Consensys zkEVM Linea head Nicolas Liochon says speed and execution will continue to increase as it tweaks its Ethereum layer-2 scaling solution.

Cryptocurrency Financial News

Consensys zkEVM Linea head Nicolas Liochon says speed and execution will continue to increase as it tweaks its Ethereum layer-2 scaling solution.

Consensys zkEVM Linea head Nicolas Liochon says speed and execution will continue to increase as it tweaks its Ethereum layer 2 scaling solution.

Coinbase is looking at “markets that are enacting clear rules” for the crypto industry, with the European Union, U.K., Canada, Brazil, Singapore and Australia its near-term priorities.

Cybersecurity professional Christian Seifert gave an example on how Discord’s measure against malicious links can be abused by scammers.

This guide delves into the significance of the OpenSea decentralized marketplace, its pros and cons, and its role in the NFT revolution.

Federal Reserve Bank of Chicago economists predict low inflation and a resilient economy, a potential goldilocks scenario for risk assets, including cryptocurrencies.

The MAS has said that rising malware scam cases in Singapore have nothing to do with cryptocurrencies. On the contrary, it claimed, such scams are more prevalent in the fiat economy.

According to Christopher Eniayemo, the decision to print new naira notes could have occurred via DeFi, involving Nigerians and aiding readiness for the change.

In a recent comprehensive report by Capriole Investments, Charles Edwards presents a compelling case for why 2024 will be a pivotal year for Bitcoin, potentially offering the highest returns in its current four-year cycle. The report delves into multiple facets of Bitcoin’s future, including its role as an inflation hedge, the upcoming Halving event, and the impact of imminent ETF approvals.

Edwards begins by addressing the skepticism surrounding Bitcoin’s performance as an inflation hedge. “Bitcoin gets a hard rep for its performance coming out of 2021 amidst growing inflation,” he notes. Contrary to popular belief, Edwards asserts, “Bitcoin was a great inflation hedge – it was when it needed to be.”

He emphasizes Bitcoin’s impressive 1000% rise from Q1-2020 to Q1-2021, outpacing all other asset classes. This surge, he explains, was a direct response to the Federal Reserve’s multi-trillion-dollar QE packages announced in March 2020. “Markets today move incredibly fast and are forward looking. As soon as macro announcements are made, the pricing-in begins,” Edwards states.

Drawing a comparison between Bitcoin and traditional hedges, Edwards points out that Bitcoin’s performance during the liquidity boom was unparalleled. “There is no doubt that Bitcoin dominated the crisis as the best inflation hedge,” he asserts, adding, “There is no second best. Bitcoin was the greatest inflation hedge we have ever seen.”

The second crucial catalyst for Bitcoin is the upcoming halving in April 2024. Edwards highlights the gravity of this event, stating, “The upcoming Bitcoin halving in April will drop Bitcoin’s supply growth rate to 0.8% p.a. and below that of Gold (1.6%) for the first time ever.” This means that “In April 2024, Bitcoin will for the first time become harder than Gold.”

Addressing the common argument that the Halving is already priced in, Edwards counters, “If there is one thing we have learnt from Bitcoin’s past it’s that the halving is never priced in.” He argues that 80% cycle drawdowns reset all interest in Bitcoin. Furthermore, Edwards draws parallels to previous cycles, noting that many on-chain metrics indicate that the current cycle mirrors those of 2019 and 2015 exactly.

Third, Edwards also touches upon the regulatory landscape, highlighting the clarity brought about by the CFTC’s classification of Bitcoin as a commodity in 2021. He also mentions the significant announcement of Blackrock’s Bitcoin ETF application and the federal appeals court’s order for the SEC to reconsider its rejection of the Grayscale spot ETF. His base case expectation is that the SEC will approve the spot ETF either in October 2023 or January 2024.

Discussing the potential impact of ETFs on Bitcoin, Edwards draws a parallel to Gold, noting the significant bull run that followed the approval of the Gold ETF in 2004. “When the Gold ETF approval hit, what followed was a massive +350% return, seven-year bull-run,” the analyst remarked, adding, “so, we have three incredible catalysts on the very near horizon,” he states, listing the upcoming halving, imminent ETF approvals, and Bitcoin’s status as the best inflation hedge.

In conclusion, Edwards presents a bullish yet cautious outlook. While he acknowledges the short-term bearish signals, he remains optimistic about the long-term prospects. “In Bitcoin’s four-year cycles, there’s typically 12-18 months where 90% of returns happen, followed by 2-3 years of sideways and down,” he observes, adding, “I am expecting that the single highest returning year of this cycle will be 2024 and I believe the data supports that thesis.”

At press time, BTC surged to $26,246, up 1.8% in the last 24 hours.

