XRP experienced a significant price drop early Wednesday amidst rumors of a potential exploit. The XRP price dropped more than 4% to $0.4853 but later recovered to $0.500 following a clarification from one of Ripple’s co-founders.

Personal XRP Accounts Impacted, Not Ripple’s

Initial reports suggested that Ripple had suffered a significant security breach, which was brought to light by decentralized finance (DeFi) investigator ZachXBT. These reports raised concerns about the overall security of the Ripple protocol.

According to investigations, the breach resulted in the theft of more than 213 million XRP tokens, valued at over $112 million. The stolen funds were reportedly laundered through cryptocurrency exchanges, including MEXC, Gate, Binance, Kraken, OKX, HTX, and HitBTC.

However, Ripple co-founder Chris Larsen took to X (formerly Twitter) to clarify the situation. In a recent post, Larsen stated:

Yesterday, there was unauthorized access to a few of my personal XRP accounts (not Ripple) – we were quickly able to catch the problem and notify exchanges to freeze the affected addresses. Law enforcement is already involved.

XRP Price Analysis

Despite the recent security concerns, XRP is trading at $0.5085, marking a 3.4% decrease in the past 24 hours. However, beyond the Ripple co-founder’s personal account exploit, the XRP price has experienced a significant decline over the past month.

Over the last seven days, the token has seen a minor 1.3% drop. The decline has deepened in the previous fourteen days with a 10% decrease. This is more problematic for XRP enthusiasts because the price has lost significant ground over the past 30 days, with an 18% dip.

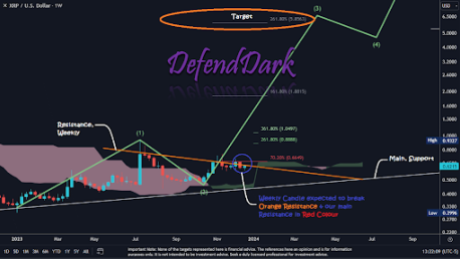

Nevertheless, XRP bull and crypto analyst EGRAG Crypto provides an intriguing price analysis that could potentially encourage investors toward a price recovery if the token manages to hold and consolidate above the $0.500 level.

According to EGRAG, a handful of chart analysts have noted that after wave 1 of the Elliott Wave theory, wave 2 could retrace up to 90% of wave 1. The initial targets of $0.85 to $1 were successfully reached during the July pump, with the price reaching around $0.93 after Ripple’s partial victory against the SEC in its ongoing legal battle over XRP classification.

Currently, EGRAG suggests that a “wicking event” down to $0.41 is possible, considering a 10%-15% fluctuation due to the volatile nature of the crypto markets.

However, the analyst points out that the upside lies in the upcoming Wave 3, which is influenced by Wave 1 and typically has a ratio of 1.618 compared to Wave 1.

If all of this plays out, EGRAG ultimately sees the next short-term target for XRP being the all-time high (ATH) at $5. If the original wave count is adjusted, the range could be between $2.2 and $2.8.

Featured image from Shutterstock, chart from TradingView.com

Source: X

Source: X Source: X

Source: X