Bitcoin holders with no record of selling their holdings have increased their BTC reserves during the Trump-led market rally.

Cryptocurrency Financial News

Bitcoin holders with no record of selling their holdings have increased their BTC reserves during the Trump-led market rally.

Crypto-based prediction markets, casinos and sports betting are reshaping the iGaming sector while generating billions of dollars in trading volume.

Crypto regulations are a competitive business in Asia, with places such as Hong Kong and Singapore vying to become Asia’s crypto hub and capture all the business associated with that status.

The challenge, though, lies in crafting a rulebook that balances investor protections with a welcomingness to businesses and new capital. And here, Hong Kong has an advantage over places like Japan or Korea, since its common-law framework for traditional finance has made its economy one of the most open and free in the world — a recent report from a Canadian think tank deemed Hong Kong the “freest economy” in the world, with Singapore just behind it in second place.

With crypto, however, Hong Kong has moved relatively slowly, especially compared to Singapore. But Duncan Chiu, a member of Hong Kong’s Legislative Council and chair of its Technology and Innovation committee, which oversees Hong Kong’s technology parks and research facilities, says the territory’s initial caution with respect to regulating crypto comes with advantages.

“Being a late mover is a good thing sometimes because you have a clear picture,” said Chiu in a recent interview with CoinDesk. For example, he pointed to how the Monetary Authority of Singapore (MAS), the city-state’s main financial regulator, has moved quickly to pass rules for crypto. MSA initially regulated crypto under its Payment Services Act, treating crypto inaccurately as a payment tool rather than an asset class. Japan did the same thing early on, forcing later revisions in 2024 as DeFi and tokenization eventually gained traction.

“While Hong Kong started late, the good thing is there were clearer patterns of how these products were being used,” said Chiu, who is one of the most prominent voices for crypto in Hong Kong, along with fellow LegCo member Johnny Ng. Chiu further pointed out how the original bitcoin white paper labeled the asset class as electronic cash, while the market reality is it’s become more of a commodity — a view shared by the U.S. Commodity and Futures Trading Commission — as another example of how market behavior around crypto has evolved and needed regulations to adapt.

One of the key issues Chiu said he’d like to work on in the LegCo is building a clear classification for different types of digital assets, such as cryptocurrencies vs. stablecoins, while also working with global regulators to ensure alignment among them.

“We need clear definitions and segmentation,” Chiu explained. “Some assets should be regulated like securities, while others should remain unregulated, like memecoins.”

According to Chiu, memecoins should be treated as collectibles, much like Pokémon cards or stamps.

“Memecoins don’t have functionality behind them — they don’t use smart contracts,” Chiu said. “They’re just collectible items, so I see no reason to regulate them like financial products.”

Given how unique crypto is as an asset class, some jurisdictions, such as Dubai and its Virtual Assets Regulatory Authority (VARA), have created their own separate regulator for virtual assets.

When asked whether he felt Hong Kong should take the same path, Chiu recalled that in his early years in the LegCo, he had initially supported the creation of a digital version of the Securities and Futures Commission (SFC), the territory’s markets regulator, called the “eSFC.”

However, Hong Kong’s government has instead chosen to keep crypto oversight under existing financial regulators. The SFC has a dedicated digital asset team, while the Hong Kong Monetary Authority (HKMA) oversees stablecoins. Chiu said that for now, he’s satisfied with this arrangement, especially as the SFC expands its headcount even as the government calls for austerity elsewhere.

“The government’s intention is to keep everything under the SFC. They will have a team inside the SFC, and they’re hiring. We just approved that in LegCo,” Chiu noted.

Chiu sees establishing OTC trading and custodian regulations as the next major priorities for the LegCo, while leaving building rules around crypto derivatives and leveraged trading to the SFC and crypto exchanges, rather than passing new laws.

