The Bitcoin network surpassed 926,000 daily transactions, driven by a growing interest in Runes.

Cryptocurrency Financial News

The Bitcoin network surpassed 926,000 daily transactions, driven by a growing interest in Runes.

Imaginary Ones co-founder Clement Chia believes that simply adding blockchain to the metaverse doesn’t solve its “purpose” problems.

The startup is one of the first to build tokenized tech for Bitcoin’s Runes era.

Nvidia-backed AI startup Synthesia unveils “Expressive Avatars,” enabling AI to convey human emotions and movements for corporate presentations and training.

The arrest of the founders of Samourai Wallet led to widespread concerns in the crypto community that the U.S. government was attempting to crack down on the industry

The new laws set up “enhanced” due diligence and customer checks for crypto firms.

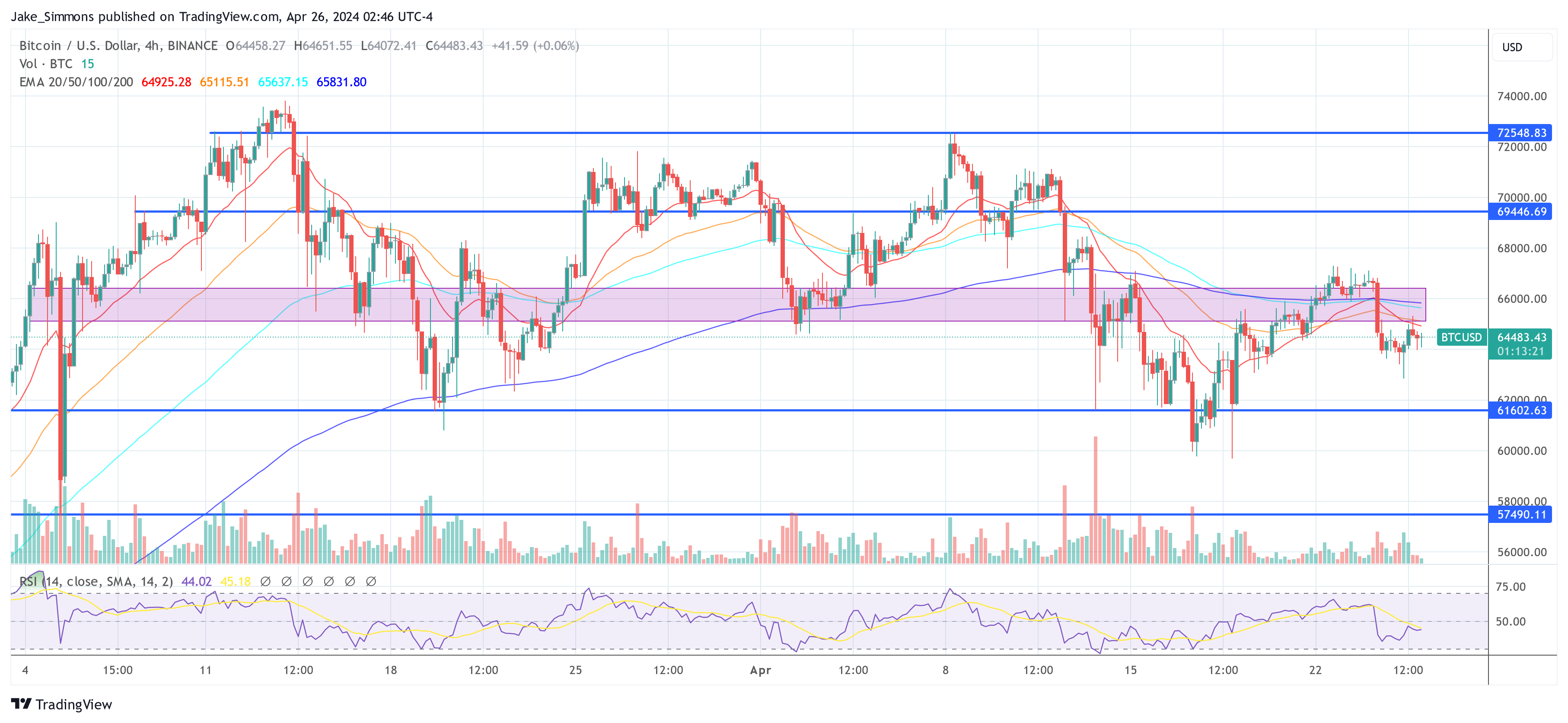

For crypto investors, the last several weeks have been a rollercoaster, with many assets seeing price dips and failing to post meaningful gains. The short-term outlook is bleak, despite some analysts’ continued optimism on the market’s long-term prospects.

Even the granddaddy of cryptocurrencies, Bitcoin (BTC), hasn’t been immune to the market downturn. Currently trading around $63,400, BTC is down 5% in the past day and a staggering 13% from its all-time high of over $73,000.

