Former SEC official John Reed Stark has criticized the misuse of “regulation by enforcement” claims in a hearing before U.S. Congress.

Cryptocurrency Financial News

Former SEC official John Reed Stark has criticized the misuse of “regulation by enforcement” claims in a hearing before U.S. Congress.

U.S. authorities have identified Russian national Dmitry Khoroshev as the mastermind behind the notorious LockBit ransomware gang, and are offering a $10 million reward for information that leads to his arrest.

In an ever-evolving world of cryptocurrency markets, deciding the bottom of Bitcoin price correction is an endeavor that attracts interest from both investors and analysts. Joining the fray is cryptocurrency analyst and trader MilkyBull offering insights on the subject, claiming that Bitcoin’s local bottom has developed due to a certain development.

Following its weekend recovery out of bear market territory, the price of Bitcoin slightly decreased on Monday. However, MilkyBull is confident that the recent retracement might be the last before BTC turns to move on the upside.

According to the expert, given that the next liquidity grab interest is above $64,557, the local bottom for Bitcoin is in. As a result, before moving on to the current all-time high of $73,000, BTC will first clear the $67,000 price level and consolidate. Thus, Bitcoin may eliminate the CME gap below either prior to or subsequent to eliminating the liquidity above $64,975.

Related Reading: Bitcoin Bottom In? Retracement From $73,800 Is Deeper And Took Longer To Form

The CME gap is a price difference that occurs between the Friday closing price and Sunday opening prices of the Chicago Mercantile Exchange (CME) Bitcoin futures market. Therefore, the expert considers this development a good area for long trade, signaling a buying opportunity for BTC bullish investors.

MilkyBull further drew attention to a previous analysis that suggests Bitcoin could be poised for a rally due to historical patterns. The analyst noted that the 2017 price action shows that when BTC breached a new all-time high, there was a healthy retracement that was driven by liquidity before it surged to a cycle peak.

Given that BTC might be mirroring this pattern, MilkyBull’s analysis might suggest that BTC has undergone its last shakeout, and a move on the upside could be imminent. He also confirmed that the present consolidation range was paralleled by the preceding consolidation, which began to materialize from December 2023 to February 2024.

This pattern, identified as a manipulative strategy of the market makers (MMs) by the expert, is meant to remove degenerate Short-Term Holders (STHs), which are particularly vulnerable to price corrections below their cost base.

While MilkyBull anticipates a rally, market expert Benjamin Cowen expects the leading cryptocurrency asset to drop in the upcoming days. Last week, Cowen claimed BTC’s Return On Investment (ROI) 12 days after the Bitcoin Halving event was the worst performance that the asset has experienced. According to Cowen, this is reasonable as it is the first time BTC is reaching a new all-time high before the Halving.

Almost a week later, there is still no improvement, as the analyst noted that BTC ROI is still performing worse than in previous cycles. Comparing this action with that of 2016, Cowen expects BTC to undergo a decline in the coming week.

During the time of writing, BTC was trading at $63,970, demonstrating an increase of over 3% in the past week. While its market cap is down by 1.17%, its daily trading volume has garnered positive sentiment, rising by 40%.

“As an environmental lawyer, scion of a Democratic political dynasty, and now maverick presidential candidate, Kennedy will explain his support for cryptocurrency and self-custody,” according to a statement.

Ethena’s USDe tokenized yield strategy has attracted over $2 billion in deposits and some scrutiny of the token’s risks.

A majority of respondents with crypto-positive views said they intended to vote in 2024, where tight elections in certain states could swing to either political party.

The New York-based firm built Spiderchain to be compatible with Ethereum Virtual Machine (EVM) layers.

On-chain data shows PEPE whales have moved large amounts of the memecoin during the past day. Here’s where these tokens have been heading.

According to data from the cryptocurrency transaction tracker service Whale Alert, two large PEPE transactions have occurred in the space of a few hours during the past day. Both of these moves are of a scale that’s typically associated to the whales, humongous entities that can carry some influence in the market thanks to their ability to make such large transfers.

Because of their position on the network, their moves can be worth watching, as they may end up reflecting on the price of the cryptocurrency. As for how exactly the asset may be impacted by the transfers of these investors can come down to what they intended to achieve with the moves.

It can be hard to say about any exact motive, but the details of the transactions on the blockhain can sometimes provide hints about the context surrounding it.