Chiu considers crypto regulation a top-five priority, the others mostly being around Hong Kong’s economic recovery and public safety issues. But he acknowledges that not all of his fellow LegCo members share this same urgency regarding crypto regulation, with some wanting to focus on building more stringent investor protection mechanisms first, in order to to avoid another FTX or JPEX, both of whose failures left many in Hong Kong — and around Asia — with a big hole in their digital wallets

However, there’s only so much legislative bandwidth available. Hong Kong’s job market is weak, and the real estate sector is on the precipice of a painful correction. Hong Kong is also caught between the U.S. and Mainland China in Donald Trump’s next trade war, making an economic recovery challenging for the territory.

“Some LegCo members are big supporters of virtual assets, but not all, of course,” Chiu said. “They all have different priorities.”

We’re thrilled to announce the launch of the CoinDesk Mobile App – designed to bring you the latest crypto news, real-time market data, and expert insights, all in one easy-to-use platform. Whether you’re a trader, investor, or blockchain enthusiast, this app will keep you informed and ahead of the game.

Breaking Crypto News – Stay updated with real-time news alerts, exclusive reports, and in-depth analysis from the industry’s most trusted source.

Live Market Data – Monitor real-time prices, charts, and trends across Bitcoin, Ethereum, and thousands of altcoins.

Custom Alerts and Notifications – Set personalized alerts for market movements, price changes, and breaking news.

Expert Analysis and Opinion – Get the latest insights from top analysts, journalists, and crypto thought leaders following the biggest headlines and news.

Seamless User Experience – A sleek, intuitive interface that makes navigating the world of crypto effortless in the palm of your hand.

The crypto space moves fast, and missing out on key developments could mean missing opportunities. With the CoinDesk mobile app, you’ll have instant access to market intelligence, regulatory updates, and in-depth reports, helping you make informed decisions anytime, anywhere.

Download Now:

Despite market turbulence, Solana (SOL) is showing resilience by maintaining a critical support level that analysts think may serve as a launching pad for further gains. A solid pricing structure may open the door for a spike toward $387 in the upcoming months, as SOL presently trades at about $204. However, how feasible is this goal?

Solana’s ability to keep vital support zones has been one of its strongest suit in recent weeks. SOL has shown positive momentum by holding steady above important levels despite general market declines. Analysts believe that if Solana can keep supporting around $200, the next upside objective might be well over $300, with $387 appearing as a possible peak.

With a market value of over $98 billion right now, Solana is among the best performing assets in the last few months. Still in a strong upswing, SOL shows a nearly 3% rise in the last 24 hours.

According to cryptocurrency researcher Ali Martinez, Solana is currently testing a significant support area at a parallel channel’s lower border. Such a support level is very important because if SOL manages to hold above it, the trend up might be consolidated even stronger, which can cause a pretty serious price pump.

#Solana $SOL is testing a key support level at the lower boundary of this parallel channel. Holding above it could strengthen the uptrend, fueling an upswing to $387! pic.twitter.com/eZdpGCZkxr

— Ali (@ali_charts) February 8, 2025

Another factor that is increasing excitement in the area is the quick expansion of Solana’s network. Claiming to generate over 5 million new addresses in a single 24-hour period, studies indicate that usage is on the rise. An increase in demand for the token is a common consequence of increased on-chain activity, therefore this surge in user involvement could be a major driver of SOL’s price.

Should this tendency continue, Solana may have an advantage over rivals, therefore enhancing its long-term optimistic case.

Some analysts, nevertheless, are dubious about the viability of such explosive development and advise investors to confirm on-chain facts before making decisions.

Can Solana Realistically Hit $387?

Reaching the $387 level would mean that the altcoin will have registered a 91% price elevation from its current valuation. Many factors could get in the way, but some market observers believe the target is not that hard to hit.

A good amount of bullish sentiment, massive acceptability of the Solana native currency, network upgrades, in addition to a conducive macro macroeconomic environment should be enough for SOL to achieve a new milestone.

Historically, altcoin price movements have mirrored Bitcoin’s price trends; therefore, for Solana to climb to the $300-$400 level, Bitcoin must surpass $105,000.

The Road Ahead For SOL Investors

Although Solana’s technical and fundamental outlook is promising, volatility remains a big factor, as it does with all crypto assets. Although a jump above $387 is possible, traders should keep an eye on market trends, Bitcoin’s movement, and on-chain data to predict SOL’s next big move.

