Solana has been one of the biggest gainers of the latest crypto cycle, with a handful of airdrops and meme tokens accelerating big boosts in the price of SOL. Also, Ethereum co-founder Vitalik Buterin has released an updated roadmap for the ecosystem.

Why The Crypto Flash Could Be The Buy The Dip Moment

In a flash, nearly $200 billion in value was wiped out of the cryptocurrency market today in a larger selloff driven by rumors that pending Bitcoin ETF approvals could end up denied by the SEC. Despite the carnage across crypto today, this could be the moment dip buyers have been waiting for.

Recapping The Crypto Market Flash Crash

At around 6AM this morning, Bitcoin price began falling, causing a cascade of liquidations in altcoins. Bitcoin dropped nearly 10% while altcoins fell anywhere between 20 and 30% from local highs.

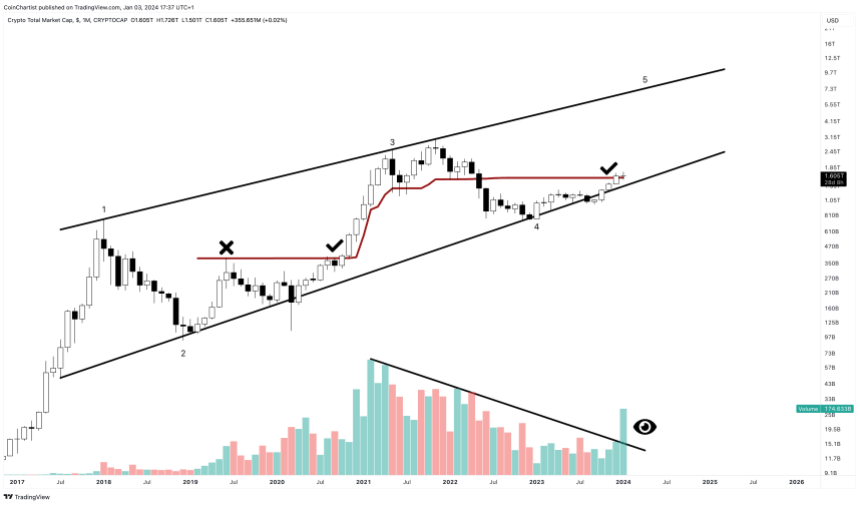

The move has likely caused a lot of fear, uncertainty, and doubt. And when in doubt, you’re supposed to zoom out. Moving away from the daily timeframe and into higher timeframes like the monthly can provide comforting view in contrast to the nasty wick left behind on the daily chart.

Instead, the high timeframe view shows that there is a breakout confirmed by high volume. The market has the rest of January to close with a gain, turning the volume bar green. If it does, this could prove to be the ideal buy the dip moment.

Why A Breakout Could Be Confirmed By The End Of January

A high volume breakout after three years of declining volume is undeniably significant and could hint at a cryptocurrency market bull run in the coming months. Volume tends to confirm price breakouts when paired with technical indicators and/or chart patterns.

In the example above, 1M BTCUSD closed above the Ichimoku’s Kijun-sen. This didn’t happen in 2019, but did in 2020 into 2021. Not pictured, Bitcoin also closed above the upper Bollinger Band – another situation that only happened in 2020.

A close above the Bollinger Band is a buy signal, especially when confirmed with high volume. Volume being high represents more BTC being traded at the current price.

The more trading volume, the more orders being filled which often is due to either big players or widespread market participation. Both scenarios are potentially bullish, but the monthly must close with a green volume bar.

Crypto Analyst Blasts $20,000 XRP Price Target, Reveals Why It’s Impossible

XRP YouTuber Moon Lambo has hit out at those who believe that the XRP price could be worth $20,000 in the future. The analyst believes that this price level is unattainable for the crypto token as he highlighted reasons why he holds this belief.