The new entity, ZAN, will help the mother company shake off its affiliations with Web3 and proceed to the IPO.

Africa must erase the poverty in general and help people into the middle class in order to drive faster blockchain technology incorporation.

Faruk Fatih Özer, the founder of the collapsed Turkish crypto exchange Thodex, his sister Serap Özer and his brother Güven Özer have been sentenced to 11,196 years, 10 months and 15 days in prison.

Binance Coin (BNB) finds itself in a precarious position, with its price rebound heavily contingent on a resurgence in network activity for BNB Chain. The decline in network activity has played a pivotal role in hindering price momentum for BNB, leaving investors and enthusiasts eager for a turnaround.

BNB’s recent price action has been characterized by extended periods of sideways movement. The bears have proven resilient at the resistance level, preventing prices from breaching the $225 mark.

Currently, BNB is trading at $216.80, according to CoinGecko, with 24-hour gains of a modest 0.8%. Over the past seven days, the coin has seen a marginal decline of 0.1%, leaving investors and enthusiasts eagerly awaiting signs of a potential price rebound.

For bulls hoping to witness an upward movement in BNB’s price, their hopes might rest largely on Bitcoin’s shoulders. A significant breakthrough for Bitcoin above the $26,000 mark could inject much-needed bullish sentiment into the broader market, potentially benefiting BNB in the process.

Technical price analysis paints a rather bleak picture for BNB. The Relative Strength Index (RSI) reflects the lack of demand for BNB, with a brief spike above the neutral 50 on August 30 quickly followed by a decline below the neutral 50. As of the latest data, the RSI remains in this bearish territory.

Additionally, the On-Balance Volume (OBV) has witnessed significant drops in trading volume, both in early June and late August. These sharp declines have contributed to BNB’s lateral price movement, further reinforcing the prevailing bearish market structure.

Adding to BNB’s challenges is the regulatory scrutiny Binance, the platform behind BNB, has been facing recently. The exchange has been in the crosshairs of regulators worldwide, and the situation has been exacerbated by the departure of several high-ranking executives.

Mayur Kamat, Binance’s head of product, is the latest in a string of senior executives to leave the company, marking the fourth such departure.

As BNB grapples with these obstacles, experts in the field predict that the coin may experience further downward pressure. According to a price report, some experts anticipate BNB’s price to drop to $208 by September 19.

Binance Coin’s prospects remain uncertain as it navigates a challenging landscape characterized by declining network activity, technical indicators flashing warning signs, regulatory hurdles, and executive departures.

The fate of BNB appears intertwined with the broader cryptocurrency market’s performance, and investors and enthusiasts will be closely monitoring developments in the coming weeks.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

Decentralized Infura will consist of Infura and a decentralized market of other third-party data providers.

Block Earner has unveiled a new crypto-backed loan product for the Australian market, amid an ongoing tussle with a federal regulator over its shuttered Earn product.

Tron price is gaining pace above $0.0780 against the US Dollar. TRX is outperforming Bitcoin and could rally further above the $0.0800 resistance.

In the last Tron price prediction, we discussed the chances of an upside break against the US Dollar. TRX remained well-bid and stable above the $0.0750 level.

It started a decent increase and broke a few key hurdles near $0.0775, outperforming Bitcoin. There was a break above a major contracting triangle with resistance near $0.0770 on the 4-hour chart of the TRX/USD pair. The pair even cleared the $0.0785 level.

A high is formed near $0.0793 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $0.0751 swing low to the $0.0793 high.

TRX is trading above $0.078 and the 100 simple moving average (4 hours). On the upside, an initial resistance is near the $0.0795 level. The first major resistance is near $0.080, above which the price could accelerate higher. The next resistance is near $0.088.

Source: TRXUSD on TradingView.com

A close above the $0.0880 resistance might send TRX further higher. The next major resistance is near the $0.095 level, above which the bulls are likely to aim a larger increase toward the key $0.10 zone in the coming days.

If TRX price fails to clear the $0.080 resistance, it could start a downside correction. Initial support on the downside is near the $0.0780 zone.

The first major support is near the $0.0770 level or the 50% Fib retracement level of the upward move from the $0.0751 swing low to the $0.0793 high, below which the price could accelerate lower. The next major support is $0.0750.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0780, $0.0770, and $0.0750.

Major Resistance Levels – $0.080, $0.0880, and $0.100.

