Monero’s version of LocalBitcoins is closing after 7 years of operations serving the XMR community.

Cryptocurrency Financial News

Monero’s version of LocalBitcoins is closing after 7 years of operations serving the XMR community.

[toc]

Monero (XMR) is one of the leading cryptocurrencies focused on privacy, zero knowledge, and censorship-resistant transactions. The Monero network operates on a proof-of-work (PoW) consensus mechanism, like Bitcoin and various other cryptocurrencies. This system incentivizes miners to contribute blocks to the blockchain. Monero’s PoW algorithm is designed to resist specialized mining equipment known as application-specific integrated circuits (ASICs). These ASICs confer a significant advantage to companies and affluent individuals, potentially leading to the centralization of the network.

In 2018, Monero became the first major cryptocurrency to deploy what is known as “bulletproofs”, a technology that greatly improved the efficiency of XMR transactions and led to at least an 80% drop in the size of the average transaction and dramatically reduced fees for the end-user.

Monero underwent an upgrade in 2019, transitioning to the RandomX algorithm. This algorithm is tailored to accommodate both CPU miners (such as laptops) and GPU miners (utilizing standalone graphics cards). Theoretically, this adjustment should foster greater decentralization within the Monero network.

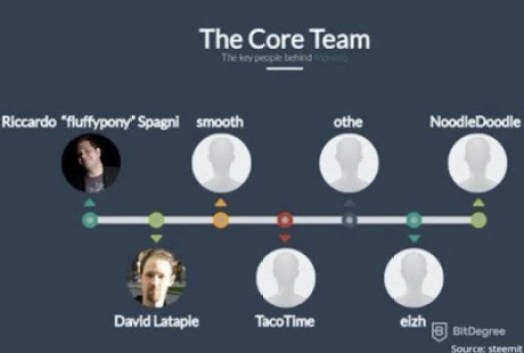

Monero (formerly known as Bitmonero) traces its roots back to 2014, when it forked from the Bytecoin blockchain. Its development has been steered by a vibrant community of developers, including Ricardo Spagni (aka Fluffypony), who played a pivotal role in shaping Monero’s trajectory. The commitment to open-source principles and community-driven governance underscores Monero’s success.

Since its launch, Monero has undergone significant enhancements, including database structure migration, implementation of RingCT for transaction amount privacy, and setting minimum ring signature sizes to ensure all transactions are private by default. These improvements have bolstered the network’s security, privacy, and usability.

The Monero Project leads the charge with its dedicated Research Lab and Development Team, continuously pioneering innovative technologies. Since its launch, the project has garnered contributions from a diverse pool of over 500 developers spanning various continents.

Understanding who directly funds Monero can be tricky due to its emphasis on privacy, but it has attracted a solid base of investors. Monero has various indirect channels through which investors and institutions support and invest in the Monero ecosystem.

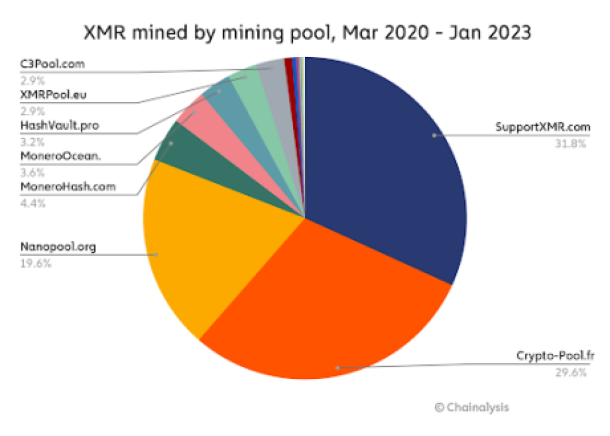

Large mining pools play a vital role in ensuring network security and processing transactions. Although they don’t directly fund Monero (XMR) Token, their involvement indicates a broader belief in Monero’s potential.

MinerGate, known for its wide user base, and SupportXMR, an open-source Monero mining pool, are actively contributing to community development. Also, Monero (XMR ) being listed on reputable exchanges like Binance and Kraken enhances accessibility and attracts large investors.

The Monero Community Development Fund (CDF) relies on donations to support developers and projects. Notable contributors include Edge Wallet and Cake Wallet, both actively contributing to the CDF.

At its core, Monero champions the right to financial privacy, offering unparalleled anonymity through advanced cryptographic techniques. Transactions conducted on the Monero network are shielded from prying eyes, ensuring the confidentiality of senders, receivers, and transaction amounts.

This commitment to privacy empowers individuals to transact freely and securely without fear of surveillance or censorship and serves as a shield against oppression in regions where financial freedom is restricted.

