Impact Theory produces entertainment and educational podcasts and was “trying to build the next Disney” when it invited investors to purchase its NFTs.

Cryptocurrency Financial News

Impact Theory produces entertainment and educational podcasts and was “trying to build the next Disney” when it invited investors to purchase its NFTs.

The Bitcoin price has barely moved a few hundred dollars since late last week, but a vital metric hints at another aggressive move. In the meantime, the cryptocurrency is likely to keep trading sideways until another liquidation event flips momentum into a specific direction.

As of this writing, Bitcoin trades at $26,100 with sideways movement in the last 24 hours. In the previous seven days, BTC recorded similar price action while other tokens in the top 10 moved in tandem except for Binance Coin (BNB) and Solana (SOL).

As the Bitcoin spot price trends sideways, most of the action turns to option contracts where “smart money” is positioning for a big move. According to a report from derivatives platform Deribit, traders in the sector are betting on the long side solely based on the potential approval of a Bitcoin price spot Exchange Traded Fund (ETF) in the US.

Thus, most traders have been buying call (buy) contracts for Bitcoin to rise above $30,000 by the end of the year. These might have been betting on the regulator and courts to announce a decision from the many petitions or because of the case filed by asset manager Grayscale.

Neither of these events has come to fruition, which has led to a decline in the overall sentiment across derivatives. As the spike in call buyers suggested, this sentiment has been primarily bullish but will likely turn negative as the US stalls its Bitcoin price spot ETF decision.

Deribit stated:

Constant positivity on ETF approval has been the main driver for medium-long-term Call buying. And yet as this moves out the timeline from Q3 to Q4 to even ’24, patience is running thin. With delays, drifting confidence & macro headwinds, we start to observe downside hedges.

These hedges might have contributed to the Bitcoin price’s recent action as operators sell their spot position to cover their call contracts with late expiration. In that sense, the main catalyzer was the liquidation cascade that the cryptocurrency experienced when moving around $29,000.

At that time, as BTC trended sideways, open interest across the derivatives sector trended to the upside. As pointed out by an analyst, a similar situation is taking place currently and could lead to another aggressive move with a downside potential.

#Bitcoin Open Interest continues to rise again. Price is still moving sideways.

I would assume that we’d see some proper action over the next couple of days as long as open interest keeps rising at this pace. pic.twitter.com/VV2xAds0t4

— Daan Crypto Trades (@DaanCrypto) August 28, 2023

Cover image from Unsplash, chart from Tradingview

The S&P 500 is attempting a recovery, but Bitcoin and select altcoins are struggling to break above their respective resistance levels.

A Binance spokesperson reportedly said the global cryptocurrency exchange was considering all options in regard to Russia, “including a full exit.”

Bitcoin price is currently trading at slightly above $26,000 per coin, but is still reeling after last week’s 10% single day selloff. The situation looks dire for crypto bulls who were hoping for a more significant recovery to begin after such prolonged sideways.

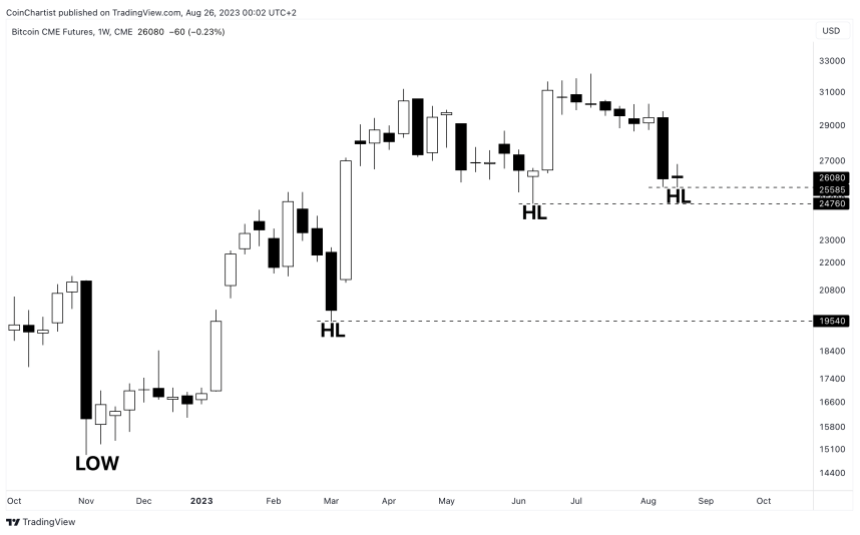

However, the bullish market structure remains unbroken. Let’s take a closer look at what exactly this means and why the 2023 uptrend is still intact.