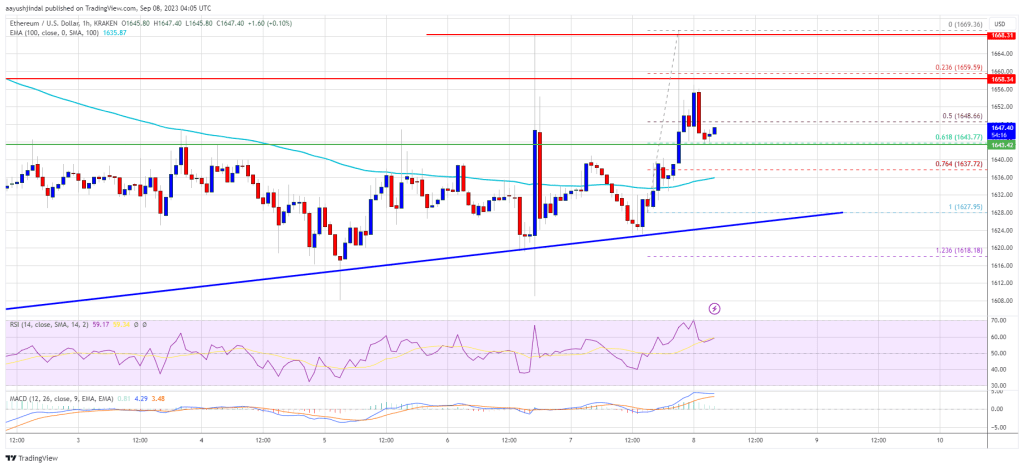

Ethereum price is eyeing an upside break above $1,650 against the US Dollar. ETH could gain bullish momentum if it clears $1,650 and $1,670 in the near term.

Ethereum’s price remained stable above the $1,620 support zone. ETH formed a base and made another attempt to clear the $1,650 resistance, like Bitcoin.

There was a spike above the $1,650 resistance zone but the bulls struggled near the next hurdle at $1,670. A high was formed near $1,669 before the price trimmed gains. It traded below the $1,650 level. The bears pushed it below the 50% Fib retracement level of the upward move from the $1,625 swing low to the $1,669 high.

However, the bulls protected the $1,640 zone. It is close to the 61.8% Fib retracement level of the upward move from the $1,625 swing low to the $1,669 high.

Ether is now trading above $1,640 and the 100-hourly Simple Moving Average. Besides, there is a key bullish trend line forming with support near $1,625 on the hourly chart of ETH/USD. On the upside, the price might face resistance near the $1,650 level.

Source: ETHUSD on TradingView.com

The next resistance is near the $1,670 level, above which the price could rise toward the $1,720 level. The next major hurdle is near the $1,750 level. A close above the $1,750 level might send Ethereum further higher. The next resistance might be near $1,820. Any more gains might send the price toward the $1,880 resistance.

If Ethereum fails to clear the $1,670 resistance, it could start another decline. Initial support on the downside is near the $1,642 level.

The first key support is close to $1,635 and the 100-hourly Simple Moving Average. The next key support is $1,625 and the trend line. A downside break below $1,625 might push it to $1,600. If there is a downside break below $1,600, the price could revisit the key $1,540 support level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is slowly gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,625

Major Resistance Level – $1,670

Blockchain-based file-sharing and payment network LBRY is planning to pick up the fight against the federal regulator again after losing the battle in November last year.

Bitcoin price is slowly moving higher above $26,000. BTC is showing signs of recovery but is still struggling to clear the $26,500 resistance zone.

Bitcoin price managed to stay above the $25,350 support zone. BTC bulls protected a major downside break and pushed the price above the $25,850 resistance.

There was a move above the $26,000 resistance zone. Besides, there was a break above a key bearish trend line with resistance near $25,940 on the hourly chart of the BTC/USD pair. The pair even climbed toward the $26,500 resistance zone where the bears appeared.

A high is formed near $26,487 and the price is now consolidating gains. It traded below the 23.6% Fib retracement level of the recent increase from the $25,609 swing low to the $26,487 high.

Bitcoin is now trading well above $26,000 and the 100 hourly Simple moving average. Immediate resistance on the upside is near the $26,400 level. The first major resistance is near the $26,500 level. A proper close above the $26,500 level might start a decent increase.

Source: BTCUSD on TradingView.com

The next major resistance is near $27,000, above which the bulls could gain strength. In the stated case, the price could test the $28,000 level.

If Bitcoin fails to clear the $26,500 resistance, it could start a downside correction. Immediate support on the downside is near the $26,100 level.

The next major support is near the $26,000 level or the 50% Fib retracement level of the recent increase from the $25,609 swing low to the $26,487 high. A downside break and close below the $26,000 level might increase selling pressure. In the stated case, the price could drop toward $25,500 or even $25,350.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $26,100, followed by $26,000.

Major Resistance Levels – $26,400, $26,500, and $27,000.

Kain Warwick tells Cointelegraph that Infinex will help reduce friction in DeFi and close the usability gap between DEXs and CEXs.