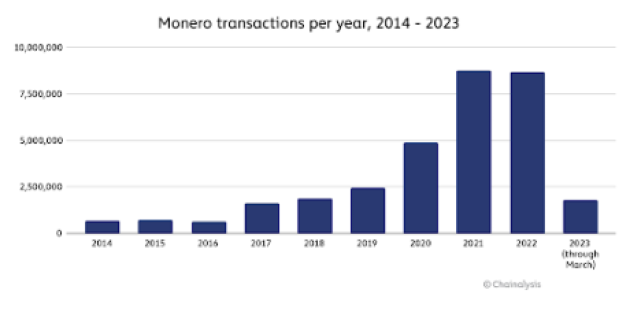

Monero has had around 32 million XMR transactions, with approximately 8.6 million in 2022, a slight drop from its peak in 2021. In comparison, Bitcoin recorded nearly 800 million transactions during the same timeframe.

Monero’s privacy features have legitimate applications in safeguarding sensitive financial information, protecting personal liberties, and preserving economic freedom.

Monero’s core privacy features are its utilization of ring signatures, stealth addresses, and RingCT. Unlike transparent blockchains like Bitcoin and Ethereum, Monero prioritizes user confidentiality, offering a level of anonymity comparable to physical cash transactions.

Despite its acclaim within the cryptocurrency community, Monero hasn’t been immune to regulatory scrutiny. Regulatory bodies have raised concerns about the potential misuse of privacy coins, leading to restrictions on their trading and listing on certain exchanges.

However, Monero remains steadfast in its commitment to privacy, offering users a secure and private means of transacting in the digital realm.

Monero’s mining mechanism sets it apart from its peers, emphasizing inclusivity and accessibility. The RandomX algorithm, optimized for general-purpose CPUs, democratizes the mining process, allowing a diverse range of hardware to participate. This approach prevents the centralization of mining power, ensuring a more decentralized network.

Monero also introduced “smart mining,” a sustainable alternative that utilizes a computer’s idle processing power to mine XMR. This energy-efficient method aligns with Monero’s ethos of accessibility and sustainability in cryptocurrency mining. It also makes use of Dandelion++ to hide IP addresses associated with nodes to avoid exposing sensitive information.

Monero’s approach to transaction handling sets it apart as a pioneer in the field of privacy-centric digital currencies. Through the utilization of split amounts and the generation of unique one-time addresses for each transaction fragment, Monero(XMR) effectively obscures the trail of funds, making it virtually impossible to trace the exact mix of currency units belonging to a recipient. This intricate methodology ensures that Monero transactions remain shrouded in secrecy, bolstering user confidence in the network’s ability to preserve financial privacy.

With features such as view keys and spend keys, Monero users have control over their accounts, allowing them to selectively grant access to specific parties while preserving the confidentiality of their financial information.

In essence, Monero’s unique blend of privacy-enhancing features, innovative transaction handling, and user-centric design sets it apart as a trailblazer in the cryptocurrency landscape.

Privacy by Default: Monero utilizes advanced cryptographic techniques such as ring signatures, stealth addresses, and Ring Confidential Transactions (RingCT) to obfuscate transaction details, ensuring unparalleled privacy.

Fungibility: Every XMR coin is interchangeable, ensuring that no history can be traced back to tarnish its value. This fungibility aspect is crucial for a currency to function effectively without discrimination based on its past usage.

Decentralization: Monero’s mining algorithm, CryptoNight, is designed to be ASIC-resistant, fostering a more decentralized mining ecosystem where individuals can participate using standard computer hardware, thus mitigating centralization risks.

Active Community: The Monero community is vibrant and passionate, constantly advocating for privacy rights and pushing the boundaries of technological innovation to safeguard financial sovereignty.

Adoption and Recognition: Despite its emphasis on privacy, Monero has garnered significant attention from both users and institutions. It has found utility in various domains, including online marketplaces, remittances, and privacy-conscious transactions. Moreover, prominent figures in the cryptocurrency space have recognized Monero’s value proposition, further solidifying its position in the digital currency landscape.

Financial Services Sector: Monero’s blockchain technology can revolutionize processes such as trade finance, lending, and asset management. Its privacy-enhancing features and technologies ensure that sensitive financial transactions remain confidential while still maintaining transparency and auditability. Additionally, Monero’s decentralized nature eliminates intermediaries and reduces costs.

Supply Chain Management: This sector stands to gain significant advantages from Monero. By leveraging Monero’s immutable ledger and privacy-enhancing features, businesses can enhance transparency, traceability, and authenticity throughout the supply chain. Monero’s blockchain ensures the integrity of goods and reduces the risk of fraud and counterfeiting.

Media And entertainment industry: These two industries can also harness the power of Monero’s blockchain for various applications. Whether it’s managing digital rights, tracking royalties, or enhancing content distribution, Monero will help secure a transparent platform for content creators, distributors, and consumers. By utilizing Monero’s blockchain, companies can streamline royalty payments, protect intellectual property rights, and create new revenue streams in the digital media landscape.

