Binance.US asks users to convert USD into stablecoins for withdrawals

Binance.US users “may convert” their U.S. dollar holdings to stablecoins or other digital assets to withdraw the funds from their accounts, the firm said.

Russian telecoms giant MTS announces ads service targeting Telegram users

Telegram denies that it has entered any advertising-related agreements with Russian companies.

Bitcoin Price: Why $28,000 Could Hold The Key For Massive Bull Run

The Bitcoin price experienced volatility in the last day following speculation about approving a spot BTC Exchange Traded Fund (ETF) in the US. The rumors turned out false, but the cryptocurrency managed to reclaim a critical level.

As of this writing, Bitcoin trades at $28,460 with a 3% profit in the last 24 hours. Over the previous week, the cryptocurrency recorded similar gains while other cryptocurrencies in the top 10 by market cap lagged the sudden rally except for Solana (SOL).

Bitcoin Price Confirms Bull Run?

Data shared by the co-founders of analytics firm Glassnode highlights the importance of the recent rally. However, driven by what many in the crypto community called “fake news,” the upside momentum cleared some obstacles for the cryptocurrency.

In that sense, the data points to a generally positive sentiment around the Bitcoin ETF, which will continue to gain relevance in the coming months as uncertainty about its approval mitigates. The Glassnode co-founders stated via social media platform X:

While this pivotal milestone was momentarily attained on futures, the spot market price peaked at $27.98k earlier today. It’s evident just how crucial this price point is in the larger scheme (…). The rapid movements and these price thresholds aren’t just numbers. They signify investor sentiment, market dynamics.

The market activity surrounding the ETF rumors on some major crypto exchanges represented around 8% of their total trading volume. However, Bitcoin must hold its current level on the daily and weekly charts.

A separate analysis by a pseudonym trader claims that the recent Bitcoin price action broke out of a macro downtrend. As seen in the chart below, every time the cryptocurrency price breaks this trend, Bitcoin consolidates for a while before re-entering price discovery.

Despite the bullish momentum, Bitcoin can still touch critical support levels around $27,880 and $27,550 on short timeframes before resuming the rally. The Bitcoin price can go much lower on higher timeframes while maintaining its bullish structure. The analyst stated:

Bitcoin has long ago broken its Macro Downtrend. It’s undeniable that Bitcoin is in a Bull Market. The question is whether Bitcoin can perform a -30% retrace over the next 4-6 months or so. History suggests it can.

Cover image from Unsplash, chart from Tradingview

Web3-Powered File Management App Raises $1.5M to Offer Alternative to Google

Fileverse offers a decentralized file management and collaboration service, an alternative to centralized providers such as Google or Notion.

When Bankruptcy Regulates Crypto: The Good, the Bad, and the (Really) Ugly

In the absence of specific policy, U.S. regulation of crypto has devolved to judges in bankruptcy proceedings, say Yesha Yadav and Bob Stark.

How African Students Became Victims of FTX’s Collapse

“We saw an exchange that was supposedly better than every other one we had used, so we let a lot of family and friends get involved with the FTX platform,” FTX Africa’s former education lead Pius Okedinachi told CoinDesk.

The Sam Bankman-Fried Trial Is Revealing Crypto’s Amateur-Hour Ways

Paradigm, BlockFi, Genesis and other companies did not have access to audited financial statements prior to investing or loaning billions to FTX, FTX.US. and Alameda Research, according to testimonies given in the trial of Sam Bankman-Fried. Rather, these investors and lenders looked at unaudited financial statements and spoke with the executives at these companies to determine critical pieces of information like FTX’s cash flow, its liabilities, its current assets and net asset value.

Crypto investor protections in EU won’t take effect until late 2024

Crypto asset service providers may not benefit from full rights and protections afforded to them under MiCA until as late as July 2026, the ESMA said.

Banks’ crypto exposure must be disclosed — BIS’ Basel Committee

The proposed regulations are currently open to the public for comments, and if approved, they will come into effect by Jan. 1, 2025.

BlackRock Reacts To False Bitcoin Spot ETF Approval News In A Positive Way

Investment management firm Blackrock has reacted to rumors about the approval of its Bitcoin Spot ETF application by the United States Securities and Exchange Commission (SEC) which caused quite a stir among the cryptocurrency community.

Blackrock CEO Responds To Claims On Bitcoin Spot ETF

On Monday, crypto news outlet CoinTelegraph posted on X (formerly Twitter) that the US Security and Exchange Commission (SEC) had approved a long-anticipated application of Bitcoin Spot ETF, but later retracted the report. However, the post sparked excitement within the crypto community causing the Bitcoin price to rise rapidly.

The cryptocurrency’s price surged to almost $30,000 earlier in the day after the alleged post was made by Cointelegraph yesterday. However, the cryptocurrency’s price fell almost immediately after the report was proven to be false by Blackrock’s Chief Executive Officer Larry Fink and other prominent voices in the crypto community.

