Spurred on by user requests, Bitcoin lending firm Ledn is rolling out an Ethereum yield product.

Cryptocurrency Financial News

Spurred on by user requests, Bitcoin lending firm Ledn is rolling out an Ethereum yield product.

Coinbase and a group of crypto entrepreneurs went to Washington, D.C. to convince lawmakers to provide regulatory clarity for the industry.

The WTI oil has surged by 30% this quarter. The rally could feed into inflation, forcing central banks to keep rates elevated for longer than expected.

Spurs became the first Premier League team in two years to issue its own fan token on the Chiliz blockchain.

Dogecoin (DOGE) has recently displayed resilience as it found substantial buying support at the $0.059 level, a zone that has remained unbreached on a daily candle close for nearly a year.

This newfound buying activity hints at a potential challenge to the overhead resistance, marking a crucial juncture for the popular meme coin’s price trajectory.

The cryptocurrency market often witnesses sideways trends, characterized by a lack of significant upward or downward movement. DOGE appears to be embracing this sideways movement, oscillating between the overhead trendline and the $0.059 mark. This kind of price action typically indicates indecision among investors, with buyers and sellers locked in a tug of war.

At the time of writing, DOGE stands at $0.060772 on CoinGecko, displaying a minor 0.1% decline over the past 24 hours and a 3.7% dip in the last seven days. The $0.06 price level carries more weight than just a numerical value; it represents a psychological threshold that has repeatedly seen DOGE rebound from its depths. The question on everyone’s mind is whether it can maintain its reliability this time.

In the midst of this lateral price movement, DOGE is on a collision course with a downward-sloping resistance trendline. This trendline has already repelled the price on three separate occasions, signifying a formidable defense by sellers at this level. Price analysis shows that should this resistance intensify, DOGE could find itself revisiting the $0.059 support level, reaffirming its significance.

Both the $0.059 horizontal level and the overhead resistance are pivotal factors influencing Dogecoin’s price trajectory. Until one of these levels is decisively breached, the price is likely to remain within a relatively tight range, keeping traders and investors on their toes.

A separate report highlights DOGE’s consistent trading volume and network activity, indicating a robust support level. This sustained stability could serve as a catalyst for future price movements, potentially propelling DOGE to new heights or solidifying its reputation for stability.

However, it’s important to remember that the cryptocurrency market is notoriously volatile. While past performance can offer insights, it’s by no means a guarantee of future results. Thus, investors should exercise caution, conduct thorough due diligence, and remain vigilant as DOGE navigates its current price territory.

Dogecoin’s recent price action at the $0.059 support level and its ongoing battle with overhead resistance offer critical insights into its near-term trajectory. As the market keeps a close watch on DOGE’s performance, its ability to maintain stability could hold the key to its future price movements, with the $0.06 threshold serving as a psychological frontier that investors and traders continue to monitor closely.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

The recent regulatory approval for Coinbase’s international subsidiary comes within a month of getting the NFA nod to offer crypto derivatives services to institutional clients in eligible U.S. states.

The company has been looking to expand globally and announced its international exchange in May this year.

Sam Bankman-Fried’s renewed request for temporary release from jail prior to his upcoming trial should be denied according to the U.S. government.

The original planned launch date of Holesky, on Sept. 15, was supposed to celebrate the one-year anniversary of Ethereum’s historic “Merge” transition.

The latest price moves in bitcoin (BTC) and crypto markets in context for Sept. 28, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

In a comprehensive evaluation of global market dynamics, Bloomberg Intelligence analyst and Chartered Market Technician (CMT) Jamie Coutts has opined on the shifting sands of financial asset volatility. With bonds potentially falling out of favor and Bitcoin cementing its place as a debasement hedge, traditional portfolio models may be on the verge of a renaissance.

Coutts tweeted, “It looks like we are about to see a substantial uptick in volatility across all markets, given where yields, USD, & global M2 are heading. Despite what lies ahead, there has been a big shift in the volatility profiles of global assets vs. Bitcoin over the past years.”

