The North Korean hacker group stole the funds over the last six years, which was likely used to fund the country’s projects, the report said.

Shibarium Transactions Sees 4,400% Explosion, Time For SHIB And BONE ATH?

Shibarium has crossed a new milestone in the space of a few days. The layer-2 solution built for Shiba Inu’s ecosystem just saw transactions spike an astounding 4,400%, registering 748,230 transactions in the past 24 hours.

Numbers like this demonstrate the sheer adoption rate of Shibarium, and investors are left wondering if high valuations for the tokens on the Shiba Inu ecosystem are inevitable.

Shibarium Transactions Explode Over 4,400% In One Day

Shibarium went live in August and has become the go-to platform for SHIB whales and investors. Shibarium recently crossed the 4 million transaction mark, but it looks like the run isn’t stopping anytime soon.

The layer-2 solution saw an explosion of over 4,400% transactions in just the past 24 hours to reach the next milestone of five million transactions. According to data from Shibariumscam, there were 748,230 transactions in the past 24 hours, the highest ever recorded since its launch.

Notably, the transaction count on the network has been on the rise in the past week, as it reported over 43,000 transactions On November 23. At the time of writing, the total transaction count now stands at 5.968 million and is steadily approaching the 6 million milestone.

What This Means For SHIB And BONE Prices

The massive increase in Shibarium transactions is hugely bullish for SHIB and BONE prices. With more activity and utility on the network, demand for the native tokens should rise. Even before the platform went live, SHIB has been known to react to updates regarding the platform. As it stands, a larger part of SHIB’s utility is now tied to the adoption and use of Shibarium.

BONE is also of this sentiment regarding Shibarium. Apart from its utility as the governance token on the ShibaSwap decentralized exchange (DEX), BONE is also used to pay gas fees on the Shabarium network. The more people buy, sell, and trade on the network, the higher BONE’s price can climb. As a result, the hype around Shibarium’s launch in August saw the crypto spike over $1.7 for a few hours.

It would seem that both SHIB and BONE have reacted positively to the recent transaction surge on Shibarium, among other things. According to data from Coinmarketcap, SHIB is up by 1.45% in the past 24 hours, while BONE is up by 2.59% in the same timeframe. However, despite the constant spikes this year, both tokens are still in the negative in a larger timeframe, down by 9.89% and 18.64% in a yearly timeframe.

Due to the recent spike in Shibarium transactions, many SHIB and BONE holders are optimistic that new all-time highs are on the horizon for these tokens. SHIB is trading at $0.000008315 at the time of writing and it would need to perform a 930% gain to reach its all-time high of $0.00008616. BONE, on the other hand, is currently trading at $0.6262 and would need to perform gains of 2375% to reach its current all-time high of $15.50.

The Shiba Inu ecosystem continues advancing, enhancing the utility and technology behind SHIB, and the future looks bright for this innovative ecosystem and its tokens.

Crypto Analyst Explores The Hype: Are These The Best 2 AI Altcoins?

Two AI-focused projects have recently garnered significant attention: Render Network (RNDR) and Bittensor (TAO). These projects, while distinct in their objectives and execution, are at the forefront of integrating artificial intelligence with blockchain technology. Analyst Crypto Stream has analyzed the two most hyped AI projects in this cycle and tried to answer the question: “Which one is the true king of AI coins?”

Render Network (RNDR): A Leap In GPU Rendering

Crypto Stream highlights that Render Network addresses a critical need in the current digital era: the demand for GPU computing power. Industries ranging from filmmaking to AI research are constantly seeking more computational resources, a need that even major tech giants struggle to meet.

Render Network ingeniously tackles this issue by enabling individuals with GPU resources to monetize their idle computing power. As Crypto Stream puts it, “Render Network is not just optimizing resource utilization but is fundamentally changing the dynamics of GPU computing power accessibility.”

The economic model of RNDR has evolved since its inception as an ERC-20 token in 2017. Migrating to the Solana blockchain, the project introduced a burn mechanism, where RNDR tokens equivalent to the fiat value of GPU power purchased are burnt, potentially reducing the token supply over time. “This burn mechanism,” Crypto Stream notes, “is a fascinating aspect of RNDR, adding a deflationary characteristic to its tokenomics.”