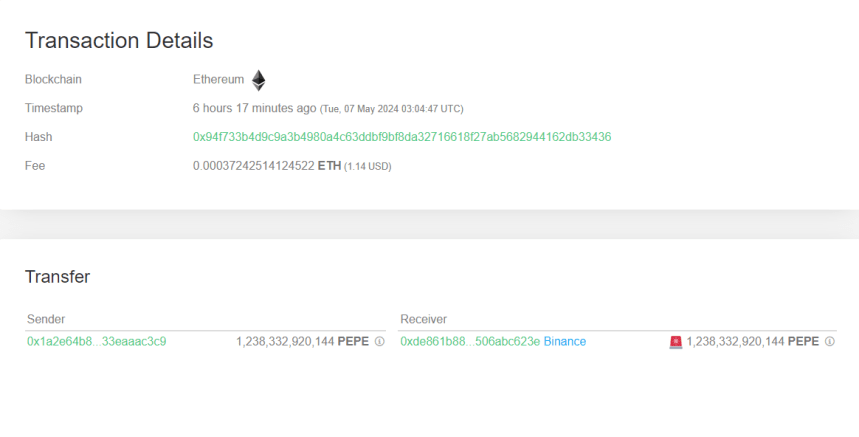

Below are the details of the first PEPE whale transfer from the past day:

As is visible, the sending address in the case of this PEPE whale transaction was an unknown wallet, meaning that it was unattached to any known centralized platform like an exchange. Such wallets are usually the investors’ personal, self-custodial addresses.

The receiving address, on the other hand, does have a platform affiliated to it: the cryptocurrency exchange Binance. Thus, it would appear that the whale moved 1,238,332,920,144 PEPE (worth over $10.5 million at the time the transfer went through) from their personal wallet to the custody of the exchange.

Transfers of this type are known as exchange inflows. The investors make exchange inflows whenever they want to make use of one of the services that these platforms provide, which can include selling. As such, exchange inflows can end up being bearish for the price.

If the whale, in the current case, indeed made the deposit to sell, then PEPE could naturally be negatively impacted, given the large scale of the transaction. Fortunately for the investors of the meme coin, though, the second transaction from today is actually the exact opposite of this transfer; it’s an exchange outflow.

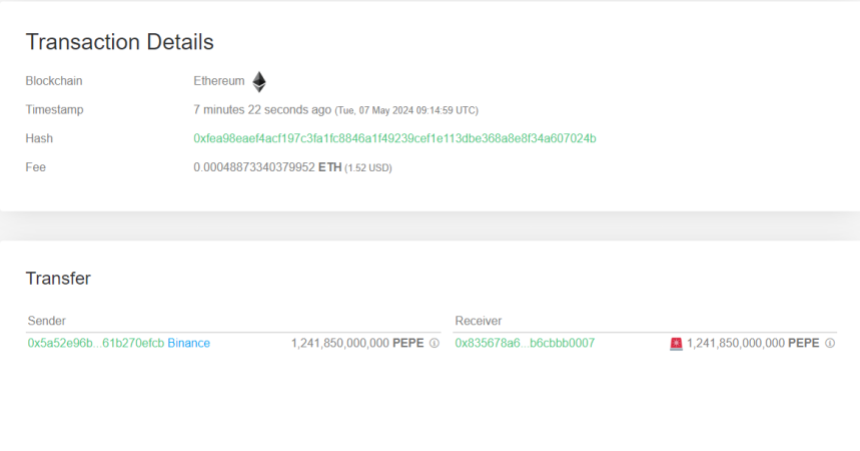

As displayed above, this PEPE whale moved coins from Binance to an unknown wallet through this transaction. Investors generally transfer to personal addresses when they plan to hold in the long term, as it’s safer to do so outside the custody of central entities. Thus, it’s possible this whale plans to HODL these coins.

Interestingly, the amount involved in this move, 1,241,850,000,000 PEPE ($10.5 million), is quite similar to the exchange inflow. Given that the same exchange is also involved in both, it’s possible that the same whale may in fact be responsible for the both of them.

Though, since the addresses don’t quite match, it’s still uncertain. Either way, the fact that an equal-sized exchange outflow has occurred mere hours after should be able to balance out any bearish effects arising out of the inflow, at least in theory.

At the time of writing, PEPE is floating around the $0.000008445479 mark, up more than 21% over the past week.

The protocol’s’s pseudonymous founder Rooter previously has been critical of “predatory” points programs.

The European Union’s Markets in Crypto-Assets Regulation is being phased in, but regulators have reportedly been inconsistent in enforcing existing laws.