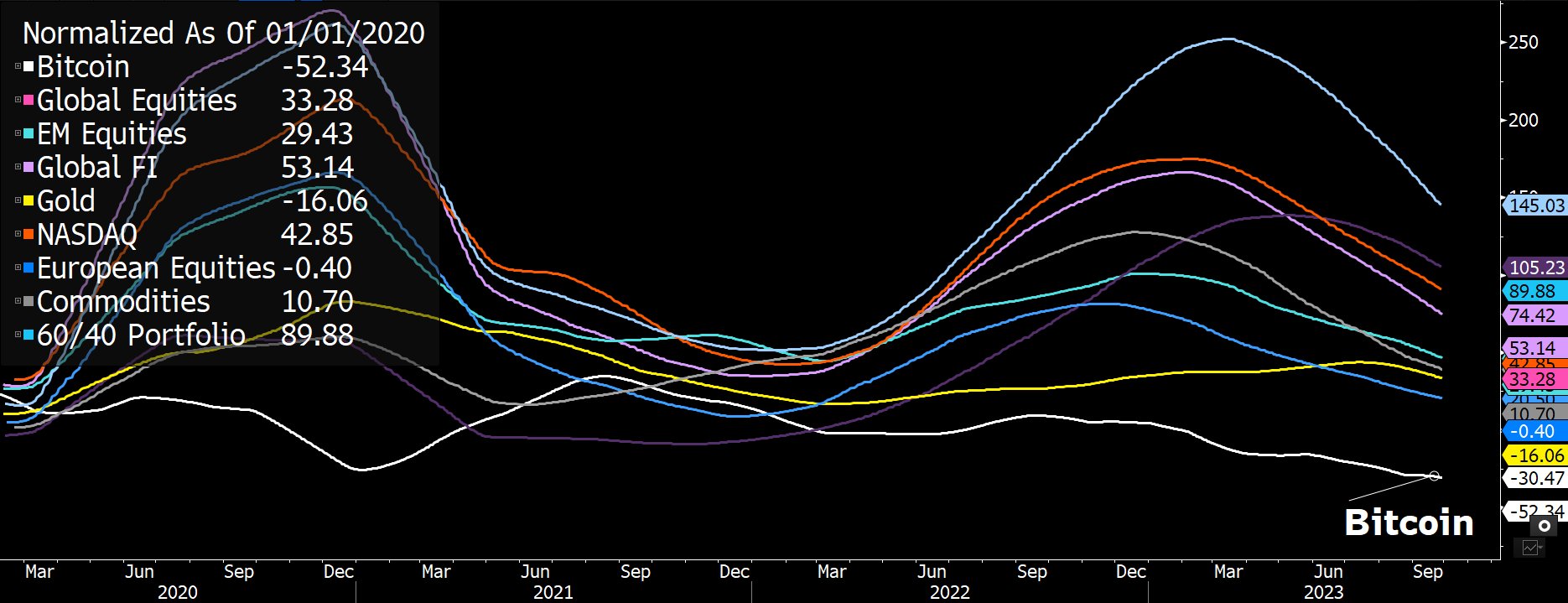

A comparative analysis by Coutts highlighted that since 2020, the volatility profiles of Bitcoin and Gold have declined, while most other assets have seen an increase in volatility.

His breakdown indicates that the traditional 60/40 portfolio volatility is up by 90%, NASDAQ’s volatility has surged by 53%, and global equity volatility rose by 33%; meanwhile, only Bitcoin’s volatility decreased by 52% as well as Gold’s volatility, which went down by 6%

