On-chain data shows that XRP and Cardano whales have been accumulating recently, which can be bullish for the prices of these altcoins.

XRP & Cardano Whales Have Gone On A Buying Spree Recently

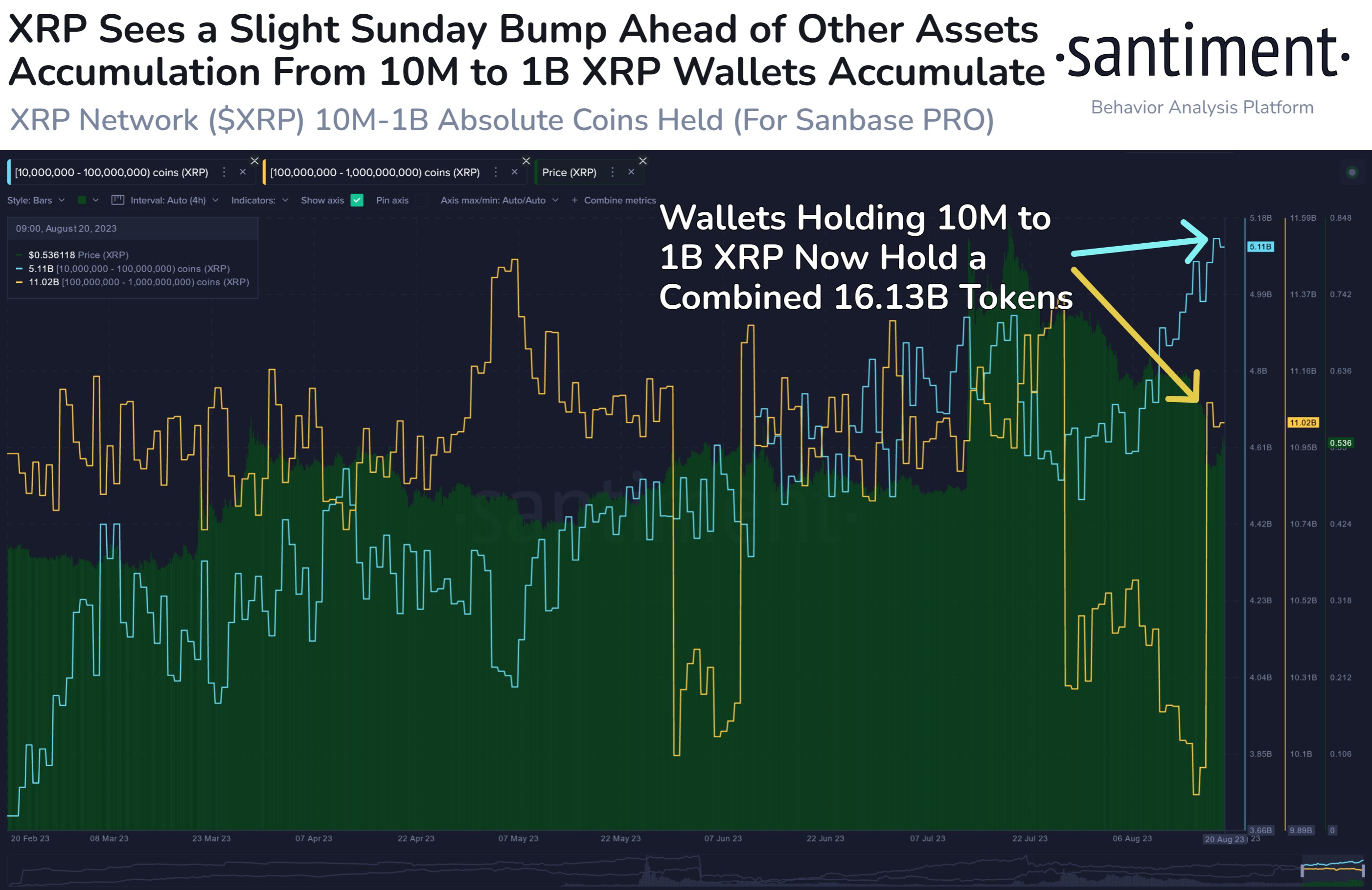

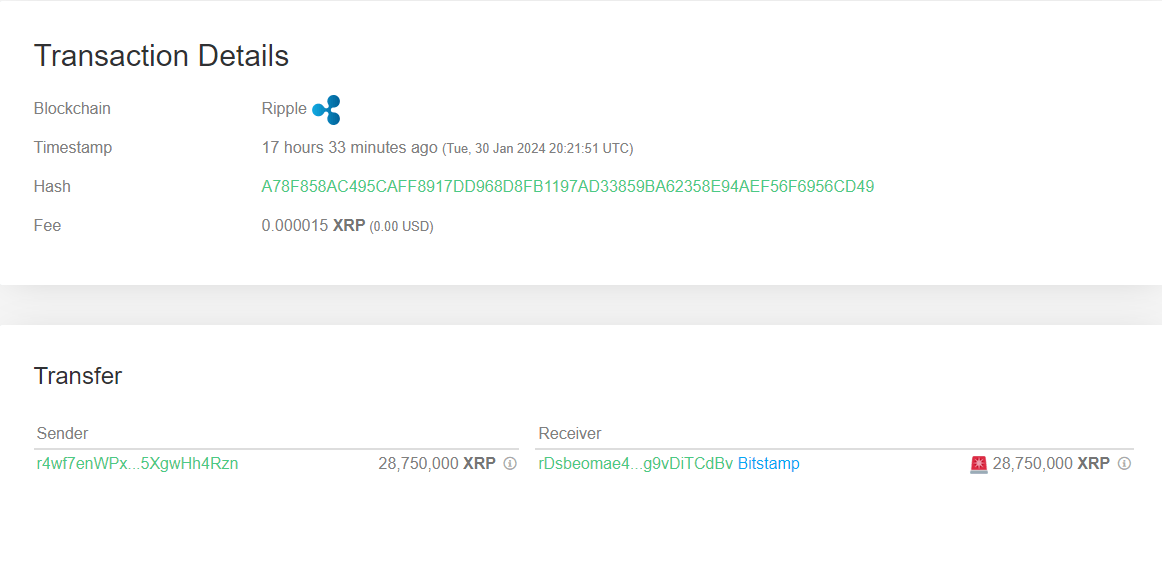

As analyst Ali explained in a new post on X, XRP whales have seen their holdings go up over the last couple of weeks. The indicator of relevance here is the “Supply Distribution” from the on-chain analytics firm Santiment, which tells us about the total amount of assets the different market groups hold.