Government Institutions: Monero’s blockchain has promising applications in government services; governments can leverage Monero’s blockchain for secure voting systems, digital identity management, and transparent public services.

Cybersecurity And IoT (Internet of Things). Monero’s decentralized and immutable ledger provides robust protection against data breaches and cyber-attacks. In IoT, Monero’s blockchain can facilitate secure data exchange and device authentication, ensuring the integrity and privacy of IoT ecosystems.

Monero XMR aims to maintain scarcity and foster value appreciation like Bitcoin. With a capped total supply of approximately 18.4 million XMR coins, similar to Bitcoin, Monero aims to prevent inflation, thereby potentially contributing to sustained value appreciation over the long term.

Monero endeavors to incentivize miners and uphold network security. Utilizing a Proof-of-Work (PoW) consensus mechanism, Monero relies on miners to safeguard the network. Initially, the emission rate of XMR was high but has gradually decreased over time. Currently, with a block reward of 0.6 XMR per block as of 2022, Monero introduces a “tail emission” to sustain ongoing miner incentives.

Conclusion

Monero’s blockchain technology holds immense potential for transforming various industries by providing a secure, private, and transparent platform for conducting transactions and managing data.

With its focus on anonymity and confidentiality, Monero offers a versatile solution for businesses seeking to enhance privacy, security, and efficiency across diverse sectors. As the adoption of blockchain technology continues to grow, the potential applications of Monero are limitless, paving the way for a more secure and decentralized future.

On February 6, Monero (XMR), a privacy and security-focused token, saw its price drop after Binance, one of the largest crypto exchanges, announced its delisting in the following weeks alongside another three tokens.

Binance recently announced the delisting and cease of all trading activity of Aragon (ANT), Multichain (MULTI), Vai (VAI), and Monero (XMR) starting on February 20, 2024, at 03:00 (UTC). The decision came after Binance’s most recent review, which determined that the platform could no longer support the tokens.

Following the review of digital assets in the exchange, Binance revealed its resolution to delist these tokens, affirming that they no longer met the exchange’s standards. Some of the factors the decision was based on include “evidence of unethical or fraudulent conduct or negligence” and “contribution to a healthy and sustainable crypto ecosystem.”

Binance has announced the removal of Monero’s trading pairs, including XMR/BNB, XMR/BTC, XMR/ETH, and XMR/USDT, from the platform. All trade orders will be automatically removed once the trading ceases.

Additionally, any XMR deposit done after February 21, 2024, at 03:00 (UTC), won’t be credited to the user’s accounts, and withdrawals of XMR will be supported until May 20, 2024. Binance also informed that XMR tokens may be converted into stablecoins on behalf of users after the withdrawal deadline, although it “is not guaranteed.”

A plunge in Monero’s price immediately followed the announcement. According to data from CoinGecko, XMR went from trading at $165 before the announcement to $148 in the following 30 minutes. Since then, the token has continued to dive lower, trading at $111,85 at writing time, accounting for a 32.7% drop in the last 24 hours.

The crypto community received the news with concerns. Several users questioned the reasons for Monero’s delisting and expressed disappointment in the exchange’s decision.

The team behind Monero shared on its X account (formerly known as Twitter) that the delisting comes after Binance’s new requirement. The crypto exchange stated that deposits must come from a “publicly transparent address, which Monero doesn’t allow.”

The delisting is happening because Binance is now requiring that deposits come from a publicly transparent address. Monero has used stealth addresses for ALL addresses since it’s launch in April 2014

Monero allows selective disclosure with view keys but not a transparent address

— Monero (XMR) (@monero) February 6, 2024

Crypto Trader John Brown shared his thoughts on XMR’s delisting from the exchange on his X account, saying that, although it’s a negative situation for Monero, this is mostly a “negative sign for Binance” due to his belief that the exchange is “so compliant” that they no longer can choose the assets to support.

Monero dropped strongly on the delisting news from Binance.

While bad for Monero, I mainly see this delisting as a sign of the slow demise of Binance. They are now "so compliant" that they cannot choose anymore which assets to support.

— John Brown (@john_j_brown) February 6, 2024

Last year, Binance and its former CEO Changpeng Zhao, known as CZ, faced regulatory scrutiny after pleading guilty in the United States to the charges of Anti-Money Laundering, Unlicensed Money Transmitting, and Sanctions Violations.

Bitcoin and Ethereum’s ETH are finding buyers at lower levels, which may be a bullish sign for XMR, OKB and RPL.

The Monero price has rallied over the past week since the broader market recovered. Over the last 24 hours, XMR was consolidating despite its weekly gains. The coin traded laterally over the past few sessions before it started to dip on its chart.