Why The XRP Price Cannot Rise To $20,000

In a video on his YouTube Channel, Moon Lambo explained that XRP’s market cap will need to run into quadrillions of dollars if it were to achieve that price level based on its current market cap. However, from his calculation, there is not enough money in the world for such an occurrence, as at least $100 trillion will need to flow into the XRP ecosystem for that to happen.

According to the YouTuber, there is a “0% chance” that this will happen. He dismissed any argument that some assets could be sold off to fund this amount of inflows into the XRP ecosystem. This is unlikely to happen as those assets will need to go to zero to get the amount of liquidity needed to get the XRP price to $20,000, Moon Lambo argued.

XRP being worth that amount would also mean the crypto token having a market cap worth over ten times more than the value of the US stock market. Moon Lambo says that it is “utter nonsense” to think that this will happen. He believes there is no way that XRP can be more valuable than all the foremost companies in the US put together.

He also alluded to arguments that XRP can attain this price by becoming the currency for the global reserve. He says that swapping out the dollar, which currently accounts for a huge chunk of the global reserve, won’t still see the crypto token get the required liquidity to hit $20,000.

Enough Reason To Still Be Excited As An XRP Holder

Despite his stance, Moon Lambo is still bullish on the XRP price. He stated that the crypto token doesn’t need this “crazy hype nonsense” for one to be excited as an XRP holder. The crypto analyst believes that as far as XRP is widely adopted, there is enough money that can flow into it, which could cause its price to hit three digits.

Unlike a price prediction of $20,000, XRP’s price hitting three digits is still within the “realm of possibilities.” However, Moon Lambo doesn’t see that instantaneously happening as he says that it could take “many market cycles.” The good news is that anyone who has been in on XRP for some time is already well-positioned for such a multiplier effect.

Meanwhile, analysts who have in the past made such “impossible” price predictions of $20,000 were not spared in the crypto analyst’s rant. Moon Lambo mentioned that such people only make baseless claims and do not provide justification for such assertions.

He provided insight into why these analysts make such predictions as he suggested that they were doing this to get more audience. He remarked that he would probably get more subscribers if he jumped on this “bandwagon.” However, he has no intention to do that as he says it will be “intellectually dishonest” to do that.

Goldman Sachs Eyeing Bitcoin ETF Role Via BlackRock and Grayscale: Sources

Goldman Sachs is in talks to play the key role of being an “authorized participant” for BlackRock and Grayscale’s bitcoin ETFs, if the SEC approves them, according to people familiar with the situation.

Forget The SEC And Bitcoin ETF Approval Drama, Here’s Why Bitcoin Flash Crashed

The recent flash crash of Bitcoin from over $45,500 to as low as $41,100 has sent shockwaves throughout the crypto community, sparking debate over the underlying causes. While some have attributed the crash to unconfirmed rumors that the US Securities and Exchange Commission (SEC) might, after all, not approve Bitcoin ETFs in January, The Wolf Of All Streets on X suggests a different explanation.

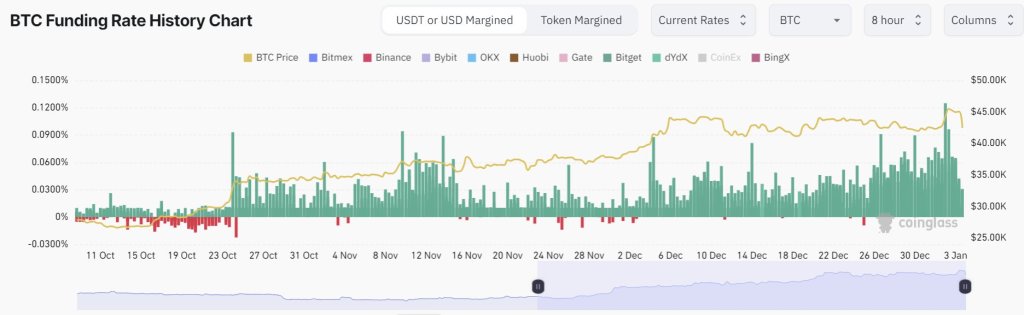

Blame The High Funding Rate For The BTC Crash

The analyst points to the ultra-high positive funding rate on perpetual futures contracts as the primary culprit. In crypto perpetual trading, the funding rate is a mechanism that adjusts the price of futures contracts to reflect the difference in the spot price of the underlying asset, in this case, Bitcoin.

