The blockchain security firm will look to support open-source projects building security and privacy tools and services for Web3.

Cryptocurrency Financial News

The blockchain security firm will look to support open-source projects building security and privacy tools and services for Web3.

The latest price moves in bitcoin (BTC) and crypto markets in context for Oct. 24, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

The Cardano ecosystem is ringing in significant transformations with the Cardano Foundation’s announcement of a pivotal modification to its staking parameters. After a stake pool operator (SPO) poll and thorough deliberations by the Parameters Committee, the foundation decided to update the network to enhance both its competitiveness and user experience.

The Cardando Foundation stated via X (formerly Twitter): “As a result of the Stake Pool Operator [SPO]-Poll and a subsequent evaluation by the Parameters Committee, the Cardano Foundation has successfully submitted a transaction on the Cardano mainnet to lower the minPoolCost parameter from 340 to 170 ADA.”

This development has been welcomed with a mix of anticipation and strategy from different sections of the Cardano community. Cardano staking pool “Stake with Pride” was quick to pivot in line with the new parameters, remarking:

The Cardano min Pool Cost fee has been dropped to 170 ADA from 340. SPOs can drop their fees starting epoch 445 on October 27th. They further pledged to optimize their policies with the recent modifications, firmly anchoring their “minPoolCost to 170 permanently, and Margin to 0% temporarily, as market dynamics are assessed.

The minPoolCost parameter, as explained in a Cardano Foundation blog post from September 13, had twofold objectives since its inception with the Shelley launch in 2020. The primary two goals were to act as a defense against Sybil attacks and to guarantee pool operators a floor income to sustain their server operations.

The Cardano Foundation elaborated, “By potentially halving minPoolCost we don’t enforce but allow the operators to reduce their ‘floor’ income.” The strategic change is anticipated to shift market dynamics favorably for smaller pool operators, providing them with a more level playing field.

The Cardano price has seen a strong uptrend in the past few hours, in line with the overall crypto market. At the time of writing, ADA was trading at $0.282, up 6.5% over the past 24 hours. The 1-day chart of ADA shows that ADA was able to break out of its 6-month downtrend (black line) this past Sunday. On April 15, ADA marked its high for the year at over $0.46, since then the Cardano price has been on the decline.

As a result of the breakout momentum, ADA was able to overcome the important 0.236 Fibonacci retracement level at $0.277. Remarkably, the price has already withstood a retest and established it as new support on the lower time frames. Should ADA manage a daily close above this price level today, the outlook for the Cardano price could turn further bullish.

As then, ADA would have to face arguably the most important resistance at the moment, the 200-day exponential moving average (EMA, blue line), at $0.299. The price indicator is often referred to as the “bull line”. Accordingly, a breach could maneuver ADA back into bullish territory. ADA last failed to complete a daily close above the 200-day EMA in mid-July.

If a breakout into bullish territory succeeds, the next targets would be the Fibonacci retracement level of 0.382 at $0.313, 0.5 at $0.341, 0.618 at $0.370, and 0.786 at $0.411. The pinnacle target remains the annual peak of $0.463, suggesting a prospective ascent of 65% from its present value.

In this context, it is important to mention that ADA has underperformed compared to other altcoins so far this year. For example: While Solana (SOL) is currently trading just below its high for the year and Ether (ETH) is only 15% away from a new high for the year, ADA is still 39% below this level.

On the one hand, this shows the existing potential, and on the other hand, it shows that ADA has not been one of traders’ favorite altcoins so far in 2023. Whether a rise above the 200-day EMA can change this remains to be seen.

This marks the first step in initiation of the v4 upgrade, where the DEX is transitioning away from its layer-2 network atop Ethereum onto its own standalone blockchain.

The Grayscale Bitcoin Trust is the largest asset held by the ARK Next Generation Internet ETF, accounting for more than 10% of its portfolio.

Marinade Finance holds over $265 million in total value locked, accounting for 70% of all funds locked on the Solana blockchain.

Institutional investors are chomping at the bit to buy bitcoin amid renewed optimism of a spot exchange-traded fund (ETF) being approved.

XRP is currently experiencing strong short-term bullish momentum and market sentiment. However, the cryptocurrency faces a formidable hurdle at the $0.55 resistance level, a barrier that has thwarted multiple attempts at a substantial recovery over the past couple of months.

The question on everyone’s mind: can XRP overcome this crucial obstacle?