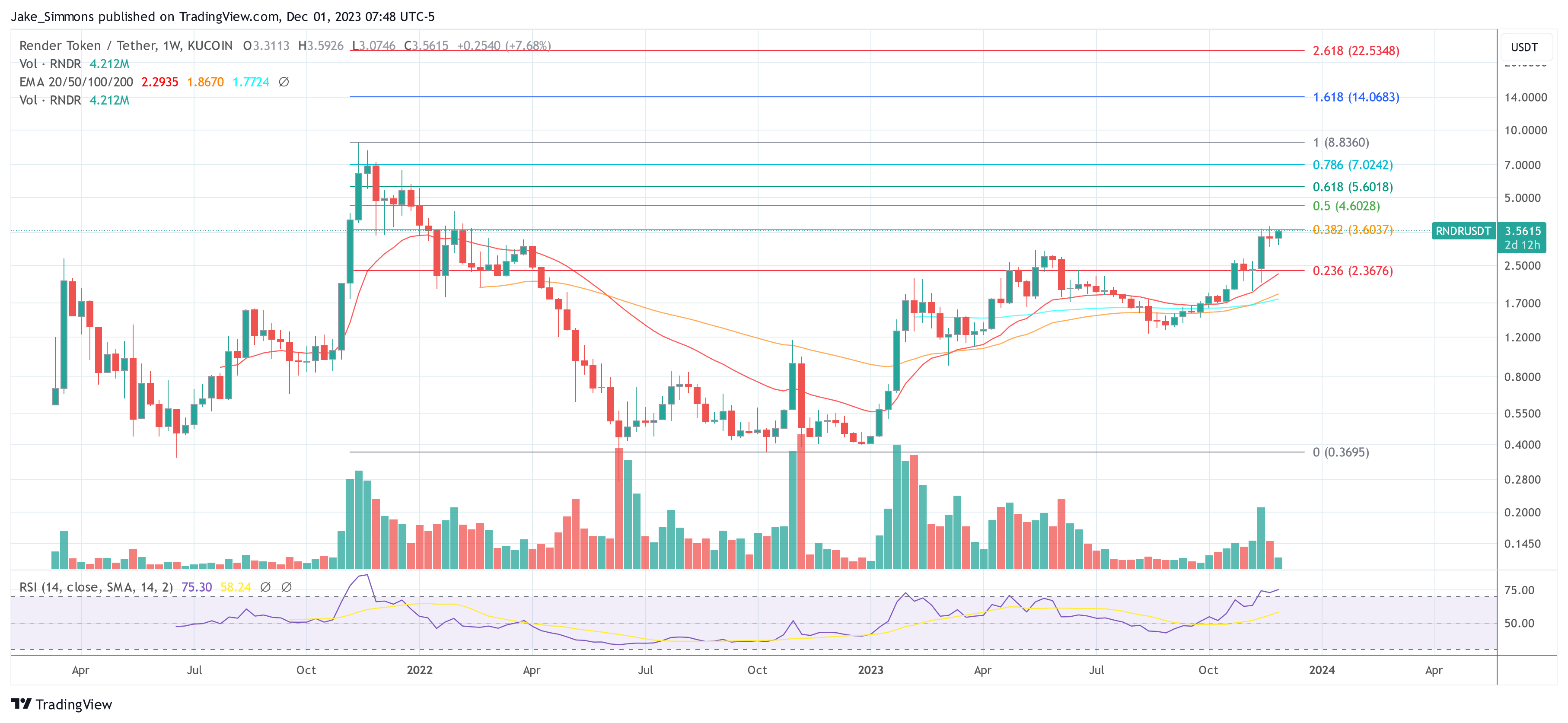

Discussing RNDR’s market performance, Crypto Stream observes that the token’s peak at over $7 in 2022 and its current price at $3.49 reflect its substantial growth. With a market capitalization of $1.3 billion and a fully diluted valuation of $1.8 billion, RNDR has already experienced a significant 10x increase this year. “We’re not early in the game with RNDR, but its potential in the AI space still makes it a project worth watching,” advises Crypto Stream.

At press time, RDNR was trading at $3.56, slightly below the 0.382 Fibonacci retracement level at $3.60.

Bittensor (TAO): Democratizing AI Model Deployment

Bittensor’s aim to decentralize the deployment of machine learning algorithms stands in contrast to RNDR. It aims to challenge the dominance of tech giants in AI, such as OpenAI and Meta, which control the best AI models, by creating a platform for trading specialized AI models.

“Bittensor is opening doors for smaller research teams globally, allowing them to contribute and monetize their specialized AI models,” states Crypto Stream. This specialized focus actively caters to a variety of needs, including non-English languages and niche industries, often overlooked by larger players.

Crypto Stream is particularly impressed by Bittensor’s tokenomics, which are inspired by Bitcoin’s model. “With a total supply mirroring Bitcoin’s, no premine or ICO, and a halving cycle every four years, TAO’s economic design is both robust and promising,” he comments.