Eleanor Terrett was the first to report that this news was false after speaking with BlackRock and that the company’s Bitcoin Spot ETF is still under review by the US regulator.

In an interview with Fox Business, Fink, who said he only learned about the ‘news’ hours later due to him being extremely busy all day, took a rather positive stance on the event. According to the CEO, noting that Monday’s event solely proved the worldwide need and desire for a Bitcoin spot ETF.

“I think the rally today is about a flight to quality, with all the issues around the Israeli war now, global terrorism,” Fink said. “I think there are more people running into a flight to quality, whether that is in Treasuries, gold, or crypto, depending on how you think of it. And I believe crypto will play that type of role, as a flight to quality.”

The SEC also confirmed that the alleged news report was false and that the application is still pending. “Careful what you read on the internet. The best source of information about the SEC is the SEC.” the post read.

So far, CoinTelegrah has apologized with a post on X for the false report it posted “which led to the dissemination of inaccurate information.” The crypto media outlet later posted the result of its internal investigation which showed a team member had posted the ‘news’ without getting approval from its editorial team.

Crypto tracker, Coinglass revealed that short trading positions held by investors betting on lower prices were liquidated to the tune of over $104 million within 24 hours due to the false news.

BitGo Buys Crypto Wealth Management Platform HeightZero

HeightZero handles portfolio rebalancing, statement generation, tax loss harvesting and automated billing for crypto clients.

Why brand consistency matters and how Web3 companies are failing to deliver

Choosing a realistic, appealing brand promise to a specific audience can improve the ability to endure difficult markets and strengthen the chances of outlasting the competition.

Binance.US Halts Direct Dollar Withdrawals

Dollar deposits in user wallets are no longer eligible for FDIC insurance protection, according to the updated terms of use.

First Mover Americas: FTX Proposes Returning Up to 90% of Customer Funds

The latest price moves in bitcoin (BTC) and crypto markets in context for Oct. 17, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Leading Video Game Company Embraces XRP As Price Faces Key Resistance

BitPay, the pioneering crypto payment service provider based in Atlanta, Georgia, has taken another significant step in its collaboration with global video game commerce company, Xsolla, by integrating the XRP token. Today, October 17, BitPay announced via X (formerly Twitter): “Xsolla now accepts XRP with BitPay as a payment method for their games, such as SMITE and Roblox. You can use your favorite cryptocurrency to buy, play, and enjoy gaming like never before.”

Why This Announcement Is Important

This announcement not only cements XRP’s growing relevance in the gaming world but also marks a significant moment in the longstanding partnership between Xsolla and BitPay. This relationship first began in 2014 when Xsolla decided to process Bitcoin (BTC) payments for gamers globally via BitPay. They’ve since expanded their crypto payment offerings, with the recent addition of PayPal USD (PYUSD) last month.

Established in 2005 by Aleksandr Agapitov, Xsolla has positioned itself as an instrumental force in the gaming industry, providing essential tools that help game developers launch, monetize, and distribute their creations on a global scale. With Xsolla’s key focus on aiding its partners to break geographical barriers and bolster revenue streams, the company continually seeks innovative solutions to global game distribution challenges.

Roblox, the popular online gaming platform boasting over 65.5 million daily active users and over 202 million monthly active users, stands out as a significant beneficiary of the XRP integration. Managed by Xsolla for in-game payments, Roblox now allows its vast user base to utilize XRP for transactions, with BitPay ensuring a smooth connection with crypto wallets. Given that Roblox users spent an astonishing $780.7 million on in-game purchases in just the second quarter of 2023, the potential volume of XRP transactions on the platform could be monumental.

Remarkably, BitPay’s association with XRP can be traced back to 2019 when they collaborated with Ripple’s investment wing, Xpring. However, the relationship hit a snag when BitPay, in alignment with many US-based crypto enterprises, ceased XRP-related transactions following the SEC’s lawsuit against Ripple Labs. The tide turned in favor of XRP when Judge Torres identified it as a non-security, prompting BitPay to reintroduce the cryptocurrency on its platform in August.

