The European Securities and Markets Authority argued that DeFi was still too small to pose any sizeable risks to overall financial stability, but should be monitored.

Cryptocurrency Financial News

The European Securities and Markets Authority argued that DeFi was still too small to pose any sizeable risks to overall financial stability, but should be monitored.

Bitcoin price is sliding and trading below $27,000. BTC is still at risk of more downsides below the $26,500 and $26,200 support levels.

Bitcoin price struggled to start a recovery wave above the $27,500 resistance. BTC remained in a bearish zone and declined further below the $27,000 level.

There was a drop below the $26,800 level and the price tested the $26,500 support. A low is formed near $26,551 and the price is again attempting a recovery wave. There was a minor increase above the $26,800 level. However, the price is still facing many hurdles.

Bitcoin is now trading below $27,000 and the 100 hourly Simple moving average. There are also two bearish trend lines forming with resistance near $26,950 and $27,400 on the hourly chart of the BTC/USD pair.

Immediate resistance is near the $26,950 level and the first trend line. It is close to the 23.6% Fib retracement level of the downward move from the $28,284 swing high to the $26,551 low. The next key resistance could be near the $27,400 level and second the trend line.

The second trend line is near the 50% Fib retracement level of the downward move from the $28,284 swing high to the $26,551 low. The first major resistance is $27,500 and the 100 hourly Simple moving average, above which Bitcoin might test $27,800.

Source: BTCUSD on TradingView.com

The main hurdle is still $28,500. A close above the $28,500 resistance could start another increase. In the stated case, the price could rise toward the $30,000 resistance.

If Bitcoin fails to recover higher above the $27,000 resistance, there could be more losses. Immediate support on the downside is near the $26,650 level.

The next major support is near the $26,500 level. A downside break and close below the $26,500 support might send the price further lower. The next support sits at $26,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $26,650, followed by $26,500.

Major Resistance Levels – $27,000, $27,400, and $27,500.

WOO Network said it had agreed to repurchase all the tokens and equity previously held by collapsed hedge fund Three Arrows Capital.

The exploiter of the Web3 social media platform agreed to keep a 10% bounty in exchange for returning the remainder of the stolen funds.

During the trial of Sam Bankman-Fried, the founder of crypto exchange FTX, shocking revelations emerged from the testimony of former Alameda Research CEO Caroline Ellison.

According to a TechCrunch report, Ellison testified that the crypto trading firm paid Chinese officials to unlock their Alameda trading accounts on OKX and Huobi in China.

Judge Lewis Kaplan clarified that Bankman-Fried was not charged with bribery in this case. Still, the evidence was presented to demonstrate trust, confidence, and motive between Bankman-Fried and Ellison.

According to Ellison’s testimony, while Bankman-Fried was CEO in 2020, the accounts valued at approximately $1 billion were frozen.

In November 2021, Bankman-Fried claimed that a colleague, David Ma, who had connections in China, found a way to unfreeze the accounts.

Ellison, who had become co-CEO of Alameda by then, made crypto transfers totaling around $100 million to $150 million to reopen the accounts, unaware that the payments were made to Chinese officials.

Ellison stated that Bankman-Fried and Sam Trabucco instructed her through a Signal chat to make the payments.

Before the accounts were reopened, Ellison revealed that Alameda employees explored various strategies to unlock the accounts, including involving lawyers and government officials.

Ellison testified that they even considered using Thai prostitutes to open accounts on the exchanges to facilitate fund transfers, but these efforts were unsuccessful.

One Alameda trader, “Handi,” resigned in early January 2022 due to her objection to paying bribes to Chinese officials, as her father held a government position.

Ellison testified that Handi had a heated argument with Bankman-Fried about the matter, during which he allegedly told her to “shut the fuck up.” A month after Handi’s resignation, Trabucco asked in a Signal chat if Handi’s father had immediately reported them, to which Bankman-Fried responded with “lol.”

Ellison shared a list with prosecutors containing notes, one of which referred to a payment of “150m from the thing?” about the money transferred to regain the accounts.

Per the report, Ellison explained that she did not want to explicitly state in writing that the payment was made to China to unlock the accounts, fearing that it could be leaked and used against Alameda Research in court.