Approximately 6 million TAO tokens are currently in circulation, with the token trading near its all-time high of $304. “TAO’s current market cap of $1.8 billion and an FDV exceeding $6 billion signify its growing prominence, though much of its supply is yet to be released into the market,” Crypto Stream added.

Which One Is The Best AI Altcoin?

Crypto Stream concludes that both RNDR and TAO offer unique and complementary solutions to the AI and crypto sector. RNDR’s focus is on solving the hardware problem by leveraging unused GPU power, while TAO addresses the software side by enabling a marketplace for AI models.

“It’s hard to declare a definitive leader in the AI token space,” Crypto Stream reflects, “as both RNDR and TAO bring innovative solutions to the table. RNDR’s burn feature and TAO’s Bitcoin-like tokenomics each have their own appeal, targeting different needs within the AI and crypto markets.”

Real AI use cases in crypto: Crypto-based AI markets, and AI financial analysis

Increasing numbers of blockchain marketplaces offer crowdsourced data and compute for AI models — and can AI analysis improve fund returns?

Evidence mounts as new artists jump on Stability AI, MidJourney copyright lawsuit

The battle continues as artists amend a lawsuit previously struck down by court authorities against major AI companies who have allegedly violated creative copyright laws.

Ethereum ATH: Exploring The Possibility Of Ether’s New Peaks In 2024

Ethereum (ETH), the world’s second-largest cryptocurrency, is demonstrating robust momentum as its price stages a resurgence, reclaiming levels above $2,000.

This bullish trend gains traction concurrently with significant developments in the US Securities and Exchange Commission (SEC). The regulatory authority is engaging in discussions regarding the potential approval of a spot Ethereum Exchange-Traded Fund (ETF).

This pivotal development has injected optimism into the Ethereum market, as the prospect of an ETF introduces new possibilities for mainstream adoption and investment, further fueling the current upward trajectory of Ether’s value.

Ethereum’s Ascending Triangle: Bullish Breakout Potential

Over the course of several months, the price of Ethereum has been in a consolidation trend that has resulted in the formation of an ascending triangle. Although the technical formation is bullish by nature, this is only true following a profitable breakout.

Trend lines connect the equal highs and higher lows of the ascending triangle configuration. This arrangement indicates that investors are growing more confident and buying the dips at a faster pace.

Interestingly, today’s charts show there are no “dips” to buy, as Ethereum broke past the vaunted $2,000 level to welcome December on a high note.

Ethereum is not only keeping up, but also rising to unprecedented heights. The price of ETH is currently up 3% at $2,100, and investors and enthusiasts are excited about the possibility of a rally to $3,000 or even higher.

Ether’s impressive success against Bitcoin, outperforming the alpha cryptocurrency by almost 5%, is a major indicator of this. Important on-chain signals imply that ETH may continue to outperform BTC this month.

Fidelity Filing Fuels Ethereum Optimism

The first indication of a bullish move was a breakout over the psychological $2,000 barrier, although there has been a lot of see-saw motion around this level. More specifically, ETH is trading between the weekly support level at $1,930 and the high for the second quarter at $2,140. This is the fourth week in a row that this has been happening.

#Ethereum Spot ETF filing by Fidelity!

Confirms my thesis that after #Bitcoin gets its shine, we’ll see Ethereum running to $3,500 in Q1 2024.

— Michaël van de Poppe (@CryptoMichNL) November 30, 2023

Crypto analyst Michael van de Poppe has voiced his optimism for Ethereum in light of the Fidelity filing. Given this submission, he affirms his conviction that after Bitcoin’s rapid increase, Ethereum is positioned to attain $3,500 throughout the initial quarter of 2024.

In a related development, research shows there has been a significant increase in Ethereum whale accumulation. On-chain data indicates that the biggest Ethereum wallets, according to Santiment, are showing a positive pattern that suggests a big change.

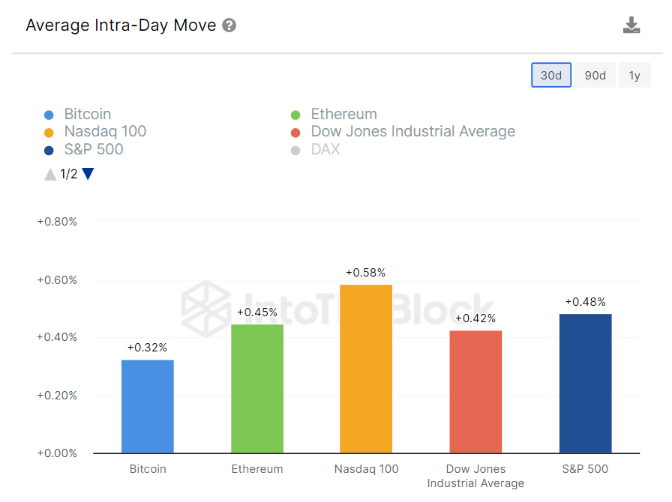

Meanwhile, Ethereum has an amazing 30-day Average Intra-Day Volatility score of 0.45%, surpassing Bitcoin’s 0.32%, a recent research by IntoTheBlock shows.