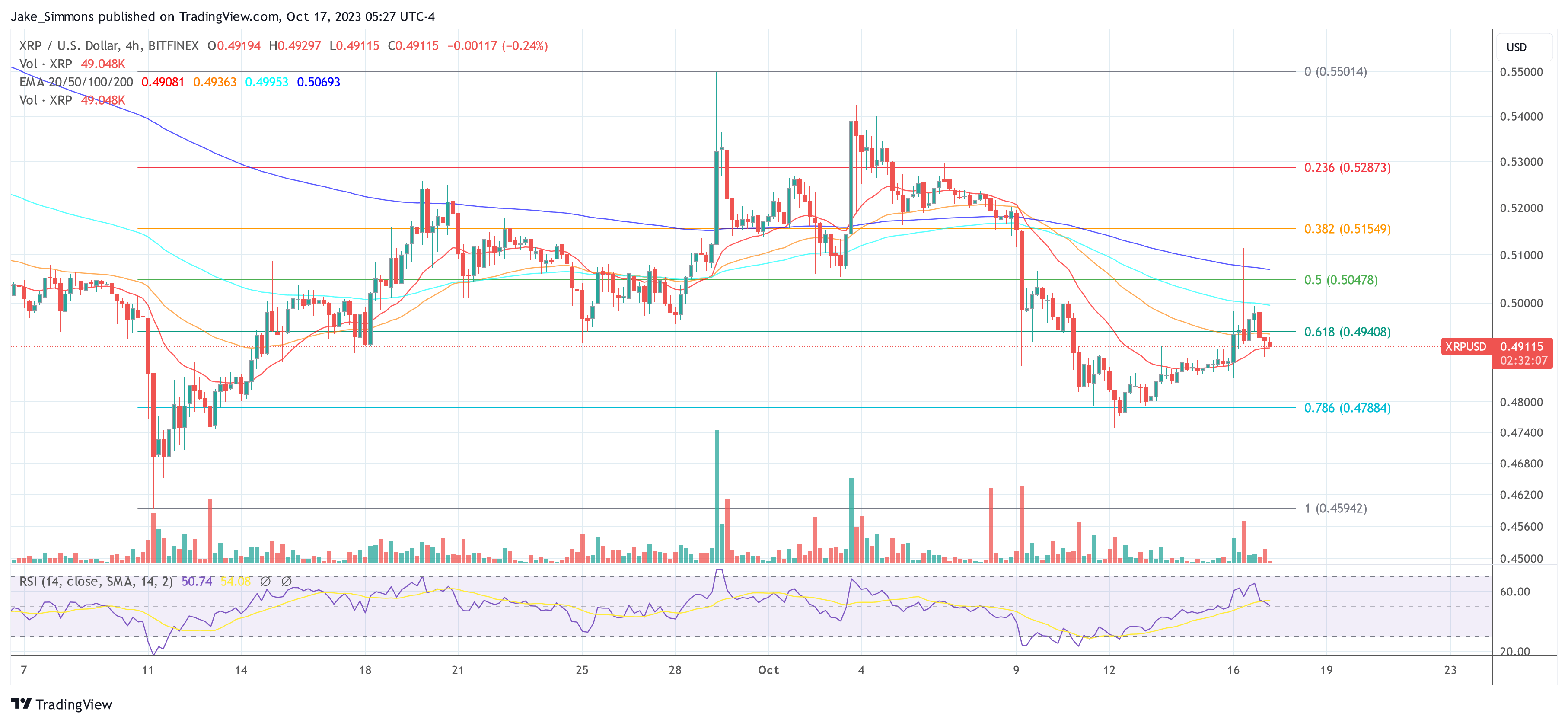

XRP Price Faces Stiff Resistance

The recent announcement undoubtedly solidifies XRP’s position in the broader market, showcasing its versatility. However, despite the promising long-term prospects stemming from XRP’s new use case, its price is currently contending with multiple key resistance levels.

Following a brief surge yesterday, attributed to the fake news surrounding a potential spot Bitcoin ETF, XRP’s price experienced a pullback, dipping below the $0.50 mark.

On the 4-hour chart, the price slid beneath the 0.618 Fibonacci retracement level, pegged at $0.4908. Yet, it demonstrated resilience, rebounding and securing a close above the 20-EMA. In the more immediate time frame, the 0.5 Fibonacci retracement level, set at $0.5048, now emerges as the pivotal resistance. A sustained close above this threshold on the 4-hour chart might be the catalyst for renewed bullish vigor.

Should this momentum be achieved, the next focal point for the XRP price would be the September high of $0.55. Notably, this price benchmark isn’t just crucial for short-term analysis but also holds significance on larger scales, like the 1-day chart, as reported previously.

Ripple VP: The Policy Considerations ‘Justifying the Implementation of CBDCs’

Central bank digital currencies have nearly limitless opportunity but ultimately, mainstream adoption hinges upon usability, Ripple Vice President James Wallis writes.

BTC price holds 6% gains as Bitcoin battles for ‘crucial’ $28K support

Bitcoin is at a “critical milestone” as BTC price tackles the $28,000 mark, say the co-founders of Glassnode.

Ripple job posting hints at possible IPO, XRP community says

The role and responsibilities listed for the potential candidate are often criteria linked to requirements for a company considering an IPO.

Pennsylvania Lawmaker Scraps Crypto Mining Ban to Advance Energy Conservation Bill

The state’s Environmental Resources and Energy Committee accepted the amended bill on Monday by a slim margin.