If true, the SEC will need to review and make a decision on Grayscale’s spot Bitcoin ETF application. If denied, Grayscale could appeal the decision.

Cryptocurrency Financial News

If true, the SEC will need to review and make a decision on Grayscale’s spot Bitcoin ETF application. If denied, Grayscale could appeal the decision.

It’s been quite a bearish week for Bitcoin, as the crypto has fallen around 3% since the beginning of the week. Price action, in particular, has had Bitcoin struggling to break above $27,000, indicating a potential risk of more losses below this resistance level in the near term.

However, according to a crypto analyst, this current retracement might be the beginning of a historical Bitcoin cycle before each halving.

Crypto analyst Rekt Capital has said in a post that if historical Bitcoin “halving cycles” are any indication, a major price correction could be right around the corner. The Bitcoin halving cuts the block reward for miners in half.

This happens roughly every 4 years to slow the creation of new BTC and control inflation. Based on historical data from the previous two Bitcoin halvings, the price of BTC could drop by up to 38% before the next halving.

In a chart shared on X (formerly Twitter), Rekt Capital showed a major pull back has happened around six months before each halving. In the 2015 cycle, BTC retraced 25% 196 days before the 2016 halving.

In 2019, BTC retraced 38%, 196 days before the 2020 halving. So with the next halving slated to occur around April 2024, it would seem the market is now in a prime position for the next correction.

Bitcoin is currently 60% below its all-time high, following a similar pattern with past halvings. 200 days before the 2020 halving, BTC was 60% below its all-time high. Likewise, 200 days before the 2016 halving, BTC was 65% below its all-time high.

Bitcoin’s price direction is currently uncertain, especially as on-chain transactions on the blockchain are now at a three-month low. On-chain metrics have shown that 95% of Bitcoin’s circulating supply hasn’t changed hands in the past month, as investors seem to be holding on to the cryptocurrency in anticipation of the SEC’s approval of spot Bitcoin ETFs.

Although past performance doesn’t always repeat, if this pattern shows up again before the next halving, Bitcoin could be in for a big correction. With the current price of BTC now at $26,770, a 38% retracement could see BTC fall below $18,000. If this happens, it would be devastating for BTC holders.

Even though a price correction may be on the horizon, Bitcoin’s long-term growth prospects remain strong. Over the past decade, Bitcoin has shown a consistent upward trend as the largest crypto by market cap despite facing several setbacks.

Bitcoin has been named the best performer this year in terms of asset investing by Reflexivity, a digital asset research firm. According to billionaire hedge fund manager Paul Tudor Jones, this is the best time to buy BTC.