In recent months, the funding rate, according to Coinglass, had surged to multi-month highs, reaching an annualized rate of 66% on January 2, as The Wolf Of All Streets noted, before today’s crash.

With Bitcoin trending higher, a large influx of long positions on Bitcoin’s perpetual futures contracts drove the funding rate to monthly highs. Expanding Bitcoin prices created an imbalance in the market, with more people paying to be long than short. As a result, when the price of Bitcoin began to decline rapidly, exchanges had to unwind long positions, triggering a wave of liquidation.

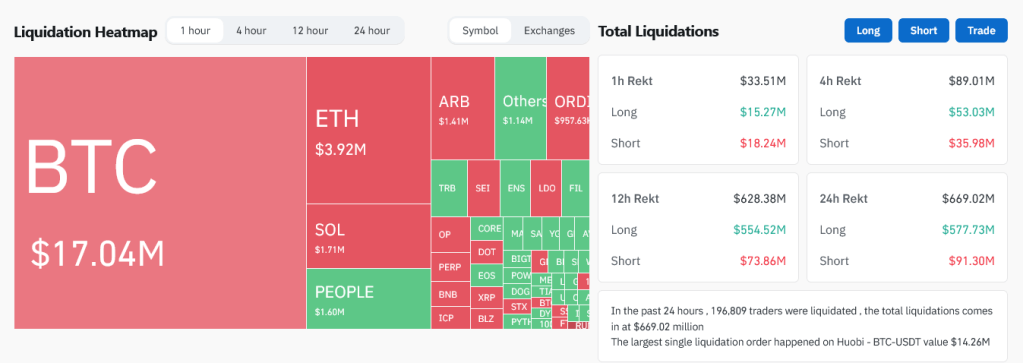

As of January 3, records from Coinglass show that over $669 million were liquidated. Most of these positions were long, at around $577 million, with only approximately $91 million being shorts. Overall, OKX closed the most positions with $292 million longs closed. Binance, Huobi, and Bybit also closed many long positions.

Will Bitcoin Degens Arrest The Sell-Off?

According to The Wolf Of All Streets, the recent flash crash was not a natural market event but an intentional move orchestrated by “degens.” Based on the analyst, the unusually high funding rate as of early January 3 created a situation where long positions, amplified by leverage, had to be liquidated for equilibrium to be reinstated in the Bitcoin market.

The analyst’s comments echo those of other market observers who have warned of the potential for blow-ups in the perpetual futures market due to the high leverage and funding rates involved. These warnings have become more significant in light of the recent flash crash.

How prices will react going forward is unclear. However, what’s clear is that bears appear to be in control in the short term. The recent sell-off is at the back of high trading volume that may see the coin track lower, towards $38,000 or lower, in the coming sessions.

Stablecoins Can Help Fix the Current Lending Market

The Global Financial Crisis reduced the depth of capital markets. Blockchain-based stablecoins can help fill the gap, say Christine Cai and Sefton Kincaid, of Cicada Partners.

Bitcoin ETF Looks Very Likely Given These Bureaucratic SEC Steps

We see a 98% chance of approval in the next couple of weeks and the high likelihood of a Bitcoin rally to follow.

By The Numbers: Crypto Users Lose $300 Million To Phishing Scams In 2023

In a startling revelation by Scam Sniffer, the cryptocurrency world has been hit hard by a series of sophisticated phishing scams in 2023. The team behind the crypto security tool has reported that Wallet Drainers, a type of malware, have successfully siphoned off nearly $295 million from approximately 324,000 unsuspecting victims in the space.