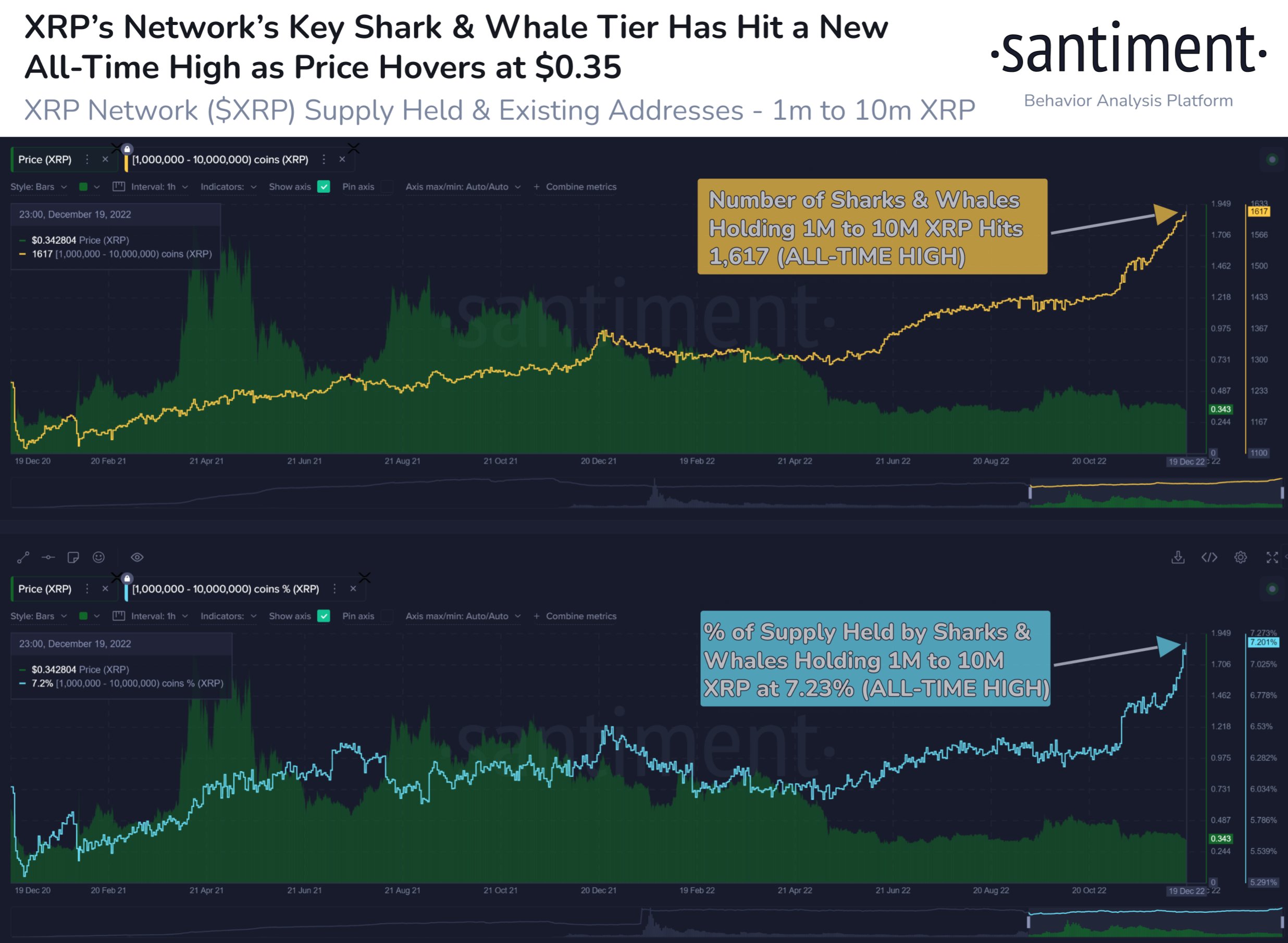

The whale cohort is of interest in the current discussion. These investors hold between 1 million and 10 million XRP in their balance.

At the current exchange rate, these amounts are worth around $0.52 million and $5.2 million, respectively. Clearly, these are pretty significant holdings, which is why whales are considered influential in the market.