Featured image from SOPA Images/Getty Images, chart from TradingView

“Mark-to-market gains, Tesla could use its Bitcoin as collateral to unlock liquidity and hedge against market downturns,” said Gadi Chait, an investment manager at Xapo Bank.

Cryptocurrency exchange Binance’s bitcoin (BTC) reserves dropped by $355 million last month while customer balances grew by more than $4 billion, bringing the two figures more in line with each other, according to recently published exchange reserves data.

At the turn of the year Binance, the largest crypto exchange by trading volume, held 622,192 BTC across third-party custody and exchanges balances. On Feb 1, that figure had shrunk to 618,563 BTC. Customer net balances, in contrast, grew from 575,296 BTC to 615,816 BTC, meaning the rate of collateralization fell to 100% from 108% .

Balances of Tether’s USDT stablecoin also fell, dropping about $25 million as customer balances rose $2.6 billion.

The motive for the shift in reserves remains unclear, and Binance did not immediately respond to CoinDesk’s request for comment.

The exchange might be reallocating funds to generate a return on investment instead of over-collateralizing, and it’s worth noting that Binance remains in a healthy financial position. At current prices it holds $160 billion worth of 34 crypto assets listed on the report, all of which are held at a 1:1 or greater ratio against user balances.

Exchanges began posting proof of reserves in response to the FTX collapse in November 2022. That was prompted by a weak balance sheet comprising illiquid altcoins, eventually leading to, in effect, a bank run where the exchange couldn’t fulfill user withdrawals.

The collapse of FTX spurred a liquidation cascade across the entire industry, with bitcoin dropping to a cycle low of $16,463. It has since recovered and is was recently trading at $97,373.

Circle’s USDC stablecoin has reached a $56.3 billion market capitalization, erasing losses sustained during the bear market.

The individual who allegedly helped compromise the SEC’s X account to post a fake Bitcoin ETF approval message earned roughly $50,000 that he could now be forced to forfeit.

In a video titled “The Macro Outlook for 2025: BIG Moves Ahead,” Julien Bittel, Head of Macro Research at Global Macro Investor (GMI) laid out a sweeping perspective on where growth and inflation trends appear to be heading, why the upcoming cycle looks more akin to 2017 than 2021, and how Bitcoin could be primed for notable upside if its historical relationship with the Institute for Supply Management (ISM) Index and global liquidity holds true.

Bittel explained that macro “summer” is the dominant regime he sees unfolding throughout 2025, meaning growth momentum is picking up while inflation remains modest enough for central banks to avoid overtightening. He underscored that “the business cycle still chugs along,” pointing to improving global manufacturing data and to the fact that more countries have been shifting into expansion territory. Although slight fluctuations persist in some indicators, including pockets that briefly resemble a slowdown, Bittel remains confident that these do not mark the onset of a new macro “fall” with sustained growth deceleration and rising inflation. He instead suggests these headwinds will prove short-lived, given an overall environment in which global financial conditions are loosening.

He highlighted the decline in US bond yields and the recent weakening of the dollar as factors that will allow “more cowbell” from central banks. China’s bond yields have also collapsed, which Bittel sees as a major signal that Beijing can provide additional liquidity injections without fearing excessive overheating. He described this combination as an echo of 2017, a year when a softer dollar and lower interest rates contributed to an upswing in both traditional markets and cryptocurrencies.

Turning to inflation, Bittel dissected why shelter and other service-related costs are such significant laggards. He observed that more than one-third of headline CPI is tied to housing, which “typically lags home prices by around 17 months,” and pointed out that shelter inflation is still keeping official CPI numbers elevated. He expects this dynamic to give central banks leeway to ease monetary policy further once they see the data turning down. While some cyclical forces, such as commodity prices, might push inflation higher later in the year, Bittel emphasizes that the peak is not imminent and that the Federal Reserve will likely retain enough flexibility to avoid stifling the ongoing economic rebound.

