Inscriptions have been acting more as a “packing filler,” stuffed into any remaining space once higher-value monetary transfers are packed into blocks, said the firm.

Cryptocurrency Financial News

Inscriptions have been acting more as a “packing filler,” stuffed into any remaining space once higher-value monetary transfers are packed into blocks, said the firm.

Chainlink’s LINK price is moving higher above the $7.25 resistance. The price is now consolidating gains and might aim for more upsides above $7.50.

In the last LINK price prediction, we discussed the chances of more gains above the $7.00 level against the US Dollar. The price did remain stable and extended gains above the $7.25 level.

The price even broke the $7.50 level. Chainlink traded as high as $7.56 and outperformed Bitcoin and Ethereum. Recently, there was a minor downside correction below $7.40. The price tested the 23.6% Fib retracement level of the upward move from the $6.60 swing low to the $7.56 high.

LINK is now trading above the $6.50 level and the 100 simple moving average (4 hours). There is also a key bullish trend line forming with support near $7.25 on the 4-hour chart of the LINK/USD pair.

Source: LINKUSD on TradingView.com

If there is a fresh increase, the price might face resistance near $7.45. The first major resistance is near the $7.50 zone. A clear break above $7.50 may possibly start a steady increase toward the $8.00 and $8.20 levels. The next major resistance is near the $8.50 level, above which the price could test $8.80.

If Chainlink’s price fails to climb above the $7.50 resistance level, there could be a downside extension. Initial support on the downside is near the $7.25 level.

The next major support is near the $6.95 level or the 61.8% Fib retracement level of the upward move from the $6.60 swing low to the $7.56 high, below which the price might test the $6.80 level. Any more losses could lead LINK toward the $6.60 level in the near term.

Technical Indicators

4 hours MACD – The MACD for LINK/USD is losing momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for LINK/USD is now above the 50 level.

Major Support Levels – $7.25 and $6.95.

Major Resistance Levels – $7.50 and $8.50.

Ethereum price is eyeing a recovery wave from $1,565 against the US Dollar. ETH could rise steadily if it settles above $1,600 and $1,620.

Ethereum’s price remained well-bid above the $1,565 level. ETH seems to be forming a base above $1,565 and is slowly moving higher, like Bitcoin.

The price was able to recover above the $1,580 and $1,590 levels. There was a move above the 23.6% Fib retracement level of the downward move from the $1,669 swing high to the $1,565 low. Besides, there was a break above a major bearish trend line with resistance near $1,590 on the hourly chart of ETH/USD.

Ethereum is now trading above $1,590 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1,600 level.

The next major resistance is $1,620. It is close to the 50% Fib retracement level of the downward move from the $1,669 swing high to the $1,565 low. A push above $1,620 might send Ether further higher and there are chances of a steady increase.

Source: ETHUSD on TradingView.com

The next major resistance is near $1,650 and $1,660. If the bulls succeed in clearing the $1,660 hurdle, the price could start a decent increase toward the $1,720 resistance. Any more gains might open the doors for a move toward $1,800.

If Ethereum fails to clear the $1,620 resistance, it could start another decline. Initial support on the downside is near the $1,580 level.

The next key support is $1,565, below which the price could test the $1,540 support. If the bulls fail to protect the $1,540 support, there could be a sharp decline. In the stated case, there could be a drop toward the $1,440 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,565

Major Resistance Level – $1,620

Crypto influencer Ben “BitBoy” Armstrong was released on bail around 8 hours after being booked by Gwinnett County police for loitering and simple assault.

An impending government shutdown is probably Not Good News for crypto’s D.C. hopes. On a trial-related note, you received preview copies of The SBF Trial, a newsletter we launched last week to keep readers up to speed on Sam Bankman-Fried’s time in court. The trial kicks off next Tuesday.

Bitcoin price is consolidating above the $26,000 support. BTC could start a recovery wave if it clears the $26,500 resistance zone in the near term.

Bitcoin price remained stable above the $26,000 support zone. BTC seems to be forming a short-term support base above the $26,000 level and is currently consolidating.

Recently, the price made a recovery wave attempt above the $26,200 level. However, the bears remained active below the $26,500 level. They rejected the 50% Fib retracement level of the downward move from the $26,712 swing high to the $26,026 low.

Bitcoin is now trading below $26,400 and the 100 hourly Simple moving average. Immediate resistance on the upside is near the $26,300 level. There is also a major bearish trend line forming with resistance near $26,300 on the hourly chart of the BTC/USD pair.