This sluggish performance follows the recent Bitcoin halving event, which some enthusiasts believed would trigger a price surge. However, market experts had predicted otherwise, and it seems their forecasts were on point.

The halving, which cuts the number of new Bitcoins entering circulation in half every four years, is intended to control inflation and theoretically increase scarcity over time. However, its impact on short-term price movements appears minimal.

One cryptocurrency experiencing a particularly harsh beating is Sui (SUI), the native token of the Sui blockchain ecosystem. SUI has been on a downward trajectory for the past week, plummeting a staggering 30% from its all-time high of $2.20.

This week alone, SUI has dipped as low as $1.15 before experiencing a brief uptick, only to fall again. The current price sits around $1.18, reflecting a 10% loss in the past 24 hours.

SUI’s TVL Tumbles

Adding to Sui’s woes is the significant decline in its total value locked. TVL refers to the total amount of cryptocurrency locked in DeFi (Decentralized Finance) protocols within a particular blockchain ecosystem.

A high TVL indicates strong user activity and locked funds, which are seen as positive indicators for the health of the ecosystem. Unfortunately for Sui, its TVL has tumbled 30% from its record high earlier this year, currently sitting at around $535 million according to DefiLlama data.

This drop in TVL suggests a decrease in user engagement and locked funds within the Sui ecosystem, mirroring the broader negative sentiment.

Broader Market Correction Or Underlying Issues?

The current market slump isn’t limited to Sui or even Bitcoin. Major altcoins like Ethereum, Solana, and Curve DAO have also seen losses ranging from 4% to 6% over the past week. This suggests a broader market correction rather than an issue specific to Sui.

Analysts point to several factors potentially contributing to the downturn, including rising inflation concerns, ongoing geopolitical tensions, and a general risk-off sentiment among investors.

What Lies Ahead For Crypto?

While the short-term outlook for the crypto market appears uncertain, many analysts remain optimistic about the long-term potential of the technology. The underlying innovation and potential for disruption across various sectors continue to attract interest.

However, navigating the current volatility will likely require a strong stomach and a long-term investment horizon for those looking to weather the storm.

Featured image from Charleston Dermatology, chart from TradingView

The investment firm sold 237,983 BITO shares worth $6.7 million at Thursday’s closing price of $28.22 from its Next Generation Internet ETF (ARKW).

Yao Qian, the first director of CBDC development at China’s central bank, is reportedly under investigation for suspected law violations.

The transaction fees are the “wild card” for Bitcoin miners, with the current increase representing a crucial revenue boost for BTC miners, according to TeraWulf’s CEO, Nazar Khan.

The trader received a $6.28 million payday trading BONK, $9.51 million trading WIF and $7.04 million from BODEN.

Microsoft and Google’s Q2 earnings reports highlight significant revenue and profit increases, driven by their investments and advancements in AI technologies.

Yao Qian is reportedly being investigated for “violations of discipline and law.”

Senators Elizabeth Warren and Bill Cassidy are asking federal agencies about their technical capacity to combat crypto payments in the sale of child abuse material.

The world of cryptocurrencies is abuzz with speculation once again, this time centered around Shiba Inu (SHIB), the Dogecoin-inspired meme coin. Prominent Bitcoin investor Armando Pantoja has thrown down the gauntlet, predicting a price surge for SHIB, potentially reaching $0.001 by the end of 2025. This ambitious target has reignited discussions about SHIB’s potential and its ability to carve a niche beyond its meme-coin origins.

SHIB’s past is a story of remarkable growth. In 2021, the meme coin defied expectations, experiencing a meteoric rise of over 800,000%. This phenomenal journey minted crypto millionaires and captured the imagination of retail investors. However, unlike established players like Bitcoin and Ethereum, SHIB’s initial value proposition was primarily driven by its meme status and community enthusiasm.

My #crypto price targets for 2024-2025$BTC: $100k-$250k$ETH: $10k-$15k$XRP: $3-$6$SHIB: $0.001+$DOGE: $1$SOL: $500-$1000$AVAX: $100+$ICP: $100+$INJ: $100-$200$PRO: $10-$20$HBAR: $5-$10

— Armando Pantoja (@_TallGuyTycoon) April 24, 2024

However, the tides appear to be shifting. Recognizing the need for more than just viral appeal, the Shiba Inu team has been actively developing its ecosystem. A central initiative in this effort is the upcoming Shibarium hardfork, scheduled for launch on May 2nd. This upgrade aims to introduce Shibarium, a layer-2 scaling solution designed to address scalability concerns and enhance user experience.

The potential impact of Shibarium is drawing comparisons to the highly anticipated Ethereum 2.0 upgrade. Ethereum, the world’s second-largest cryptocurrency by market cap, has long grappled with scalability issues, leading to high transaction fees and network congestion.

Ethereum 2.0 promises to address these challenges by transitioning to a proof-of-stake consensus mechanism, offering faster processing times and lower fees. However, its development has faced delays, leaving a gap in the market for user-friendly alternatives.

