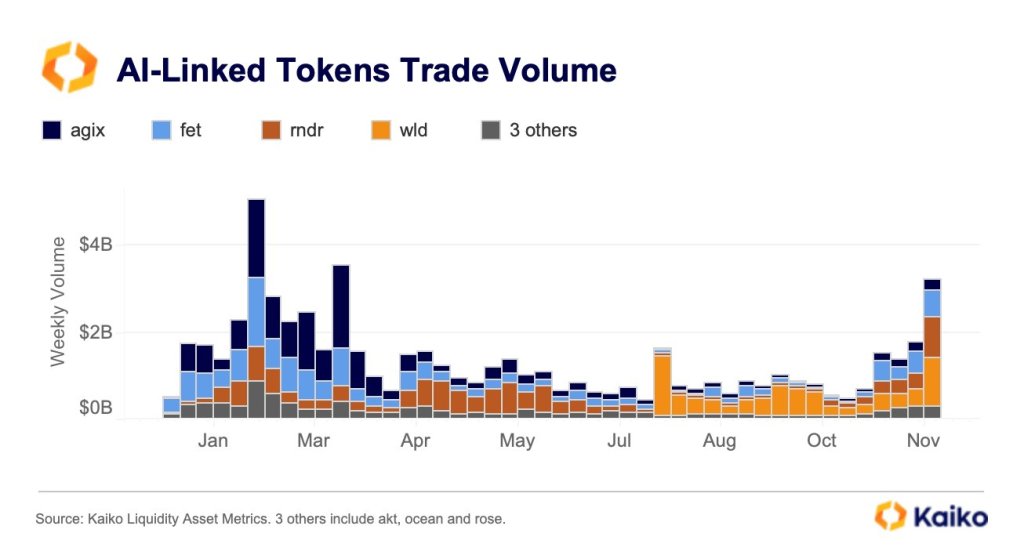

The recent saga surrounding OpenAI and its co-founder Sam Altman has sparked a surge of interest in AI tokens, with total weekly trade volume surpassing $2 billion for the first time since March, fresh data from Kaiko, a blockchain analytics platform, shows.

According to statistics, WLD, the native token on Worldcoin, a project co-founded by Altman, and other tokens, including FET, the primary coin behind the AI-reliant blockchain, Fetch.ai, appear to be primary gainers. Even so, WLD prices remain below November 2023 lows when writing.

Even so, looking at market data, the spike in crypto AI trading volume seems driven mainly by WLD activity. Looking at the project’s share, trading volume comprises over 33% of all related crypto AI trading volume.

While there is a noticeable spike in activity, it remains below the all-time high of above $4 billion in Q1 2023. Then, traders and investors were keen on AGIX, the SingularityNET token. However, over the months, Worldcoin has since taken over as investor interest shifted to WLD, evidenced by the gradual rise of trading volume.

Looking at WLD price action over the past three days, prices have been volatile, though trading volume has been mostly up from November 13. Following news of Altman’s removal as CEO of OpenAI, prices fell before slightly expanding with news of negotiations to return to the role, followed by his appointment to lead Microsoft’s AI team.

All these events have contributed to the market’s heightened interest in WLD. Accordingly, trading volume across the broader crypto AI scene stands above the $2 billion level for the first time since March.

Though there is no direct connection between OpenAI and Worldcoin, crypto participants focus on events at OpenAI and how the board handled Altman as a factor catalyzing WLD’s activity.

The general lack of clarity on why the board ousted Altman as CEO worsens the situation, sparking speculation that this could also impact WLD’s prices and how Worldcoin is governed, considering the former CEO is also behind the crypto AI project.

Looking at the co-founder’s previous role as the team leading Worldcoin’s developments, Altman also holds significant sway, contributing to discussions on how the government should regulate AI at the end of the day.

Altman’s influential role has impacted Worldcoin and its prices since the blockchain project aims to create a global identity system. Worldcoin’s operations would rely on AI, including fraud prevention, data analysis, verification, and more.

The narrative around Sam Altman and OpenAI seems to have had a major impact on the value of WLD, the token that Worldcoin, a cryptocurrency that Altman co-founded, is issuing.

As the drama surrounding Sam Altman’s dismissal from OpenAI and possible reinstatement continues to captivate the crypto space, the Worldcoin digital token has been one of the most unpredictable in the cryptocurrency market as of late.

As of today, the trading price of Worldcoin (WLD) has reached $2.43, indicating that the cryptocurrency has made a strong recovery. In comparison to the previous 24 hours, this is a significant gain of 19%, with an impressive 24% rally in the last week, data from crypto price aggregator Coingecko shows.