In discussing Bitcoin, Bittel zeroed in on the business cycle’s role in driving outsized price movements. He recalled that when the ISM Index barely hovered above 50 in 2013 and 2017, the leading cryptocurrency proceeded to rally by dozens of multiples. In 2021, the macro picture abruptly topped out as soon as ISM and liquidity peaked, cutting short the cycle and capping Bitcoin’s run at roughly an 8x move from its initial pivot out of recession. Today’s backdrop looks materially different. Bittel noted that “the ISM is just now moving above 50,” which contrasts with the late 2020–early 2021 surge that raced from the low 40s to the mid-60s almost in one breath.

He added that “if we’re right about the weaker dollar and a pickup in global liquidity,” Bitcoin’s path could more closely resemble the elongated upturn of 2017 than the compressed momentum of 2021. Although Bittel did not offer a precise price target for Bitcoin, he referenced the historical precedent of a 23x jump in 2017 once the cycle gained traction. His caution was clear—he stated repeatedly that these moves are never guaranteed and that “I’m not telling you Bitcoin is going 23x,” but he also stressed that in every prior crypto run, persistent strength in the business cycle proved to be “the magic gift that keeps on giving.” He believes the foundation has been set for an extended upswing, yet reminded everyone that 20–30% drawdowns are inevitable even during powerful rallies.

He further noted that “once you understand where the economy is going, you understand where assets are going,” and reiterated that liquidity, particularly from China, could become an even bigger driver for digital assets as 2025 progresses. Bittel reinforced the point, saying that “historically, the biggest surges in Bitcoin happened when the ISM is rising and we’re in macro summer.”

He also highlighted that any short-term pullbacks in Bitcoin should not be mistaken for macro regime shifts. The cyclical conditions, fueled by easier financial conditions, remain in place, though he reminded viewers to expect corrections and remain patient. In his words, “it’s never a straight line,” and it can feel like “the end of the world” in some weeks. Yet, given the parallels to 2017 and the ongoing slide in the dollar, he believes the runway for Bitcoin—and other risk assets—still appears relatively long.

While Bittel’s presentation also addressed broader market segments, such as commodities and cyclical equities, Bitcoin received special focus. In explaining why GMI’s macro framework still signals optimism, Bittel emphasized that “dips are for buying,” provided that investors keep a close eye on signs of any deeper structural slowdown. He stressed that “no one should forget that if you sign up for Bitcoin, you’re signing up for volatility,” but with the business cycle only just beginning its ascent and liquidity conditions gaining traction, there may be ample room for Bitcoin to move beyond its previous peaks if the data continue to favor cyclical expansion.

At press time, BTC traded at $97,710.

President Trump has proposed the Federal government hold digital currencies, and some media and political people have pushed back with dire warnings of the impact on the U.S. dollar. But the reality of Trump’s proposal differs sharply from that painted by Trump’s hysteric critics. BTC is not a threat to the U.S. dollar and U.S. government holding of BTC or any other digital currencies is not an endorsement.

The U.S. dollar still dominates the world, representing nearly 60% of all currency held by central banks, as of Dec. 2024, according to the IMF. Unlike fiat currencies, bitcoin and other digital currencies are not governed by any central bank. So, there is no way to ever have an adversarial relationship with the issuer of BTC – unlike the issuer of Chinese yuan or Russian rubles.

Most of the forex reserves held by the U.S. are euros and Chinese yuan. But no one is calling for the U.S. to stop holding euros. That’s because holding a currency in reserve is not an endorsement of that currency. Countries hold forex reserves primarily for liquidity purposes – mainly to facilitate foreign trade with counterparties using the other currency. And, since BTC and ETH are the largest digital currencies, the most liquid and the largest volume of USD transactions, it makes sense for the U.S. to hold those currencies.

Most importantly, the U.S. dollar dwarfs BTC in size. USD value is more than 1,150x larger than BTC at $2,300 billion USD versus about $2 billion for BTC. And BTC ranked as only the 16th largest foreign currency in the world, measured by USD, as of the start of 2024. So, if the U.S. held 50,000 BTC, it would represent less than 5% of its foreign currency reserve holdings.