In recent months, the XRP price has exhibited a sideways trend, primarily oscillating between the horizontal levels of $0.55 and $0.458. While the daily chart reveals significant price fluctuations, traders have struggled to make any substantial progress in either direction, reflecting a market plagued by indecisiveness.

As of the most recent data, XRP’s price on CoinGecko stands at $0.5396, reflecting a 3.1% rally in the past 24 hours and nearly 10% surge over the last seven days. These gains have stoked anticipation among investors, but the $0.55 resistance continues to cast a shadow.

XRP traders have established a trading range spanning from $0.47 to $0.54, with the $0.51 midpoint proving to be a pivotal level. This price point has functioned as both support and resistance on multiple occasions, enhancing the range’s credibility. Investors keenly watch for any movements within this range as a potential signal for XRP’s next course of action.

A glimmer of hope for XRP supporters comes from several bullish indicators. The Relative Strength Index (RSI) has climbed above the neutral 50 threshold, indicating that bullish momentum is gathering strength. The Directional Movement Index (DMI) echoes this sentiment, signaling a significant uptrend in progress as the Average Directional Index (ADX) surges past the 20 mark.

In the futures market, XRP’s spot Cumulative Volume Delta (CVD) saw a downtrend from Oct. 20-22, even as prices shot higher. While this may have been worrisome for the bulls, the CVD has exhibited a rebound in recent hours. Simultaneously, the Open Interest and the price have trended higher, underscoring a robust bullish sentiment in the near term.

The critical question that XRP investors must grapple with is whether the cryptocurrency can successfully breach the $0.55 resistance. A breakthrough at this level would serve as a solid foundation for extending the current rally. Nonetheless, caution is advised as traders should seek a daily candle close above this level before committing funds.

In the event of a successful breakout, XRP could potentially target the $0.60 level, offering the possibility of a 16% gain. As XRP navigates the precarious waters of resistance and support, market participants remain on edge, eagerly anticipating the next chapter in this cryptocurrency’s journey.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Medium

Bitcoin (BTC) dominance hit its highest level since April 2021, outpacing the majority of altcoins – but the Pepe memecoin has bucked that trend.

The outflow of assets from crypto exchanges is considered a bullish sign, as it indicates traders are moving their assets away from exchanges and no longer want to sell.

Shiba Inu’s latest price action seems like the meme token has bounced off the critical $0.0000061 support level to set the stage for a possible bull run. The cryptocurrency is up by 3.63% in the past 24 hours and 5.79% in a seven-day timeframe.

However, a larger timescale reveals a different picture, as the value of the cryptocurrency has dropped by 49% since reaching its yearly high of 0.00001471 on February 5. Nevertheless, positive momentum could be building up at the moment, particularly with Shiba Inu’s Layer-2 scaling solution Shibarium attaining a new milestone.

Shibarium was created to provide lower gas fees and faster transaction times for Shiba Inu. As a result, the Layer-2 scaling solution has been well accepted by the Shiba Inu community since it launched, despite having a few hiccups after its early stages. Data from Shibariumscan revealed that Shibarium recently surpassed 1.3 million blocks mined and a total transaction of 3.574 million.

The 1.3 million block milestone in such a short time shows the sheer capability and adaption of Shibarium. Each block has an average processing time of 5.0 seconds, demonstrating its efficiency and speed. In comparison, Bitcoin, the world’s largest cryptocurrency, has a block creation time of 10 minutes.

Past news around Shibarium has always positively affected the price of SHIB. Each new milestone and benchmark reached in developing Shibarium generates excitement and drives up the price of SHIB.

Rumors surrounding its launch in August propelled SHIB to $0.00001137, although it has since lost most of those gains. At the time of writing, SHIB is trading at $0.000007484, and it appears to be on the verge of a price breakout that could retest its August highs. This would mean a 43% spike from its current price.

According to data from DeFi aggregator DeFiLlama, the total TVL in Shibarium is now at $770,562. While this is low compared to its TVL of $1.47 million in late August, the new milestone and Shibarium’s continued adoption could also push up the TVL in the next few days.

What’s Next For Shiba Inu?

The entire crypto market has had an influx of funds in the past few days, with Bitcoin leading the charge with a 24-hour increase of 10.37%. SHIB has also piggybacked on these gains and has had a few whale movements.

4,544,030,677,374 #SHIB (32,142,200 USD) transferred from unknown wallet to unknown wallethttps://t.co/Y7jvL2qtJV

— Whale Alert (@whale_alert) October 21, 2023

Recent price action shows the crypto testing a minor resistance at the $0.0000076 level. A strong breakout could push SHIB to another resistance at $0.0000087 and then to its August high of $0.00001137.

