A memecoin drawing its name from the Grok AI project plummeted after allegations its social media account was recycled from that of a former scam token.

Cryptocurrency Financial News

A memecoin drawing its name from the Grok AI project plummeted after allegations its social media account was recycled from that of a former scam token.

Ethereum prices are firm at spot rates, still trading above the $2,000 level, and multiple other factors point to possible trend continuation.

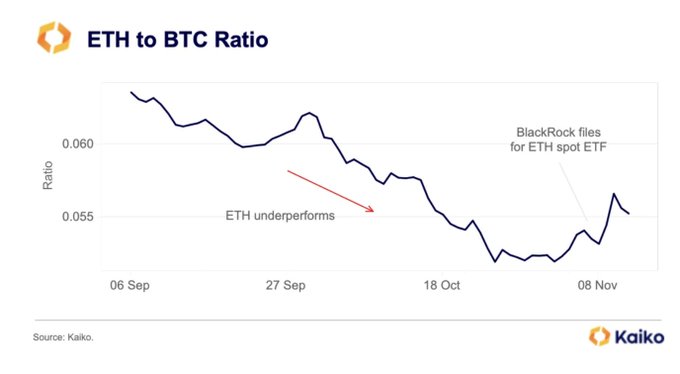

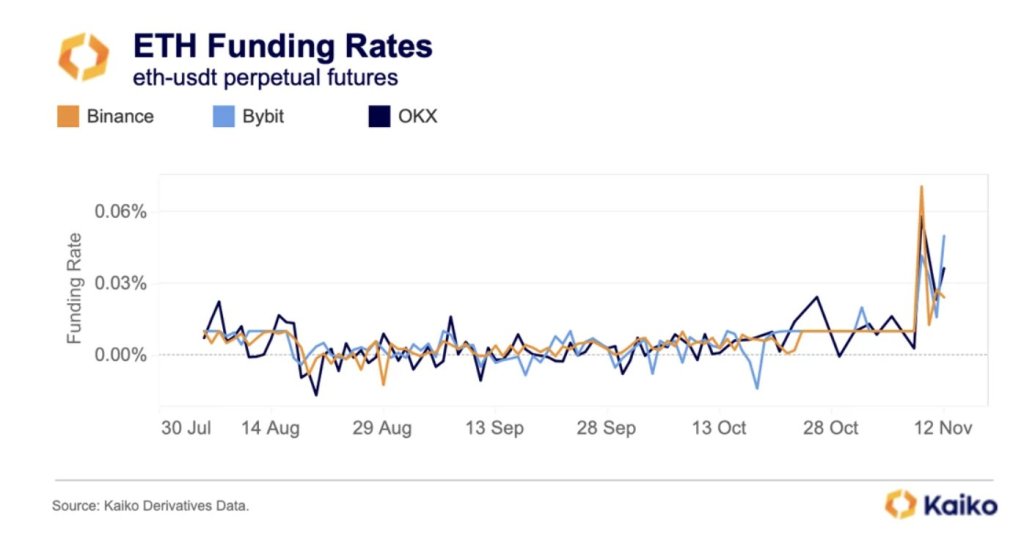

According to Kaiko’s data on November 12, not only is the ETH-BTC ratio shifting and reversing after extended periods of lower lows, but also there is a notable uptick in trading volume with funding rates in crypto derivative platforms shifting from negative to positive, suggesting increasing demand.

As of writing on November 13, Ethereum is relatively firm and changing hands at around the $2,090 level. Despite the expected contraction in trading volume over the past couple of days following the rally on November 9, the uptrend remains in place.

So far, the immediate support level technical analysts are watching remain at $2,000, marking July 2023 highs. Conversely, the $2,100 zone, marking the April high, is a critical liquidation level that optimistic bulls must break for a buy trend continuation pattern.