As momentum halted recently, it is still uncertain whether XMR will resume its upward price movement. The technical outlook of the coin continued to side with the bulls despite lateral trading.

Accumulation remains high on the chart despite a downtick in demand over the last trading sessions. Monero also displayed overbuying tendencies, and the recent fall in the asset’s value could be tied to a price correction.

The altcoin can prevent considerable loss if Monero stays above its immediate support line. The market capitalization of Monero declined slightly, meaning that the coin encountered selling in the past trading sessions. At the current price, the coin was trading at 70% low than its all-time high secured in 2021.

XMR was trading at $166 at press time. Over the last week, the coin secured gains and pierced through various resistance lines. The coin crossed the $157 resistance line and flipped it into a support zone for itself.

Monero was trading on an ascending trendline (white), typically characterized by a breakout, either on the upside or the downside. Over the last 24 hours, XMR diverted from the trendline and fell on its chart.

This could imply that the coin will depreciate and rest at $163, then drop to $157 before rising again. For Monero, there was stiff resistance at $169, which is why the coin could not move past it.

The resistance above the line has not been breached since July last year. The amount of Monero traded in the previous session was red, indicating that the coin experienced some selling.

Although XMR noted a slight downtick in demand, sellers were minimal compared to buyers. The Relative Strength Index (RSI) was still above the 70 mark. This indicated that the asset was overbought, which means that a price correction for Monero was on its way.

Depicting bullishness, XMR was above the 20-Simple Moving Average line (SMA), indicating that buyers were driving the price momentum in the market. XMR also rested above the 50-SMA (yellow) and 200-SMA (green) lines.

Per the increase in accumulation, the technical outlook depicts buy signals. The Moving Average Convergence Divergence (MACD) reads the price momentum and trend reversals. MACD formed green signal bars, but the last bar declined in height. This ideally means that the price is expected to fall.

The Chaikin Money Flow indicates capital inflows and outflows; the indicator was above the half-line, reflecting increased institutional interest. Monero has been on the list of well-performing assets as the broader industry continues its recovery. Still, the chance of a price correction remains on the charts.

Monero (XMR), an open-source, privacy-oriented cryptocurrency launched in 2014, managed to reach the $151 marker on November 2 as it briefly rallied before it experienced slight price correction.

Here’s a quick glance at XMR trajectory:

At the time of this writing, according to tracking from Coingecko, the altcoin is changing hands at $149.10, going down by almost 1% over the last 24 hours.

The digital currency’s weekly, biweekly and monthly performance is relatively well, considering the crypto market was on an extended bearish momentum before the October 25 rally.

During the last seven days, Monero managed to go up by 1.5% while over the last two weeks, the asset increased by 2.8%. On a month-to-date gauge, XMR is on the midst of a 5.4% price surge.

Even with this kind of showing, the cryptocurrency is still nowhere close to its January 9, 2018 all-time high (ATH) of $542.33, already losing more than 72% of that value.

Since September, Monero traded within the narrow range of $152 and $136 as it was the subject of numerous bearish signals during the month, including a significant decrease in transaction count.

But XMR technical indicators now are showing signs of good buying pressure that may soon translate into a bullish rally.

Source: TradingView

Source: TradingView

For instance, the 12-hour Relative Strength Index (RSI) of Monero managed to climb above the 50-nuetral zone indicating that bulls, which struggled to break the resistance marker for the asset, were finally able to gain solid footing in the market.

Furthermore, XMR OBV was able to move past the resistance zone, denoting that the altcoin is primed for an upward momentum.

In summary, if the digital coin manages to reach, sustain and surpass the $156 marker, it will confirm the bullish signals sent by its technical indicators and will surge all the way up to $172.

However, should this happen without accompanying trading volume increase, the earlier thesis will be invalidated and XMR will be pulled back down to $148.

Online crypto tracker Coincodex’s forecasts for XMR conform to the above technical analysis for the asset’s price movement.

Accordingly, over the next five days, the virtual coin is expected to reach its crucial resistance marker as it is forecasted to trade at $152.9.

Meanwhile, the next 30 days appears to be good for the digital asset as its spot trading price is seen to climb to even higher levels.

Coincodex believes Monero will trade at $159.12 30 days from now as it will enter the last month of 2022 with a value that is closer to the $172 target.

XMR total market cap at $2.7 billion on the daily chart | Featured image from Reddit, Chart: TradingView.com

Disclaimer: The analysis represents the author’s personal understanding of the crypto market and should not be construed as investment advice.

Monero (XMR), an open-source cryptocurrency first focusing on privacy and decentralization, managed to initiate a price pump despite the greater majority of crypto space struggling to get out of the red zone.

The altcoin, for the past few days, has been on a consistent price increase, seeing all-green on its hourly, intraday, weekly and monthly levels.

