[toc]

What Is Monero (XMR)?

Monero (XMR) is one of the leading cryptocurrencies focused on privacy, zero knowledge, and censorship-resistant transactions. The Monero network operates on a proof-of-work (PoW) consensus mechanism, like Bitcoin and various other cryptocurrencies. This system incentivizes miners to contribute blocks to the blockchain. Monero’s PoW algorithm is designed to resist specialized mining equipment known as application-specific integrated circuits (ASICs). These ASICs confer a significant advantage to companies and affluent individuals, potentially leading to the centralization of the network.

In 2018, Monero became the first major cryptocurrency to deploy what is known as “bulletproofs”, a technology that greatly improved the efficiency of XMR transactions and led to at least an 80% drop in the size of the average transaction and dramatically reduced fees for the end-user.

Monero underwent an upgrade in 2019, transitioning to the RandomX algorithm. This algorithm is tailored to accommodate both CPU miners (such as laptops) and GPU miners (utilizing standalone graphics cards). Theoretically, this adjustment should foster greater decentralization within the Monero network.

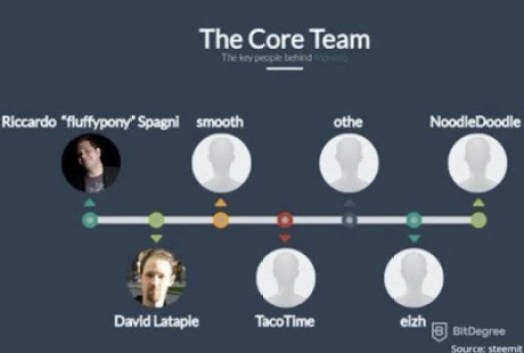

Who Are The Founders Of Monero (XMR)Network?

Monero (formerly known as Bitmonero) traces its roots back to 2014, when it forked from the Bytecoin blockchain. Its development has been steered by a vibrant community of developers, including Ricardo Spagni (aka Fluffypony), who played a pivotal role in shaping Monero’s trajectory. The commitment to open-source principles and community-driven governance underscores Monero’s success.

Since its launch, Monero has undergone significant enhancements, including database structure migration, implementation of RingCT for transaction amount privacy, and setting minimum ring signature sizes to ensure all transactions are private by default. These improvements have bolstered the network’s security, privacy, and usability.

The Monero Project leads the charge with its dedicated Research Lab and Development Team, continuously pioneering innovative technologies. Since its launch, the project has garnered contributions from a diverse pool of over 500 developers spanning various continents.

Investors And Institutions Backing the Monero (XMR) Token

Understanding who directly funds Monero can be tricky due to its emphasis on privacy, but it has attracted a solid base of investors. Monero has various indirect channels through which investors and institutions support and invest in the Monero ecosystem.

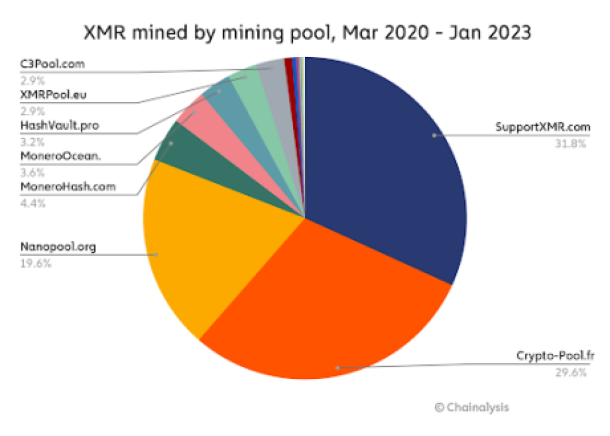

Large mining pools play a vital role in ensuring network security and processing transactions. Although they don’t directly fund Monero (XMR) Token, their involvement indicates a broader belief in Monero’s potential.

MinerGate, known for its wide user base, and SupportXMR, an open-source Monero mining pool, are actively contributing to community development. Also, Monero (XMR ) being listed on reputable exchanges like Binance and Kraken enhances accessibility and attracts large investors.

The Monero Community Development Fund (CDF) relies on donations to support developers and projects. Notable contributors include Edge Wallet and Cake Wallet, both actively contributing to the CDF.

What Monero Network Aims To Achieve In The Crypto Space And Beyond

At its core, Monero champions the right to financial privacy, offering unparalleled anonymity through advanced cryptographic techniques. Transactions conducted on the Monero network are shielded from prying eyes, ensuring the confidentiality of senders, receivers, and transaction amounts.

This commitment to privacy empowers individuals to transact freely and securely without fear of surveillance or censorship and serves as a shield against oppression in regions where financial freedom is restricted.

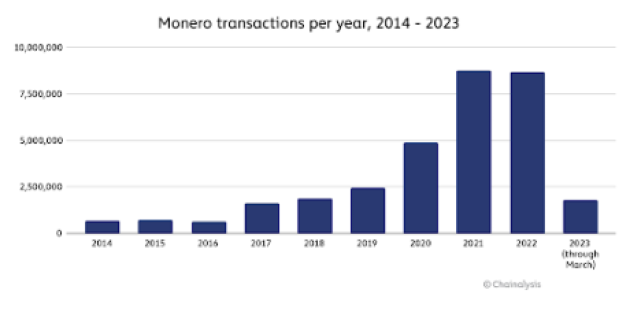

Monero has had around 32 million XMR transactions, with approximately 8.6 million in 2022, a slight drop from its peak in 2021. In comparison, Bitcoin recorded nearly 800 million transactions during the same timeframe.

Monero’s privacy features have legitimate applications in safeguarding sensitive financial information, protecting personal liberties, and preserving economic freedom.