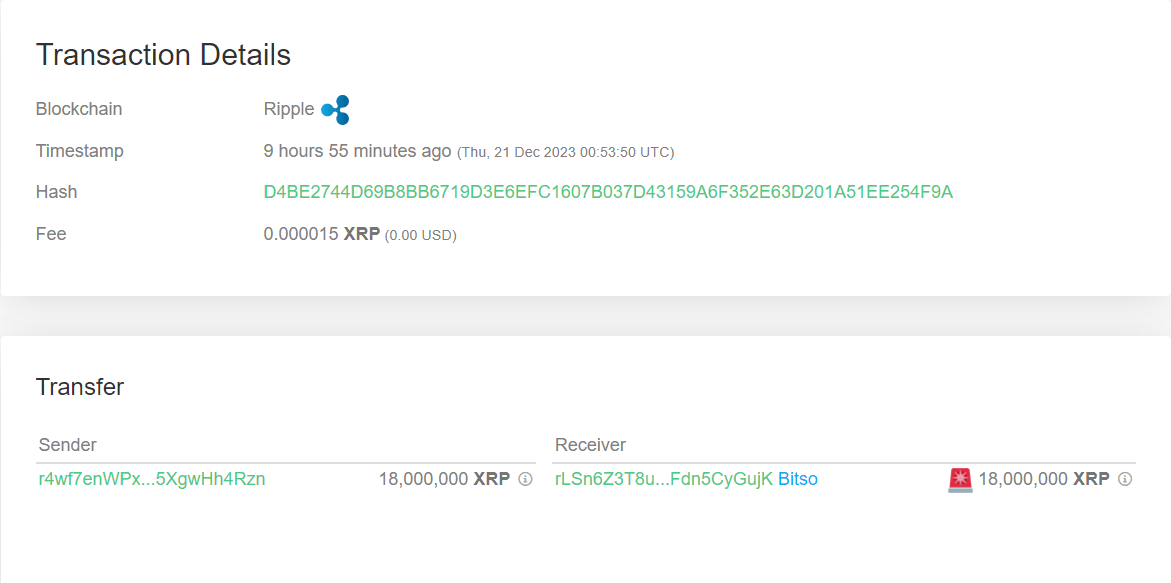

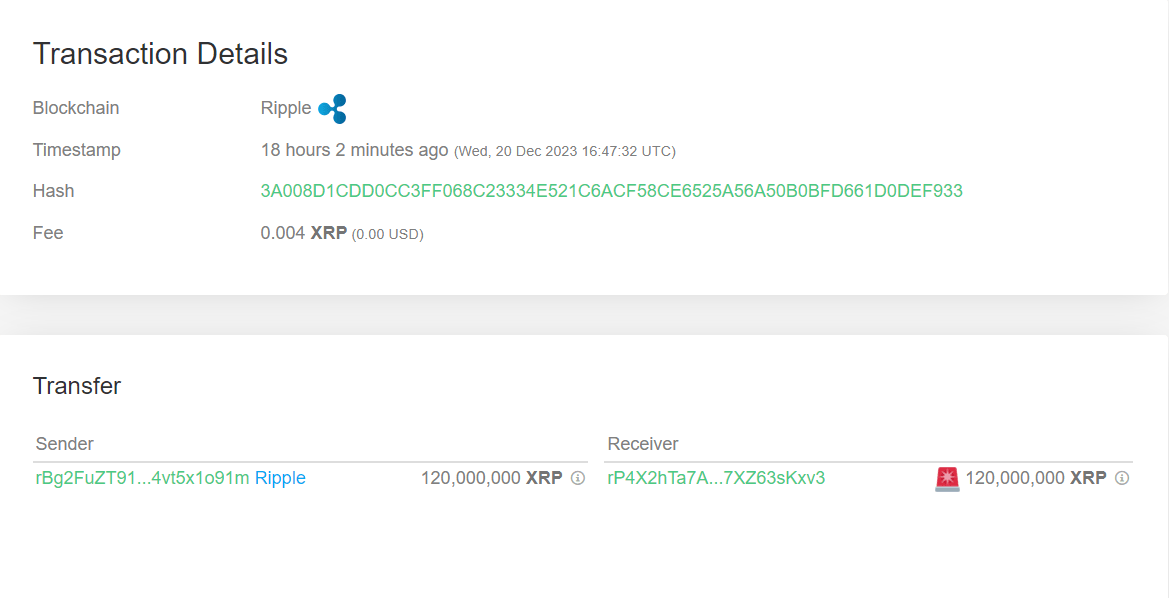

Now, here is a chart that shows how the Supply Distribution of the entities belonging to this XRP group has looked like recently:

The graph shows that while the XRP price has been stuck in consolidation during the last couple of weeks, the whales have been viewing the opportunity as a buying one.

These humongous investors have scooped up over 110 million cryptocurrency tokens (equivalent to almost $57 million) inside this window. This buying scale isn’t particularly massive, but the fact that these investors have been backing the coin through this poor period should be an optimistic sign.