Further, the U.S. has extensive reserves of gold and silver, neither of which is used any longer as currency by any major country. There does not seem to be any risk these U.S. holdings will be deemed to be an endorsement of gold as a currency, though gold is held by the U.S., in part, because it is a good store-of-value.

Critics of digital currencies argue they have no inherent value – but that is like saying a Picasso has no inherent value, aside from the inherent value of dried paint and an old canvas. What a Picasso has is social value and scarcity value – the same sources of value as BTC. Bitcoin’s social value derives from its objective to serve a role outside control of governments. Its scarcity value acts to support BTC’s price and enhances its utility as a store-of-value.

There’s another reason for the U.S. to hold virtual currencies. They represent a major leap in financial technology and it is in the paramount interest of the United States to be at the forefront of fintech. It’s not only to make the U.S. the most efficient financial player, but also to be best prepared for changes that may come in the future. Blockchain technology has proven to have many uses beyond digital currencies, including reducing transaction costs thereby benefiting all consumers.

So, not only is Trump’s proposal based on solid economics and consistent with holdings of other foreign currencies, but, also, it gives a boost to the fintech sector. It is smart and forward-looking. Sounds like a double win for the U.S.

A man who says he lost $784 million worth of bitcoin (BTC) in a landfill site is talking to investors about potentially buying the land, the BBC reported on Monday.

“I have discussed this option recently with investment partners and it is very much on the table,” James Howells said, according the BBC.

Howells said his ex-girlfriend mistakenly threw out a hard drive containing 8,000 bitcoin in the landfill site on Newport’s Docks Way in 2013. Over the last decade he has made requests to Newport Council to try to retrieve it, and said he was largely ignored. Newport Council declined to comment, the BBC said.

He tried to sue the council for 495 million pounds ($646 million), the peak valuation of the bitcoin in early 2024, but his case was dismissed by the judge in January. The authority plans to close the site in the coming financial year and has permission to build a solar power farm on the land.

Ethereum may also lack fundamental blockchain activity for an Ether price recovery, analysts told Cointelegraph.

Following the acquisition, Holonym plans to offer its rebranded Human Passport to users worldwide.

Ethereum is the key to driving Web3 growth, thanks to its robust ecosystem, the rise of layer 2 rollups, and the Superchain’s potential.

The University of Austin is launching a $5M Bitcoin fund for its $200M endowment.

The foundation’s chief investment officer, Chun Lai, said that they’re keen to capitalize on crypto’s potential and wouldn’t want to risk ‘losing the train’ once this red-hot market flares back up.

Moreover, the University of Austin is planning to hold the BTC for at least five years, meaning it’s in it for the long haul.

With that in mind, here are the top 4 altcoins to buy and hold in 2025.

Austin’s not the only university to have joined the crypto bandwagon. Georgia’s Emory University, for instance, is holding Bitcoin ETFs worth $15M.

UA and Georgia’s HODL strategies for Bitcoin are an industry-wide trend, signaling that the crypto is becoming increasingly stable.

Amidst a sea of pro-crypto developments under the new Trump administration, seeing traditional institutions like universities give crypto the green light is another testament to increasing crypto adoption and bullish times ahead.

So if you’re also reluctant to miss the gravy train, here are 4 of the best altcoins to be looking at investing in right now.

Solaxy ($SOLX) is easily one of the best cryptos to buy now. This is because it’s building a new layer 2 protocol that aims to unlock the popular Solana blockchain’s full potential.

Despite being a relatively new player in the industry, Solana ($SOL) has managed to surpass both Ethereum and Bitcoin in terms of price gains and trading volumes.

Now, with the launch of Solana ETFs imminent, Solaxy is likely to be the biggest beneficiary of Solana’s upward rally. Here’s our Solaxy price prediction for more insights.

The network has a lot of potential, but some key issues, like network congestion and limited scalability, can disrupt transactions, which in turn hampers user experience.

Solaxy aims to fix all these issues by creating a network that’s fast-paced, low-cost, and efficient.

The project has raised $19M so far, and the token is currently available at just $0.00163. However, with prices increasing almost every other day, interested investors should get in ASAP! Here’s how to buy $SOLX.