Crypto analyst Charles Edwards believes we’ve entered “the 12-month window” to make altcoin profits: X Hall of Flame.

A Trump election win could be positive for crypto as his administration would likely push for a more supportive regulatory environment, the report said.

An Ethereum whale was recently revealed to have made $16 million from a single trade involving the second-largest crypto token by market cap. This whale’s story again highlights how conviction in an investment can be very rewarding in the crypto space.

On-chain analytics platform Lookonchain revealed in an X (formerly Twitter) post that the whale withdrew 12,906 ETH ($24.39 million) from Binance when the crypto token was still trading at $1,890 a year ago. With Ethereum currently trading at around $3,100, the whale’s ETH investment is now worth over $40 million, signifying a profit of about $16 million.

Interestingly, his profits from this trade will likely be more than $16 million, as the trader deposited those tokens in the staking platform Lido when he withdrew them from Binance last year. That means he also earned significant staking rewards to go alongside his $16 million profit.

On-chain data shows the whale recently withdrew 7,000 ETH ($21 million) from Lido back to Binance but has yet to offload these tokens. However, that is something to keep an eye on as the whale offloading those tokens could have a negative impact on Ethereum’s price.

Tron’s founder, Justin Sun, looks to be another Ethereum whale that could make such significant returns on their ETH investment. Two wallets believed to belong to Sun are reported to have accumulated 295,757 ETH ($891M) at an average price of $3,014 since February 12. Since then, Sun has made some notable moves that could be profitable for him.

One such move is that the Tron founder recently deposited 120,000 eETH into Swell L2, a liquid restaking protocol. Although Sun claims that this move isn’t profit-motivated, he could still make huge profits from his venture, considering that restaking is one of the leading narratives at the moment.

There have been a lot of reports highlighting how crypto investors and traders have been making life-changing, which suggests that the bull run is already in full force despite Bitcoin’s unimpressive price action lately. One opportunity that these traders have taken advantage of in this market cycle is meme coins.

Before the bull run began, there was the belief that memes would be one of the leading narratives, and that has been the case. Bitcoinist recently reported two Solana meme coin traders turned $6,400 into $8 million. Meanwhile, Lookonchain revealed a Solana trader who turned 60 SOL ($8,673) into $1.26 million in 2 months, making a 144x return on his investment.

Quantum computers will be able to crack today’s main cryptographic algorithms employed by the whole internet, including banking applications, email providers, and social media platforms.

Bitcoin exchanges are seeing the kind of daily inflows more associated with BTC prices under $1,000.

Cardano (ADA), the third-generation blockchain platform, has been mirroring a mountain climber clinging to a precarious ledge. After a brief ascent earlier this month, the price has dipped back down, leaving investors questioning the strength of the current uptick.

While a recent surge in active addresses hints at renewed interest, technical indicators and declining trading volume paint a picture of an uncertain future.

Cardano’s current price action presents a complex picture. The recent uptick offers a glimmer of hope, but the technical indicators and declining volume suggest a possible continuation of the downtrend.

Though its impact is still unknown, the increase in active addresses is a promising indication of possible rekindled interest. It will take time to see if ADA can emerge from the gloomy clouds and start its ascent with greater assurance.

For holders of ADA, May started off with a ray of hope. After a rally of three days, the price increased to $0.46 from $0.45. Nevertheless, a series of losses soon erased these gains, returning the price to the $0.45 region, which is where it was previously. This pattern of stops and starts emphasizes how ADA suffers from a lack of consistent propulsion.

As of today, a small uptick has brought ADA back to the $0.45 zone, offering a temporary respite. But lurking beneath the surface is the persistent bear trend, a fact confirmed by the Relative Strength Index (RSI) hovering just above 40. This metric suggests weak buying pressure and the potential for further price slides.

Making matters worse, a technical indicator known as a “death cross” looms on the horizon. This ominous pattern occurs when the short-term moving average crosses above the long-term average, often signaling a bearish price trend.

With ADA currently trading below both these averages, the threat of a death cross adds another layer of uncertainty to the price trajectory.

Cardano’s Quiet Streets: Trading Volume Dampens Enthusiasm

Trading activity on the Cardano network hasn’t exactly been bustling. The volume, which surged to over $400 million at the beginning of May, has since dwindled to around $275 million. This significant drop suggests a decline in investor interest, which can act as a drag on price increases.

Typically, a healthy increase in volume accompanies sustained price hikes, indicating strong buying and selling activity. In Cardano’s case, the muted volume paints a concerning picture of a market lacking conviction.