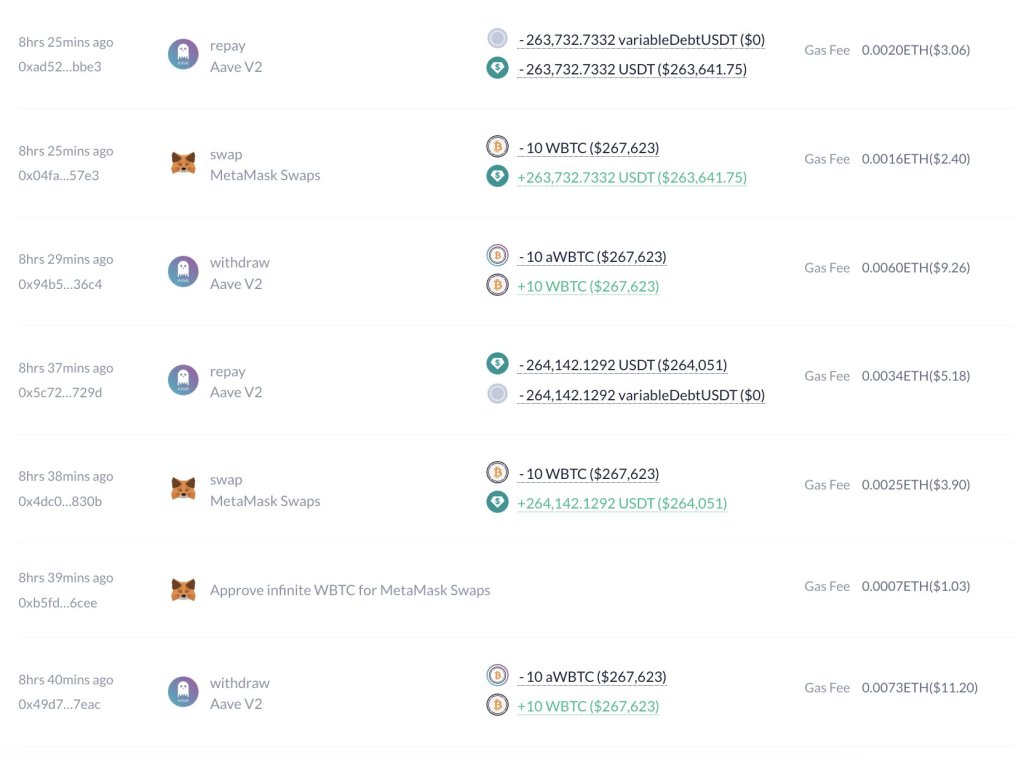

A trader on Aave, a decentralized liquidity protocol operating on multiple platforms, including Ethereum and OP Mainnet, has begun selling wrapped Bitcoin (WBTC) to repay outstanding debt, records on October 13 reveal. WBTC is a tokenized version of Bitcoin issued on Ethereum that allows holders to engage in decentralized finance (DeFi) activities.

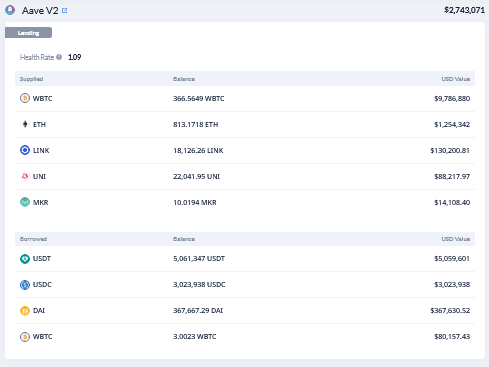

According to Lookonchain data, the unidentified trader marked with address “0x47ab” borrowed roughly $8 million worth of multiple stablecoins, including USDC, USDT, and DAI, Maker’s stablecoin, on Aave v2 after depositing various assets, including WBTC, Maker (MKR), and Ethereum (ETH) worth approximately $11 million.

When writing, the health factor of borrowed assets stands at 1.09, teetering close to liquidation. According to Aave’s documents, the health factor is a metric that compares the safety of collateral and borrowed loans to the underlying value. Technically, the higher it is, the safer the funds are from liquidation. If the health factor exceeds $1, deposited collateral will be liquidated to borrow outstanding loans.

Aave is a popular decentralized finance (DeFi) protocol where token holders can choose to supply liquidity and earn passive income. At the same time, users can deposit collateral and borrow overcollateralized loans, which they can repay at any time, provided the health factor is around 1. Since loans are overcollateralized, the collateral is usually higher than the borrowed amount.

As it is, the trader, Lookonchain shows, has started selling WBTC to repay outstanding debt. A big chunk of what the trader supplied is in WBTC, standing at 366.56 WBTC, worth roughly $9.1 million at spot rates.

However, considering market prices have fluctuated recently, the contraction has impacted the health factor, increasing the risk of collateral liquidation. To counter this, the trader sold 3 WBTC for roughly $80,000.

The address still owes Aave V2 approximately $8.08 million, mostly in USDT, at around $5 million. There are $3 million of USDC and around $368,000 of DAI. It is unclear whether the trader will seek to borrow more, especially if Bitcoin prices increase.

The address remains long on MKR, the governance token of the MakerDAO protocol; Uniswap’s UNI; Chainlink’s LINK; and Ethereum. Besides WBTC, the trader’s second-largest holding is in ETH, while the smallest is MKR. Ironically, MKR has been one of the top-performing assets, rallying by over 160% in H2 2023 alone. The token peaked at $1,600 in early October before cooling off to spot rates.

Former Alameda CEO Caroline Ellison recognized she wasn’t doing a good job months before the company filed for bankruptcy, but Sam Bankman-Fried persuaded her to stay.

A crypto mining operation near a Microsoft facility that supported the Pentagon was reportedly under scrutiny by U.S. officials.

The decision, reported by Reuters, boosts the odds that Grayscale Investments will be able to turn its Grayscale Bitcoin Trust (GBTC) into a more investor-friendly ETF.

Cardano is down 45.6% from its yearly high of $0.4518 and is showing no signs of slowing down at the moment. Data has shown that at its current price, the majority of Cardano holders are losing money, further showing the state of the cryptocurrency’s price.

Cardano (ADA) addresses in loss is now over 94%, leaving many investors wondering if it’s time to cut their losses and move on.