These malicious software programs, predominantly found on phishing websites, trick users into authorizing harmful transactions, leading to significant asset theft from their crypto wallets.

Wallet Drainers: The New Threat in Crypto Security?

A closer examination of the data reveals a worrying trend of increasing phishing activities; each correlated with specific events in the crypto space. For instance, a significant theft of almost $7 million was reported on March 11, coinciding with fluctuations in USDC rates and an impersonation scam of Circle, the company behind the stablecoin.

Additionally, a noticeable theft spike was observed around March 24, aligning with the hacking of Arbitrum’s Discord and its airdrop date. Scam Sniffer’s report highlighted several notable Wallet Drainers, including Inferno Drainer, which alone stole $81 million from 134,000 victims, and MS Drainer, with a haul of $59 million from 63,000 victims.

The report notes the alarming scale and velocity of these operations. For example, Monkey Drainer extracted $16 million over six months, whereas Inferno Drainer looted $81 million in just nine months, as seen in the chart below. The report also sheds light on the common phishing signatures these Drainers use.

Depending on the type of assets in a victim’s wallet, various phishing methods are deployed, ranging from increased allowance to ERC20 permit signatures. The most severe cases involved victims losing millions to these sophisticated scams.

Scam Sniffer’s Analysis: Tracking Malicious Trends

Scam Sniffer has ramped up its efforts in response to this growing threat. Over the past year, the tool scanned nearly 12 million URLs, identifying close to 145,000 as malicious. Furthermore, its open-source blacklist contains nearly 100,000 dangerous domains, continuously updated to platforms like Chainabuse.

The increasing use of smart contracts by scammers, such as multicall for efficient asset transfers and CREATE2 & CREATE functions to bypass wallet security checks, marks a significant change from the previous year. This evolution underscores the need for enhanced vigilance and updated security measures in the crypto community.

Scam Sniffer’s work extends beyond just tracking and reporting. The team actively collaborates with well-known platforms, offering its services to their users. They encourage all stakeholders in the crypto ecosystem to “join the fight against phishing, emphasizing that security is a collective responsibility.”

In closing, Scam Sniffer acknowledges the support of its community:

(…) crypto phishing involves multiple parties, crypto, and non-crypto platforms. Security requires a collective effort. If you wish to enhance your product’s capabilities in this area, please contact us at b2b@scamsniffer.io.

Finally, thanks to all the supporters of Scam Sniffer! Your support is the motivation that keeps us going.

Cover image from Unsplash, chart from Tradingview

The Genesis Block: The First Bitcoin Block

Satoshi Nakamoto mined the Genesis Block on Jan. 3, 2009. That was three months after the pseudonymous inventor published the Bitcoin white paper in an online cryptography forum. People now call Jan. 3 “Genesis Block Day.”

USDC Stablecoin Momentarily Depegs to $0.74 on Binance

Circle’s USDC stablecoin spiked down to as low as $0.74 on three occasions today following a marketwide sell-off spurred by a report casting doubt over whether a spot bitcoin ETF will be approved this month.

Solana Has Flipped Ethereum In Yet Another Metric In Its Bid To Reach $200

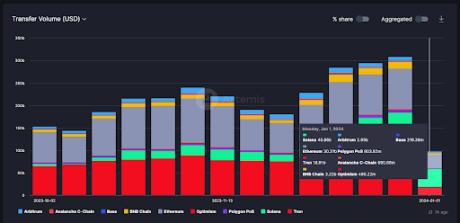

Solana has continued its bullish sentiment in its ecosystem to flip Ethereum in the stablecoin market for the second week in a row, according to on-chain data. SOL’s price gain has slowed in the past week, showing a negative 2.3% in a 7-day timeframe at the time of writing. However, stablecoin transfers on the Solana chain reveal the blockchain retaining its reputation as an Ethereum killer, registering more than $10.3 billion more trading volume in the last week.