The next key resistance could be near the $26,350 level or the 100 hourly Simple moving average, above which the price could revisit the $26,500 resistance or the 76.4% Fib retracement level of the downward move from the $26,712 swing high to the $26,026 low.

Source: BTCUSD on TradingView.com

To start a recovery wave, the price must settle above $26,500. In the stated case, the price could climb toward the $27,000 resistance. Any more gains might call for a move toward the $27,500 level.

If Bitcoin fails to start a fresh increase above the $26,300 resistance, it could continue to move down. Immediate support on the downside is near the $26,050 level.

The next major support is near the $26,000 level. A downside break and close below the $26,000 level might start another major decline. The next support sits at $25,400. Any more losses might call for a test of $25,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $26,050, followed by $26,000.

Major Resistance Levels – $26,300, $26,500, and $27,000.

Convicted fraudster Pablo Renato Rodriguez will also need to serve three years of supervised release after he finishes his 12 year imprisonment sentence.

In a landmark verdict, Pablo Renato Rodriguez, the co-founder of AirBit Club, has been sentenced to 12 years in prison by US District Judge George B. Daniels.

According to the US Department of Justice (DOJ), Rodriguez, along with his co-conspirators, masterminded a sprawling global pyramid scheme that defrauded investors of millions of dollars through false promises of cryptocurrency trading and mining profits.

Per the DOJ’s investigations, the elaborate scheme involved luring unsuspecting and often inexperienced investors into purchasing AirBit Club memberships with the guarantee of substantial returns.

However, instead of engaging in legitimate cryptocurrency activities, Rodriguez and his cohorts allegedly diverted the funds for personal gain while employing an intricate money laundering operation to conceal their ill-gotten profits.

Rodriguez’s co-defendants, Gutemberg Dos Santos, Scott Hughes, Cecilia Millan, and Karina Chairez, have already pleaded guilty and await sentencing. The court has also ordered the forfeiture of the fraudulent proceeds, which include a staggering $100 million worth of assets, such as US currency, Bitcoin (BTC), and real estate.

Describing Rodriguez’s actions as a flagrant exploitation of cryptocurrency for fraudulent purposes, US Attorney Damian Williams emphasized the importance of this case in deterring potential fraudsters from making false promises of lucrative cryptocurrency investments.

According to court documents, Rodriguez and Dos Santos founded AirBit Club in 2015 and “aggressively” marketed it as a multilevel marketing club operating in the cryptocurrency industry.

The duo reportedly organized extravagant expos and presentations worldwide, enticing victims to invest in cash and providing them access to an online portal showcasing false investment returns.

As early as 2016, victims who attempted to withdraw funds encountered excuses, delays, and exorbitant hidden fees. The scheme’s architects, including Rodriguez, spent the defrauded money on luxury items, financed more expos to attract additional victims, and siphoned funds through a network of domestic and foreign bank accounts.

According to the DOJ, Rodriguez’s attorney trust account, managed by Scott Hughes, played a crucial role in concealing the illicit proceeds of the AirBit Club scheme.

Before AirBit Club, Rodriguez and Dos Santos were involved in another pyramid investment scheme called Vizinova, which led to a legal battle with the US Securities and Exchange Commission (SEC).

Hughes, an attorney representing Rodriguez and Dos Santos in the Vizinova case, later assisted them in perpetrating the AirBit Club fraud by removing negative information about both schemes from the internet.

With Rodriguez’s sentencing, justice has been served to one of the key figures responsible for defrauding countless victims through AirBit Club.

Featured image from Shutterstock, chart from TradingView.com

Despite campaign finance charges being dropped in July, the prosecution has been granted permission to present evidence of Bankman-Fried’s political donations in his upcoming fraud trial.

Bitcoin price is up 30% versus Ethereum (ETH) in 2023, and bulls appear not to be slowing down, looking at the performance in the weekly chart. BTC is on the brink of pushing ETH lower at spot rates, registering new 2023 lows and extending gains from early this year.

Bitcoin bulls are in the driving seat. Candlestick arrangement in the weekly chart shows that BTC pushed on, extending its rally against the second most valuable coin despite attempts for higher highs in mid-August.

In the second week of August, ETH added roughly 7% versus BTC. Notably, this expansion was after a period of horizontal consolidation as momentum shifted in favor of ETH. However, bears reversed gains and continued the primary trend established since the beginning of the year.

