Sam Bankman-Fried’s trial is scheduled to start on Oct. 3, but the actual opening arguments are projected to begin a day later, a newly released court trial calendar shows.

BREAKING: Valkyrie Secures Green Light For Ethereum Futures ETF, Trading Launching Tomorrow

According to a recent FOX Business report, Valkyrie Investments has secured approval from the Securities and Exchange Commission (SEC) to launch the first exchange-traded fund (ETF) featuring Ethereum (ETH) futures.

This achievement positions Valkyrie as the frontrunner among nine issuers seeking to provide investors with an opportunity to speculate on the future price of the world’s second-largest digital asset through an ETF.

Valkyrie Emerges As First Mover In Ethereum Futures ETF Race

Ether, the native token of the Ethereum blockchain, currently holds a value of approximately $1,659 per token. Valkyrie aims to enhance retail participation in the crypto market by introducing an ETF that tracks Ether futures.

According to FOX, Valkyrie Investments plans to merge its existing Bitcoin (BTC) futures ETF with the newly introduced Ether futures ETF, creating a combined fund named “the Valkyrie Bitcoin and Ether Strategy ETF”.

Notably, the ETF’s Nasdaq ticker, BTF, will remain unchanged. The fund’s strategy includes opportunistically purchasing Ethereum futures, reflecting the growing interest in this digital asset over the past year.

Originally scheduled to commence trading on October 3, Valkyrie expedited its launch in response to the possibility of a government shutdown on Friday, a development that would limit SEC operations.

With nearly two million federal workers facing layoffs without a funding agreement, Gensler has urged companies planning to go public to expedite their offerings before the shutdown occurs.

The fate of the Ether futures applicants remains uncertain, as the SEC has requested that they update their filings with any additional information by Friday afternoon.

Lastly, Steven McClurg, Chief Investment Officer at Valkyrie, expressed enthusiasm about being at the forefront of offering Ethereum futures to investors, recognizing the exponential growth in interest surrounding this asset class.

Featured image from Shutterstock, chart from TradingView.com

Ripple CTO Addresses Bitcoin Adviser’s Claims That XRP Is Centralized

Ripple CTO David Schwartz has addressed claims made by El Salvador Advisor Max Keiser that the XRP token is a “centralized” cryptocurrency. Schwartz took to X (formerly Twitter) to clear the air, stating that the Bitcoin Adviser’s opinion of XRP was too ignorant to warrant a proper reciprocation.

Ripple CTO Criticizes Centralization Claims

On September 24, Co-founder of Volcano Energy and Bitcoin Advisor to El Salvador’s President, Max Keiser made a controversial statement about the XRP token. In an X (formerly Twitter) post, Keiser stated that Ripple’s native token, XRP was “centralized”, which was negatively received by the community and triggered a response from the Ripple CTO.

Responding to Keiser’s controversial claim about the XRP, Schwartz expressed his indignation and stated that he found the statement laughable.

“This is such an incredibly stupid argument I have no idea how I could possibly respond to it other than to laugh,” Schwartz said.

In addition to Schwartz, the Product Head of Visa Installment and former employee of Ripple, Josh Gierscha, also jumped on the bandwagon to debunk Keiser’s claims.

Initially, Giersch had believed that Keiser’s centralization claims were made from an X account impersonating the Bitcoin Advisor or from a fan account.

However, Schwartz revealed that the comment was made by the real Max Keiser. He responded by quoting the original post from Keiser’s real account.

Of course the real Max Keiser would never say anything this dumb.https://t.co/dd9JQUPvIYhttps://t.co/mOkN3v0vFU

— David “JoelKatz” Schwartz (@JoelKatz) September 27, 2023

Giersch then topped off the conversation, saying, “Keiser’s an industrial-grade crank, I shouldn’t have expected any better from him”

Keiser’s view on the XRP token was based on the cryptocurrency’s US patent created by Schwartz in 1992 which illustrated a cooperative system involving several interconnected computers.

This is not the first time that Keiser has said something to draw the ire of the XRP community. The Bitcoin advisor has had a poor view of the token for some time now and occasionally criticizes XRP while idolizing Bitcoin. Back in May, the Bitcoin advisor had come under fire following a statement labeling the XRP token a “shitcoin.”

XRP Twitter Community Reacts To Centralization Argument

The XRP community also poured out to criticize Keiser’s claims about the token. One community member attributed the statements to Bitcoin maxis being scared of the token’s abilities, saying; “Bitcoin maxis are terrified of XRP.”

Another X user jumped in to add their own two cents saying that Keiser was being intentionally misleading to his over 500,000 followers. Pointing to the patent which Keiser used as the basis for his statement, the user said “There’s no way he believes you filed a patent for the XRPL in 1988. Not a chance. Yet this is what he asserts. Seems he’s just an “ends justify the means” type of guy.”

Keiser’s remark on XRP’s decentralization contradicts the inherent nature of the token which is seen in its value as a digital payment currency and an open-source ledger blockchain.

DAOs need to learn from Burning Man for mainstream adoption

DAOs should learn from Burning Man’s example in simplifying their missions and governance structures and keeping community members engaged.

Back To BlockShine ☀️

As I kid I remember reading a Donald Duck story about him being frustrated that people were different to him. In the story, he then all of a sudden multiplied to be in the city with just various versions of himself, leading everything to be a total mess.

