In a recent statement, Dennis Porter, the co-founder and CEO of Satoshi Action Fund, expressed his belief that the year 2024 will mark a crucial turning point in the history of Bitcoin.

Porter’s remarks amidst growing anticipation surrounding the approval of spot Bitcoin exchange-traded funds (ETFs) and the highly anticipated halving event scheduled for April 2024.

According to Porter, these events, combined with the efforts of the Satoshi Action Fund, have the potential to impact the price and adoption of Bitcoin significantly.

Satoshi’s Plan To Establish The US As Global Bitcoin Leader

Satoshi Action Fund, a non-profit organization dedicated to informing policymakers and regulators about Bitcoin, has actively shifted the narrative surrounding the world’s leading cryptocurrency.

The fund aims to promote “hyper-Bitcoinization,” a term coined to describe the widespread adoption of Bitcoin as a global currency.

One of the primary goals of the Satoshi Action Fund is to advocate for the passage of pro-Bitcoin legislation in 10 different US states by 2024. According to Porter, these proposed laws would protect individuals’ rights to self-hold and mine Bitcoin, positioning the United States as a global leader in Bitcoin adoption and mining.

Interestingly, Porter envisions a future where bipartisan legislation empowers Bitcoin and fosters the growth of an emerging digital asset industry.

Recent developments in the Bitcoin ecosystem further bolster Porter’s optimism. The halving event occurs approximately every four years and is anticipated to reduce the rate at which new Bitcoins are created, potentially leading to increased scarcity and upward price pressure.

Additionally, the long-awaited approval of Bitcoin ETFs by the Securities and Exchange Commission (SEC) has the potential to attract institutional investors and facilitate mainstream adoption.

BTC’s Path To New Heights

Renowned crypto expert Charles Edwards has boldly proclaimed that the recent liquidation of fear, uncertainty, and doubt (FUD) surrounding the crypto market will pave the way for a significant price rebound.

Edwards believes that the culmination of recent developments, particularly the Binance news, will eliminate sources of FUD accumulated over the past two years.

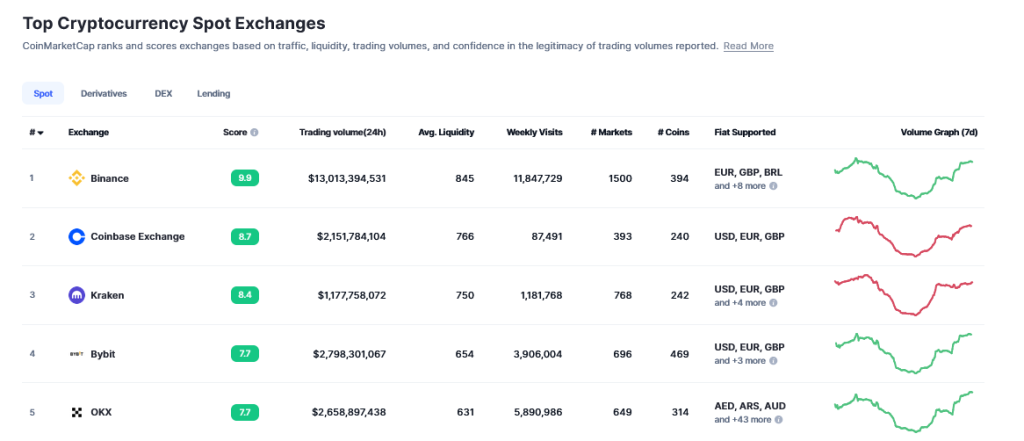

The market has been gripped by panic triggered by headlines associating the term “guilty” with cryptocurrencies. However, Edwards suggests that the recent news concerning Binance should be viewed more as a settlement rather than a detrimental event.

Edwards points out that five years ago, exchanges were not compliant with know-your-customer (KYC) and anti-money laundering (AML) regulations, whereas now, they have implemented these practices. Consequently, Edwards believes that the lingering FUD surrounding Binance can finally be restored.

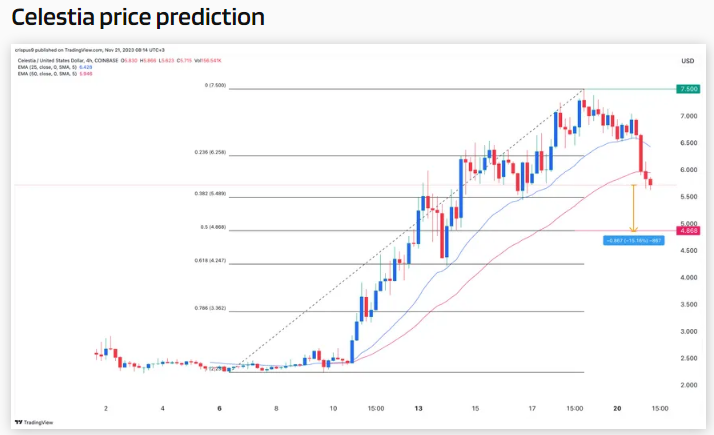

Looking ahead, Edwards highlights several positive catalysts on the horizon for BTC. These include the potential approval of ETFs, the upcoming Bitcoin halving event, expectations of lower interest rates, and the possibility of a recession leading to increased quantitative easing (QE).

Edwards concludes by envisioning a “Bitcoin liquidity atomic bomb” waiting to explode. With the elimination of FUD and a series of positive triggers aligning, the market is poised for a substantial rebound.

The convergence of ETF approvals, the halving event, accommodative monetary policies, and a potential recession are expected to propel Bitcoin to new heights.

At the time of writing, Bitcoin (BTC) is trading at $36,500, experiencing a slight decline of 2.2% over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com