Bankman-Fried’s defense lawyer, Mark Cohen, attempted to strike Ellison’s statement about avoiding written evidence of the payments, but Judge Kaplan overruled the request.

The trial continues to uncover new details and allegations, shedding light on the actions and motivations of the individuals involved, and the cryptocurrency community eagerly awaits further developments and the subsequent outcome of the trial.

Featured image from Shutterstock, chart from TradingView.com

The initial impact amounted to 20 Ether, worth $31,000, while the validator involved has now been taken offline.

Former FTX CEO Sam Bankman-Fried was once “freaking out about” getting regulators to crack down on Binance and raising capital from a Saudi Crown Prince, according to Alameda former CEO Caroline Ellison.

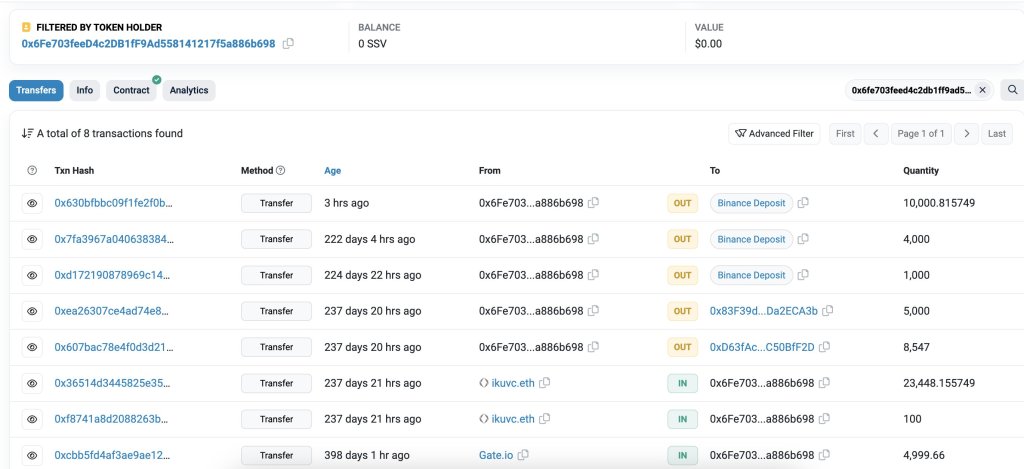

Alon Muroch, the founder of SSV Network, has been drafted into the Israeli Army, according to an X post shared on October 10. Following this news, SSV, the native token of the SSV Network, fell 5%, dropping below the $14 mark. At this pace, SSV is moving closer to its all-time low of around $13.40, registered in September 2023.

In response to the ongoing crisis in the Middle East, Muroch stated that the situation on the ground is “much worse than described.” The founder said that being drafted into the army might help “tip the scale” and improve the situation on the ground.

The escalation in the Middle East as of this week has created a humanitarian crisis leading to loss of lives and destruction of property. As of writing on October 11, it is unclear whether Muroch has been mobilized and actively serving in the military.

Although this news didn’t immediately impact sentiment, blockchain analysis platform Lookonchain picked out two notable transfers. Two addresses, “ikuvc.eth” and “0xF447,” deposited 18,055 SSV worth over $250,000 to Binance, a leading exchange.

Transfers to centralized exchanges usually indicate a potential intention to sell. Even so, it still needs to be determined whether these addresses have liquidated their tokens for other currencies, usually USDT or more liquid and stable tokens such as Bitcoin (BTC) or Ethereum (ETH).

SSV remains under pressure at spot rates. The token is down 5% on the last trading day, extending losses, collapsing from its all-time highs of nearly $100 when it first listed on Binance. Currently, SSV is down by over 95% from its peak, highlighting the dicey state of the token and how unfavorable the markets have been in the past eight months.

The SSV Network aims to strengthen Ethereum by allowing anyone to become a validator without necessarily operating a node. Ethereum is a proof-of-stake network reliant on a web of validators for security.

The SSV Network uses the Distributed Validator Technology (DVT). This system distributes the validator key among a network of non-trusting nodes. The platform allows anyone to stake ETH without running a full validator node, earning rewards.