As it is, traders are optimistic. However, whether the uptrend will continue depends primarily on trader sentiment and if existing fundamental factors might spark more demand, lifting ETH to new 2023 highs. Thus far, even though the general ETH support base remains upbeat, the coin, unlike Bitcoin (BTC), is struggling to break key resistance levels recorded in H1 2023, which is a concern.

On the positive side, looking at the ETHBTC candlestick arrangement in the daily chart, the sharp reversal of ETH fortunes on November 9 could anchor the next leg up, signaling a new shift in a trend that favors Ethereum buyers. Looking at the ETHBTC formation, Bitcoin bulls have had the upper hand in 2023.

Related Reading: XRP Price Path To $1: Exploring Two Potential Outcomes From The $0.66 Resistance Level

To quantify, BTC is up 33% versus ETH, with the climactic sell-off of October 23 pushing BTC to the highest point against the second most valuable coin in 2023. However, the sharp recovery on November 9 and the subsequent failure of BTC bulls to reverse losses suggest that ETH has the upper hand.

Thus far, ETHBTC prices are trending inside the November 9 bullish engulfing bar at the back of light trading volumes, a net positive for bullish ETH holders.

Following this surge, Kaiko notes that the funding rate of the ETHUSDT pair is positive, signaling increasing demand in the crypto derivatives scene. When funding rates turn positive from negative, it means “long” traders are paying “short” traders to keep their positions open. This development indicates that more traders are long ETH, expecting prices to rise in the sessions ahead.

Grok (GROK) token, inspired by Elon Musk’s artificial intelligence service through X (formerly Twitter), has recently come under scrutiny following explosive growth in market capitalization.

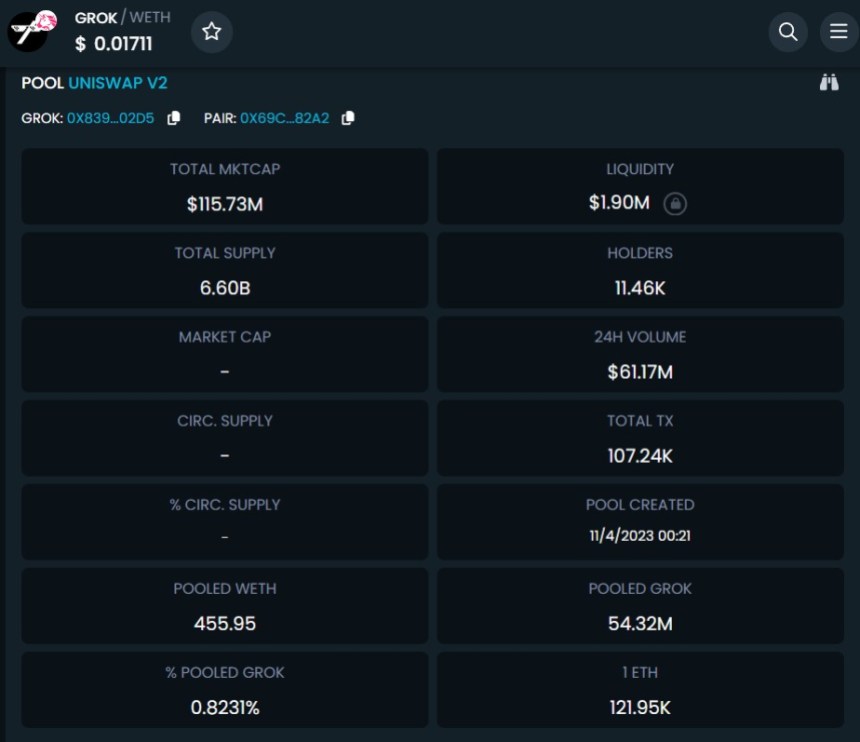

According to recent reports, Grok zoomed to a staggering $160 million market cap within just eight days of its release. However, reports of alleged scam involvement have overshadowed the token’s rapid ascent.