With a thriving layer 2 ecosystem and a large community, Shiba Inu could transition from being just another meme cryptocurrency to cement itself as a leader in decentralized finance and payments.

The defense team has revealed its sole proposed expert witness, who’ll try to point out flaws in the DOJ’s presentations.

The Nym Innovation Fund, with commitments from Polychain, KR1, Huobi Incubator and Eden Block, among others, supports projects aiming to safeguard privacy in the crypto ecosystem.

Noble is an appchain built for native asset issuance in Cosmos and the boundless Inter-Blockchain Communication (IBC) ecosystem.

U.S. law “does not control the world,” said the filing by the world’s biggest crypto exchange as it feels increasing regulatory pressure.

Total market capitalization rose 8% to reach levels not seen since mid-August.

Jonathan Farnell, who served as head of Binance U.K. and CEO of its payment service Bifinity – which was disbanded in August – left the firm in September.

The rising gas fees suggest increased network usage.

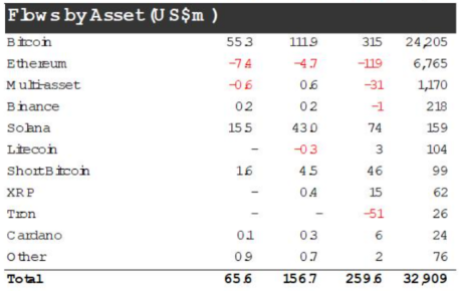

The digital assets markets experienced a consecutive fourth week of inflows from institutional investors. CoinShares data shows that a portion of the momentum observed can be attributed to an increasing expectation for the authorization of a spot Bitcoin Exchange-Traded Fund (ETF) in the United States.

The aggregate value of assets under management (AuM) has experienced a notable surge, reaching $33 billion, denoting a 15% growth rate since the beginning of September. Nevertheless, investors are displaying a greater degree of prudence compared to their response to Blackrock’s announcement in June.

The latest influx of funds, although possibly associated with the prospective introduction of a spot bitcoin ETF in the US, is very modest in comparison to the inflows witnessed in June.

Coinshares: Digital asset investment products saw inflows for the 4th consecutive week totalling US$66m. Total AuM has now risen to US$33bn.

Solana saw a further US$15.5m inflows last week, bringing year-to-date inflows to US$74m, making it the most popular altcoin this year so…

— Wu Blockchain (@WuBlockchain) October 23, 2023

According to the report, a significant portion of the inflows seen in the previous week amounted to $55.3 million, representing 84% of the total. This influx was specifically directed towards investment products related to Bitcoin. As a result, the cumulative inflows for Bitcoin products during the current year have reached a total of $315 million.

Solana experienced an additional infusion of $15.5 million during the previous week, resulting in a cumulative inflow of $74 million for the year. This notable performance positions Solana as the leading alternative cryptocurrency thus far in the current year.

On the other hand, and amidst persisting concerns, Ethereum faced a challenging week as it observed a significant outflow of $7.4 million. Notably, Ethereum was the only altcoin to encounter a decline in its financial performance during this period.

Other altcoins such as Cardano (ADA) and Binance Coin (BNB) saw small inflows of $0.1 million and $0.2 million, respectively.

James Butterfill, the Head of Research at CoinShares, pointed out that the inflows observed in the previous week have not yet achieved the same magnitude as those witnessed earlier this year when BlackRock initially submitted an application for a Bitcoin ETF.

Butterfill said:

“While the most recent inflows are likely linked to excitement over a spot Bitcoin ETF launch in the U.S., they are relatively low in comparison to the initial inflows following BlackRock’s announcement in June.”

Digital assets are becoming more and more popular, and many people are investing in them. However, some investors are being careful about these assets, and we don’t know if they will keep being cautious. We have to wait and see if the market will change and bring new trends or chances for investors in the next few weeks.

The world of digital assets is rapidly growing, with more and more people putting their money into cryptocurrencies and other digital investments. Despite this, some investors are still being careful and not rushing into things.

We can’t predict whether this cautious approach will continue or if the market will surprise us with new trends and opportunities in the weeks ahead. It’s an exciting time in the world of finance, and we’ll have to keep a close eye on how things develop.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Ledger Insights

Stablecoin activity has been increasingly occurring through entities that aren’t licensed in the United States, according to Chainalysis.