The medium trajectory seems to be guided by events in mid-March 2023. Then, ETH prices devalued drastically versus Bitcoin, forming a bearish engulfing bar marked by a spike in trading volume. The surging demand for BTC saw prices reverse progress in late October 2022.

Bitcoin bulls have since extended gains versus Ethereum. However, one notable formation is that BTC is rallying at the back of light trading volume. Since the rally of BTC in Q1 2023 versus ETH, trading volume has been contracting despite prices printing lower lows.

It cannot be immediately ascertained whether the current draw-down will continue. The level of participation has significantly decreased in the last six months as sentiment dipped.

Over the past two quarters, the involvement of regulators, including the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), seems to have negatively impacted activity.

In early June, the SEC sued Coinbase and Binance, two of the world’s leading cryptocurrency exchanges. The regulator cited various claims, accusing Coinbase of listing unregistered securities and Binance of, among other charges, manipulation and violating different securities laws. Binance and Coinbase plan to defend themselves against the SEC.

Besides regulations, the broader community remains cautious, considering the number of hacks targeting multiple exchanges and decentralized finance (DeFi) protocols. Some of these exploits have been linked to the Lazarus Group, a notorious cell allegedly sponsored by North Korea.

Despite the general market lull, traders look forward to the upcoming Bitcoin halving event in 2024. The event will create a supply shock, making BTC scarcer. Whether this will see BTC press ETH even lower back to June 2022 lows is yet to be seen.

Based on a recent report by Bloomberg analyst Jamie Coutts, asset managers’ interest in Bitcoin stretches beyond exchange-traded funds (ETF) into the mining sector. In particular, Coutts speaks about BlackRock, describing the asset manager’s application with the US Securities and Exchange Commission (SEC) to offer a Bitcoin spot ETF as “unsurprising.”

The analyst stated that BlackRock and other prominent global asset managers, namely Vanguard and State Street, have been involved in the Bitcoin mining industry for over three years.

In hindsight, #BlackRock's massive #Bitcoin spot ETF play shouldn't have been that surprising. Along with other behemoths (Vanguard, StateStreet) who espouse #ESG-driven investing principles, they started scooping up public mining stock back in 2020

ESG, Institutionalization

pic.twitter.com/VcKX8TrgZ2

— Jamie Coutts CMT (@Jamie1Coutts) September 26, 2023

James Coutts stated that BlackRock began its venture into Bitcoin mining in 2020 by investing in Marathon Digital, the second-largest publicly traded mining company.

Notably, this development occurred when the Bitcoin mining industry faced high criticism, likely due to the substantial reliance on fossil fuels.

Over the last three years, Coutts reports that BlackRock, Vanguard, and State Street have increased their respective investments in Bitcoin mining companies, regardless of the market cycle.

Interestingly, all three asset managers are known to promote Environmental, Social, and Governance (ESG) investment principles, part of which is limiting fossil fuel use. However, it appears that investing in Bitcoin mining may not damage the ESG credentials of these companies.

According to a report by Daniel Batten, co-founder of CH4 Capital, James Coutt notes that Bitcoin mining currently derives 50% of its energy from sustainable sources. And this percentage is likely to increase as Bitcoin mining has the unique ability to monetize stranded energy and stabilize energy grids.

Based on James Coutts’s report, BlackRock and the two other asset managers in the discussion are currently the top investors in the three largest publicly traded mining companies, namely Marathon Digital, Riot Platforms, and Cleanspark.

Together, these mining companies collectively own 8.9% of the global hash rate, which is significant as public miners only account for 15% of the global hash power.

For now, James Coutts believes that the involvement of these asset managers in Bitcoin mining poses little challenge to the network’s decentralization.

However, the analyst notes that there may be a future clash of network and ESG values, especially given the activist tendencies of BlackRock, Vanguard, and State Street.

However, this would not prevent the Bitcoin network from operating as expected. But it may lead other miners whose operations still rely on fossil fuels to start processing “censored transactions.”

At the time of writing, Bitcoin trades at $26,198.48, with a 0.57% gain in the last month, according to data from Tradingview.

The partnership comes weeks after KBank, rival of SCBX’s parent, announced a $100 million web3 fund.

The Ethereum open interest has been on an upward trajectory that has culminated in it crossing the $5.2 billion mark. This surge is important to Ethereum’s native token ETH in a number of ways as it could point to how investors are viewing the cryptocurrency at this point.

Data from Coinglass shows that the Ethereum open interest has risen rapidly in recent times. Over the last week, the open interest has grown, eventually crossing $5.2 billion at a time when the crypto market continues to struggle to loosen the grip of bears.