In doing so, SSV Network aims to make staking more decentralized and accessible while enhancing security and reliability. Currently, SSV Network is still in development and permissioned. However, they plan to update via a Permissionless Launch, broadening their base of operators and validators.

Real-estate-backed stablecoin USDR fell to $0.53 per coin on Oct. 11, but the team said it was merely a liquidity issue and that real estate holdings and digital assets will be used to support redemptions.

Following the Terra LUNA network collapse back in 2022, the price of Ethereum followed the general market downtrend. As a result of this, the ETH price had fallen to a new cycle low of $900, before recovering once more. However, now that the altcoin is still deep in the throes of the bear market, questions have arisen once more about the chances of the price returning to its 2022 lows.

In an analysis posted on TradingView, crypto analyst FieryTrading presents a scenario in which the price of Ethereum could fall back toward its 2022 lows. The analysis in question takes into account the multiple bullish trend lines that the digital asset’s price had fallen through over the last year.

According to FieryTrading, Ethereum had one last remaining bullish line which had emerged on the chart back toward the bottom of the June 2022 sell-offs. However, the digital asset hasn’t been able to hold this trend line and they point out that “it’s well over a year old and must carry some weight.”

Due to this, the crypto analyst believes that the digital asset has entered into a long bearish stretch. As this bear stretch continues, which the analyst expects to be even longer, they see a high possibility of the Ethereum price reaching as low as $900 once more, as shown in the chart below.

Despite being seemingly convinced about ETH’s price decline, the analysis still needs confirmation. Their explanation which is shown in the chart as well asks to wait for the price to break below the $1,510 level for this to take place.

As the analyst explains, the bearish expectation is not localized to just the Ethereum price alone. It seems to encompass the whole market which the analyst believes has finished out its half bullish stretch and has now entered into the bearish half that often leads up to the halving. As the analyst puts it, this indicates “that it’s the turn of the bears by now.”

This school of thought is not new and is actually backed up by historical data. When looking at the charts of cryptocurrencies such as Bitcoin and Ethereum, it shows that there was a bearish stretch leading up to the Bitcoin halving. After the event, this trend tends to reverse, which then signals the start of the bull market.

In the months leading up to the 2020 halving event, the price of Ethereum saw a sharp decline that put its price in the $120 region before picking back up. So if there is a repeat of this, then FieryTrading’s analysis for ETH could play out.

All US stock indices rose on October 11, as traders awaited consumer price index data to be released on the 12th.

GoPlausible, a team of developers building tools for people to create and use Algorand, has launched AlgorandExplorer. This explorer fuses the capabilities of ChatGPT to ease interaction with the public, proof-of-stake blockchain. Algorand is a smart contract platform similar to Ethereum, allowing users to deploy decentralized applications (dapps).

In a Medium post on October 10, the team said the plugin aims to solve challenges facing Algorand indexers and eventually simplify exploring the smart contract platform. Ordinarily, users rely on indexers through which users can search and query the blockchain. This is because indexers have to create a searchable database holding all data, such as transactions, blocks, and more.

Besides offering an interface for users to explore Algorand, the AlgorandExplorer supports “semantic conversational searches, enriching data with logs and related transactions,” allowing on-chain searches to “reason with data” more effectively. The explorer will integrate a language translation tool, meaning users from across the globe can explore Algorand using their native language.

Still, the AlgorandExplorer is under development. Eventually, in the coming version, the GoPlausible plans to include more enhancements, including Algorand Request for Comments (ARCs) and technical documentation.

Algorand is far from the only platform investing in AI; a few months ago, Solana announced their integration of a ChatGPT plugin focused on non-fungible tokens (NFTs). The plugin, the foundation said, facilitates the buying and listing of NFTs. At the same time, it can interpret data and find the floor price of NFT collections listed on the blockchain. The floor price is the lowest price an NFT in a given collection can be sold.

While the move by the Algorand Foundation could see more users explore and analyze transactions on the smart contract platform, there has been no significant impact on prices. The ALGO sell-off was made worse by allegations made by the United States Securities and Exchange Commission (SEC) in June that ALGO and other coins, including Axie Infinity (AXS) and Cardano (ADA), are unregistered securities.

Presently, ALGO remains under pressure, consolidating within a tight range defined by the sell-off recorded in August. Based on that formation, the coin is technically bearish and trending within the bear bar of August 17, a bearish engulfing bar that had high trading volume.

