3Commas finally admitted there was an API leak after months of refuting community reports that it had occurred. Users were not happy about being “gaslighted.”

Cryptocurrency Financial News

3Commas finally admitted there was an API leak after months of refuting community reports that it had occurred. Users were not happy about being “gaslighted.”

Bitcoin price is slowly moving lower from the $17,000 resistance. BTC could continue to move down towards the $16,000 support zone.

Bitcoin price failed to gain pace above the $17,000 resistance zone. BTC started a fresh decline below the $16,800 support zone to move into a bearish zone.

The price even traded below the $16,650 support zone and the 100 hourly simple moving average. It traded as low as $16,453 and is currently consolidating losses. The price is clearly trading in a bearish zone below $16,700 and the 100 hourly simple moving average.

Bitcoin price is now facing resistance near the $16,580 level. It is close to the 23.6% Fib retracement level of the downward move from the $16,961 swing high to $16,453 low. There is also a key bearish trend lie forming with resistance near $16,600 on the hourly chart of the BTC/USD pair.

The first major resistance is near the $16,700 zone and the 100 hourly SMA. It is close to the 50% key bearish trend lie forming with resistance near $16,600 on the hourly chart of the BTC/USD pair.

Source: BTCUSD on TradingView.com

The main hurdle is still near the $17,000 level. A proper close above the $17,000 resistance might start a steady increase in the near term. The next major resistance is near $17,200, above which the price rise towards the $17,500 resistance zone.

If bitcoin fails to start a recovery wave above the $16,700 resistance, it could continue to move down. An immediate support on the downside is near the $16,450 level.

The next major support is near the $16,200 level. A downside break below the $16,200 support might spark a move towards the $16,000 level. Any more losses might send the price towards $15,550.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $16,450, followed by $16,200.

Major Resistance Levels – $16,700, $17,000 and $17,200.

MicroStrategy’s Lightning Network solutions include Satoshi-powered incentives for marketing and website cybersecurity.

Compared to his prison accommodations in The Bahamas, the former billionaire appears to be living a pretty decent life while under house arrest.

The last time the DFPI sent out such a large batch of crypto scam alerts was in June when it sounded the alarm over 26 dubious crypto platforms.

The Bitcoin price has finally shown signs of life, albeit to the downside, a direction that might dominate the charts in 2023. During the holidays, the cryptocurrency was stuck on a single level, but the end of 2022 might see

As of this writing, Bitcoin trades at $16,600 with a 1% loss in the last 24 hours. On higher timeframes, the cryptocurrency records similar losses. Across the crypto market, red is the predominant color as significant assets follow BTC into the downside.

The decline in trading volume due to the holiday season has led the Bitcoin price to move sideways. This status quo is poised to change in early January when market participants return to active trading.

However, the bulls might have issues pushing the price beyond local resistance at around $17,500 and $19,200, two levels that used to operate as critical support. Historically, the first month of the year is among the worst performers.

Since 2013, the Bitcoin price has traded in the red for 60% of its monthly performance during January. According to a pseudonym analyst, this period has ended in adverse price action for the benchmark cryptocurrency.

In addition to negative performance, the Bitcoin price often experiences sudden changes in its value. During this month, the cryptocurrency sees a spike in volatility which historically favors the selling side. The analyst said while sharing the chart below:

We can also see how the percentage change on average in January is quite major. Both up and down. Will January bring some volatility back into the market? (…). Keep in mind that this data is not a reliable indicator for future returns. Use in confluence.

After The Storm, Will Bitcoin Bounce?

On a positive note, February is one of Bitcoin’s best-performing assets. Last year, the Bitcoin price ascended from a new all-time high of around $30,000 to $60,000. As seen in the chart above, February brought double-digit gains for BTC since 2021.

Thus, while BTC might see a negative first month in 2023, February and March might become more favorable. This possible future performance coincides with some positive developments in the macroeconomic landscape, including a decrease in inflation and a short-term cap in interest rates hike from the U.S. Federal Reserve (Fed).

However, these conditions could apply for a limited time. NewsBTC reported that the traditional market would determine much of what happens with the Bitcoin price and the crypto market.

If equities can rebound from their current levels and kick off 2023 on a high note, the benchmark crypto might follow. According to a report from Coinbase, BTC’s long-term bullish thesis remains strong:

(…) the value proposition for bitcoin has only strengthened this year as sovereign currencies around the world have shown signs of stress and central banks continue to grapple with policy credibility.

Users are still seeking to move their funds away from centralized exchanges, paving the way for blockchain-based alternatives to thrive.

The largest crypto by market capitalization dropped below $16.5K at one point on Wednesday. ALSO: CoinDesk research analyst George Kaloudis ranks his top five industry annoyances, and FTX tops the list.