Turns out, we need different views, temperaments, skills, and cultural standpoints to make this whole planet thing work. These days, when ever you have something real to say, you are a threat to someone.

We’ve lost the idea that some of our bad ideas should die facing better ones in public conversations, so we don’t all have to die by the bad ideas. As it is perceived by many that there is no transcendent realm, many feel like their ideas is who they are. So challenging ideas, even shitty ones, feels like dying to them.

We are each others checks and balances, if this democracy thing is done right, but it goes beyond it. We are born with different temperaments to maintain the balance of the cosmos, even if the planets collide into one another on occasion. A simpler way is trying a make a NY socialite do your farm growing.

As hinted towards in the previous article, the art world is by en large, is still totally clueless about the value of digital decentralised certificates. The human desire to erase the parts we don’t like, multiply ourselves in an attempt to reach utopia, and play power games – without accountability – led to this multiplied Donald Duck nightmare. Real inclusivity means inclusivity of temperaments and ideas foreign to us, and that is HARD work to live with. The law of entropy means something Ayn Rand once said:

You Can Avoid Reality, But You Cannot Avoid the Consequences of Avoiding Reality

The Fork and Flip piece now works in AR via the Artivive app

From Vantaa to Dubai

When I was a kid, a couple kids used to call me “big head” as my head was disproportionately bigger than the rest of my body. It was true at that point, but I figure it had also something to do with those big ideas I had, that didn’t really fit into the sub-urban grey Vantaa school setting. I’m sure you’ve never heard of Vantaa, but that has something to do with big ideas not being so common there, even if some individuals reach escape velocity. Not saying it was Bronx in the 70’s, but as tough environments damage us, but they also breed sisu. This is a Finnish term equivalent to something like grit, but it doesn’t quite cover it. It has been a very useful thing throughout my life, as I keep being animated and inspired by big ideas.

This bubble head figure is being turned into a 50cm 3D statue by the talented and idea filled Hadrien from Arteier3D. We met through Hamad Al Ali from Yalla Group earlier in Dubai, and kept in touch figuring out ways to work together. Getting this statue done is a great honor for me with a sentiment reaching all the way to some lemons being made into lemonade since a kid. It comes to show that through working hard enough and pushing for a vision, things become possible. Very grateful for this whole process now, even if part of the pain remains as the rocket fuel to elevate further still.

More on this collab later, as we are onto even bigger ideas.

Renaissance 360 continued

The Desert Rose piece from the MIrrors series.

The Desert Rose piece from the MIrrors series.

https://www.newsbtc.com/wp-content/uploads/2023/09/IMG_4817_1.mp4

Blow up at the Theatre of Digital Art in Dubai

Would you live here?

Would you fly in this?

Thanks to Mic Kuisma, that I finally met in person at the Tmrw Conf in Serbia, I was introduced to Martin from White Mammoth studios. He is now responsible for the implementation of “Desert Rose” into a fantastic render of a villa as well as a jet, giving a vision on where we are headed. We will be working together on many things, to which this is a great start.

What does it look like, when liabilities get turned into assets via a creative art & licence process utilising digital certificates? Can assets be turned into further value through the same process?

Before heading to Finland this summer, due to the kind introduction of H.E Amna Fikri, we had a meeting with the eloquent H.E Fahad Al Gergawi, who is the Chief Executive Officer of the Dubai Investment Development Agency (Dubai FDI). We keep being inspired by the vision of Dubai and UAE, as well as feel there is a significant contribution we can add to the region via our Renaissance 360 concept.

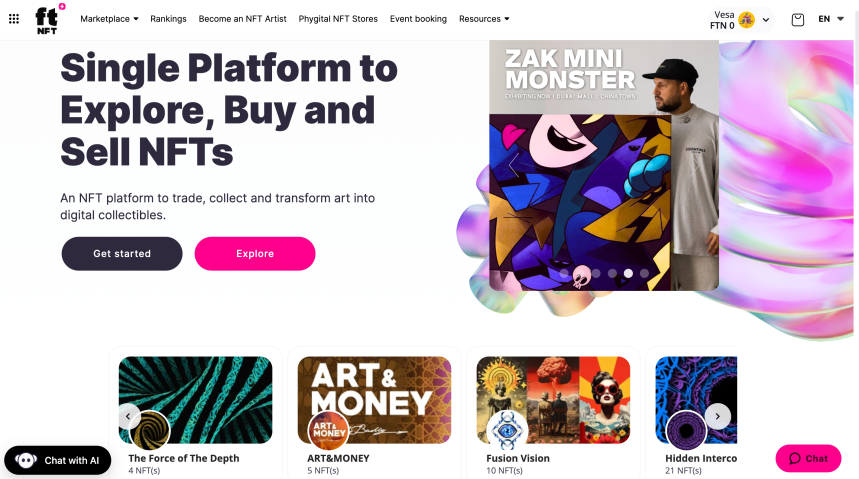

fT NFT at Dubai Mall

Pioneering physical and digital integration, the ftNFT Art Gallery located at the Dubai Mall is one of its kind. The super sleek store, equipped with screens and opens space to showcase physical works and merchandise, stands as the grand creative experiment of the Fastex exchange. VESA has always worked to bridge physical and digital together, so a partnership between the two was a natural evolution.