One thing about open interest is that it can point to how investors are viewing the cryptocurrency and whether they are bearish or bullish. When open interest rises, it points to investors becoming more bullish. On the other hand, a drop in open interest suggests that investors are more bearish and expect prices to drop.

This time around, with the open interest being on the rise, it suggests that crypto investors are turning bullish once more. This reflects the Crypto Fear & Greed Index showing that investor sentiment has been improving during the same time period.

The chart above shows that the ETH price has often rallied when open interest has surged, which could happen in this case. If this holds true, then the ETH price could be looking at a rise toward the $1,700 level once more.

The turn to bullishness marked by the increase in Ethereum open interest is not limited to the cryptocurrency alone. Looking at the long/short ratio on Coinglass shows that long volumes have begun to recover while short volume has plummeted.

Ethereum long volumes are currently sitting at $574 million compared to $548 million for short. This comes out to 51.28% for longs with 48.72% for shorts. And while these differences are not especially significant, it does show that crypto investors are betting more on a recovery for the cryptocurrency.

Liquidations have also shown that short traders are losing more in the market. Ethereum currently has a 24-hour liquidation volume of $6.63 million. $1.57 million of this is long positions while $5.06 million is accounted for by short traders.

The ETH price is sitting at $1,588 at the time of writing. It’s seeing small gains of 0.84% in the last day but nursing 3.59% losses on the weekly chart.

The efforts from Ark 21Shares and Global X to list spot bitcoin exchange traded funds (ETFs) must now officially wait longer for the U.S. Securities and Exchange Commission (SEC) to either approve or reject or deny their applications as the agency moved to extend deadlines Tuesday.

The approval is seen as a milestone moment for BlockFi’s over 100,000 creditors, who have been long awaiting repayment.

HTX (formerly known as Huobi), one of the leading cryptocurrency exchanges, has been embroiled in a new controversy as Justin Sun, Tron’s founder and BitTorrent’s CEO, faces allegations of a staggering $2.4 billion shortfall in user funds.

Adam Cochran, Managing Partner at Cinneamhain Ventures, has shed light on the intricate details of the alleged malpractice, revealing a web of “financial manipulations.”

Cochran’s analysis raises concerns over Huobi’s financial stability, questioning the integrity of the exchange’s claims regarding its holdings of Ethereum (ETH) and USDT, a stablecoin pegged to the US dollar.

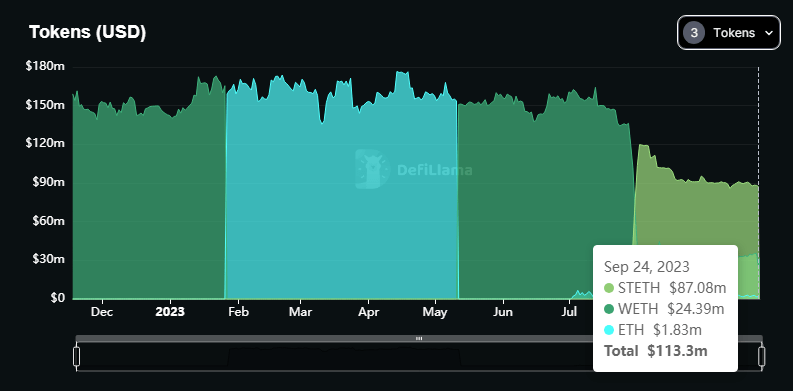

As seen in the chart above, while Huobi asserts assets worth $200 million in ETH, Cochran’s investigation, corroborated by defillama data, reveals a discrepancy, with the actual value amounting to under $113 million, even when considering wrapped ETH (WETH) and staked ETH (stETH).

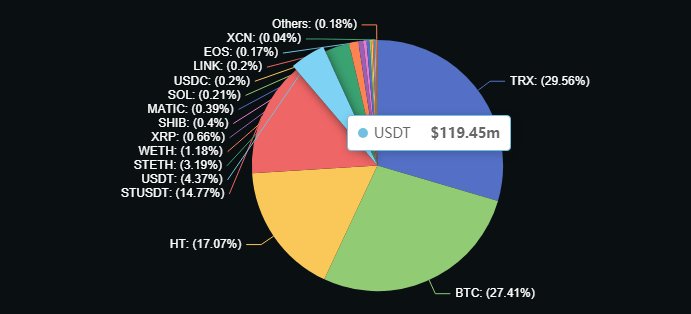

The situation further unravels when examining Huobi’s purported $624 million USDT holdings. However, Cochran’s findings indicate that only $119 million of USDT resides within the exchange, while the remaining balance is in staked USDT (stUSDT).

