Bitcoin has observed a pullback in the past day, but these factors may imply that the cryptocurrency’s rally can continue.

These Factors Could Suggest A Bullish Outcome For Bitcoin

A couple of days back, Bitcoin had started observing some sharp upward momentum, and by yesterday, the cryptocurrency had managed to breach the $28,500 level. In the past day, however, the asset has registered a decline, falling below the $27,500 mark.

While it’s uncertain whether the rally is over or not, some signs can be optimistic for the investors. As explained by the on-chain analytics firm Santiment, two positive developments have occurred related to Tether (USDT), the largest stablecoin in the cryptocurrency sector.

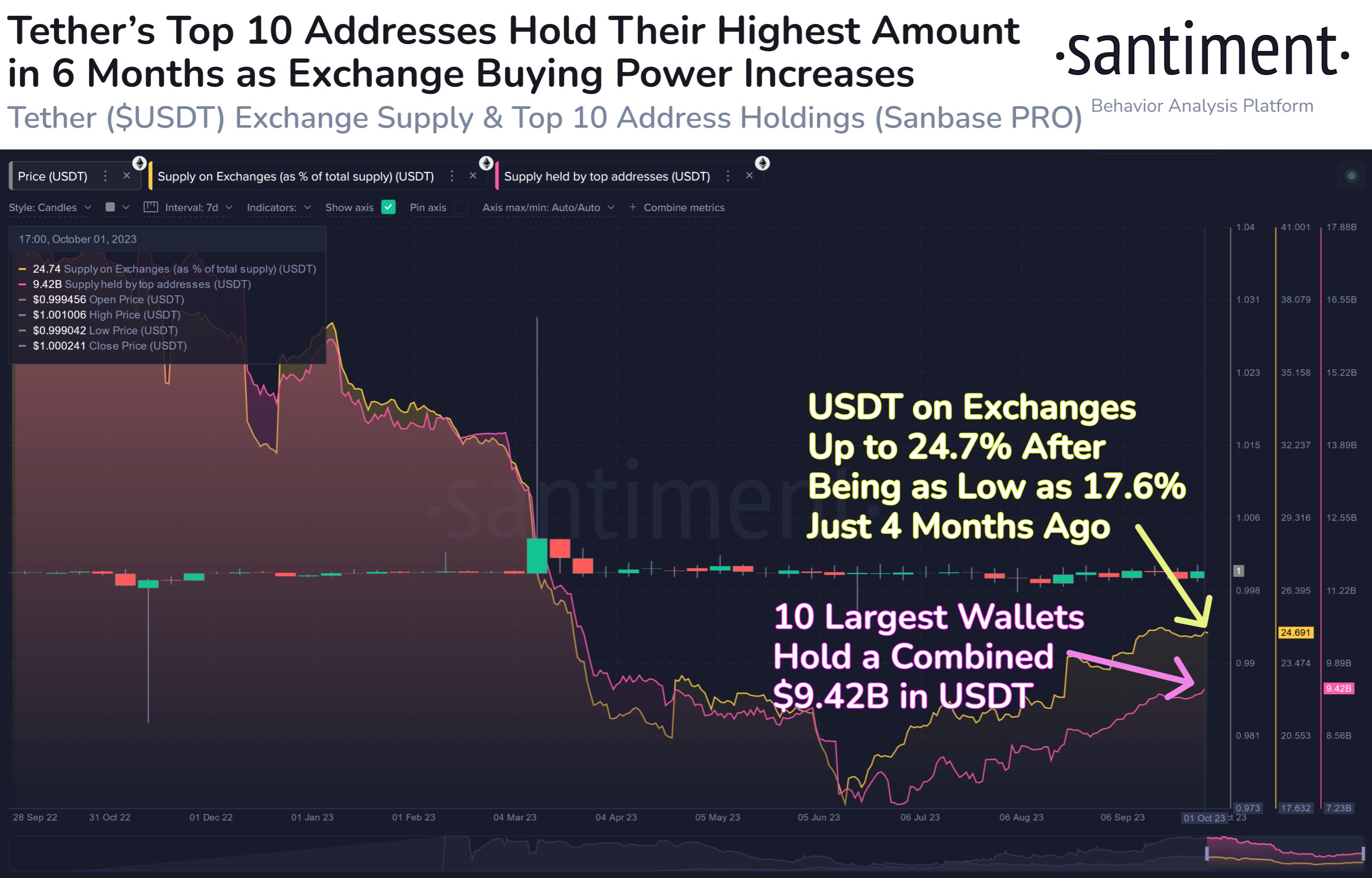

The first indicator of relevance here is the “USDT supply on exchanges,” which measures the percentage of the total circulating supply of the stablecoin in the wallets of all centralized exchanges.

Here is a chart that shows the trend in this Tether metric over the past year:

Usually, investors store their capital in the form of a stablecoin like USDT whenever they want to avoid the volatility associated with the other assets in the sector. Such investors generally plan to go back into the volatile side of the market eventually, though, as they would have instead gone for fiat if they didn’t.

Once these holders feel the time is right to dive into Bitcoin and other coins, they trade their stables for their desired cryptocurrencies. Naturally, such a shift provides a bullish boost to whatever assets they buy using their stablecoins.

Investors generally use exchanges for conversions like these, so the current supply on these platforms can be considered potential dry powder ready to be deployed into BTC and others.

The graph shows that the Tether supply on exchanges had plunged to a low of 17.6% a few months back, implying that the available buying pressure from the stablecoin had run out.

Interestingly, this low in June had occurred in the leadup to a sharp Bitcoin rally, implying that the plunge in the exchange reserve of the stablecoin was, in fact, because of it being converted into the asset, thus providing the fuel for the surge. However, the rally back then couldn’t be sustained, as BTC eventually faced a struggle.

In the months since this low, USDT reserves have slowly built back up on exchanges, as 24.7% of the stablecoin’s supply is now sitting on these platforms. Unlike that previous rally, it would appear that this latest surge has a store of potential buying power available that may be deployed at any time.

In the chart, Santiment has also attached the data for another metric: the combined supply of the ten largest Tether whales. It would appear that these humongous investors have also increased their holdings during this period, implying that they also carry significant dry powder now.

It now remains to be seen whether this stored-up USDT will be converted into the cryptocurrency to provide support to the surge in the coming days or not.

BTC Price

At the time of writing, Bitcoin is trading at around $27,400, up 5% in the last week.