Tom Badley’s “Art & Money” show is currently on, so please check that out.

Tom Badley’s “Art & Money” show is currently on, so please check that out.

Team VESA has consulted for the gallery over the summer, and now the partnership will turn to exhibiting VESA at their location.

https://www.newsbtc.com/wp-content/uploads/2023/09/Million_Dirhmh-Hotel_05.mp4

“Million Dirham Hotel” is one of the ones being sold as a motion NFT coming with a physical piece that launches the AR animation.

“Caramel” is one of the ones being sold as a motion NFT coming with a physical piece that launches the AR animation.

The show will include some OG Crypto artworks as re-paints as well as new works from the Mirrors series.

Some of them were last seen in Toda Dubai at the MKO concert.

https://www.newsbtc.com/wp-content/uploads/2023/09/MKOtweet.mp4

The opening night will be on the 11th of November at Dubai Mall / ftNFT store.

Check them out here: FT NFT GALLERY

I mean, just WOW!

If you’ve been to this event, you already know. WOW Summit (8.-9. October) is back, bigger, and more lavish than before. One of the most epic events in town, WOW reunites once again the spearheading keynote speakers, Founders, panelists, and thought leaders of our industry.

VESA will be featured on a panel on NFTs during the event, and excitingly on the first night, he will give a presentation before the gala dinner for the VIP guests.

Looks

https://www.newsbtc.com/wp-content/uploads/2023/09/Cars-at-WOW.mp4

This was from a previous presentation at WOW Summit 2021 at the Atlantis hotel conference room.

Primal Scream

While we live in a gas light planet, I don’t know if you are doing well or not, but this will give a kick to your day!

Enjoy!

Catch you at the events,

Keep your flag high,

VESA & Lotta

Crypto & NFT Artist

All links to physical, NFTs, and more below

http://linktr.ee/ArtByVesa

Bitcoin Tops $27K as Rates and Oil Retreat; Ether Outperforms on ETF Hopes

Cryptocurrency markets surged higher Thursday, with the price of bitcoin (BTC) breaking above the $27,000 level for the first time alongside easing macro pressures.

Ripple pulls back from Fortress acquisition 20 days after announcement

Ripple’s CEO Brad Garlinghouse shared the news on X, saying it will remain an investor in Fortress Trust.

Ripple Cancels Plan to Buy Fortress Trust

“While this outcome is different from what was originally planned, we’ll continue to support them and hope to work together in the future,” said CEO Brad Garlinghouse.

Bitcoin’s Hidden Threat? Miner Revenue Sent To Exchanges Surges Over 300%

The world’s flagship crypto, Bitcoin (BTC), is showing some signs of tension. While external events frequently steer its course, the latest headwinds arise from within its mining community, as recent data suggests mounting selling pressure from Bitcoin miners.

Miles Deutscher, a seasoned crypto analyst, has been vocal about this emerging trend, casting light on what might be a significant underlying issue in the Bitcoin realm. Given the innate mechanics of Bitcoin, miners play a pivotal role not just in transaction verification but also in the coin’s overall market dynamics.

Selling Pressure Amplified By Miners

There’s currently an escalating concern in the Bitcoin community. Miners, the entities ensuring Bitcoin’s transactional integrity and security, appear to be offloading their holdings at an unprecedented rate.

Glassnode, renowned for its report on blockchain data analytics, has revealed that miner revenue sent to exchanges has skyrocketed, marking a new all-time high of 315%.

Such statistics beckon inquiries. Deutscher’s analysis points toward several factors that could be prompting this sell-off converging to produce this scenario. According to Deutscher, Bitcoin’s all-time high hash rates, peak mining difficulty levels, and escalating operational costs have squeezed miners.

One of #Bitcoin‘s biggest supply headwinds right now (that no one is taking about) is the increasing miner sell pressure.

ATH hash rates, peak difficulty + rapidly rising energy prices have combined to heavily affect mining profitability.

With rewards set to be cut in half via… pic.twitter.com/HlL2nuendj

— Miles Deutscher (@milesdeutscher) September 28, 2023

With the profitability of mining endeavors getting pinched and the next halving event looming on the horizon, it’s plausible that miners seek to liquidate their BTC holdings. Deutscher explained such sales are essential for these miners to maintain operational fluidity and ensure their ventures remain viable.

Implications For The Broader Bitcoin Market

With Bitcoin being decentralized, every actor, from individual hodlers to large-scale miners, plays a part in its market dynamics. As miners dispatch more BTC holdings to exchanges, they inadvertently ramp the selling pressure. If it persists, such a trend can exert a downward force on Bitcoin’s price.

However, it’s worth noting that this is just one piece of a vast jigsaw. While miners’ selling pressures are influential, other macro factors, such as approving a spot BTC Exchange Traded Fund (ETF), regulatory landscape, and market sentiment, will influence Bitcoin’s journey ahead.

Meanwhile, Bitcoin has seen a slight bullish trajectory of 2.2% over the past day. The asset currently trades for $26,828 at the time of writing, with a 24-hour trading volume of $11.2 billion and a market cap of $523.9 billion.

Featured image from Unsplash, Chart from TradingView

PayPal applies for NFT marketplace patent for on-chain or off-chain asset trading

PayPal’s proposed NFT purchase and transfer system would handle fractionalization, DAOs and royalties through a third-party provider.