What raises suspicion is that Justin Sun has enabled staked USDT (stUSDT) a staking feature, which allows users to stake either USDT or TUSD (TrueUSD) to earn stUSDT, as reported by NewsBTC.

Instead of following the expected protocol of burning staked assets to claim the cash and take it offline, these funds are redirected to Justin Sun’s addresses or utilized to support JustLend, a lending platform associated with the Huobi ecosystem.

Contrary to Huobi’s claim that it burns the stUSDT with Tether, Cochran’s investigation reveals that the counterparties for USDT on Huobi are the exchange’s deposit wallets or Binance.

This suggests that Justin Sun may utilize USDT from user balances on Huobi to generate stUSDT, subsequently leveraging the underlying USDT to support JustLend or repurchase TUSD on Binance.

Cochran concludes that this complex financial arrangement, including TUSD deposits into stUSDT, effectively mints “fake assets” against an unknown equity.

As a result, Cochran estimates that Justin Sun’s alleged debt to users across the Huobi and Tron ecosystems amounts to approximately $2.4 billion, all while users remain unaware of the situation.

Huobi has not yet formally responded to these allegations, leaving the situation’s outcome uncertain. However, the possibility of Huobi’s insolvency raises significant concerns regarding the security of user funds and the overall trustworthiness of the exchange.

It remains to be seen how this situation will develop and what actions will be taken to address these concerns effectively.

Featured image from Shutterstock, chart from TradingView.com

The Japanese bank joins a rapidly growing number of digital asset firms operating in Abu Dhabi and the rest of the United Arab Emirates.

The commission gave itself an additional 60 days to consider the listing of ARK 21Shares’ investment vehicle on the Cboe BZX Exchange, with a final deadline set for Jan. 10.

The financial sector was abuzz recently, with Citibank announcing a platform backed by blockchain technology to transform institutional savings into tokens. This news drew interest from various quarters, including prominent financial educator and “Rich Dad Poor Dad” author Robert Kiyosaki, who tied it to Bitcoin.

Using the X (formerly known as Twitter) platform, Kiyosaki expressed curiosity about the potential ramifications this could have for Bitcoin and the US dollar, igniting a flurry of responses from the online community.

Citibank’s recent dive into the realm of blockchain technology marks a significant shift for the institution. Their new offering, a tokenization service, specifically focuses on cash management within the finance sphere.

This latest development is tailored to cater to institutional clients’ unique needs, leveraging blockchain technology’s features and smart contracts.

The announcement by the bank provides a deeper insight into the vision behind this initiative. According to the update, Citibank intends these smart contracts to act as modern substitutes for long-standing banking instruments like bank guarantees and letters of credit.

The decision symbolizes not just an adaptation to current technological trends but a response to the changing dynamics of the financial world. At its core, Citibank’s strategy revolves around recognizing and meeting the growing demand for ‘always-on,’ flexible financial services.

This demand comes in an age where businesses operate globally, and the need for instantaneous transactions is paramount. To address this, Citi Token Services is poised to change how institutions handle their finances.

The service promises to enable uninterrupted cross-border payments, ensure liquidity, and deliver automated trade finance solutions, all operating on a 24/7 basis.

Kiyosaki’s inquiry on the X platform was straightforward: with Citibank’s new technological adoption, is this the end of Bitcoin and the US dollar as we know them? The crypto community was swift in its response, dismissing any looming threats to Bitcoin due to Citibank’s tokenization initiative.

BYE BYE Bitcoin & US Dollar? Citibank announced today it is offering bank block chain technology to turn institutional savings into Citibank tokens which can be used for instaneous 24/7 cross border transactions. Bye bye BC & US $?

— Robert Kiyosaki (@theRealKiyosaki) September 26, 2023

Shivam Sharma, a user on the X platform, emphasized the unique value proposition of Bitcoin, noting that Citibank’s tokens are essentially digital ledgers. They operate in a different space, he suggests, from Bitcoin, which has carved its niche as a decentralized currency.

Another user with the handle Happenings NFT said:

A software is not an asset & other banks don’t trust other banks. Banks will need a third party to facilitate instant cross-border payments because they don’t trust each other. This is why the JPM coin didn’t work.”

Featured image from iStock, Chart from TradingView

The members of the House Financial Services Committee are expected to question Gary Gensler during a Sept. 27 hearing on SEC oversight.