MIND of Pepe ($MIND) is a self-evolving AI agent that runs its own X account where it autonomously publishes content and engages with the crypto community.

$MIND gathers all the chatter around new crypto trends and market news and then churns out expert trading insights.

Additionally, MIND of Pepe can also operate a crypto wallet, access other blockchain apps, and launch brand-new tokens, which would be made available to its community before going public.

Anyone who holds $MIND tokens can benefit from these exclusive insider tips to make informed investment decisions.

The $MIND presale has already raised $5.6M. Currently, each token is priced at $0.0032924, offering early adopters a lucrative entry point. Here’s how to buy it.

Best Wallet Token ($BEST) is the native token of the popular crypto wallet, Best Wallet. Holders of the $BEST token get additional perks within the Best Wallet ecosystem.

These include lower transaction fees on each purchase/sale, voting rights on key decisions that’ll be made regarding the Best Wallet App, and early access to promising new crypto projects.

The best way to understand the hype around $BEST is to look at the Best Wallet App’s potential, itself.

This crypto wallet aims to take over 40% of the non-custodial crypto wallet market in the next two years – and with over 500K current users, it’s well on its way.

Given its utility within a popular crypto wallet, $BEST has emerged as one of the best crypto presales of 2025. The presale has racked up over $9.4M at the time of writing, and you can become an investor for just $0.023925.

XRP is the native currency of XRP Ledger— an open-source blockchain. Both XRP and XRP Ledger were designed for the Ripple Payments network to enable faster international transactions at a cheaper rate.

Transactions using XRP require minimal energy, making it one of the few sustainable crypto blockchains. XRP is a listed token currently trading at $2.42.

The past week hasn’t been great for the crypto industry, with most tokens seeing a consistent decline. XRP also fell from its previous high of $3.10 to current levels of $2.4.

However, analysts believe this is a temporary slump and also a great accumulation opportunity for healthy long-term gains.

Now that we’ve discussed the best altcoins to buy as US universities make their first foray into crypto, it’s important we once again point out the overall crypto market’s volatility.

As always, please do your own research before investing – the above article is not meant to be seen as financial advice. This also means only investing an amount you’re comfortable losing and having the stomach to hold onto your bets through the rapids.

For the past century, the U.S. has reigned as the economic superpower of the world. The key to this sustained economic might is a regulatory environment that encourages and enables technological innovation. From semiconductors to personal computers to internet 1.0 and 2.0, U.S. companies have led in developing cutting-edge technologies because our country empowers its builders and creators. Unfortunately, when it comes to Web3 – the next generation of the internet built on blockchain, digital assets, and cryptocurrencies – we are trailing and are at risk of falling further behind.

In 2023, the European Union passed comprehensive cryptocurrency regulation [americanbar.org], and numerous meaningful provisions went into effect this past summer. China’s central bank has been promoting its digital yuan [forbes.com], which threatens the U.S. dollar’s role as the global reserve currency. The U.S. is just watching, while our opponents move pieces on the chessboard.

It is absolutely essential to our country’s future that the U.S. enact clear and sensible cryptocurrency regulations that foster innovation and keep Web3 jobs within our borders, protect consumers, and maintain the dominance of the U.S. dollar.

We should start with stablecoins.

For newcomers, stablecoins are cryptocurrencies whose values are pegged to national currencies or high-quality financial assets. This gives them stability and enables them to play a crucial role in the digital economy, where they combine the transaction speed and low cost of digital assets with the price stability of traditional reserve currencies. The U.S. is already playing a major role in this space. According to one report, more than 95% of stablecoins are “linked to the U.S. dollar.”

The many use cases of stablecoins have earned them support from policymakers across the ideological spectrum. Conservatives value their low-cost, frictionless and instantaneous payment abilities, which can lower costs on merchants and consumers and spur startups and economic activity. Progressives appreciate their use in lowering the cost of remittances and reaching the underbanked and underserved, and their ability to increase access to basic financial services.