Cardano (ADA) is currently the 8th largest crypto by market cap, with a market cap of $8.65 billion. However, all metrics have pointed to the cryptocurrency losing stream and struggling to receive inflow from investors.

For instance, ADA is down by 7.% in a 7-day time frame. Its trading volume has also fallen by 12.67% in the past 24 hours, showing a lack of interest in either buying or selling the cryptocurrency.

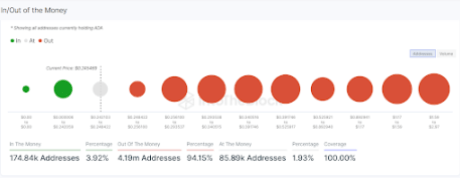

Data from IntoTheBlock’s In/Out of the Money metric has shown the number of Cardano addresses in red is now at 94.15%. The metric, which shows the number of addresses making profits and losses at a cryptocurrency’s current price, shows that the number of Cardano addresses in loss is now over 4.19 million.

Many ADA investors bought in near the peak hype during its all-time high. Of the 4.19 million addresses in loss, 691,480 addresses bought between $1.59 to $2.97, and 608,590 addresses bought between $1.17 to $1.59. On the other hand, only 174,840 Cardano addresses representing 3.92% of the total addresses, are currently at a profit.

Whale transactions have also been quiet on Cardano’s blockchain in the past 24 hours. Another IntoTheBlock metric shows the number of transactions with a value of $100,000 or greater has been in a freefall since May.

Source: IntoTheBlock

Source: IntoTheBlock

The low profitability of ADA holders is probably surprising, given the Cardano blockchain’s popularity. According to recent data released by blockchain analytics firm Santiment, the Cardano network is still the most popular among developers.

Cardano developers have also been actively building and introducing exciting innovations to the blockchain and ecosystem. One example of these developments is the updates to its Lace wallet.

Cardano’s founder, Charles Hoskinson, recently dismissed rumors of issues within the blockchain. And as long as developers remain dedicated to improving the network, Cardano will continue to progress as one of the biggest cryptocurrencies.

For long-term believers in ADA, the current low price could actually be an opportunity to stock up in anticipation for the next crypto bull market.

In what could be a pivotal day for the Bitcoin price, the last day for the US Securities and Exchange Commission (SEC) to appeal the Grayscale Bitcoin (BTC) spot Exchange-Traded Funds (ETF) decision is approaching, and the crypto community is eagerly awaiting the outcome.

The implications of this decision are significant, as it could pave the way for the approval of several other spot Bitcoin ETFs.

According to crypto YouTuber Crypto Rover, if the SEC does not appeal the court’s ruling by the end of the day, it would potentially lose its ability to deny future applications, resulting in the likely approval of all proposed spot ETFs.

The current list of applicants seeking approval includes prominent names such as Grayscale Bitcoin Trust, Ark/21 Shares Bitcoin Trust, Bitwise Bitcoin ETF Trust, BlackRock Bitcoin ETF Trust, VanEck Bitcoin Trust, WisdomTree Bitcoin Trust, Valkyrie Bitcoin Fund, Invesco Galaxy Bitcoin ETF, and Fidelity Wise Origin Bitcoin Trust.

If all Bitcoin spot ETFs are approved, the move would mark a significant milestone in the mainstream adoption of cryptocurrencies.

Accepting these financial instruments would provide investors with a regulated and easily accessible avenue to gain exposure to Bitcoin’s price movements without directly owning the underlying asset.

The approval would also vote for confidence in the cryptocurrency market, attracting institutional investors and potentially injecting fresh capital into the space.

The approval of Bitcoin spot ETFs also can ignite a renewed sense of optimism and investor sentiment. The anticipation of such a development has already fueled speculation of a Bitcoin rally, with market participants eyeing a new annual high.

The thawing of the crypto winter and the approval of these ETFs could create a perfect storm for a Bitcoin price to surge, potentially breaching the $30,000 mark and beyond.

The largest cryptocurrency in the market is striving to reclaim the crucial $27,000 level, trading at $26,700. This level holds significant importance for bullish investors as it represents a key threshold to break the mid-term downtrend structure observed in BTC’s 1-day chart since its yearly high of $31,800 on July 13

Additionally, the failure of the Bitcoin price to hold its 200-day (yellow line) and 50-day (brown line) moving averages (MAs) as support lines is a cause for concern among bullish traders. These MAs, similar to the situation in March 2023, are currently converging.