After a solid start to 2023 – certainly a year that’s been kinder to the king of cryptocurrency than 2022 – BTCUSD has bears celebrating and bulls kicking their wounds. Several months of sideways price action and dwindling volatility ended with a bang as expected, but the move was down and not what bulls had been hoping for.

A sharp, 10% intraday selloff caused more long liquidations than the FTX collapse, and sent the Relative Strength Index immediately into the most oversold territory in all of 2023. But even with all the carnage, Bitcoin remains in a near-term uptrend with a bullish market structure.

By pure definition, an uptrend is a series of higher highs and higher lows. Which is precisely what is still happening in BTCUSD price action throughout 2023. Currently, the FTX collapse in November 2022 was the local “low” of the downtrend. In contrast, a downtrend is a series of lower lows and lower highs. Once a new high was made in early 2023 and then a higher low was put in, the downtrend was considered over.

The recent 2023 uptrend in Bitcoin hasn’t yet made a lower low after a lower high. Even a possible lower low beyond here is still without a proper lower high. This means that the top cryptocurrency by market cap could potentially bounce here, or even lower, and still maintain an overall bullish market structure.

A lower low would still be important, potentially warning that the market structure is turning back bearish. If a lower low happens below the $25,000 low from June 2023, then it will be all eyes on if a lower high is to follow.

The 2023 uptrend in Bitcoin has been muted compared to what the cryptocurrency is capable of. BTCUSD is up roughly 50% during the first roughly nine months of the year. The final nine months of 2020, for example, had over 900% ROI by comparison. Could this type of returns soon be on the way? Or will the cryptocurrency market fall back into the clutches of bears?

This chart originally appeared in Issue #18 of CoinChartist VIP. Subscribe for free.

Crypto was on fire as a topic in the early U.S. presidential campaigning, but the first Republican debate last week showed it may not be an issue that has legs with candidates trying to grasp mainstream attention. While we wait to see whether digital assets come up at the Republican primary debate next month, here’s how the major candidates from both parties shake out on the topic:

In June, Belgium’s financial regulator ordered Binance to stop offering crypto exchange and custody wallet services, citing violations of the country’s AML and CFT requirements.

The price of Bitcoin has taken a beating in the past month. The leading cryptocurrency by market cap is down by more than 11% from its price in July and has lost more than $50 billion in market cap since then.

While the price plunge has been painful for investors, Bitcoin miners have also been feeling the sting as mining revenue per computing power has been dwindling for the past few months. On the other hand, Bitcoin’s hashrate has soared to high levels as mining farms continue to come online.

Over the last year, Bitcoin’s hashrate (the total combined computing power of miners) has almost doubled. Data from Blockchain.com shows that the Bitcoin network hash rate surpassed 414 terahashes per second (TH/s) for the first time on August 16.

This metric has since retraced to 390 TH/s, but it is expected to rise further in the coming weeks as miners bring on more computing power to break even on their mining operations. The higher the hashrate, the more difficult it becomes to mine BTC and earn rewards. This means that miners are now making less BTC per terahash of computing power than ever before.

Data from Hashrate Index shows this figure is now at $0.06016 per terahash/second per day. In comparison, this figure was at $0.08124 on May 8 during the rise of Bitcoin Ordinals and Inscriptions. A further decline from here would see mining revenue fall below the lowest point in November 2022.

The Bitcoin mining industry has proven itself resilient, even during the depths of the crypto winter. According to data from investment information platform MacroMicro, the current average cost to mine a BTC stands at $45,877 with the current price of BTC now at $25,936.

To remain profitable with the rising hash rate, Bitcoin miners have had to adjust their operations. Publicly traded mining companies like Marathon Digital and Riot Platforms have had to raise about $440 million through stock sales.

Bitcoin miners have also avoided selling their $900 million BTC, as it could trigger a major selloff from investors. While previous on-chain data have shown miners sending a significant amount of coins to exchanges, miners have been expanding their reserves recently.

BTC Mining Outlook

The outlook for Bitcoin mining economics in the coming months is uncertain but potentially promising if the hashrate continues to increase. The next Bitcoin halving is expected to take place in April 2024, slashing block reward by 50%.

When the halving occurs, things could even get tighter for miners, as they would have to increase mine more blocks to break even. Nevertheless, big BTC mining companies are already on track for this adjustment. Marathon Digital, for example, was able to achieve a 54% boost in its hashrate during the second quarter but reported a net loss of $21.3 million.

The on-chain analytics firm CryptoQuant has discussed how the Bitcoin market has changed during the past year.

In a new post on X, CryptoQuant has broken down the changes that the cryptocurrency’s landscape has observed recently. The first would be that the US-based exchanges have been registering withdrawals, while the global platforms have seen growing holdings.