From a high of $2.50 on November 16, WLD started to weaken as digital asset markets backpedaled the next day, with Altman’s dismissal only making the decline worse. In the hours following his departure, the token dipped to $1.85 according to statistics compiled by CoinGecko.

As artificial intelligence (AI) develops at a rapid pace, Worldcoin is working on a digital identity network that will collect retina scans to verify users’ identities.

The project’s orbs collect users’ retina scans, and in return, they give users WLD tokens as a compensation for giving their biometric data.

Events at OpenAI, which Altman acted as a go-between for Worldcoin and, by extension, WLD, continue to impact WLD price, even though the two projects are unrelated.

With a market value of approximately $280 million, the token holds the 160th position in the crypto market, as reported by CoinGecko on Monday.

The surge in the token’s value is intricately linked to the news surrounding Altman and the uncertainties arising from his removal at OpenAI, according to Richard Galvin, co-founder at Digital Asset Capital Management.

As events unfolded, the token experienced a rebound, gaining momentum as it became evident that there was no significant negative event fueling the board’s decision.

Digital asset platform VDX’s head of research in Hong Kong, Greta Yuan, predicted that WLD will experience additional volatility in the coming weeks.

Altman is the face of Worldcoin, so depending on how this drama plays out in the next few days, the token may fluctuate, but its appeal to investors will not diminish, Yuan said.

Meanwhile, even though OpenAI’s stock dropped to $2.04 over the weekend after the announcement of Altman’s resignation as chief executive, the company’s efforts to reassign his role as CEO helped propel the stock back up.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Business Wire

Sam Altman’s eye-scanning world ID project saw its token price go on a wild ride over the weekend after he was fired by OpenAI.

At least three senior researchers have left OpenAI since Sam Altman was removed as the startup’s CEO on Nov. 17.

Worldcoin (WLD) experienced a sharp decline in its market price on Saturday after its founder, Sam Altman, was removed as the CEO of popular artificial intelligence company OpenAI. This development follows the heavy regulatory scrutiny on the crypto project due to privacy concerns.

In a shocking development on Friday, OpenAI announced a leadership change, stating that Sam Altman will immediately exit the company as its CEO.

In this statement, the company expressed its gratitude to Altman for contributing immensely to their development during his four-year tenure as their global leader.

However, after an intense review process by the board of directors, it was concluded that the Worldcoin founder had not been fully honest in his exchanges with the board, leading to a loss of confidence in his ability to continue his duties as CEO.

Following Altman’s departure, Mira Murati, OpenAI’s chief technology officer, will now act as interim CEO pending the appointment of a permanent successor.

However, as one could expect, Altman’s removal as OpenAI CEO, combined with the scathing statements in the company’s announcement, has created a negative sentiment around the Worldcoin project.

According to data from CoinMarketCap, WLD is currently down by 12.75% over the last 24 hours. Meanwhile, the token’s daily trading volume has managed to remain afloat with a 15.13% gain.

Worldcoin was officially launched in July with the goal of creating the largest digital identity and financial network. The project relies on the use of iris-scanning orbs to physically admit new members, prompting concerns about privacy, anonymity, and user data protection.

After Altman’s departure from OpenAI, there are currently speculations on Worldcoin’s future trajectory. Clearly, Worldcoin benefited from Altman’s visibility as OpenAI’s CEO, as reflected in the token’s current downtrend.

Notably, WLD gained by over 25% in October, with many analysts citing anticipation of the OpenAI developer conference in November as the driving force.

Therefore, the removal of Altman from OpenAI may not bode well for Worldcoin in terms of credibility and public investor sentiments. On the other hand, Worldcoin could soon recover from its market slump and rise to higher heights despite this new challenge.

Following its public official launch in July, Worldcoin came under much criticism from global regulators who expressed concerns over operations in regard to the collection of data using iris scanning orbs and the potential applications of user data.

Notably, Worldcoin has been suspended from Kenya, while the governments of the United Kingdom and Germany have opened investigations into the project’s operation.

However, the crypto project has remained resilient despite these regulatory hurdles, marking a milestone of 4 million app downloads and 1 million monthly active users, as reported earlier in November.

At the time of writing, WLD trades at $1.85, with a 0.86% decline in the last hour. Meanwhile, the token’s market cap stands valued at $211.37 million.

The board of directors removed Altman on the grounds that he was allegedly “not consistently candid in his communications with the board.”

Artificial intelligence (AI) company OpenAI ousted Sam Altman as CEO and from the board, the board of directors announced in a blog post Friday.

The CME booms as the crypto industry anticipates the approval approval of a spot Bitcoin ETF in the United States.

The ‘World App’ for iOS and Android has now been downloaded 4 million times, according to data collected by its development team, Tools for Humanity.

Users will receive WLD tokens, instead of USDC, starting Tuesday, as per a new developer document.