Investment strategies may need to change as a result of this change in volatility dynamics, which would highlight the Ethereum market’s dynamic prospects.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Freepik

KuCoin pledges $20K grant to TON Foundation for ecosystem development

The funding will support TON ecosystem projects, research and development efforts, community-building and marketing activities.

Hashing It Out: A case for Web3 chat apps with Push Protocol’s Harsh Rajat

Harsh Rajat, founder and project lead of Push Protocol, explains the surge in the development of Web3 chat applications on the latest episode of Hashing It Out.

First Mover Americas: Bitcoin Hits $38.8K for First Time in Over a Year

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 1, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

KuCoin Ventures to Provide $20K Grant to TON Ecosystem

KuCoin Ventures’ funding will be allocated to five “mini-apps” on TON focusing on payments and gaming.

DeepMind exec: AI assesses climate issues, falls short of full solution

Google DeepMind Climate Action Lead Sims Witherspoon suggested a strategy dubbed the “Understand, Optimize, Accelerate” framework, outlining three steps for tackling climate change with AI.

Bitcoin ETFs, user experience will drive adoption — eToro CEO

Yoni Assia told Cointelegraph that products like Bitcoin ETFs align with institutions’ existing modes of operation, making it easier for them to enter the market.

Mystery Bitcoin Whale Who Bought 10,000 BTC Has Been Exposed

The attention of the crypto community has been drawn to a particular whale that has been accumulating Bitcoin for some time now. The magnitude of the whale’s holdings has left many wondering who it might be and the reason for the accumulation.

Bitcoin Whale Accumulates Over 10,000 BTC In November

In a post on his X (formerly Twitter) platform, popular Bitcoin investor Lark Davis revealed details about the “mystery whale” who had been accumulating Bitcoin. Interestingly, the wallet (bc1qch) had accumulated over 10,000 BTC in November. On-chain data also showed that the wallet currently holds over 12,000 BTC ($460 million).

Following this revelation, many began to speculate on who the owner of the wallet was and the reason for such accumulation. Lark suggested that it could be institutional investors looking to “front-run the Spot Bitcoin ETF approval.” Some were of the opinion that it could be one of the Spot Bitcoin ETF filers who were preparing ahead of a possible approval.

Irrespective of who the owner was, many felt it was a good sign of things to come for the crypto market. That is because the accumulation showed that there was still a huge demand for the flagship cryptocurrency. One could have also inferred that the whale was possibly loading up their bags ahead of the bull run which some project is around the corner.

The bullish sentiment was also ignited by the fact that the wallet had not sent out any BTC since it began accumulation at the end of October. That instantly suggests that the whale was in it for the long term rather than looking to make quick profits.

BitMEX The Mystery Whale

The mystery around who the whale might be seems to have been resolved. The wallet is reported to belong to the crypto exchange BitMEX. The exchange is also said to have been simply moving its Bitcoin holdings to this new wallet, which forms part of the exchange’s cold wallet.

This is a real possibility, considering that some of the inflows into the wallet came from a particular BitMEX wallet (bc1qm). ZachXBT, a prominent blockchain investigator, also stated that the wallet belongs to the crypto exchange. He referred to an X post, which noted that the wallet address in question was included in BitMEX’s proof-of-reserves.

If so, then there isn’t so much meaning to read into the accumulation. It has become standard procedure for these exchanges to have proof of reserves as evidence of enough liquidity on their platform. These reserves are usually proportional to the users’ assets on the exchange.

Hut8 Mining operates as U.S.-domiciled entity following USBTC merger

Amid the delisting and relisting process, Hut8 shareholders received 1 New Hut common stock for every Hut 8 share held, an official announcement confirmed.

Terraform Labs, Do Kwon Fail to Have Singapore Class-Action Suit Rejected: Report

The suit was filed in September 2022 by Julian Moreno Beltran and Douglas Gan on behalf of 375 others, who claim they lost a combined $57 million.

Bitcoin Rises to $38.8K for the First Time Since May 2022

Overall crypto market capitalization is at its highest level since May 2022 with nearly $400 billion added since the start of October.

Starknet token distribution not yet finalized, despite speculation over portal screenshots

The Starknet Foundation is warning community members to be on the lookout for scams relating to circulating screenshots of early iterations of a token distribution portal.