Stablecoins Growing On Solana

Ethereum has mostly dominated the stablecoin market since the inception of Tether USDT. However, according to data from the crypto analytics platform Artemis, stablecoin trading volume on Solana surpassed Ethereum last week for the second week in a row, showing how quickly Solana is gaining traction. Solana registered $40.86 billion in stablecoin volume, compared to Ethereum’s trading volume of $30.31 billion.

On-chain numbers since December demonstrate that SOL is quickly becoming the chain of choice for stablecoin usage and transactions. Solana surpassed Ethereum in stablecoin volume for the first time in the week leading to December 25. During this period, SOL registered a weekly stablecoin trading volume of $103.01 billion, $12.14 billion more than Ethereum’s volume of $90.87 billion.

Solana also went on a crazy surge last year, registering over a 950% gain as it reached a yearly high of $121. During this period, we saw Solana compete vigorously with Ethereum across various metrics.

Stablecoin trading volume, in particular, is at a 2,213% gain in a 3-month timeframe. The chain also witnessed 27.17 million stablecoin transactions in the same timeframe, compared to Ethereum’s 1.17 million transactions.

DeFi aggregator DeFiLlama also shows DEX trading volume on SOL soared to $28.13 billion in December, surpassing Ethereum L2 chains Arbitrum and Polygon. Solana also overtook Ethereum in NFT trading volume in early December.

SOL Price To $200?

The Solana ecosystem is expanding quickly, as evidenced by price surges and on-chain metrics. The price surge can also be attributed to various airdrops and the hype surrounding BONK, the first meme coin on the Solana chain. As more people buy and trade SOL and other assets on the blockchain, demand for the SOL coin is likely to increase.

Related Reading: Is A Bitcoin Spot ETF Approval A Sell The News Event? Experts Respond

At the time of writing, SOL is trading at $107, down by 5.74% and 3.44% in the past 24 hours and seven days respectively. It is now facing resistance at around $115, and a failure to rally above this price point could lead to a continued consolation toward support at $100.

While there are never any guarantees, SOL’s strong fundamentals point to a potential price appreciation throughout the year and SOL’s path to revisiting the $200 price level and beyond.

If Solana continues to also outpace Ethereum and Ethereum L2 chains on key metrics and grows its real-world utility, $200 could be on the horizon sooner than most investors would expect.

ENS Token Jumps 50% as Vitalik Buterin Hails It as ‘Super Important’

ENS, the governance token of the Ethereum Name Service project, surged after Ethereum cofounder Buterin posted on X that the service is “super important.”

Bitcoin Crashes To $41,500 As ETF Approval Hangs In Balance: Experts

As the January 10 deadline for the US Securities and Exchange Commission (SEC) to decide on a series of spot Bitcoin Exchange-Traded Funds (ETFs) approaches, the market is rife with speculation.

Initially, there was a strong consensus for approval, but recent expert analyses suggest a possible change in course. Meanwhile, the Bitcoin price has crashed by 6.5% in 20 minutes, dropping from $44,400 to $41,500.

1. Bloomberg’s Insight: A Matter of Timing, Not Denial

Bloomberg’s ETF expert, Eric Balchunas, assessed a mere 10% chance of the ETFs not being approved, primarily due to the SEC requiring additional time to review the proposals. This perspective is critical because it implies that the SEC is not outright opposed to the idea of a spot Bitcoin ETF, but is cautious in its approach.

Related Reading: Bitcoin ETF: SEC May Notify Approved Issuers To Launch Very Soon – Here’s When

Balchunas commented, “I would say if we don’t see it in the next two weeks, it’s more because they need more time,” indicating that a delay in approval should not be interpreted as a final rejection.

His colleague, James Seyffart, provided further insights, noting, “Still looking for potential approval orders in that Jan 8 to Jan 10 window. […] We’re focused on these 11 spot Bitcoin ETF filers […] Expecting most of these N/A’s to be filled over the next ~week,” highlighting the dynamic nature of the situation.