Bitcoin is still strangling at the $16,000 price level with no significant movement up or down. This is normal given the historically low rates of volatility that are being recorded in the market. However, there may be some good rallies in the near future for the digital asset, but it depends on what BTC whales do.

A look at bitcoin whale transactions over the month of December shows that whale interest in the digital asset has been on the decline. This coincides with the low price ranges of BTC during this time, and with such little movement, it becomes harder to flip a profit.

These whale transactions carrying $1 million and above have seen a decline in recent times. This shows a lack of interest in both buying and selling from these large investors. As a result, the price of bitcoin has continued to stagnate between $16,600 and $16,800. In essence, this lack of activity from the large BTC whales is neither bullish nor bearish. The next trend, however, will be decided from what these large holders decide to do from here.

As this Santiment chart shows, a decline in whale interest has usually coincided with periods of low prices. However, if there were to be some significant accumulation from these large holders, then the price of bitcoin will begin another bull rally.

Since whale transactions carrying at least $1 million are sitting at a 2-year low, it makes for a prime setup for at least a short-term rally. If the whales increase their BTC holdings during this time, the impact on the price of BTC will become apparent right away.

Santiment notes that an accumulation trend from these large whales would trigger a historically bullish signal for the digital asset. This means that such events have always led to an upward rally in the past. When this happened in August 2021, it triggered the rally that saw bitcoin hit its all-time high price of $69,000.

This time around, with the BTC price sitting so low, such a trend would lead to at least a 10% increase in the price of the digital asset. From here, a 10% increase would mean that bitcoin would surpass the $20,000 level once more, although a lot of resistance from the bears would be expected at such levels.

However, on the flip side, a continued decline will increase selling pressure on BTC from here. That would mean a reversal toward the $15,000 level once more. Now, it becomes a waiting game to see what happens first.

BTC’s price was sitting at $16,684 at the time of this writing.

The Binance CEO was less than receptive to claims of losses due to a 3Comma API key leak earlier this month; now he recommends disabling 3Comma API keys.

Sports players, movie stars, models, musicians; the gang’s all here, with more celebrities entering the blockchain space with each passing month. Will that trend continue in 2023?

The Shiba Inu price has moved south on its chart over the last 24 hours. In the same time frame, SHIB depreciated by 3%. In the past week, the meme coin also did not register gains, losing a few support lines after losing close to 6% of its market value.

SHIB has now formed a pattern that indicates that the coin might witness a breakout to the upside in the coming 24 hours. The technical outlook still displays bearish signs on the daily chart. Sellers have remained in control of the price for most of this month.

Buyers still have to come to the rescue for SHIB to follow through with an upside breakout. According to the technicals, the coin might fall on its chart over the immediate trading sessions and then move to the upside.

The trading volume of SHIB declined, which supports the notion that buyers have remained low in the market. At the moment, SHIB is trading 90% below its all-time high, which the coin secured almost one year ago.

SHIB was exchanging hands at $0.0000080 at the time of writing. Over the past week, the Shiba Inu price fell from the $0.0000082 support line. Shiba Inu is expected to fall below the $0.0000080 level as buying strength remains low.

It has formed a symmetrical triangle pattern which re-affirms that the coin could witness a rally due to a breakout. The first local support stood at $0.0000076, after which the meme coin is expected to break out.

The breakout will cause the Shiba Inu price to rally to $0.00000824, and clearing that resistance will take the coin to $0.0000086. The amount of Shiba Inu traded in the last session declined, which explains why buyers remained low.

SHIB was in the sellers’ dominance zone for November and December. The Relative Strength Index was below the 40 mark after the recent fall in price. The indicator’s reading displayed that sellers exceeded buyers at press time, indicating bearishness.

On the same note, due to a lack of demand, SHIB traveled below the 20-Simple Moving Average line (SMA), which meant that sellers were driving the price momentum in the market. If SHIB remains above the $0.0000080 mark, the meme coin will move above the 20-SMA.

Other technical indicators have also sided with the possibility of SHIB’s value dropping on its chart. The Parabolic SAR demonstrates the price direction and the trend of the asset. The indicator was above the price candlesticks, which indicates that the price is in a continued downtrend.

The Moving Average Convergence Divergence (MACD) presents price momentum and trend reversals. MACD continued to paint red histograms, which meant that this was an indication for traders to sell, as that would mean that the price of SHIB could increase.

Bankman-Fried has claimed repeatedly that he does not consider himself to have criminal liability in the collapse of FTX, but his colleagues have already pleaded guilty.

While trading digital collectibles has been popular amongst Chinese collectors through heavily regulated marketplaces, this is the country’s first official foray into NFTs.

Users’ subscriptions to cloud mining products have been extended for three days due to the power outage.

Investment firm Fidelity recently filed trademarks that showed its intentions to enter the NFT and metaverse space.

The leak comes after 3Commas repeatedly told users that they had been “phished” after widespread hacks.