At press time, according to data from Coingecko, Monero is trading at $146.56, being up by 1.8% over the last 24-hours. On a week-to-date and month-to-date basis, XMR increased by 1.3% and 4.5%, respectively.

But even with the recent price pumps, Monero is still far from its all-time high value of $542.33 that it hit on January 9, 2018.

Still, holders of the crypto should have plenty of reasons to be optimistic over the next days as the asset is leaning towards a bullish momentum.

Monero Price Analysis

XMR, just like the rest of its fellow altcoins, experienced rigid price correction as the crypto market plunged into yet another bearish cycle.

A look at the trading data and chart for Monero shows the cryptocurrency’s fall stopped at $134.5 marker which acted as its support range last month.

Source: TradingView

Buyers took advantage of the price dump but the struggles of the crypto market prevented XMR to move past the $151.8 mark despite bouncing back twice from the mentioned support level.

Caught in a parallel channel pattern, Monero, instead of continuing its decline, managed to start its bull run, steadily increasing its price by as much as 6%.

Volume activity is also working wonders for the asset as continued increase on it will push XMR price to $153, a level that might soon be established as the crypto’s next resistance range.

Given the nature of its current pattern, Monero could break the overhead trendline on its way to attaining the target trading price of $171.

Holders Must Remain Cautious

Forecasts from crypto data provider Coincodex indicate the bullish run of Monero will continue over the next five days.

With this, XMR is likely to breach the $153 resistance range to push its spot trading price at $154.49. This prediction supports the thesis that the asset will continue its bull momentum as it heads towards the next bear cycle.

From there, things will slowly take turn for the worse as the crypto is expected to drop below the $100 levels 30 days from now.

Specifically, Monero could be looking at trading price of $91.84 as there is extreme fear towards it according to its score in Fear and Greed Index.

XMR total market cap at $2.6 billion on the daily chart | Featured image from Smartereum, Chart: TradingView.com

Disclaimer: The analysis represents the author’s personal views and should not be construed as investment advice.

Monero has its hands full trying to keep its momentum and rally forward. But, it must first overcome obstacles. As do other tokens.

The token is trying to keep up with the upward tilt. Remarkably, XMR price is trying hard to recover and keep up with the pace but it seems XMR is doing a great job as it’s currently on the green and winging it.

The daily price chart shows that XMR price is trying to soar upwards. Monero is gaining strides as it shoots up close to the top trendline of the channel. In order for XMR to rebound or go through the target resistance, the coin must maintain its current pace in terms of price.

Monero (XMR) Price Surges 4.33%

For XMR to shoot hoops at a bullish pace and breach the ascending parallel channel, the XMR bulls must push through its upward movement. However, it seems the bears are attempting to weaken the XMR market.

With a frail market, it is challenging for XMR and other cryptocurrencies to recover. XMR investors must hold it off until such time that the bulls can maneuver and maintain the current position found at the top trendline of the ascending parallel channel.

According to CoinMarketCap, Monero price is currently trading at $167.68 or showing off an increase of 4.33%. Trading volume was seen to drop by 6.88% as depicted in the intraday trading session. As of press time, bears try to drag the token towards the lower trendline of the ascending channel.

Bulls’ Accumulation Pivotal For XMR Price Rally

It would need more buyers for XMR price to leap quickly closer to the top trendline of the channel. But, the volume change also indicates that boosting the bulls’ accumulation is pivotal for XMR price to surge. For XMR to show significant recovery on the daily price chart, XMR price must move closer to the upper trendline.

The daily price chart for XMR price shows the formation of a rising parallel channel. More so, the technical indicators for Monero show the token’s downward trend in terms of momentum. RSI at 58 also shows a downward movement for XMR which is gearing close to a neutral zone.

MACD is showing the downward movement of XMR as it glides under the signal line following a failed crossover. Hence, XMR investors will need to wait on the sidelines for any changes on the daily chart.

XMR total market cap at $3.02 billion on the weekend chart | Source: TradingView.com

Featured image from The Market Periodical, Chart from TradingView.com

Monero (XMR) spiked to its peak levels in three months, in the face of challenges in the crypto market.

XMR has been gaining momentum since June 13 as it has been enjoying highest highs over the past few months.

The token has been on an uptrend for the fourth day in a row and today it’s at fever-pitch with an intraday high beaming at $153.09 3hich is considerably the highest gain it has had since June 13.

With this big move, XMR/USD has set its targets on a new resistance level at $155, which will be considered as the price ceiling for many traders. This new price ceiling will come in tandem with another resistance level.

Monero Going For A Bull Run At $175

Two things can happen: The bears might look at the market scenario as being overbought and will then reenter or can even push other bulls to vacate their recent positions. On the other hand, if a breakout happens, then Monero could push for a bull run toward a higher ceiling eyed at $175.

XMR was able to breach its support zone and is now trying to retest the trendline. XMR is currently going for an ascending triangle pattern.