Google and Microsoft-backed AI firm AlphaSense raises $150M at $2.5B valuation

AlphaSense’s client list now includes most of the S&P 500 and nearly every firm listed in the Dow 50.

Buenos Aires to issue blockchain-based digital ID

The first documents to be available on-chain in Buenos Aires include birth and marriage certificates, along with proof of income and academic verification.

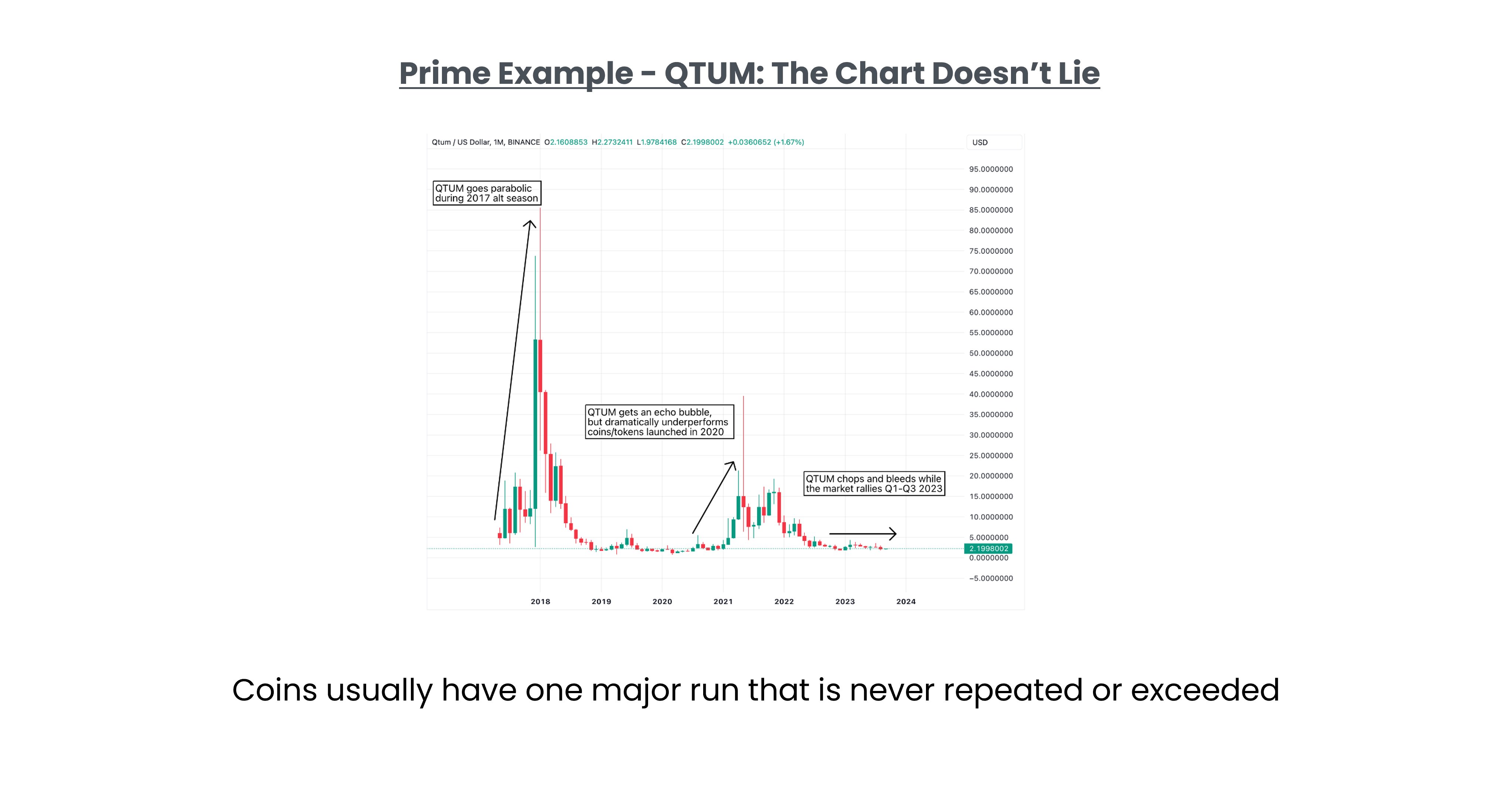

Research Firm Reveals Its “Altcoin Trading Playbook”

A research firm has revealed an altcoin trading playbook that could serve as a guide for navigating the next cryptocurrency bull run.