It must be acknowledged that, as with any new technology, stablecoins have challenges. Some stablecoins, backed by complex algorithms instead of stable reserve currency, have collapsed due to design flaws. Additionally, unlike bank deposits, stablecoins are not FDIC insured, creating risks should the issuer go bankrupt. While concerns have been raised about money laundering, stablecoins aren’t misused for this purpose any more than traditional cash. But for the public to have confidence in stablecoins, and for businesses to adopt them, we need clear regulations to provide consumer protection, to govern issuers and to guard against money laundering.

The bipartisan Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which I introduced Feb. 4 alongside Senators Bill Hagerty, Cynthia Lummis, and Tim Scott, will address these challenges, and create a clear regulatory environment that enables the cryptocurrency environment to thrive.

It protects consumers by holding stablecoin issuers to strict reserve requirements, requiring them to maintain one-to-one reserves in cash and cash equivalents. The bill prohibits the issuing of unbacked, algorithmic stablecoins, the collapse of which have led to substantial losses. To address their use for illicit purposes, it requires approved stablecoin issuers to comply with U.S. anti-money laundering and sanctions rules. Finally, the bill clarifies rules around conservatorship and procedure should a stablecoin issuer experience insolvency.

While this bill will undoubtedly be tweaked as it moves through Congress, it has already received input from a wide swath of stakeholders, including industry participants, academic experts and federal regulators. It’s a true bipartisan effort that will empower innovators and builders while simultaneously rooting out bad actors.

Laying the groundwork for the next century of American exceptionalism is a mission that should unite us all, and positioning the United States at the leading edge of the next iteration of the internet is key to that goal. Stablecoins are already playing an important role, and it’s critical we act now to maintain our position as the leader in global economic competitiveness.

BTC price momentum is still lacking as the active Bitcoin trading range gets ever narrower.

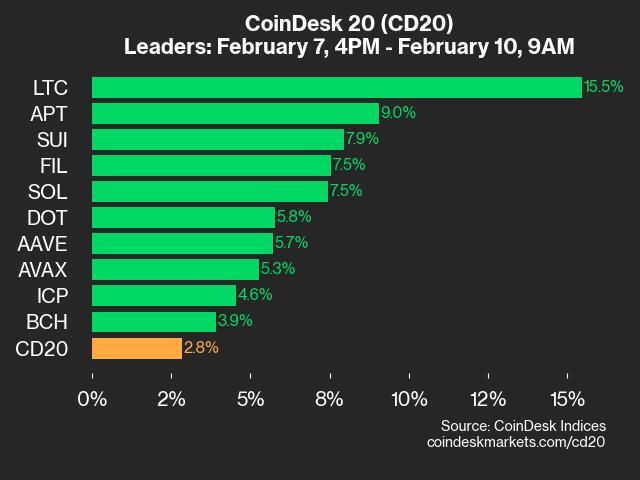

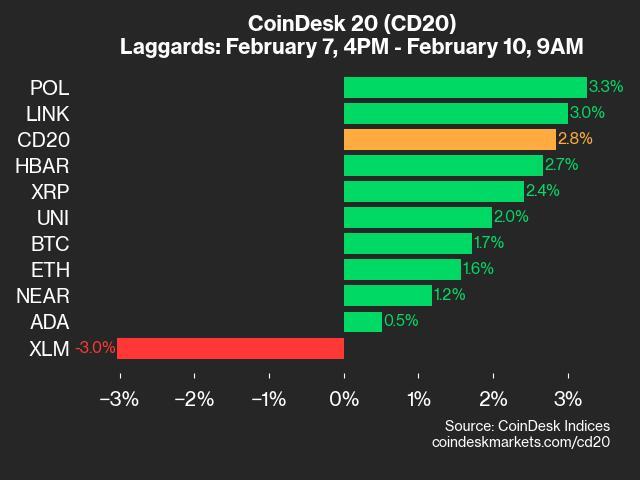

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3223.5, up 2.8% (+89.04) since 4 p.m ET on Friday.

Nineteen of 20 assets are trading higher.

Leaders: LTC (+15.5%) and APT (+9.0%).

Laggards: XLM (-3.0%) and ADA (+0.5%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Strategy’s fresh 7,633 Bitcoin purchase came days after the firm rebranded from “MicroStrategy” last week.