The current Bitcoin cycle might be its “most challenging” one yet if the drawdown in this on-chain metric is anything to go by.

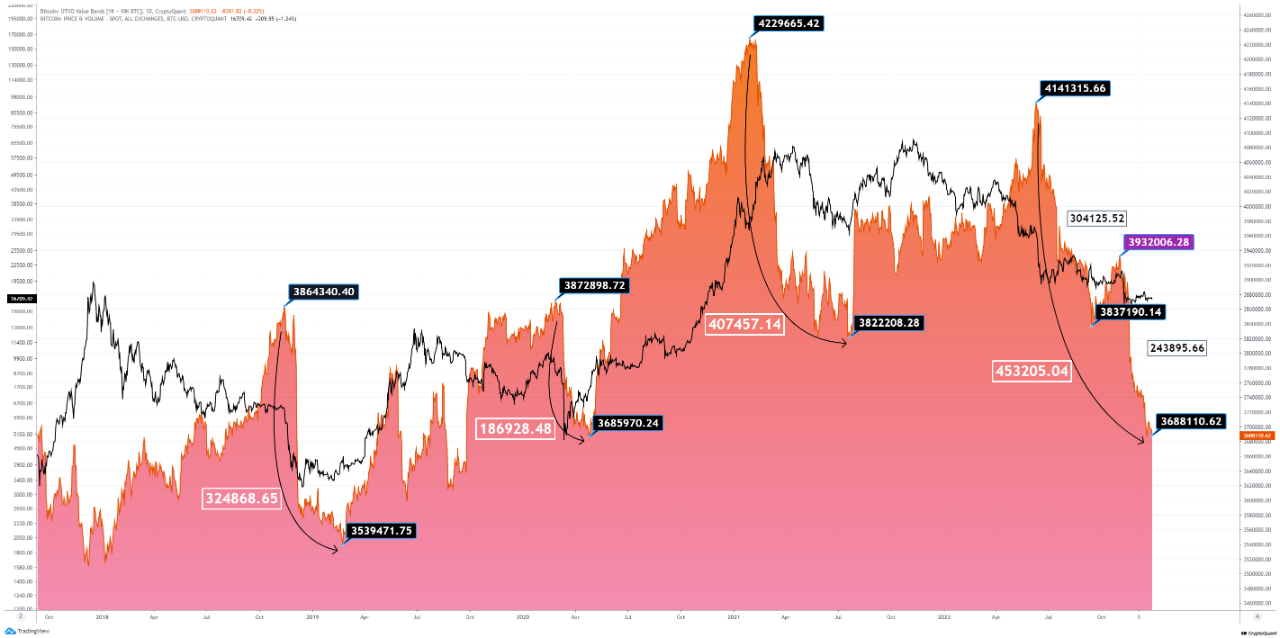

As pointed out by an analyst in a CryptoQuant post, the latest drawdown in the holdings of the 1k-10k BTC value band is the most drastic in the history of the crypto. The relevant indicator here is the “UTXO Value Bands,” which tells us the total amount of coins each value band is holding in the market.

UTXOs are divided into these “value bands” or groups based on their current value. For instance, the 100-1k BTC value band includes all UTXOs carrying between 100 and 1,000 coins. Here, the relevant UTXO value band is the 1k-10k BTC range, a historically important cohort as usually only the whales have wallets with UTXO amounts so large.

Now, the below chart displays the trend in the total holdings of this value band over the last five years:

The graph shows that the total number of coins held by this Bitcoin UTXO value band has seen a sharp drop this year. In all, the drawdown has amounted to 453,205.04 BTC being dumped by this cohort since the peak observed in June 2022.

For comparison, in the 2018/19 bear market, the 1k-10k BTC value band saw a total drawdown of 324,868.65 BTC from the high. During the COVID black swan crash of 2020, the group also distributed a significant amount, shedding 186,928.48 from its holdings.

And in the bull run during the first half of last year, these whales reduced their holdings by 407,457.14 BTC between the peak in February and the July bottom. The latest drawdown in the metric’s value is the sharpest that Bitcoin has seen yet. Because of this fact, the quant exclaims the current cycle to be the “most challenging” one in the history of the asset so far.

An interesting pattern can also be seen in the chart; whenever the 1k-10k BTC has finished with the distribution and started accumulating again, Bitcoin has felt a bullish impact. “Generally, the market can only recover when this cohort has enough confidence to accumulate again,” explains the analyst. “And at the moment, we still not get any positive signals from this cohort.”

At the time of writing, Bitcoin’s price floats around $16,600, down 1% in the last week.

Michael Greco, policy research director at the Digital Dollar Project (DDP) and Josh Lipsky, senior director of the Atlantic Council’s GeoEconomic Center, discuss why the development of a central bank digital currency in the U.S. may only be a matter of time.

A lack of excitement on order books is just one sign that downside volatility could easily resume, says Material Indicators.