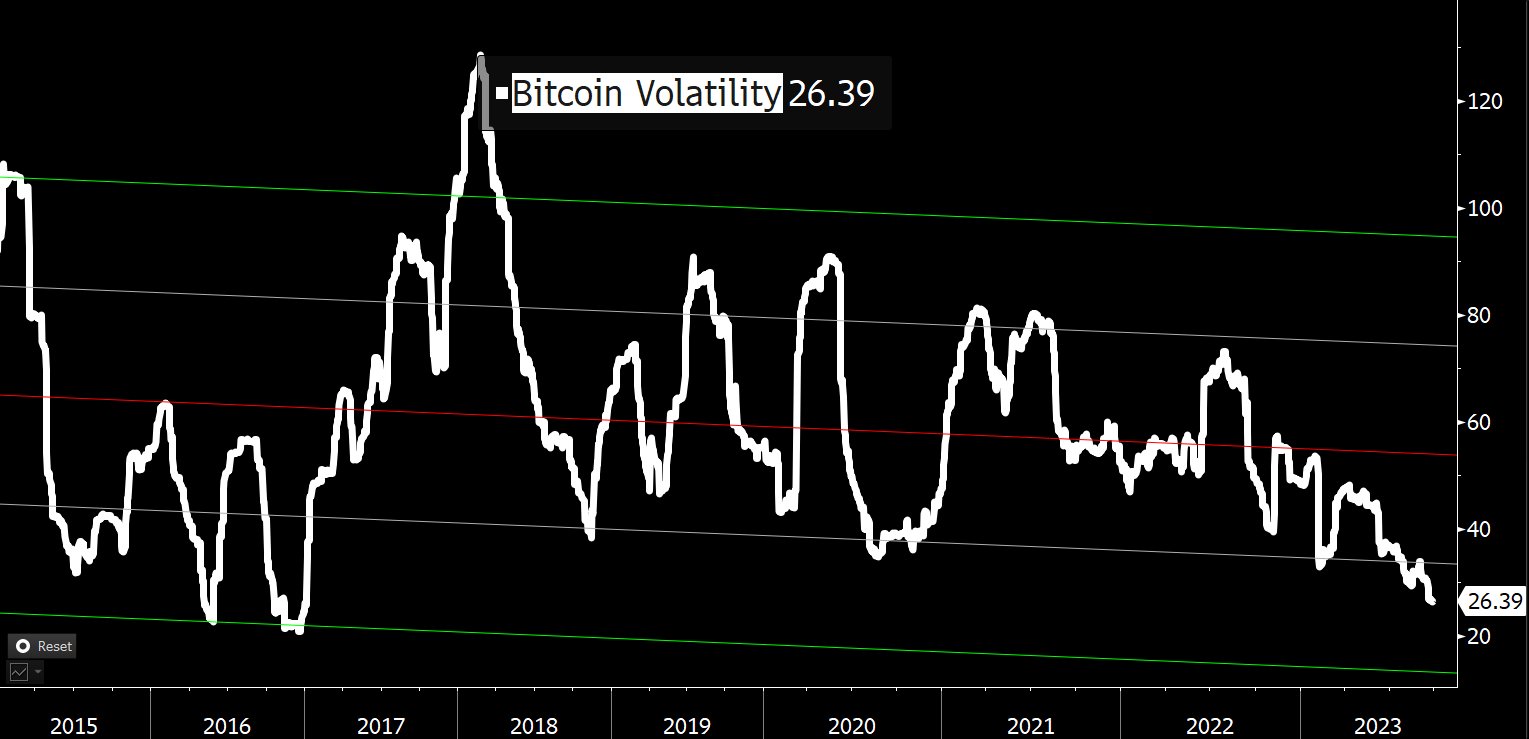

Coutts further elaborated that following the “hyper-volatile” phase of Bitcoin during 2011-14, the cryptocurrency’s volatility has been on a downward trajectory. From a peak above 120 in early 2018, this metric currently stands at 26.39.

However, Coutts maintains skepticism over Bitcoin’s short-term prospects given the deteriorating macro environment: “Given that BTC volatility is near the bottom of the range plus a deteriorating macro environment: US dollar (DXY) is up, 10Y Treasury Yield is up, Global M2 money supply is up. It’s difficult to see how BTC (& all risk assets) can hold up with this setup.”