2. Matrixport’s Pessimistic Outlook: A Delay To Q2 2024

Matrixport offers a more cautious outlook, anticipating that the SEC’s approval of Bitcoin ETFs might be deferred until the second quarter of 2024. This analysis hinges on a combination of regulatory challenges and the prevailing political climate under SEC Chair Gary Gensler‘s leadership.

The report states, “The leadership of the SEC’s five-person voting Commissioners, predominantly Democrats, influences the decision-making process. With Chair Gensler’s cautious stance on crypto in the US, it seems unlikely that he would endorse the approval of Bitcoin Spot ETFs in the near term.”

The firm further explains that despite the ongoing interactions between ETF applicants and the SEC, resulting in multiple reapplications, there remains a fundamental requirement unmet that is crucial for the SEC’s approval. This requirement, although unspecified in the report, is suggested to be a significant compliance or regulatory hurdle that could be addressed by the second quarter of 2024.

The potential delay or rejection of the ETFs, according to Matrixport, could have a notable impact on Bitcoin’s market value. They predict a possible 20% correction, with prices potentially falling to the $36,000 range.

Furthermore, Matrixport suggests that such an outcome could lead to a swift unwinding of market positions, particularly the $5.1 billion in additional perpetual long Bitcoin futures.

The report advises traders to consider hedging their positions if no approval news emerges by January 5, 2024, suggesting the purchase of $40,000 strike puts for the end of January or even shorting Bitcoin through options.

3. Greeks Live’s Analysis: Decreasing Confidence

Greeks Live, focusing on crypto options trades, has observed a shift in market sentiment, with a decreased likelihood of the ETF’s passage. They report a significant decline in the ATM option IV for the week and below 65% for the January 12 expiration, indicating reduced market expectations for the ETF approval.

The report notes, “Current month puts are now cheaper, and block trades are starting to see active put buying, with options market data suggesting that institutional investors are not very bullish on the ETF market.”

A possible delay or rejection of Bitcoin ETFs carries significant market implications. The anticipation of ETF approval has been a major driving force in recent market dynamics, leading to increased investments. A decision against the ETFs could result in a rapid unwinding of these positions, potentially causing a sharp decrease in Bitcoin prices.

At press time, BTC had already recovered some of its losses and was trading at $42,450. This means that the price has once again returned to the upward trend channel in the 1-day chart that was established in mid-October last year.

First Mover Americas: Bitcoin’s Strong Start to January May Falter

The latest price moves in bitcoin [BTC] and crypto markets in context for Jan. 3, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Cardano In 2024: Dollar Dream Or Downward Spiral For ADA?

After a spectacular climb of over 150% in 2023, Cardano (ADA) has reached a new yearly high, touching a peak of $0.67 for the second time last month.

Notably, the increase coincides with an impressive rise in important Cardano ecosystem components, with the leading Decentralized Exchange (DEX) Minswap witnessing an astounding 26,000% gain and drawing a sizable influx of new users.

On its one-day timeframe, Cardano, the eighth-largest cryptocurrency by market value, and currently trading at $0.61, is now exhibiting optimistic signals. The digital currency’s trajectory indicates that, despite a minor growth of 1.28% over the past week, a retest of the $1 threshold may occur soon.

Monthly stats are here!

Highlights

Trading Volume up BIG (+166.80%) to 300mn USD for the month, mostly from $SNEK and $FREN.

Real yield rewards of 252,963 $ADA to be distributed to $MIN stakers (2.5x times last month!).

$MIN daily Emissions were lowered 5%. pic.twitter.com/ji54mF3jNE

— Minswap Labs (@MinswapDEX) January 1, 2024

Prominent analyst Dan Gambriello emphasizes how Cardano depends on the dynamics of the Bitcoin market to make significant gains. He points out that ADA emerged from a crucial symmetrical triangle and suggests $0.80 as a possible target.