Grok token prices have soared, doubling within the past 24 hours alone, extending a week-long rally that has seen an astonishing 13,000% increase. The token boasts an impressive 11,000 holders and has witnessed a trading volume of over $60 million over the past 24 hours, according to data from DEXTools.

However, ZachXBT, a self-proclaimed crypto detective, has raised concerns about the legitimacy of Grok, stating that the token was created by a scammer. ZachXBT has stated that the same X/Twitter account associated with Grok has been linked to at least one other fraudulent scheme. ZachXBT stated:

Not that people in this space will care but GROKERC20 GROK was created by a scammer. Same exact X/Twitter account has been reused for at least one other scam. X/Twitter ID: 1690060301465714692

Satoshi Flipper, another prominent crypto trader on X, echoed this sentiment, labeling Grok as an “effing scam” and emphasizing that Elon Musk did not authorize the token’s launch. Satoshi Flipper said:

This is Grok. $1.9M liquidity and a $137M market cap? What an effing scam. Not only that, it’s completely fraudulent to trade this knowing Elon Musk, the owner of Grok, did not authorize these devs to launch a token. Imagine touching this toxic trash.

Experts from Arkham Intelligence also weighed in, reporting that an on-chain trader sold a significant amount of GROK at nearly 40% slippage, reinforcing the scam allegations made by ZachXBT.

The controversy surrounding Grok has raised concerns within the cryptocurrency community. Critics argue that the token’s market cap, coupled with the lack of authorization from Elon Musk, raises red flags.

The token’s market cap has undergone a retracement, now at $108 million, down from its previous value of $160 million. Additionally, the token exhibits a liquidity of $1.83 million.

Despite experiencing a substantial slippage of 48%, with its price dropping as low as $0.0056000, the token has remarkably recuperated and is now trading at $0.0108452.

It is yet to be determined whether further reports will surface to shed light on the individuals behind the token’s creation and their objectives, potentially exposing the risk of a rug pull within the cryptocurrency industry.

However, despite these allegations, the token has attracted significant attention and excitement from investors eager to participate in the potential surge of the next major meme coin, aiming to achieve substantial gains in their investments. As of the time of writing, the Grok official account on X has not made any statements regarding these allegations.

Featured image from Shutterstock, chart from TradingView.com

DTCC, Euroclear, Nomura and WisdomTree also participated in the Series B funding round.

Crypto analyst Fiery Trading has revealed a very bullish outlook for the Cardano (ADA) price. The digital asset which has been having a reasonably good run over the last few weeks is expected to shatter expectations as the analyst puts the price at $35.

Fiery Trading’s latest Cardano (ADA) prediction right be one of the most bullish for the digital asset this year. ADA, the native token of the Cardano network, is currently trading at $0.388 and if the crypto analyst’s prediction proves true, then it’ll be an 8,800% rise to $35.

The analyst presents the argument that ADA had already bottomed out last month and this is why the price has been in an uptrend. They place the bottom for the price downtrend at the bottom support of the parallel channel which happened right before the price recovery started.

As the analyst explains, “The parallel channel is formed by drawing a line between the two bull-market tops, and copying that exact line towards the Corona dump’s bottom.” So with this, ADA has confirmed the pattern, which is very bullish for the digital asset.

Fiery Trading explains that it is this trend that could drive the Cardano price toward the new all-time high of $35. However, this is not happening soon as the crypto analyst expects that the next market top for ADA during the bull market will happen sometime in 2025. Nevertheless, the analyst expects ADA to follow this pattern and ride it all the way above $35.

Fiery Trading’s prediction above $30 is not the first to emerge for the Cardano price. Another analyst Lucid had also presented a similar argument that the ADA price could climb above $30. However, where Fiery Trading used the parallel channel confirmation as a basis for their analysis, Lucid argued that Cardano had the potential to surge to $30 if “even Ethereum with all its issues hit $500 billion!”

Investors seem to agree with this outlook as they have increased their accumulation over the last month. Notably, Cardano whales spent over $600 million to buy 1.89 billion ADA in one month. These large investors also increased the frequency of their transactions and the fact that the price continued to climb amid this suggested that they were buying rather than selling.