However, the potential approval of a BTC spot ETF could provide much-needed relief to Bitcoin’s price. Forming a complete rally would require overcoming various resistance levels in such a scenario.

In the short term, Bitcoin’s price will likely face a significant obstacle at the $27,900 level, which was briefly surpassed on October 2nd. Furthermore, BTC encounters a 3-month resistance at $28,700, marking the final hurdle before reaching the $30,000 level, serving as another resistance line.

Nevertheless, the community anxiously awaits the approval of BTC spot ETFs, hoping that it will bring a sense of relief and bullish momentum for investors and Bitcoin’s price.

Featured image from Shutterstock, chart from TradingView.com

More signs say the acquisition will boost metaverse applications in business than in gaming as CEO Nadella talks about productivity and metaverse enthusiast Kotick leaves Activision.

Bitcoin trades in a predictable range, but will the sideways price action tempt altcoin traders to open new positions?

EU securities regulators have their eyes on DeFi, and the top 100 DeFi tokens had mixed price action over the past week, with most trading in a tight range.

Reports this week about multi-million dollar Hamas crypto financing may have left a faulty impression.

Bitcoin’s history is filled with stories of people who put small, disposable amounts of money into the crypto and ended up making a fortune. This has been no different from the case of one Norwegian man, whose throwaway $22 Bitcoin investment has turned into a life-changing sum.

When Kristoffer Koch had originally invested in Bitcoin back in 2009, the cryptocurrency was only trading for a few cents. Koch, at the time, was intrigued which is why he said he made the purchase. He got 5,000 BTC for around $22 at the time, although this figure often varies.

Nevertheless, Koch ended up forgetting about this purchase until four years later when Bitcoin had blown up. By the time the Norwegian man got into his Bitcoin wallet, his initial $22 purchase had ballooned into $850,000. Upon seeing the life-changing sum, Koch revealed that he had used part of the money to buy himself a flat in Oslo.

As stories like these continue to make the rounds, a question on the lips of investors, especially those who came in later than the likes of Koch, is which cryptocurrencies could replicate such growth. So here are some picks that look good.

The AI narrative is still holding strong both within and outside the crypto market and this has positioned some projects to be able to take advantage of its expected growth. Fetch AI’s native FET token has already shown the opportunity that lies in this space but that was only in a bear market. A bull market could see FET’s price rise further and do numbers.

The project is looking to democratize AI access through a crypto economy. This means users will be able to access AI in a completely decentralized and permissionless way unlike the AI products seen in traditional spheres.

Presently, when the topic of privacy coins comes up, two names tend to pop up quickly, which include Monero’s XMR and Secret’s SCRT. Secret actually users ‘Secret Contracts’ to allow decentralized applications to offer completely private transactions.

As the demand for privacy grows among crypto users who constantly have to be aware of the government’s encroachment, SCRT’s value proposition becomes even more important. Added to its low $51 million market cap, SCRT could see a rally similar to that of Bitcoin.

Radiant Capital (RDNT) With Fragmented Liquidity

When it comes to carrying out transactions on-chain, liquidity becomes king, and this is where Radiant Capital (RDNT) comes in. The project is looking to consolidate fragmented liquidity in a bid to enhance the available liquidity for decentralized finance (DeFi) protocols.

This will work across a number of lending protocols regardless of the blockchain that they are on. So instead of hopping from one protocol to another, DeFi users can take advantage of this using a single protocol.

Radiant’s value proposition in a sector that is continuously evolving and growing could see it put on a Bitcoin-like rally. This could see its market cap go from its current $70 million to billions of dollars.

The Ethereum network’s revenue from fees dropped to its lowest level since April 2020 as speculative activity disappeared and users migrated to layer 2s, IntoTheBlock said.

Eth price is at risk of trading below a key price support and multiple data point point to a bearish outlook for the altcoin’s price.

The revelations that the terrorist group behind last week’s attack on villages in southern Israel that left more than 1,200 Israelis dead was partially funded with cryptocurrency may lend additional weight to an effort from Sen. Elizabeth Warren (D-Mass.) and others to push for a law targeting money laundering and sanctions abuses in crypto.

BlockFi lost “a little over a billion dollars” due to its involvement with FTX and Alameda Research, Zac Prince said.

Lawyers petitioned the court to allow them to question witnesses for the prosecution based on FTX’s terms of service, as well as preclude testimony from “lay fact witnesses”.