Active Addresses Show Tentative Rise

A lone bright spot emerges in the form of Cardano’s active addresses. This metric tracks the number of unique addresses participating in transactions on the network. There’s been a recent uptick in seven-day active addresses, with the number rising from around 155,000 to over 160,000.

While this increase is encouraging, some analysts believe it might not be substantial enough to significantly impact trading activity and trigger a sustained price reversal.

Featured image from InspiredPencil, chart from TradingView

Regulators like HKMA and SFC united with local private sector firms like HSBC and HashKey to support the market of tokenization in Hong Kong.

In a post on X, crypto analyst Miles Deutscher laid out his strategic predictions for high-performing cryptocurrencies in the upcoming week to his 501,700 followers. His analysis delved deep into Bitcoin’s trading patterns, the surging AI-driven altcoin sector, and specific tokens that are displaying considerable potential due to recent developments and broader market dynamics.

At the forefront of Deutscher’s analysis, Bitcoin has recently returned to its previous trading range between $60,000 and $69,400 after experiencing a sharp drop. This movement was characterized as a significant deviation, suggesting manipulation or a shakeout of weak hands before a potential rally.

“Bitcoin is at the top of my watchlist for this week. Had a big fakeout/deviation to the downside, and now back within the range,” Deutscher stated. He pointed out that the key factor to watch is whether the current range’s lower boundary will hold, which could serve as a strong foundation for an upward trajectory.

Moreover, the AI sector has been particularly resilient and robust recently, bouncing back significantly amidst broader market recoveries. Deutscher highlighted the sector’s potential for outperformance, driven by several upcoming major events.

These include Apple’s Worldwide Developers Conference (WWDC), NVIDIA’s earnings announcement, and the anticipated release of ChatGPT 5. “AI is one of those unique narratives that retains constant mindshare due to its endless real-life news flow/hype,” Deutscher explained.

One specific AI token which Deutscher watches closely due to its alleged partnership with Apple is Render (RNDR), making it a prime candidate for speculation around the upcoming Apple event. Historically, RNDR has also led the AI token sector during market rotations.

Furthermore, Deutsches focuses on Near Protocol (NEAR), Fetch.ai (FET), AIOZ Network (AIOZ). He grouped these tokens together due to their correlation but noted their recent technical performance, where they bounced cleanly off daily support levels and established higher lows.

More Altcoins To Watch

TON: Recently the center of attention, TON experienced a drop after the Token2049 event in what Deutscher described as a “sell-the-news” scenario. However, recent investments by firms like Pantera signal continued interest and potential undercurrents of growth.

Ethena (ENA): With the market sentiment turning bullish again, Deutscher anticipates a return to positive funding rates, which typically benefit tokens like Ethena. Recent activity from the Ethena team, including increased reward boosts and optimistic social media posts from its founders, further bolster the bullish case. “Also hearing rumors of a T1 exchange listing,” Deutscher added, suggesting an impending increase in liquidity and exposure.

Jito (JTO): Jito is reportedly developing what Deutscher referred to as the “Eigen Layer of Solana,” aiming to replicate the success and hype surrounding the Eigen project’s layer solutions. Despite the challenges of a recent airdrop, Deutscher sees potential if the team executes well, particularly as the restaking narrative has not yet fully penetrated the market.

PopCat (POPCAT): Despite facing some fear, uncertainty, and doubt (FUD) related to copyright issues over the weekend, POPCAT continues to exhibit strong price action, pushing toward new highs. “POPCAT seems the best contender, for now, not a single cat meme coin has yet to hit a $1B market cap,” noted Deutscher, highlighting its standout performance.

Ethereum Finance (ETHFI): In the realm of liquidity reward tokens (LRT), ETHFI remains a notable mention despite a broader sector sell-off post-Eigen. Deutscher believes the selling may have been overreactive, and with total value locked (TVL) still on the rise, a reversion to mean on prices could be imminent.

SEI Network (SEI): As anticipation builds for the launch of the new layer one blockchain, Monad, later this year, SEI is seen as a strategic play. Categorized within the parallelized Ethereum Virtual Machine (EVM) narrative, SEI experienced a substantial sell-off but is poised for recovery as the market focus shifts towards upcoming launches.

Friend (FRIEND): After recommending FRIEND at $1.30, Deutscher continues to see upside potential, particularly as it approaches more significant centralized exchange listings. He advises keeping an eye out for major pullbacks as opportunities to buy.

The in-principle approval enables QCP Capital to offer regulated digital asset activities in the region.