In spite of this bullish forecast, he cautions about the barrier the 200-week moving average presents, indicating a possible obstacle or reassuring element for Cardano’s upward journey.

Cardano Faces Resistance, Struggles Persist

Cardano’s critical resistance zone, according to cryptocurrency expert LuckSide, is $0.60 to $0.67. There are two situations that could occur: an increase to $0.70 or a probable decrease to $0.40.

Notwithstanding regulatory obstacles, such as monitoring from the SEC, the analyst continues to have an optimistic prognosis for Cardano in 2024.

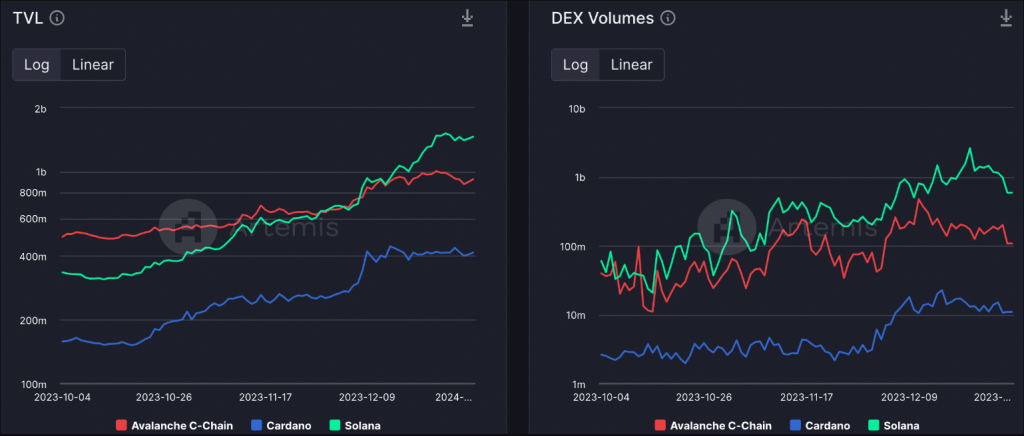

Meanwhile, when comparing Total Value Locked (TVL) and decentralized exchange (DEX) volumes, Cardano has found itself lagging behind prominent platforms such as Solana (SOL) and Avalanche (AVAX).

Despite witnessing significant growth in both TVL and DEX volumes over recent months, Cardano continues to face the challenge of attaining parity with other Layer-1 blockchains. Although strides have been made, reaching a comparable standing remains an ongoing endeavor for the Cardano ecosystem.

The Total Value Locked (TVL) chart shows that Avalanche C-Chain has the highest TVL, followed by Solana and then Cardano. However, all three blockchains have seen their TVL grow in recent months. Cardano’s TVL has grown the most, from about 200 million on October 4, 2023 to about 800 million on January 1, 2024.

The DEX Volumes chart shows a similar pattern, with Avalanche C-Chain having the highest DEX volumes, followed by Solana and then Cardano. However, the growth in DEX volumes has been less pronounced than the growth in TVL. Cardano’s DEX volumes have grown from about 10 million on October 4, 2023 to about 40 million on January 1, 2024.

Overall, the chart shows that Cardano’s TVL and DEX volumes have grown in recent months, but they still lag behind those of Avalanche C-Chain and Solana. This suggests that Cardano is still making progress in the DeFi space, but it has not yet caught up to its competitors.

Cardano (ADA) Price Analysis

The present price movement of Cardano (ADA) is being supported by an upward sloping trendline. If a collapse occurs, it would provide an opportunity for buyers who have been waiting on the sidelines to accumulate more. However, if there is a breakout above a significant obstacle, it might push ADA to higher levels.

Cardano’s inclining trendline suggests that buyers have been stepping in as the price dips down towards the trendline, preventing a significant breakdown.