K33 Research Shares Its Altcoin Trading Playbook

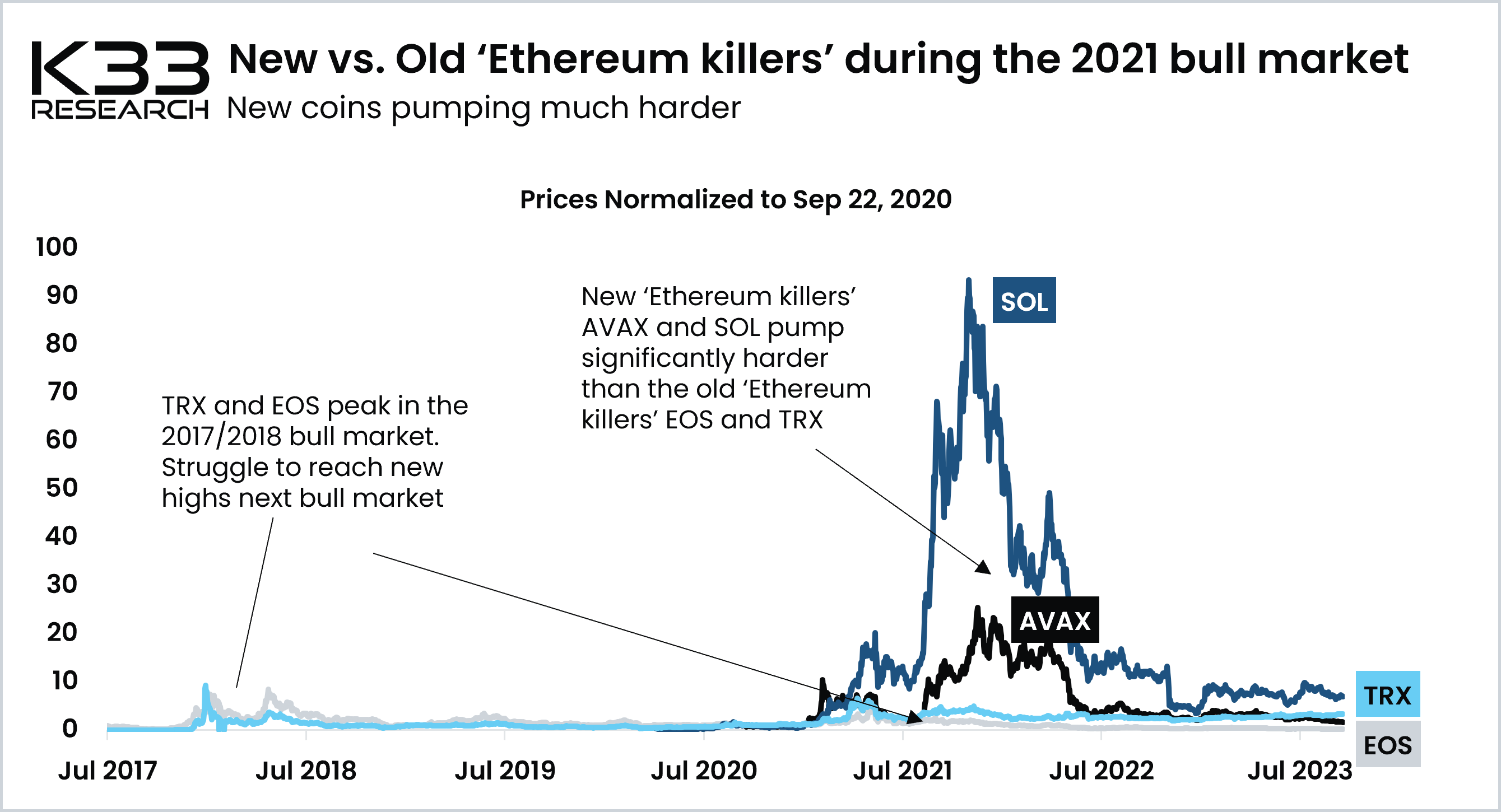

In a new post on X, K33 Research (formerly Arcane Research) explained that new altcoins make better trades than old ones. The firm has given a few reasons for why this is so.

“In lack of price-driving fundamentals, the narratives and liquidity matter,” explains the research organization. “And new coins generally outperform old coins.”

K33 Research has used the example of some “Ethereum killers” during the last bull market to show how the newer coins outperform the older ones. The below chart shows how the performance of these coins has been compared (note that the Y-axis, the price, is normalized concerning September 22, 2020, here).

From the chart, it’s apparent that Tron (TRX) and EOS (EOS), which were vouched as the Ethereum killers during the 2017/18 bull market, failed to set new all-time highs (ATHs) during the 2021 bull run.

However, the new kids on the block, like Solana (SOL) and Avalanche (AVAX), observed much better returns than the old, established altcoins during the latest bull market.

Why do old altcoins have difficulty returning to their former glory? According to K33 Research, there are a few factors behind this. First, the coins that have gone through a cycle have many holders at a loss, waiting to come into the green to exit.

These underwater investors provide additional selling pressure during rallies that new coins, where everyone is in the green during the initial rally, don’t have to face.

The old coins also have to deal with the rising circulating supply because of the token unlocks, which, due to supply-demand dynamics, can hurt the price if the demand side doesn’t catch up.

Finally, the research firm notes that old coins are also tied to narratives that have gone out of fashion. On the other hand, new coins are the narratives when they launch and, thus, appear interesting to investors.

While new altcoins certainly have a leg up to old coins regarding these factors, K33 Research notes that not all such coins make for a good investment. The firm advises investors to look for a few things to know whether a project may be worth investing in.

The first thing could be whether or not the total number of holders is rising rapidly for the altcoin. A high amount of adoption means the asset has more steam behind it for building sustainable moves. The firm also says that a low float and high fully dilated value (FDV) should be avoided.

ETH Price

At the time of writing, Ethereum is trading at around $1,600, up 3% during the past week.