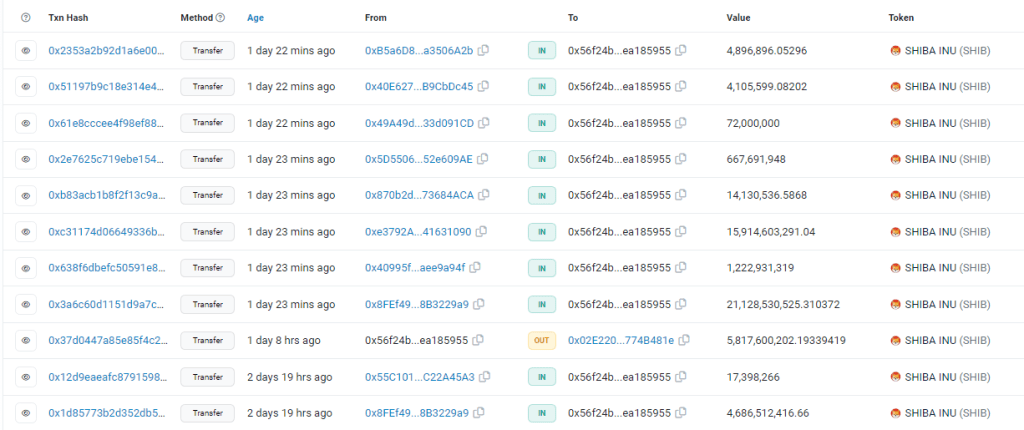

Shiba Inu Ripple: Massive $300 Billion Transfer Sends Crypto Community Into Speculation

Surprisingly, unknown whales have managed to move 300 billion Shiba Inu tokens from Binance in one big swoop. The reason for such a significant transfer is questionable given the sheer size of this token migration.

Everyone in the cryptocurrency community is wondering who the address owner is and what they’re up to after this unusual move sent shockwaves across the ecosystem.

Examining the wallet’s past activity in more detail indicates a pattern of major purchases from Binance that occurred over a few weeks prior to this noteworthy transfer.

Shiba Inu Whale Surge: Decoding The Unexpected Spike On Binance

Now, the question is: Who is responsible for this enormous transfer?

Verified in the immutable ledger of the blockchain, the transaction hash attests to the successful transfer. Despite being a cost-effective maneuver, with a transaction charge of only $3.73, it signifies a substantial change in the meme coin’s distribution.

The recent whale accumulation of SHIB is unexpected considering that the volume of major transactions on the chain has supposedly decreased by 90% since early November.

SHIB Downtrend Sparks Speculation: Unpacking Strategic Moves

Over the previous few months, Shiba Inu has experienced frequent losses. There have been rumors circulating that many SHIB holders are losing money. As of this writing, the price of Shiba Inu is $0.000008, down 1.0% in the last 24 hours.

Market observers have interpreted this as an indication that the market is gradually shifting from Shiba Inu to other cryptocurrency coins.

The aforementioned movement of SHIB has demonstrated activity in recent weeks with a trend of significant purchases from Binance.

This pattern points to a potential source of strategic amassing that could affect the coin’s value: provisioning of liquidity, investments, or even planning for additional token burns.

For the purpose of increasing scarcity and maybe influencing the coin’s value, token burns—the purposeful destruction of a portion of the cryptocurrency supply—have become a popular practice in some crypto projects.

Shiba Inu whale stockpiling is essential to the cryptocurrency’s ability to sustain upward movements. SHIB may benefit from this most recent action, but more could be needed to maintain the meme-coin’s momentum moving ahead.

In other unexpected news, Upbit, the top cryptocurrency exchange in South Korea, saw a surge in Shiba Inu (SHIB) tokens today, amounting to an astounding 84 billion SHIB, or more than $700,000.

The movements of today are noteworthy because they make up more than 25% of the SHIB volume on Upbit. This has raised suspicions regarding the intentions of the exchange and whether the large Korean CEX is getting ready for a big development involving Shiba Inus.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Freepik

FTX and Alameda Research cash out $10.8M to Binance, Coinbase, Wintermute

The latest transfer of $10.8 million was spread across 8 tokens, including Stepn (GMT), Uniswap (UNI), Synapse (SYN), Klaytn (KLAY), Fantom (FTM), Shiba Inu (SHIB), Arbitrum (ARB) and Optimism (OP).

Cathie Wood’s ARK Invest Offloads a Further $4.7M Worth of Coinbase Shares

COIN reached its highest level since April 2022, rising to $130.31 on Wednesday.