A breakdown below the trendline could signify a period of weakness for Cardano, potentially leading to further declines. This could be an entry point for “sidelined buyers,” who have not already purchased ADA, to accumulate coins at a discount.

Conversely, a breakout above a key hurdle could trigger a surge in buying pressure, propelling Cardano’s price higher. Identifying this key hurdle on the chart is crucial for understanding the potential upside.

Featured image from iStock

Bitcoin Spot ETF Proposals to Be Rejected by SEC: Matrixport

“SEC Chair Gensler is not embracing crypto in the U.S., and it might even be a very long shot to expect that he would vote to approve bitcoin spot ETFs,” Matrixport said.

Bitcoin Slumps as $400M Liquidated in Two Hours

Bitcoin slid 8% from a 20-month high on Wednesday as jitters around the anticipated approval of a spot BTC ETF began to enter the market.

Bitcoin Breaks Through Securities Barrier: Registered Funds Want Exposure To BTC

An interesting trend looks to be developing among institutional players as their interest in the flagship cryptocurrency, Bitcoin, continues to rise. This interest has in no small way been thanks to the frenzy around the Spot Bitcoin ETFs, which could be approved sooner than later.

Other ETFs Considering Bitcoin As An Investment Option

Crypto commentator and music producer Marty Party recently drew the crypto community’s attention to an emerging trend among fund managers and their ETFs. He noted how these asset managers are amending the prospectus of funds they manage so they can gain exposure to Bitcoin.

These institutions are said to be looking to use 15% to 50% of assets under their management to gain exposure to BTC. One way they will be looking to achieve this is through the Spot Bitcoin ETFs that could potentially launch anytime soon.

Marty Party specifically highlighted the case of Advisors Preferred Trust, which is already looking to gain the SEC’s permission to invest up to 15% of its AuM in Bitcoin-related ETFs like Grayscale’s Bitcoin Trust (GBTC) and ProShares Bitcoin Strategy ETF.

MicroStrategy’s Executive Chairman and Co-founder, Michael Saylor, had previously hinted that something like this was going to happen soon enough. Then, he suggested that more institutional players were going to direct more of their capital to Bitcoin.

A rule that was implemented by the Financial Accounting Standards Board (FASB) has also paved the way for more companies like MicroStrategy to include BTC on their balance sheet.

The launch of Spot Bitcoin ETFs will also make it easier for these institutional investors to gain direct exposure to the flagship cryptocurrency.

For a long time now, those who had a prior interest in the crypto token have had to either invest in Bitcoin futures ETFs or other Bitcoin derivatives on exchanges like the Chicago Mercantile Exchange (CME). But this is changing with the potential approval of a Spot Bitcoin ETF.

Grayscale Leading In The “Cointucky Derby”

As highlighted recently by Bloomberg Analyst James Seyffart, Grayscale looks to set the lead the way, assuming all pending Spot Bitcoin ETFs were approved simultaneously. This is because the asset manager has already established itself with GBTC and would likely have more capital than other issuers upon launch.

Bloomberg Analyst Eric Balchunas highlighted this fact and hinted that the Securities and Exchange Commission (SEC) could decide not to let Grayscale launch on day one because of this. If that doesn’t happen and all funds launch simultaneously, then Grayscale is likely to have a sort of ‘first mover advantage.’

However, other asset managers will be looking to assert their dominance by adopting different strategies. One such strategy will be these issuers undercutting themselves in terms of the fees they will charge to manage their respective funds. Invesco already made it known that they will be waiving fees for the first six months and the first $5 billion in assets.

BRC-20 Marketplace, Creator Take Opposing Positions on Proposed Network Upgrade

BRC-20 marketplace UniSat said it would follow a proposed fork in the network’s token standard, which was met with opposition from Domo, the pseudonymous creator of BRC-20.

Arbitrum Token Sets Record High as Value Locked Crosses $2.5B

Transaction volumes on the network overtook those for Solana-based applications, which boomed after a meme coin-led frenzy in December.