This growing confidence from investors and the fact that Cardano remains one of the top networks in terms of developments suggests that it is primed for an intense breakout. It also means that the digital asset is well-positioned to do well in the bull run.

XRP’s price surge was short-lived and has almost returned to its original price.

A fake BlackRock XRP Trust filing roiled the crypto market during U.S. afternoon hours, weighing on altcoins as the crypto rally cooled.

The open source protocol spearheaded by DeFi giant Stani Kulechov has released a bevy of new monetization features.

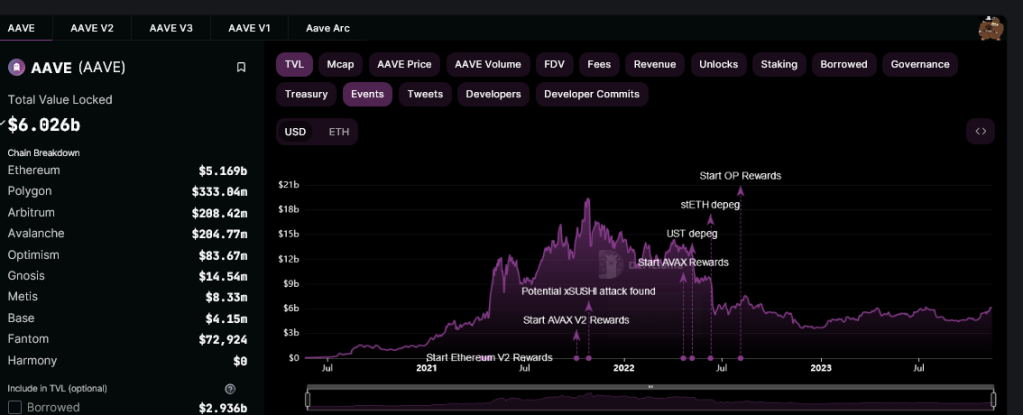

All Aave v2 markets are now operational, the team behind the non-custodial liquidity protocol announced in a November 13 post on X. This a day after v3 markets were unfrozen following the approval from the community.

Aave is a platform where users can supply liquidity in exchange for rewards while borrowers are free to take loans while paying interest in a trustless environment.

In the post, Aave said the security of the decentralized finance (DeFi) protocol remains a “priority and is non-negotiable for the community.”

On November 4, Aave said they received a report “of an issue on a certain feature.” After being validated, the protocol decided to take a step and pause the operation of their v2 markets on Ethereum. At the same time, some v2 markets on Avalanche were frozen. Even so, the v2 markets on Polygon were unaffected.

Aave also froze operations on Aave v3 on Polygon, Arbitrum, and OP Mainnet. However, v3 markets on Ethereum, Base, and Metis were unaffected.

While Aave v2 and v3 markets were frozen, the protocol clarified that users supplying or borrowing affected assets could still withdraw and repay their positions but couldn’t supply or borrow more. With those markets unfrozen, they can now continue as it was before.

The resumption of services, looking at the AAVE candlestick arrangements in the daily chart, has not impacted prices. However, the token is trading at around 2023 highs and remains within a bullish formation as optimistic traders expect the uptrend to continue.

Despite the uptrend, bulls have failed to break above the $110 resistance level. As it is, this reaction level marks August 2022 highs and has not been breached in the past 15 months.

The token has more than doubled at spot rates, rising from $50, a critical support level marking January and June 2023 lows. For trend continuation, there must be a solid breakout above $110 and the $60 range from where prices have been moving horizontally in a multi-month accumulation.

Still, it is unclear how the token will react in the days ahead and whether there will be more upside momentum as liquidity increases as activity resumes on Aave v2 markets.

According to DeFiLlama data, Aave is one of the largest DeFi protocols, with over $6 billion in total value locked (TVL). Most of these assets are locked in Ethereum, where over $5.1 billion of tokens are under management.

