With anticipation around Bitcoin ETFs from giants like BlackRock, Fidelity, and Invesco, and an expected halving in April 2024, forecasts for Bitcoin’s price next year show a significant range. From JPMorgan to Standard Chartered Bank, here are the most notable estimates for 2024:

Pantera Capital: $150,000

In their August “Blockchain Letter”, Pantera Capital, led by Dan Morehead, predicts a possible rise to $147,843 post the 2024 halving. Employing the stock-to-flow (S2F) ratio, they believe the price model suggests the valuation of Bitcoin against its scarcity will become more pronounced.

Specifically, Pantera Capital stated, “The 2020 halving reduced the supply of new bitcoins by 43% relative to the previous halving. It had a 23% as big an impact on price.” With history as a reference, this could indicate a hike from $35k before the halving to $148k after. However, not all Bitcoin supporters are on board, having witnessed failed predictions based on this model in the recent past.

Standard Chartered Bank: $120,000

In a recent research report from July, Standard Chartered Bank offered a bullish outlook on Bitcoin’s potential trajectory. The British multinational bank now expects Bitcoin’s value to ascend to $50,000 by the end of the current year, with the potential to soar as high as $120,000 by the close of 2024. This revised forecast from Standard Chartered marks an increase from their previous April prediction, where they projected a top of $100,000 for Bitcoin.

The upward revision in the bank’s forecast is underpinned by several determining factors. Notably, one primary reason cited for the potential price escalation is the ongoing banking-sector crisis. Additionally, the report sheds light on the rising profitability for Bitcoin miners as a pivotal factor influencing the price trajectory. Geoff Kendrick, the head of FX and digital assets research, emphasizes the instrumental role of miners. He notes, “The rationale here is that, in addition to maintaining the Bitcoin ledger, miners play a key role in determining the net supply of newly mined BTC.”

JPMorgan: $45,000 Per Bitcoin

JPMorgan, one of the world’s leading investment banks, anticipates a more restrained growth for Bitcoin, predicting a rise to $45,000. This forecast is influenced by the surging gold prices. Historically, Bitcoin and gold have shown correlation in their price movements, and with the gold price recently surpassing the $2,000 mark per ounce, it has bolstered JPMorgan’s conservative outlook on Bitcoin.

In a detailed note from May, JPMorgan strategists explained, “With the gold price rising above $2,000, the value of gold held for investment purposes outside central banks stands at about [$3 trillion]. Consequently, this suggests a Bitcoin price of $45,000, based on the premise that BTC will achieve a standing akin to gold among private investors.”

Matrixport: $125,000 By End-2024

In July, Matrixport, a prominent crypto services provider, predicted that Bitcoin’s price could surge to as high as $125,000 by the close of 2024. This optimistic outlook was based on historical price patterns and a significant signal: Bitcoin’s recent breach of $31,000 in mid-July, marking its highest level in over a year. Historically, such milestones have signaled the end of bear markets and the beginning of robust bull markets.

By comparing these patterns with historical data from 2015, 2019, and 2020, Matrixport estimated potential gains of up to 123% within twelve months and 310% within eighteen months. This translates to potential Bitcoin prices of $65,539 and $125,731 within those respective timeframes.

Tim Draper: $250,000

Tim Draper, a prominent venture capitalist, maintains a highly bullish outlook on Bitcoin. While his previous prediction for Bitcoin to reach $250,000 by June 2023 didn’t materialize, he remains optimistic about the cryptocurrency’s long-term potential. In a July interview on Bloomberg TV, Draper attributed recent regulatory actions in the United States, such as those against Coinbase and Binance, to BTC’s short-term downtrend.

Despite these challenges, Draper continues to believe in Bitcoin’s transformative power and sees it potentially reaching $250,000, albeit now possibly by 2024 or 2025. His confidence in Bitcoin’s ability to revolutionize finance and retain its long-term value remains unwavering.

Berenberg: $56,630 At Bitcoin Halving

The German investment bank Berenberg revised its prediction in July, pointing toward $56,630 by April 2024. This upward adjustment was supported by improved market sentiment attributed to the anticipation of the Bitcoin halving event expected in April 2024 and the growing interest exhibited by prominent institutional players.

Berenberg’s team of analysts, led by the insightful Mark Palmer, emphasizes their expectation of significant appreciation in Bitcoin’s value in the coming months. This projection is driven by two key factors: the highly anticipated Bitcoin halving event and the growing enthusiasm displayed by significant institutions.

Highlighting their confidence in the market, Berenberg also reaffirmed its buy rating on the stock of Microstrategy. The bank has revised its share price target for Microstrategy from $430 to $510, driven by a higher valuation of the company’s BTC holdings and an improved outlook for its software business.

Blockware Solutions: $400,000

Blockware Intelligence, in an analysis from August titled “2024 Halving Analysis: Understanding Market Cycles and Opportunities Created by the Halving,” delved into the intriguing possibility of Bitcoin’s price reaching $400,000 during the next halving epoch, anticipated in 2024/25.