Thus far, looking at trackers, the coin is down by over 70% in the past year of trading. From the daily chart, ALGO is also edging lower, wiping gains posted in the first week of October.

Technically, ALGO is edging closer to all-time lows registered in August, a net negative. The primary supports remain at $0.08. If broken in Q4 2023, the odds of ALGO sinking even lower, completely reversing gains of 2021, will be on the table.

The crypto tax reporting requirements proposed by the IRS in August are currently scheduled to go into effect in 2026 — according to 7 senators, that isn’t soon enough.

The FAB pilot follows Bank ABC’s in Bahrain. JPMorgan also just launched its Tokenization Collateral Network on Onyx.

After failing again at $28,000 resistance over the weekend, bitcoin has retreated to its weakest level since late September.

Telegram’s partner, the Open Network (TON) Foundation, in partnership with Alibaba Cloud, has announced plans to set up 256 servers for a performance testing event scheduled for October 31, 2023.

Per the announcement, the objective of this event is to officially establish the TON blockchain as the world’s fastest blockchain to earn accreditation from the Guinness World Records.

According to a report by Yahoo Finance, the TON blockchain has experienced significant growth since 2022, witnessing a 20-fold increase in addresses from 170,000 to 3.5 million.

The network has also expanded its validator nodes to 350, fostering a more decentralized network across 25 nations. The blockchain has maintained a track record throughout this expansion, with no major network disruptions reported.

Both parties view the upcoming performance test as a crucial step in showcasing the unique capabilities of the TON blockchain, which serves as a trusted infrastructure layer for the Web3 ecosystem within Telegram.

Anatoly Makosov, the Core Development Lead at the TON Foundation, expressed anticipation for the performance testing event, highlighting the TON blockchain’s technical superiority, particularly regarding scalability.

Makosov emphasized that TON’s large-scale public performance testing is an exciting opportunity to witness significant results and validate the blockchain’s technical prowess. Makosov stated:

We look forward to October 31, 2023, to confirm that the TON blockchain technically stands out among any other blockchain, especially in its ability to scale. This is the first large-scale public performance testing of TON – we’re just as excited as you are to see the results.

MEXC Ventures, a subsidiary of MEXC’s global cryptocurrency exchange, has also announced a significant investment in The Open Network. According to Yahoo Finance, this investment is MEXC’s largest Layer-1 funding and is accompanied by a partnership with the TON Foundation.

Justin Hyun, Director of Growth at the TON Foundation, expressed enthusiasm about the partnership with MEXC, emphasizing their shared goal of offering global access to the decentralized Web3 ecosystem within Telegram.

Per the report, the foundation is committed to delivering a “user-centric experience” for the community. MEXC’s support “significantly strengthens” its ability to develop new tools and services seamlessly integrating crypto with social media.

Steve Yun, President of the TON Foundation, highlighted MEXC’s belief in the TON blockchain’s potential for building a Web3 super-app ecosystem on Telegram. Yun expressed confidence in the TON ecosystem’s and MEXC’s mutual growth as they prepare for the next market cycle.

The collaboration between the Open Network Foundation, Alibaba Cloud, and MEXC Ventures underscores blockchain technology’s increasing recognition and adoption, particularly in the Web3 space.

These partnerships aim to enhance the functionality, scalability, and accessibility of the TON blockchain while promoting global adoption and innovation within the decentralized ecosystem.

At the time of writing, the native token of the protocol, Toncoin, is trading at $2,006, reflecting a marginal decline of 0.2% over the past 24 hours. Nevertheless, the token has experienced substantial growth year to date, boasting an impressive increase of 59% during this timeframe.

Featured image from Shutterstock, chart from TradingView.com

The decentralized autonomous organization is holding a vote on how to respond to securities regulators.

ZeroSync’s Robin Linus has ignited excitement in the Bitcoin community by introducing the “BitVM” paper, proposing a straightforward method for incorporating smart contracts into the original blockchain, a feature predominantly associated with Ethereum and its numerous derivatives.

Billionaire investor Paul Tudor Jones says he is bearish on U.S. stocks, and bullish on Bitcoin and gold.