Even if approved by Nov. 17, the spot Bitcoin ETFs are unlikely to come to market for at least a month after approval.

U.S. Treasury Secretary Janet Yellen said she is looking forward to hearing from the finance ministers of some of the world’s most crypto-forward countries.

Despite an 11.3% correction in just two days, SOL maintains a robust position with healthy derivatives markets and on-chain metrics.

Uniswap Labs, the company behind the decentralized finance (DeFi) protocol, has achieved a milestone in its revenue generation strategy. Just a month after its implementation, the firm’s newly introduced front-end fees have crossed roughly $1 million, a testament to the platform’s robust activity and user base.

This achievement comes shortly after the mid-October decision to introduce a 0.15% fee on some certain tokens transacted on its front-end interface. This new fee structure applies to various assets, including popular ones like ETH, USDC, WETH, USDT, DAI, WBTC, and others.

As shown in data from Token Terminal, over the past few weeks following the fee’s launch, Uniswap has amassed about $1.14 million.

This figure translates to an average daily revenue of approximately $44,000. Projected annually, this rate could bring in roughly or more than $16 million in revenue for Uniswap Labs.

Meanwhile, Blockchain reporter Colin Wu estimated daily fees from Uniswap V3’s new structure could range between $388,000 and $444,000. Although the figures have been more modest, they still represent a substantial income stream.

Wu’s analysis also reveals that about 35% to 40% of Uniswap’s total transaction volume is processed through the front end, indicating a significant portion of the platform’s activity is subject to these new fees.

Regardless, the total cumulative amount recorded in the past weeks, nearly a month, marks a significant financial upturn for the company and highlights the potential profitability of increased fee structures in the DeFi space.

Notably, unlike the long-established 0.3% fee, dispensed among liquidity providers as an incentive, the new front-end fees solely directed towards Uniswap Labs is not just a revenue-generating move, as it also signified a strategic shift towards diversifying income sources.

So far, this step allows Uniswap Labs to have a direct and consistent revenue stream, independent of the protocol fees traditionally distributed among liquidity providers.

It is worth noting that the recent boost in Uniswap’s cumulative front-end fees aligns with an emerging DeFi resurgence, marked by a significant rise in capital inflows.

Data from DeFiLlama reveals a notable nearly $10 billion increase in the DeFi market’s total value locked (TVL) over the past month. This upward trajectory has seen the TVL escalate from $36.62 billion in October to roughly $46.65 billion.

Moreover, this bullish trend extends to DeFi tokens, with leading DeFi assets experiencing substantial growth. Top tokens such as Chainlink (LINK), Avalanche (AVAX), and Uniswap (UNI) have recorded increases of 19.39%, 35%, and 8.56% respectively in the last week, reflecting the overall positive momentum in the crypto market.

Featured image from Unsplash, Chart from TradingView

While crypto representatives and lawyers cautioned the U.S. Internal Revenue Service (IRS) that its crypto tax proposal is a dangerous and improper overreach, questions posed by a panel of IRS and Department of the Treasury officials at a Monday hearing may reveal some flexibility in the rule as it’s still being written.

The Blockchain Association claimed the U.S. Treasury overstepped its authority in proposing crypto tax rules difficult or impossible to follow by many in the space.

On-chain data shows the Bitcoin sharks and whales have participated in a selloff of around $2.2 billion during the past week.

As pointed out by analyst Ali in a post on X, the large BTC investors might have been harvesting their profits recently. The indicator of interest here is the “BTC Supply Distribution,” which keeps track of the total amount of Bitcoin the different wallet groups in the sector are holding.

The addresses or investors are divided into these groups based on the total number of coins they currently carry. For instance, the 1 to 10 coins cohort includes all wallets with a balance of at least 1 and at most 10 BTC.