A central factor identified in the research is the role of the halving in shaping Bitcoin’s market cycles. The report asserts that miners, responsible for a significant portion of sell pressure, receive newly minted BTC, much of which they must sell to cover operational costs. However, the halving events serve to weed out inefficient miners, leading to reduced sell pressure.

With supply diminishing due to halvings, the research emphasizes that demand becomes the primary determinant of BTC’s market price. Historical data indicates that a surge in demand typically follows halving events. Market participants, equipped with an understanding of the supply-side dynamics introduced by halvings, prepare to deploy capital at the first signs of upward momentum, potentially leading to substantial price appreciation. This surge in demand is particularly evident in current on-chain data, validating the positive sentiment surrounding halving events.

Beyond these notable forecasts, there are a plethora of other price predictions for BTC, ranging from Cathie Wood’s (ARK Invest) ambitious $1 million projection to Mike Novogratz’s (Galaxy Digital) $500,000, Tom Lee’s (Fundstrat Global) $180,000, Robert Kiyosaki’s (Rich Dad Company) $100,000, Adam Back’s $100,000, and Arthur Hayes’ $70,000 prediction, underscoring the diverse perspectives on Bitcoin’s future value.

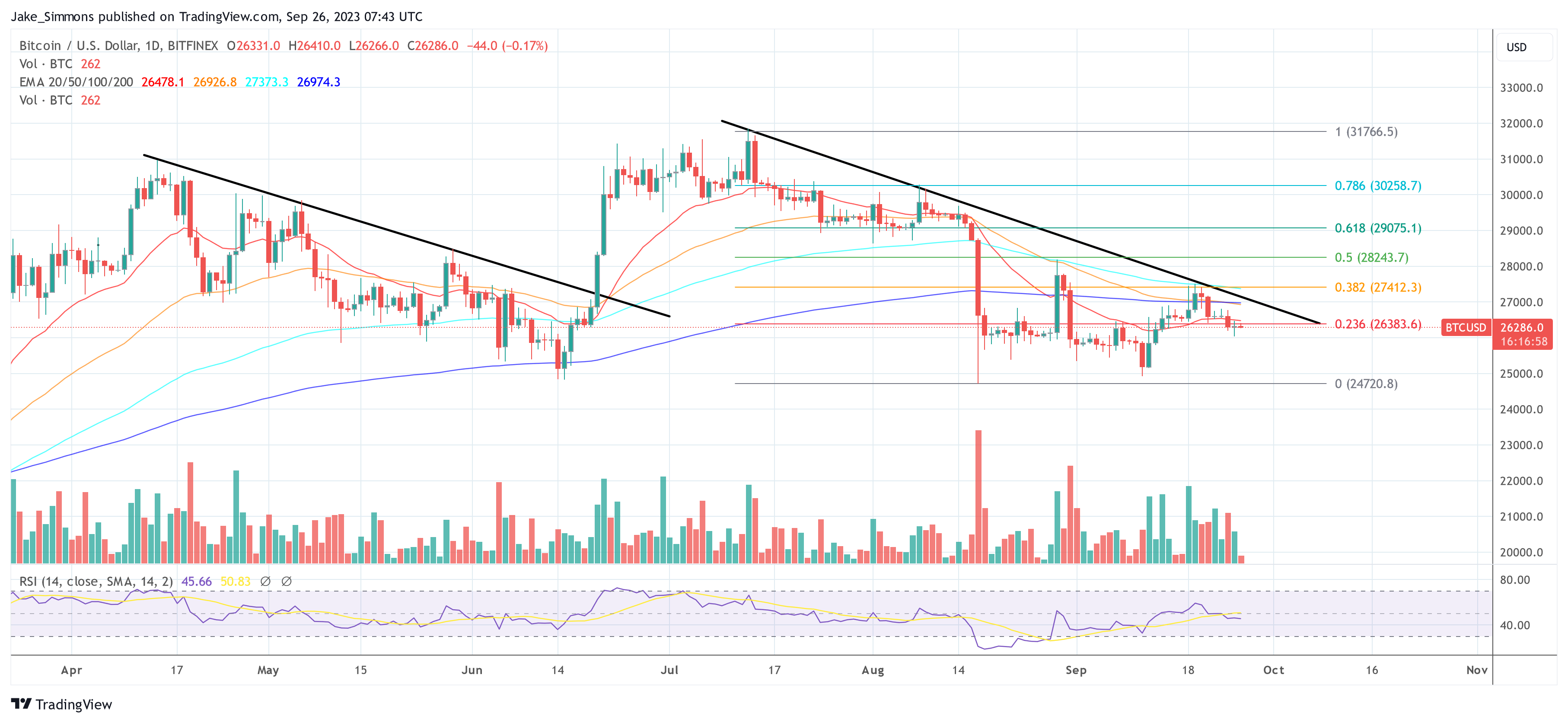

At press time, Bitcoin traded at $26,286.