On-chain data recently showed that Ripple carried out its monthly escrow unlock for May. As expected, this has raised concerns about how it could affect the XRP price, especially since Ripple has been accused of manipulating the token’s price.

Ripple Unlocks 500 Million XRP Tokens

Onchain data revealed 500 million XRP tokens were unlocked from Ripple’s escrow on May 1. The crypto firm is known to unlock 1 billion tokens monthly, although it looks to have only unlocked half this time around. The magnitude of these tokens always raises concerns, considering the negative impact they could have on the altcoin’s price if dumped on the market.

Further analysis of the on-chain data shows that Ripple sent 300 million XRP out of the unlocked tokens to an escrowed account (2Not4co2op). Meanwhile, the crypto firm sent the remaining 200 million XRP tokens to another wallet (4vt5x1o91m). Considering that the 200 million XRP tokens weren’t sent to escrow, Ripple may have plans to sell them at some point, although it has yet to do so.

It is also worth mentioning that Ripple received another 500 million XRP tokens from an unknown wallet (ymFZmKxEsF). However, these funds were immediately sent to an escrow account. As such, the community can heave a sigh of relief since most of the XRP tokens Ripple received in the last 24 hours have been sent back to escrow.

Talks About Ripple Dumping On The Market Resurface

Following the latest token unlock, the crypto community has reignited talks about Ripple’s alleged dumping on XRP holders. The question of whether or not Ripple’s XRP sales influence the token’s price has been a long-standing discussion, with notable figures like pro-XRP crypto YouTuber Jerry Hall even accusing Ripple of intentionally suppressing the altcoin’s price with its sales.

On the other hand, people like Ripple’s Chief Technology Officer (CTO) have clarified that the crypto firm’s XRP sales do not impact the crypto token’s price. Moreover, Ripple already discontinued programmatic sales, which means that its transactions cannot affect prices on crypto exchanges.

Ripple also noted in its recent court filing in its ongoing legal battle against the Securities and Exchange Commission (SEC) that it had taken measures to ensure its institutional sales did not violate securities laws. This suggests that Ripple conducts its sales over the counter (OTC) to avoid further scrutiny from the Commission.

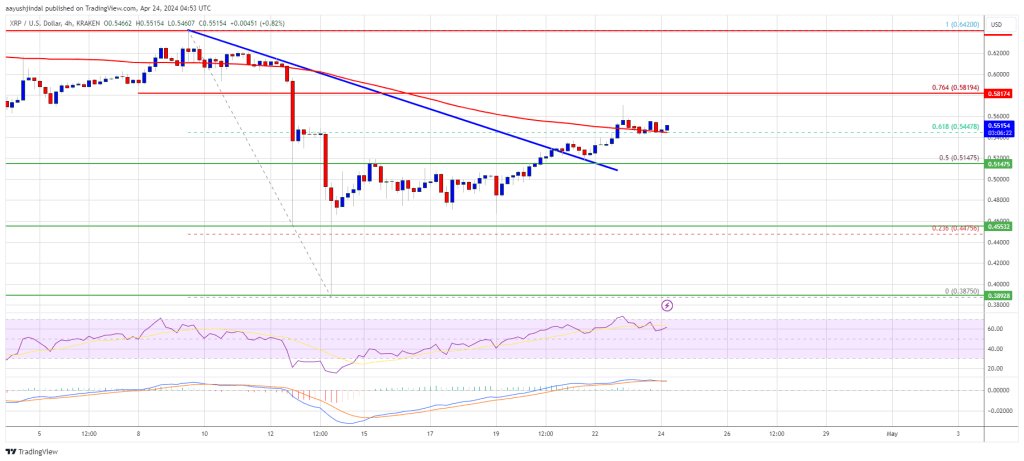

At the time of writing, the token is trading at around $0.5, up over 2% in the last 24 hours according to data from CoinMarketCap.

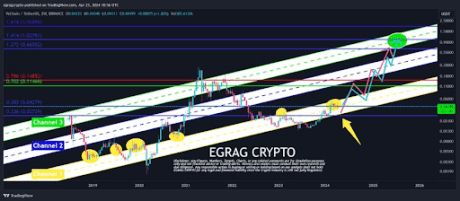

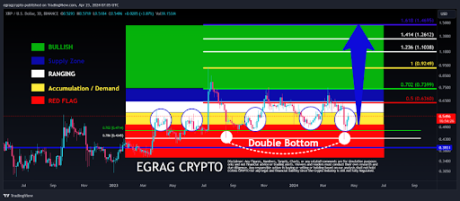

Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target.

Blue Section: The current trajectory suggests a possible reach of $1.4 by June-July, a key target. The price range between ($1.2 – $1.8) is a plausible target. Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.…

Yellow Section: Aiming for $4 is feasible if we follow a similar path to 2021.…

MARKS (@JavonTM1)

MARKS (@JavonTM1)