In the context of the current discussion, the 100 to 10,000 BTC range is of focus. The 100 to 1,000 coins group is popularly called the “sharks,” while the 1,000 to 10,000 cohort includes the whales.

Both groups carry significant amounts, so their behavior can be relevant for the wider market. Though the whales are much larger of the two, and thus hold much more influence on the network.

Now, here is a chart that shows the trend in the combined Supply Distribution of the Bitcoin sharks and whales over the past couple of months:

As displayed in the above graph, the 100 to 10,000 coins Bitcoin investors have seen their supply go through a steep drawdown during the past week. During this drop, these humongous entities have sold around 60,000 BTC, worth about $2.2 billion at the current asset price.

This is a notable amount, and considering that the timing of the distribution has coincided with BTC’s latest break above the $37,000 level, it would appear possible that these key holders have participated in this huge selloff to harvest the profits that they would have amassed in the rally.

The sharks and whales also took part in some selling when BTC had broken above $35,000 last month, but both the rate and the scale of the selloff were lesser when compared to the one now, as the Supply Distribution for these cohorts has plunged rather steeply this time around.

So far, however, despite this large selloff, Bitcoin hasn’t had much trouble maintaining around the $37,000 mark. The asset initially saw a pullback when the selling started, as it retraced towards $36,000, but it rebounded back quickly enough.

That said, BTC may not be able to break out of its sideways movement toward the upside without the backing of the sharks and whales. The aforementioned surge towards the $37,000 had also occurred just after these investors had made some huge buying moves.

Bitcoin has continued to consolidate around the $37,000 level during the past few days as the chart below shows.

A crypto expert has disclosed a bullish outlook for the XRP price during the upcoming bull run, highlighting XRP’s advantage over other altcoins due to its lack of ties with China’s CCP.

A crypto influencer on X (formerly Twitter) called BoringSleuth has expressed his sentiment about XRP’s potential success in the eagerly anticipated bull run.

BoringSleuth has stated that the XRP price could stand to benefit considerably from the bull market due to its lack of affiliations with the Chinese Communist Party (CCP). He said that other cryptocurrencies like DAG which have no links with the CCP may also experience a successful bull run.

“The protocols that weren’t in bed with the CCP will be the benefactors of future bull cycles. A protocol like DAG, which works with the DOD is one example of a well-positioned protocol. XRP is another,” BoringSleuth stated.

Responding to BoringSleuth’s declaration, an X (formerly Twitter) user posted a screenshot stating that Ripple had deep ties with the IDG which is strongly backed by the CCP.

“The Protocol may or may not be clear…but Ripple has deep ties to IDG, which has strong support from the CCP. IDG are also investors in Coinbase and KuCoin,” an X member, AltarofEgo stated.

Additionally, when asked by a crypto member on X what he meant by “well positioned,” BoringSleuth responded by saying that crypto companies that have no links to the CCP are strategically positioned to become the prime beneficiaries position of retail and investment cash flows in the case CCP-linked companies ever faces scrutiny.

“If there is a crackdown on CCP-affiliated companies, then that investment and retail money will flow somewhere. The companies well positioned to get those dollars will be the ones not in bed with the CCP,” BoringSleuth stated.

Recently, the crypto market seems to be on a rallying trend and XRP has taken advantage of the market sentiments to push its price higher. According to a crypto analysis by ProSignalsfx on TradingView, the XRP price is on an upward trend and may continue rising.

“RIPPLE is trading in an uptrend along the rising support line and after the retest of the said support. We will be expecting a further move up,” ProSignalsfx stated.

According to CoinMarketCap, the price of XRP at the time of writing is $0.65 with a 24-hour trading volume of over $101 billion. The cryptocurrency’s value has recovered steadily following several partial victories during its intense legal battle with the United States Securities and Exchange Commission (SEC).

Many investors and XRP community members are looking forward to a bullish rally for the token following the conclusion of its court case with the SEC.

The new trading capability comes simultaneously with a surge in interest in crypto financial products in the United States.