Suggested Reading | Binance Coin Trading Volume Up 35% As BNB Spikes To $274

The XMR/BTC pair soared by 0.67% in market cap and is currently trading at 0.006390; evident in the past 24 hours.

XMR is showing a downtrend after it has successfully breached the long-term resistance zone and has turned the supply zone now at $135.

It has been retesting that resistance level by forming higher highs and higher lows. It has now tried doing the contrast and forming lower lows and lower highs for a shorter time frame.

XMR total market cap at $2.76 billion on the daily chart | Source: TradingView.com

The Monero coin has been showing a bearish movement as it was able to cross the long-term demand zone.

The bearish trend has caused the breakdown set at $200 giving away a sell-off signal. Now, the coin is trading under the supertrend line which works as a resistance.

So, if XMR can break out of its triangle pattern, it will show a bullish streak in price. If it cannot sustain the supertrend line of $200 then the price can further drop to $100.

Suggested Reading | Cardano (ADA), After 35% Spike, Locks On Next Target: $0.55

XMR Forms Falling Wedge Pattern

If the $135 supply zone is breached, then this can push the price up to $175. XMR is currently forming the falling wedge pattern as it shoots for lower lows and lower highs.

Consequently, the Average Directional Movement Index (ADX) has slumped over the past few days and it even further dipped below 20 with coin facing rejection at the $135 zone.

On the brighter side, the ADX curve is now seeing some recovery and went for an uptrend.

Overall, it’s looking bullish for the crypto as of press time with the resistance zone falling in between $135 to $175.

Featured image from Coin Central, chart from TradingView.com

The list is curated after studying the drawdowns of the top 30 crypto assets by market cap from their record highs.

XMR’s bearish setup comes as Monero prepares to launch the testnet version of its hard fork this month.

The bullish setup emerges as Monero gears up to undergo a major hard fork in July 2022.

Popular privacy coin Monero (XMR) has been on a rally since the start of 2022. The cryptocurrency appears to be moving on its own as the crypto market trends sideways.

Related Reading | Monero And Zcash Take Off With 15% Gains, Here’s What May Have Spurred The Rally

Recently, XMR bulls are displaying more strength. At the time of writing, XMR trades at $285 with a 6% profit in 24 hours, a 34% and 50% profit in the last two weeks and 30-days, respectively.

XMR on an upward trend on the 4-hour chart. Source: XMRUSDT Tradingview

As announced by one of Monero’s maintainers via a post, the network will undergo an upgrade on July 16th, 2022, at the height of block 2.6 million. The “Fluorine Fermi” update will introduce new features to the network.

As the developer stated, Monero will increase its ring size from 11 to 16. The ring size is a term to refer to the total number of signers in an XMR transaction. As part of this network’s unique model, the update will provide users with more base privacy.

In addition, the network will implement an upgraded version of its Bulletproofs algorithm to decrease its transaction size by around 7%. This change is supposed to improve the network’s scalability by making “every transaction lighter and faster”.

On the latter, the network will reduce the wallet’s sync time by around 30 to 40%, the post said, and will implement a change to Monero’s fee model. Thus, users can expect to see an uptick in the network’s “security and resilience”.

As the update will be deployed via a Hard Fork, users and node operators will need to update their software. The maintainer made the following request to the users:

A new release will be announced before the network upgrade (around the 16th of June). You will only have to be using the updated software by the time the network upgrade occurs (16th July). To the end user, it will be like a simple software update.

#Monero will undergo a network upgrade on July 16th, 2022:https://t.co/9NKlGtqXAn

All users will need to do is keep their favorite wallet up to date, update their nodes once v0.18 is released (~June 16th), and enjoy even better digital cash afterwards

— Monero (XMR) (@monero) April 20, 2022

Could Monero Be Spelling Danger For The Crypto Market?

It’s possible that Monero’s recent price action is due to its upcoming network update. As mentioned, they are substantial and will provide the users with interesting new features.

Data from Material Indicators (MI) records an increase in buying pressure from retail investors during April. At the same time, investors with ask orders larger than $10,000 have been selling into the rally. Unless larger investors classes step in, XMR could be at risk of a short-term decrease.

Retail (in yellow on the chart) buying into XMR’s price rally as larger investors sell or stay neutral. Source: Material Indicators.

Related Reading | Monero (XMR) Price Slides As Canada Includes Crypto In Emergencies Act

Additional data provided by Jarvis Labs indicates a potential danger for the entire crypto market. According to their “Dino Index” (comprise of Ethereum Classic, Zcash, Litecoin, Bitcoin Cash, and others), a metric to track the performance of these assets to show their inverse correlation with the crypto market, there could be some obstacles ahead. Jarvis Labs said via their Telegram Channel:

Quite evident that majority of the time when these dino coins rise and btc rises, better to look at profit taking or hedging the risk and look for market tops.