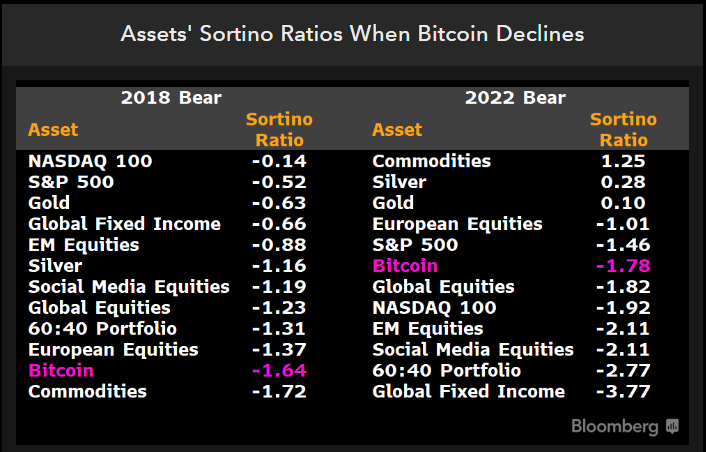

On the bright side, from an asset allocation perspective, Coutts considers the real question to be whether “Bitcoin can add value as a risk diversifier & improve risk-adjusted returns.” Comparing the risk-adjusted returns using the Sortino ratio during the last bear market, Bitcoin’s performance is not the best.

In the 2022 bear market, Bitcoin’s Sortino ratio is -1.78, positioning BTC above global equities, the NASDAQ 100, and the traditional 60:40 portfolio. However, it trails the S&P 500 (-1.46), European Equities (-1.01), Gold (+0.1), Silver (+0.28), and commodities (+1.25).

Elaborating on the cyclical behavior of Bitcoin, Coutts added, “The problem with BTC is the relatively short history makes inferences difficult and 1 year periods are certainly not significant. The best we can go on is multiple cycles. It’s clear that holding over the full cycle has been a winning strategy.”

Evaluating the Sortino ratio over the past three Bitcoin cycles (2013-2022), Coutts found Bitcoin to lead with a score of 2.46, outperforming the NASDAQ 100 (+1.37), S&P 500 (+1.25), and global equities (+1.05).

In this scenario, Debasement concerns further enhance Bitcoin’s proposition. Coutts emphasized this saying, “And if allocators want to outpace monetary debasement, over most timeframes, bonds are not the place to be.” He identified Bitcoin as the foremost choice for portfolio reallocation against monetary debasement.

Citing the vast difference between asset returns concerning money supply growth (M2) over the past 10 years, he highlighted Bitcoin’s dominance with a staggering ratio of +8,598, followed by NASDAQ (+109), S&P 500 (+25) and global equities (-7.5).

In a concluding statement, Coutts postulated, “In the years ahead it’s conceivable that allocators begin to shift towards better debasement hedges. BTC is an obvious choice.” Moreover, he suggests that Bitcoin could supplant bonds by securing at least 1% of the traditional 60/40 portfolio.

At press time, BTC traded at $26,433.

Citizens of Buenos Aires can access the identity solution, the QuarkID wallet, where they can store their birth and marriage certificates, according to the city government.

Users can also send SMR tokens (and in the future NFTs and custom Native Assets) to the ShimmerEVM through Firefly.

Zodia’s Interchange allows clients to keep their assets on its platform, while their holdings are mirrored and available on an exchange for trading.

The staking powerhouse dominates the market for liquid tokens. Is this a problem? Marin Tvrdić, a protocol relations contributor at Lido, responds.

Investors could see outsized gains by buying a diversified portfolio of publicly listed mining companies, the report said.

The bloc’s executive arm is commissioning a $842K study as it considers what to do about energy-hungry proof-of-work technology

Bitcoin miners may see “severe” economic consequences from BTC price action staying below $30,000 after the 2024 halving, Glassnode warns.

Conversations with key speakers at the Blockchain Expo in Amsterdam suggest that cryptocurrency exchanges and companies see Europe as a key region for growth.

The Bank for International Settlements alongside the central banks of France, Singapore and Switzerland tested out using wholesale CBDC to conduct cross border trading.