Shibarium’s success could position SHIB as a more attractive option for developers seeking to build decentralized applications (dApps). By offering faster and cheaper transactions, Shibarium could potentially lure developers away from Ethereum, especially those focused on projects requiring frequent interactions and lower costs. This scenario could mirror the way Ethereum itself disrupted the dominance of Bitcoin in the early days of decentralized finance (DeFi).

1/ SHIBARMY, we are on the brink of a transformative upgrade for Shibarium.

Through an upcoming hard fork expected to go live on May 2nd, we’re introducing a suite of new features designed to enhance user experience and empower our community of innovators and developers.

— Shib (@Shibtoken) April 25, 2024

Despite the optimism surrounding Shibarium, reaching $0.001 by 2025 remains a significant hurdle. The cryptocurrency market is inherently volatile, and unforeseen events can drastically impact prices. Widespread adoption of Shibarium is crucial for long-term growth, and its success hinges on attracting developers and users to build a robust ecosystem.

As of the time of publication, Shiba Inu is trading at $0.00002459, indicating a decrease of 9% over the previous day. For Shiba Inu to potentially reach a price higher than $0.001 this year, it needs to increase by nearly 4,000%.

Meanwhile, some analysts remain cautious. While acknowledging SHIB’s past gains, they point to the dominance of established cryptocurrencies like Ethereum and the overall market conditions. Platforms like Telegaon offer a more conservative outlook, predicting a maximum price of $0.0000728 for SHIB by 2025, falling short of its all-time high.

Featured image from Pixabay, chart from TradingView

Bitcoin and crypto may still have a friend in U.S. treasury secretary Janet Yellen if liquidity comes roaring back to the economy next week, says Arthur Hayes.

BTC Stable Above $64K While ETF Outflows Hit $200 Million

SlowMist Technology’s report stated that this type of scam exploits users’ trust and negligence, resulting in asset losses.

Arthur Hayes, co-founder and former CEO of the cryptocurrency exchange BitMEX, took to X to provide a detailed analysis of the US economic landscape and its potential effects on the crypto market. With a reputation for incisive commentary and a deep understanding of both traditional and digital finance, Hayes’s insights are closely watched by industry participants.

In a post, Hayes noted a significant increase in the Treasury General Account (TGA), which he attributed to an influx of approximately $200 billion from tax receipts. “As expected tax receipts added roughly $200bn to TGA,” Hayes stated, setting the stage for a broader discussion on potential implications for financial markets.

Hayes then shifted focus to upcoming decisions by US Treasury Secretary Janet Yellen concerning the management of the TGA. With a tone mixing respect and sternness, he outlined several potential scenarios, each with profound implications for market liquidity. “Forget about the May Fed meeting. The 2Q24 refunding announcement comes out next week. What games will [Janet] Yellen play, here are some options,” Hayes remarked.

Firstly, he suggested that by “stopping issuing treasuries by running down the TGA to zero,” Yellen could unleash a $1 trillion liquidity injection into the economy. This strategy would involve using the accumulated funds in the TGA for federal spending without issuing new debt, thus directly boosting the money supply.

Secondly, Hayes speculated about “shifting more borrowing to T-bills, which removes money from RRP,” resulting in a $400 billion liquidity boost. This maneuver would involve the Treasury opting for shorter-duration debt instruments, which typically carry lower interest rates but increase the turnover of government securities. This could potentially draw funds away from the overnight reverse repo market, where financial institutions temporarily park their excess cash.

Combining these two approaches, according to Hayes, could lead to “a $1.4 trillion injection of liquidity” if Yellen decides to both cease long-term bond issuance and ramp up the issuance of bills while depleting both TGA and RRP accounts. Hayes emphatically noted, “The Fed is irrelevant, Yellen is a bad bitch, you best respect her.” This statement underscores his belief in the significant impact of Treasury actions over Federal Reserve policies in the current economic setup.

Hayes predicted that these actions could lead to a bullish response in the stock market and, more crucially, a rapid acceleration in the crypto market. “If any of these three options happen, expect a rally in stonks and most importantly a re-acceleration of the crypto bull market,” he explained.

The implications of such fiscal strategies are significant. Increased liquidity typically diminishes the appeal of low-yield investments like bonds and encourages the pursuit of higher returns in riskier assets, including equities and cryptocurrencies. Moreover, a shift in market sentiment toward ‘risk-on’ could see substantial capital flows into the crypto space, perceived as a high-growth, albeit volatile, investment frontier.

In conclusion, Hayes’ analysis suggests that the coming week – the refunding announcement comes on Monday, April 29 – could be critical for market watchers. His perspective, drawing from deep financial expertise, points to a possible pivotal shift in US fiscal policy that could ripple through global markets. For crypto investors, these developments could signal important movements, underlining the need for vigilance and readiness to respond to new economic signals.

At press time, BTC traded at $64,483.