Banking Giants Abuzz About Tokenization of Real-World Assets as DeFi Craves Collateral

JPMorgan, Citi and Franklin Templeton are digitizing traditional assets. Will they end up trading on crypto networks like Ethereum?

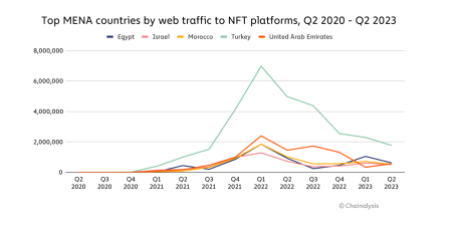

Report Reveals Crypto Whale Center With Majority Of Transactions Crossing $1 Million

A report from blockchain data analytics platform Chainalysis has revealed that the majority of crypto transactions in the United Arab Emirates (UAE) from July 2022 to June 2023 have been whale transactions, crossing over $1 million each.

Majority Of UAE Crypto Transactions Exceeds $1 million

The report from Chainalysis reveals that institutional investments accounted for the majority of cryptocurrency transactions in the UAE with over 67% from July 2022 to June 2023.

The Institutional investments in the country range from $1 million, followed by professional investments ranging from $10,000 to $1 million, and retail investments which accounted for just 4.63% of cryptocurrency transactions in the country up to $10,000.

Kim Grauer, the Director of Research at Chainalysis shed more light on this significant trend noting that the report marks a significant interest among organizations and high-net-worth individuals in the UAE to add cryptocurrency to their investment portfolios.

“The fact that by far the larger portion of crypto investments in the UAE is for institutional and professional-sized transactions, indicates an eagerness from organizations and high-net-worth individuals to add cryptocurrency to their investment portfolios. This market confidence is validation of the efforts being made by the country’s leadership to offer commendable regulatory clarity, and establish the nation as a global crypto hub,” the director said.

The report shows that UAE was one of the only countries in the MENA (Middle East and North Africa) region to spot a higher share of crypto activity within the decentralized exchanges than centralized exchanges. The country’s decentralized exchanges activity was over 48% with centralized exchanges accounting for 46%.

So far, the country’s crypto market value dropped by 17% over the past year accounting for over $34 billion in crypto market value this year. However, the country still managed to outperform other countries in the MENA region.

The Decentralized Finance (DeFi) sector has also seen tremendous popularity in the country since 2022. This further proves that the country has been successful in passing innovation-friendly regulatory frameworks that allow the development of innovative cryptocurrency platforms in the country, with a direction that keeps consumers safe.

The country also displayed its interest in Non-Fungible Tokens (NFTs) over time. The report revealed that the country had an impressive number of over 4 million web traffic visits across NFT sites from July 2022 to June 2023, despite the fast declination of NFTs since 2022.

Chainalysis Cryptocurrency Adoption Ranking

On September 12, 2023, Chainalysis released an excerpt based on a variety of parameters to determine the grassroots crypto adoption. The excerpt revealed that most of the countries leading the charge are from the Central & Southern Asia and Oceania (CSAO) region.

According to the excerpt, six countries from the CSAO region are among the top 10 leading countries. These include India, Vietnam, the Philippines, Indonesia, Pakistan, and Thailand.

The lower middle-income (LMI) countries were identified to be leading the way in grassroots crypto adoption around the world since last year.

The excerpt was released following the data analysis of 154 countries across five sub-indexes around the world. The rankings were then determined by each country’s geometric mean in all five areas, crypto purchasing power, and population strength.