How Does Monero (XMR) Work?

Monero’s core privacy features are its utilization of ring signatures, stealth addresses, and RingCT. Unlike transparent blockchains like Bitcoin and Ethereum, Monero prioritizes user confidentiality, offering a level of anonymity comparable to physical cash transactions.

Despite its acclaim within the cryptocurrency community, Monero hasn’t been immune to regulatory scrutiny. Regulatory bodies have raised concerns about the potential misuse of privacy coins, leading to restrictions on their trading and listing on certain exchanges.

However, Monero remains steadfast in its commitment to privacy, offering users a secure and private means of transacting in the digital realm.

Monero’s mining mechanism sets it apart from its peers, emphasizing inclusivity and accessibility. The RandomX algorithm, optimized for general-purpose CPUs, democratizes the mining process, allowing a diverse range of hardware to participate. This approach prevents the centralization of mining power, ensuring a more decentralized network.

Monero also introduced “smart mining,” a sustainable alternative that utilizes a computer’s idle processing power to mine XMR. This energy-efficient method aligns with Monero’s ethos of accessibility and sustainability in cryptocurrency mining. It also makes use of Dandelion++ to hide IP addresses associated with nodes to avoid exposing sensitive information.

What Makes The XMR Token Unique?

Monero’s approach to transaction handling sets it apart as a pioneer in the field of privacy-centric digital currencies. Through the utilization of split amounts and the generation of unique one-time addresses for each transaction fragment, Monero(XMR) effectively obscures the trail of funds, making it virtually impossible to trace the exact mix of currency units belonging to a recipient. This intricate methodology ensures that Monero transactions remain shrouded in secrecy, bolstering user confidence in the network’s ability to preserve financial privacy.

With features such as view keys and spend keys, Monero users have control over their accounts, allowing them to selectively grant access to specific parties while preserving the confidentiality of their financial information.

In essence, Monero’s unique blend of privacy-enhancing features, innovative transaction handling, and user-centric design sets it apart as a trailblazer in the cryptocurrency landscape.

Notable Features Of The Monero (XMR) Network

Privacy by Default: Monero utilizes advanced cryptographic techniques such as ring signatures, stealth addresses, and Ring Confidential Transactions (RingCT) to obfuscate transaction details, ensuring unparalleled privacy.

Fungibility: Every XMR coin is interchangeable, ensuring that no history can be traced back to tarnish its value. This fungibility aspect is crucial for a currency to function effectively without discrimination based on its past usage.

Decentralization: Monero’s mining algorithm, CryptoNight, is designed to be ASIC-resistant, fostering a more decentralized mining ecosystem where individuals can participate using standard computer hardware, thus mitigating centralization risks.

Active Community: The Monero community is vibrant and passionate, constantly advocating for privacy rights and pushing the boundaries of technological innovation to safeguard financial sovereignty.

Adoption and Recognition: Despite its emphasis on privacy, Monero has garnered significant attention from both users and institutions. It has found utility in various domains, including online marketplaces, remittances, and privacy-conscious transactions. Moreover, prominent figures in the cryptocurrency space have recognized Monero’s value proposition, further solidifying its position in the digital currency landscape.

Potential Applications Across Various Industries

Financial Services Sector: Monero’s blockchain technology can revolutionize processes such as trade finance, lending, and asset management. Its privacy-enhancing features and technologies ensure that sensitive financial transactions remain confidential while still maintaining transparency and auditability. Additionally, Monero’s decentralized nature eliminates intermediaries and reduces costs.

Supply Chain Management: This sector stands to gain significant advantages from Monero. By leveraging Monero’s immutable ledger and privacy-enhancing features, businesses can enhance transparency, traceability, and authenticity throughout the supply chain. Monero’s blockchain ensures the integrity of goods and reduces the risk of fraud and counterfeiting.

Media And entertainment industry: These two industries can also harness the power of Monero’s blockchain for various applications. Whether it’s managing digital rights, tracking royalties, or enhancing content distribution, Monero will help secure a transparent platform for content creators, distributors, and consumers. By utilizing Monero’s blockchain, companies can streamline royalty payments, protect intellectual property rights, and create new revenue streams in the digital media landscape.

Government Institutions: Monero’s blockchain has promising applications in government services; governments can leverage Monero’s blockchain for secure voting systems, digital identity management, and transparent public services.

Cybersecurity And IoT (Internet of Things). Monero’s decentralized and immutable ledger provides robust protection against data breaches and cyber-attacks. In IoT, Monero’s blockchain can facilitate secure data exchange and device authentication, ensuring the integrity and privacy of IoT ecosystems.

The Tokenomics Of XMR

Monero XMR aims to maintain scarcity and foster value appreciation like Bitcoin. With a capped total supply of approximately 18.4 million XMR coins, similar to Bitcoin, Monero aims to prevent inflation, thereby potentially contributing to sustained value appreciation over the long term.

Monero endeavors to incentivize miners and uphold network security. Utilizing a Proof-of-Work (PoW) consensus mechanism, Monero relies on miners to safeguard the network. Initially, the emission rate of XMR was high but has gradually decreased over time. Currently, with a block reward of 0.6 XMR per block as of 2022, Monero introduces a “tail emission” to sustain ongoing miner incentives.

Conclusion

Monero’s blockchain technology holds immense potential for transforming various industries by providing a secure, private, and transparent platform for conducting transactions and managing data.

With its focus on anonymity and confidentiality, Monero offers a versatile solution for businesses seeking to enhance privacy, security, and efficiency across diverse sectors. As the adoption of blockchain technology continues to grow, the potential applications of Monero are limitless, paving the way for a more secure and decentralized future.

(@gladstein) March 9, 2022

(@gladstein) March 9, 2022