Source: Jarvis Labs via Telegram

A surge in ransomware in 2021 has also resulted in a surge in Monero usage as the method of payment as more criminal groups want only XMR.

XMR price cup-and-handle pattern fetches a bold $10,000 price prediction for 2023.

The Monero blockchain fork has surged by nearly 100% in the past five days against a rising appetite for privacy-focused cryptocurrencies.

Privacy coins, Zcash (ZEC) and Monero (XMR), have been outperforming larger cryptocurrencies in the last 24 hours. The sudden surge on the price of these cryptocurrencies seems to be responding to recent developments around the Russia-Ukraine conflict, and the signed of an executive order from the U.S. Joe Biden administration.

Related Reading | Monero (XMR) Price Slides As Canada Includes Crypto In Emergencies Act

At the time of writing, Zcash (ZEC) records a 11.7% profit trading at $142, while Monero (XMR) records a 15.5% profit trading at $195. These cryptocurrencies have been following the general sentiment in the crypto market flipping towards a more positive stands as Bitcoin breaks above $41,000.

FTX’s Privacy Index with moderate gains on the daily chart. Source: Tradingview

Zcash And Monero React To A FED Coin

As mentioned, the U.S. President Joe Biden has signed an executive order which has surprise for its positive approach to cryptocurrencies and digital assets. As the war between Russia and Ukraine ranges on, the International Community has quickly imposed financial sanctions of Putin, the Russian elite, and its banking system.

As Coin Center’s Executive Director Jerry Brito said, mainstream media have been pushing a negative narrative around cryptocurrencies. Classifying them as “dangerous”, and with the potential to allow Russia to evade sanctions. Fortunately, some U.S. government officials have also look at the other side of the coin.

The core message in this executive order, as Brito said, is a serious acknowledgment from the U.S. Federal Government of cryptocurrencies as legitimate assets. The crypto market seems to have gotten used to negative or nothing messages from the U.S., thus, why this news could have been translated into a relief rally.

Jake Chervinsky, Head of Policy at the Blockchain Association, commented the following on Biden’s executive order and why it has been perceived as bullish by market participants:

Anyone worried that President Biden’s executive order would spell doom & gloom for crypto can fully relax now. The main concern was that the EO might force rushed rulemaking or impose new & bad restrictions, but there’s nothing like that here. It’s about as good as we could ask.

In addition to the total surge in cryptocurrencies, privacy coins like Zcash and Monero seem to have benefited from the shift in narrative. The executive order also contemplates the creation of a U.S. Central Bank Digital Currency (CBDC).

This assets have been perceived as the oppositive of Bitcoin, Zcash, and Monero. Rather than give individuals power over their finances, they seem to provide governments with absolute control and oversight on the national currency. Thus, why some investors might have decided to increase their ZEC and XMR holdings.

POTUS: “My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC”

FedCoin

Worth noting this entire executive order on digital assets is heavy on CBDCs, doesn’t mention Bitcoin pic.twitter.com/PuXtVI34hD

— Alex Gladstein

(@gladstein) March 9, 2022

(@gladstein) March 9, 2022

Privacy About To Gain More Relevance?

Other privacy coins have seen a similar rally with Dash (DASH) recording a 12.8% increase over the past day. Oasis Network (ROSE), Secret (SCRT), Horizen (ZEN), and Keep Network (KEEP) averaging a similar profit during the same period.

In low timeframes, data from Material Indicators suggest retail investors have been leading ZEC and XMR rallies. Investors with bid order of around $100 injected close to $1 billion in liquidity for the ZEC/USDT trading pair.

Related Reading | Monero (XMR) Readies For A Breakout As It Touches Important Milestone

The XMR/USDT trading pair has seen a similar story. Retail investors are also leading the rally in lo timeframes.

Retail Investors (yellow line on the chart) leading the rally above all other classes. Source: Material Indicators

Monero (XMR) is trading at $172.80, down 4.61% with a low of $171.473 and a high of $183.58 in the last 24 hours.

The crypto has a market capitalization of $3,126,923,853, and a price nearing the $170 resistance threshold.

According to Coindesk’s price research, bearish swings are back, and price increases have been slower than in previous months because of the downward trend.

Monero is going bearish again following a decrease in the XMR/USD market, as a result of negative news coming from Canada.

Monero (XMR) Bullish Indicators

At the time of writing, technical analysis by CoinCodex shows that short-term sentiment on XMR has become neutral, with 17 indicators flashing bullish signs versus 12 bearish signals.

According to TradingView data, the daily simple and exponential moving averages are showing buy signals, while the relative strength index (RSI) was at 55.4 as of February 16.

A reading of 30 or less on the RSI suggests that the market is experiencing an oversell.