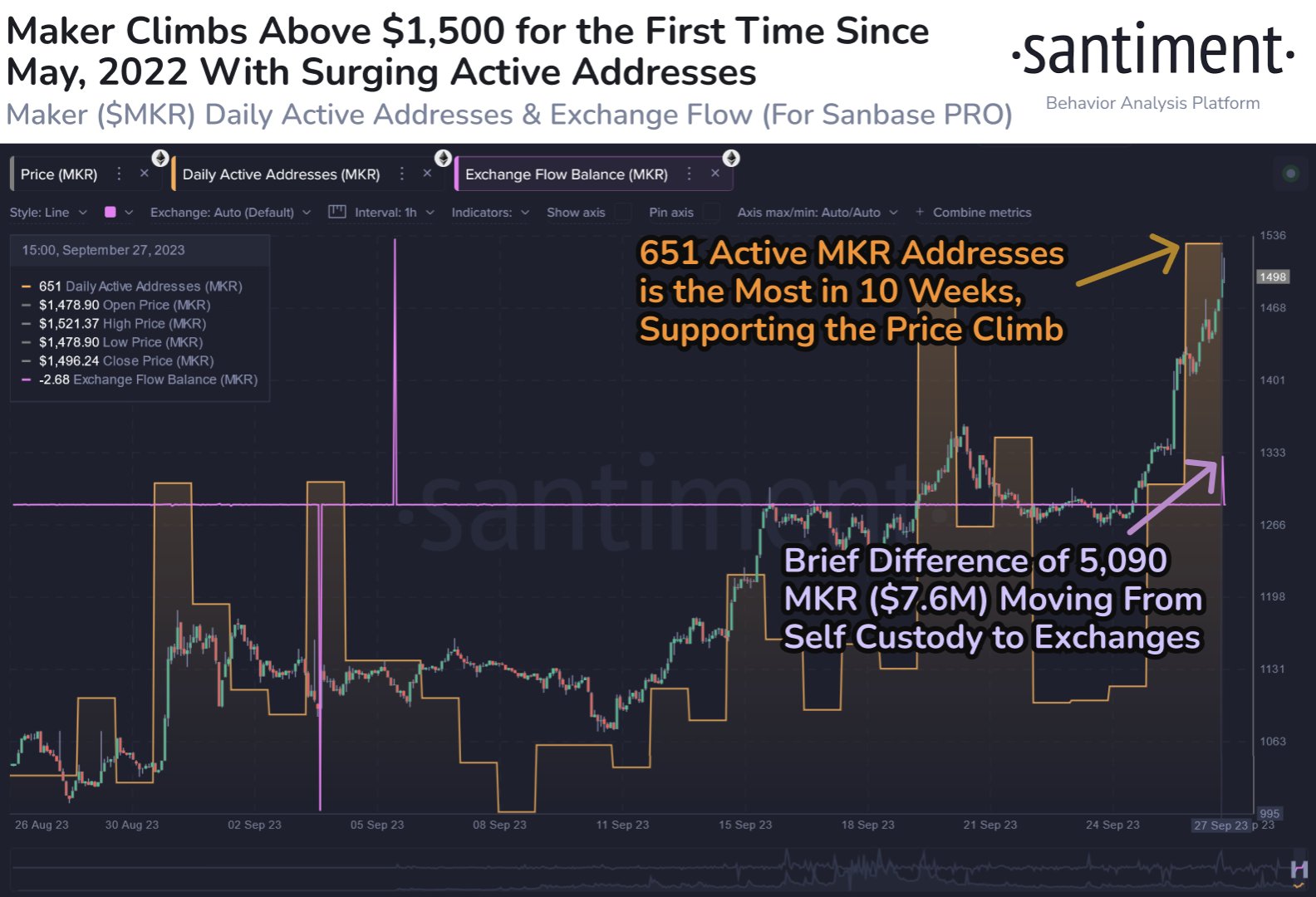

Maker (MKR) Rockets To $1,500 With 15% Surge, Will This Run Continue?

The Maker token, MKR, has managed to break the $1,500 level with a sharp 15% rally as on-chain data shows MKR has seen high address activity recently.

Maker Has Outperformed Top Coins With 15% Rally In Past Week

While giants like Bitcoin have struggled recently, MKR has proven to be different as the coin has observed an impressive run of bullish momentum. Following the latest leg up in the asset’s rally, it has surged past the $1,500 level, a feat it hasn’t replicated since May 2022, almost a year and a half ago now.

Related Reading: Bitcoin Bearish Signal: Long-Term Holders Deposit To Exchanges

The below chart shows what the asset’s recent rally has looked like:

Out of the top 100 cryptocurrencies by market cap, only Chainlink (LINK) and Curve (CRV) have seen better returns than Maker’s 15% gains during the past week.

Even these two assets haven’t seen bullish momentum as consistent as MKR in the past month, though, as MKR’s superb 42% profits in the period notably outshine theirs.

Maker Active Addresses Have Hit A 10-Week High

According to data from the on-chain analytics firm Santiment, this sharp run in MKR has come alongside a surge in the cryptocurrency’s “active addresses” metric.

This indicator keeps track of the daily total number of unique Maker addresses that are taking part in some kind of transaction activity on the blockchain. This metric’s value can simply be looked at as the amount of traffic that the network is receiving every day.

When the indicator has high values, it means that a large number of users are participating in the trading activity of the asset. Such a trend implies that interest in the coin is high currently.

Now, here is a chart that shows how the active addresses metric has changed for MKR during the past month:

From the graph, it’s visible that the Maker active addresses have climbed up alongside the rally in the asset’s price. After the latest increase in the indicator, its value has hit 651, which is the highest observed in around 10 weeks.

Generally, for any surge to be sustainable, it requires continued participation from a large amount of traders. Rallies that aren’t accompanied by a sufficient rise in user activity usually run out of steam before long.

Since the latest Maker surge has seen an increasing number of addresses becoming active, signs could be looking good for its sustainability. As the price continues its run, though, some investors might be tempted to harvest the high profits that they have amassed.

In the same chart, Santiment has also attached the data for the exchange netflow, which shows that some inflows of $7.6 million just have occurred towards centralized exchange platforms, implying that profit-taking may already be beginning.

This is a relatively modest amount, but the analytics firm warns that inflows can be something to be cautious about, as they could lead towards at least a temporary top in the price.