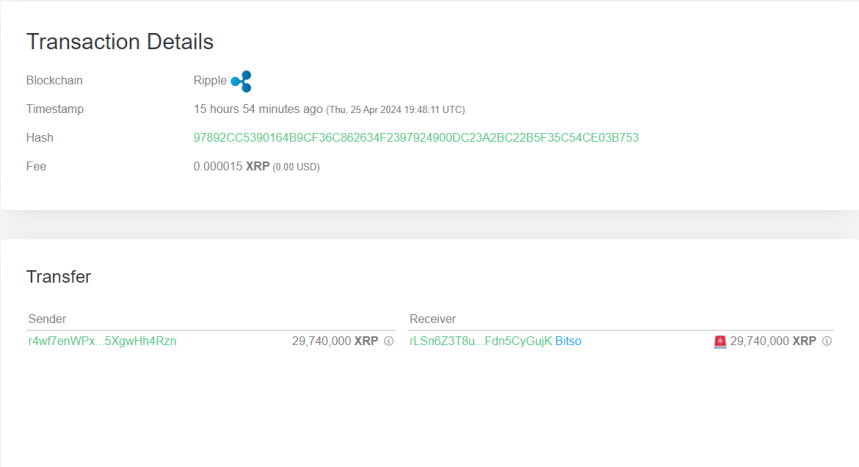

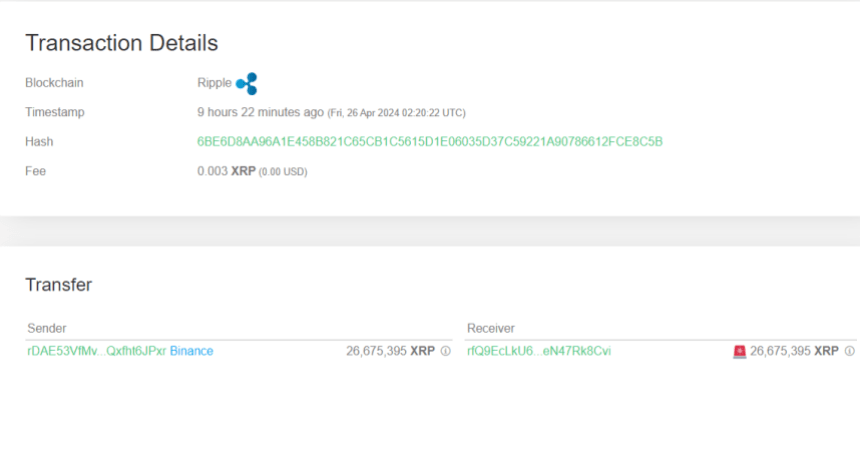

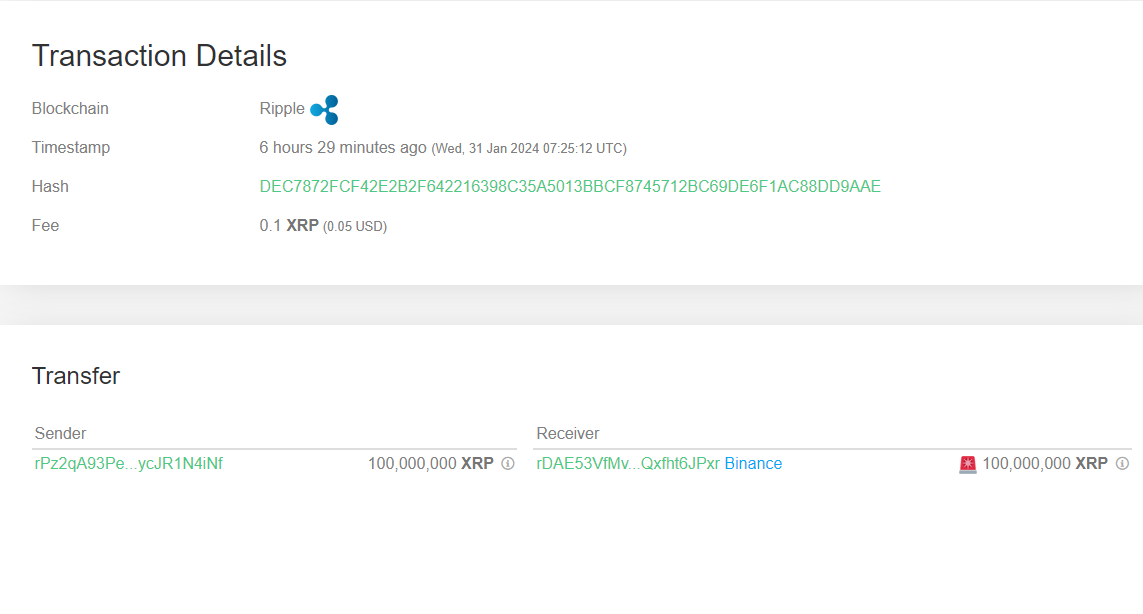

It would also appear that XRP isn’t the only one on the large holders’ radar recently. Market intelligence platform IntoTheBlock revealed in an X post that Cardano has also seen a significant buying push.

In the above chart, IntoTheBlock displays the holdings of the Cardano investors, which are between 100 million and 1 billion ADA. This range’s bounds convert to about $45.3 million and $453 million, respectively, so these whales would be much more massive than the XRP ones just discussed.

As is apparent from the graph, these ADA entities have expanded their holdings over the past month. More particularly, their supply has grown by 11% in this period, which, when considering the scale of the total holdings of this group, is an enormous increase.

According to the analytics firm, these Cardano whales now control 6.71% of the entire circulating supply of the cryptocurrency all by themselves.

This latest buying push towards XRP and ADA from the whales simultaneously could be a potential sign that these large entities are expecting an altcoin rally soon. Given that Cardano has seen it happen at a much more significant scale, the coin could likely see better returns than XRP if a surge does happen.

XRP Price

XRP has displayed stale price action recently, as its price has continued to move sideways around the $0.52 level.

18,750,448

18,750,448

Brace yourselves, XRP fam – looks like a major pump is on the horizon!

Brace yourselves, XRP fam – looks like a major pump is on the horizon!  Who else is seeing this? Drop…

Who else is seeing this? Drop…