XMR total market cap at $2.964 billion in the daily chart | Source: TradingView.com

Related Reading | Monero Featured In Last Week Tonight, Essential Tool In “Ransomware Economy”?

Due to adverse market movement, the cryptocurrency has shown a slow decline. The price has been falling in the previous hours as the negative trend rises.

Experts describe Monero’s overall market position as “less lucrative.”

Canadian Emergencies Act Deals Blow On XMR

Canadian Prime Minister Justin Trudeau’s imposition of the country’s Emergencies Act is taking a heavy toll on several cryptocurrencies, including Monero (XMR).

The crypto joins a list of other key digital assets the Canadian government bans in the face of ongoing protests in Ottawa by the Canadian Freedom Convoy (CFC).

Related Reading | Monero (XMR) Readies For A Breakout As It Touches Important Milestone

Authorities want to reduce the amount of money protesters allegedly utilize, which comes from assets and contributions of digital currencies like Bitcoin, Cardano and Monero.

An emergency measures act has been passed to ban future funding to trucker-based activists who are opposing the country’s COVID-19 vaccine mandate.

Monero (XMR), according to reports, is being used to sponsor the protesters, who have so far received $870,000 to $1.1 million in cryptocurrency donations.

Because of its decentralized status and low charges, a good number of donors choose to pay for their donations using cryptocurrencies such as Monero.

Monero (XMR) Seen To Make Strong Rally

Meanwhile, analysts anticipate that the value of XMR will likely climb between now and the end of 2022.

Based on current data and the coin’s recent successes, the majority of cryptocurrency experts predict that the price of Monero will rise in the near future.

The combination of technology and positive crypto market dynamics gives XMR a strong possibility of becoming one of the most traded cryptocurrencies this year.

Monero is in high demand as a mode of payment on the dark net, primarily because it provides a high degree of anonymity in terms of transactional information.

Featured image from Reddit, chart from TradingView.com

The sharp increase in MineXMR’s mining hash rate in the past few months has led some XMR enthusiasts to suspect ulterior motives.

Privacy coin Monero (XMR) usually spends its time in the shadows, which is exactly the way its community likes it. Till date, it is still impossible to penetrate the privacy that the digital asset offers, making it the go-to choice for investors who are trying to keep their crypto transactions and holdings a secret. Recently though, the cryptocurrency is breaking out onto the radars of more investors as it shatters an important milestone.

As more crypto users are discovering their transactions are not as hidden as they might have thought, they are moving towards coins like Monero that offers the privacy they desire. This has seen the number of users rise on the blockchain and total transactions carried out has soared, more than doubling in just the first quarter of 2022.

Monero (XMR) Surpasses 20 Million Transactions

Monero is no doubt the leading privacy coin in the crypto space and it has once again proven this with its recent milestone. The coin seems to have exploded in popularity in just the first two months of 2022 as the number of transactions carried out has doubled from 2021. Last year, the number of transactions recorded was sitting at 8.65 million. With less than two months into the new year, the volume of transactions tells a new story.

Related Reading | Bitcoin Hits Two-week High Imitating The Stock Rally

Growing almost 150% in just a matter of months, the number of Monero transactions has crossed 20 million. Data from Blockchair shows that there have been a total of 2,554,175 blocks mined over the lifetime of the privacy digital asset, landing on more than 20,023,000 transactions carried out in the same time period.

This number is important for a digital asset like Monero whose sole utility is being untraceable. It spells more usage from crypto users as they move towards keeping their crypto footprints hidden. It also points towards more adoption of the coin, and as the market rises out of the ashes of the last burn, it may mean significant growth for the digital asset in relation to price.

Growing With The Market

Like most cryptocurrencies, the price of Monero (XMR) had suffered when the market had crashed. This saw the cryptocurrency crashing from its high of almost $525 to the low $140, around which its value has trended for the past week. However, with the recent market recovery going into last weekend, Monero has followed along and has posted a recovery, up 16% in the past 24 hours alone.

Related Reading | Cryptocurrency Wallet Phantom Marks $1.2 Billion Valuation Amid Recent Funding Round

This does not mean that the digital asset is out of the woods though. Sentiments around the cryptocurrency continues to skew greatly in the bearish territory, and sell signals continue to overpower the asset. According to data from Barchat, Monero’s sell indicators have taken hold with 88% pointing towards sell. The 50-day, 100-day, and 200-day MACD Oscillator also point towards sell.

XMR recovers to $176 | Source: XMRUSD on TradingView.com

On the short term though, the 20-day moving average has turned towards buy. Coupled with the increased adoption and growing volume recorded, this trend is expected to continue and drive the price of the digital asset up in its wake. With a strong close above $180 by end of day, next significant support will be at $200, at which point, bulls will be able to sink their claws firmly into the asset.

Featured image from CoinJournal, chart from TradingView.com