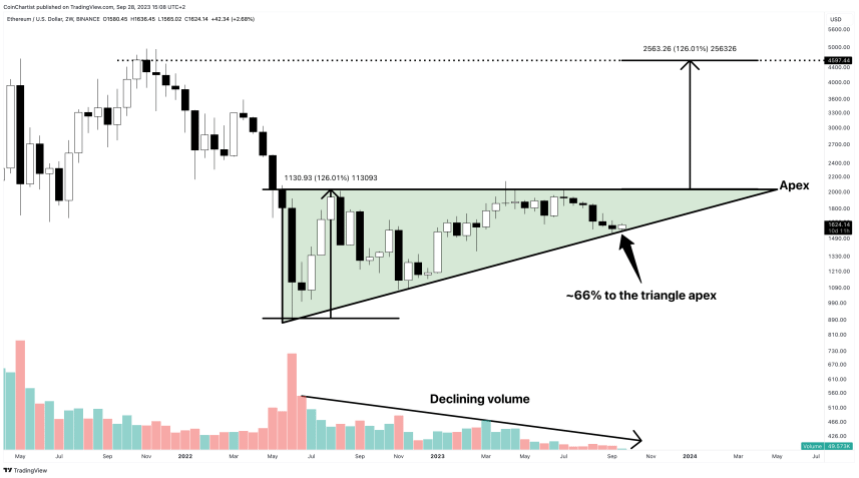

Ethereum News Catalyst Could Trigger Triangle Breakout To $4,000

Could bullish Ethereum news related to the launch of an ETH futures ETF be the catalyst that triggers a massive breakout of a nearly 16-month long ascending triangle pattern?

If the pattern is valid, the target is roughly $4,000 per ETH and a revisit to former all-time highs from the last bull market.

VanEck Announces ETH Futures ETF

Global asset manager VanEck, known best for its ETFs and Mutual Funds, today revealed the upcoming launch of the VanEck Ethereum Strategy ETF (ETUF).

ETUF will be “an actively managed ETF designed to seek capital appreciation by investing in Ether (ETH) futures contracts.”

Rather than investing in spot ETH, the Fund will trade Chicago Mercantile Exchange (CME) ETH futures, and will be managed by the firm’s Head of Active Trading, Greg Krenzer.

ETUF will trade on CBOE alongside VanEck’s Bitcoin Strategy ETF (XBTF). And although its inception of November 15, 2021 marked the end of the bull market in crypto, the introduction of Ethereum futures has the potential to kickstart the next bull run.

Ethereum News Catalyst Could Trigger Ascending Triangle Breakout

Show me the chart and I’ll tell you the news, is a famous quote from the late Bernard Baruch. The message reflects the fact that the largest technical moves tend to coincide with a news catalyst and vice-versa.

Essentially, the a bullish chart pattern could possibly appear before positive news – such as the launch of an ETH futures ETF – while the news itself is the catalyst for a strong breakout.

This is precisely what appears to be brewing in ETHUSD charts since June of 2022. Unlike Bitcoin which put in a bottom late in 2022, Ethereum found support about halfway through the year. Since then, Ether has consistently made higher lows, forming a potential ascending triangle chart pattern.

Now, the ascending triangle pattern is nearing the two-thirds point from its apex. This increases the chances of a breakout occurring as an Ethereum futures ETF gets launched have increased significantly. All that’s required is a breakout above $2,000 per ETH on higher than normal volume. Based on the measure rules, reaching the target objective could push prices to over $4,000.

Median Web3 developer salary stands at $128K in 2023

In a recent Pantera survey, less than 2% of respondents said they worked full-time in an office setting, with the rest working remotely.

TradFi: 11 things to do when considering adding digital assets

Digital assets can present expansive and valuable opportunities for a TradFi institution that’s prepared to lay the necessary foundation.

Bitcoin, XRP Price Receive Boost Following This Coinbase Announcement

The Bitcoin and XRP price are showing some green on low-timeframes as certain narratives around the crypto space gain momentum. The cryptocurrencies stayed about two critical levels and could be poised to extend the trend in the coming days.

As of this writing, the XRP price trades at $0.50 with a 1% profit in the last 24 hours. In the meantime, Bitcoin recorded a 2.4% profit over a similar period, but the number one cryptocurrency by market cap could underperform XRP and other altcoins.

Coinbase To Launch Crypto Futures Trading Worldwide

Crypto exchange Coinbase recently announced the launch of a derivatives platform for its international clients. The US company has been trying to increase its presence overseas as the Securities and Exchange Commission (SEC) tightens regulatory conditions in the country.

In that sense, the crypto trading venue launched an international arm to grow revenue as spot trading volumes decline with the crypto market. Today, the exchange is confirmed to have secured a license with the Bermuda Monetary Authority (BMA) to allow institutions to trade perpetual futures outside the US.

The company said in an official statement:

Today, we are excited to announce that Coinbase International Exchange has received additional regulatory approval from the BMA to extend perpetual futures trading to non-US retail customers. In the coming weeks, we will begin to offer eligible customers access to regulated perpetual futures contracts on Coinbase Advanced.

This announcement could onboard more traders to the crypto ecosystem to benefit Bitcoin, the XRP price, and the entire market. XRP has been among the most popular coins in the past few months following a critical legal victory in the US.

XRP Price Ready For A Surprise Soon?

While the legal scenario in the US is still uncertain for the nascent sector, analyst Brett Hill believes that XRP is one of the coins that will benefit due to its victory against the SEC. The analyst claims that the “Far West,” the era where everything was allowed, is “virtually over” for the nascent industry.

If this scenario plays out, tokens with legal support will thrive, and XRP and Bitcoin seem the two likely winners in this new era. Just yesterday, SEC Chair Gensler reiterated that Bitcoin is not a security, according to US law, and a court did the same for XRP.

In that sense, the analyst says that the XRP could “take you all by surprise” in the coming 48 hours while adding:

The golden age of cryptocurrency in the far west is virtually over; coming forward, everything will be regulated by white hats.

Cover image from Unsplash, Chart from Tradingview