The relevant on-chain indicator here is the “exchange reserve,” which keeps track of the total amount of Bitcoin stored inside the wallets of a centralized exchange or a group of exchanges.

First, here is a chart that shows the trend in this metric for the foreign platforms:

The above graph shows that the Bitcoin exchange reserves for Binance, Bitfinex, and OKX have increased during the past year. In total, the indicator’s value for these non-US platforms has increased by 10% in this period.

This increase would naturally suggest that these exchanges have seen net deposits in the last year. However, the exchange reserve for the US-based platforms paints a different picture.

While the foreign exchanges have seen deposits, the platforms based in the US, such as Coinbase, Gemini, and Kraken, have observed declining reserves during the past year.

In general, the reserves of these platforms have dropped by at least 30%, which is a very significant value. The opposite trends being followed by the two groups of exchanges could imply a migration of coins between them, with investors increasingly preferring the non-US platforms.

The second change in the BTC market is that institutional investors have started displaying an accumulation behavior. “Considering the amount withdrawn and the deposit and withdrawal records of the wallets, institutions are continuously buying Bitcoin,” explains the analytics firm.

CryptoQuant notes that in August alone, Gemini has seen a huge withdrawal of more than 20,000 BTC, which can be a sign that institutional investors are buying.

Finally, there is a change in how market participants have been looking at the futures sector recently, as they have increased their exposure to derivative products.

The ratio of the trading volume of the asset between spot and derivative platforms has dropped to pretty low values recently, a sign that activity on the derivative exchanges is overwhelmingly more than on the spot ones.

The open interest, a measure of the number of positions open on the derivative market, also showcases this change, as the metric’s value hit very high just recently.

The chart shows that while the open interest was at highs just a while ago, it has since observed a plummet. The reason behind this plunge was the latest Bitcoin crash, which resulted in a cascade of liquidations in the market.

Bitcoin is trading around the $25,900 level, unchanged from one week ago, showing how stagnant the cryptocurrency has been recently.

The latest in blockchain tech upgrades and announcements.

Financial authority FSMA told the company in June to cease serving Belgian customers from outside the European bloc

In his third weekly dispatch from El Salvador, Jonathan Martin meets two Bitcoin entrepreneurs working to improve financial inclusion.

It’s all about the 200-week EMA and the area just below $26,000 if Bitcoin bulls are to stand a chance, BTC price analysis says.

The cryptocurrency market has been in a declining trend for years. However, reports reveal a possible recovery and bullish turn for popular cryptocurrencies in the space. JP Morgan has predicted a possible price rebound for Bitcoin, saying that long-term liquidations are “largely behind us.”

JP Morgan, an American multinational financial services firm published an interesting research report on Thursday, August 24. Analysts led by Nikolaos Panigirtzoglou, Managing Director at JP Morgan indicated that crypto markets are likely to emerge from the declining trend from liquidations and market turmoil and move into a correction phase completely.

They believe that the crypto market has been able to overcome a significant amount of negative factors that push the market to a “limited downside.” Their predictions are also based on the indications of a decline in open interest in Bitcoin futures contracts on the Chicago Mercantile Exchange (CME), a global derivatives marketplace.

The crypto market has been on a severe declining trend while Bitcoin’s progress has been muffled after experiencing devastating market blows, and regulatory hurdles. The stunning fall of Terra stablecoin was one of the major challenges the industry faced, wiping over $200 billion worth of cryptocurrency assets from the space.

FTX’s collapse has also pushed the evolution of cryptocurrencies back by a couple of years, shattering investor’s confidence in the crypto space and hinting at the lack of a better regulatory framework in the industry.

The United States Securities and Exchange Commission (SEC) has also been in hot pursuit of new victims, throwing lawsuits against prominent exchanges and crypto firms like Binance, and Coinbase.

All things considered, Bitcoin’s fight against evolutionary pressures has yielded positive results. A crypto analyst provided compelling insights on Bitcoin’s network, revealing that the spikes in on-chain transfers seen in Bitcoin’s network activity are a great indicator for a probable macro uptrend for the cryptocurrency.

#Bitcoin network activity, particularly the USD value of coins transferred on-chain, is a compelling indicator for predicting macro uptrends.

Historically, significant spikes in this metric have often preceded #BTC bull runs.

Given that this metric has been consolidating for… pic.twitter.com/2zHNoBo6Yp

— Ali (@ali_charts) August 26, 2023

There have been a significant number of positive developments that have pushed the price of major cryptocurrencies, including Bitcoin upwards. Ripple’s victory against the SEC is among said developments. The XRP ruling by Judge Annalise Torres has brought new optimism in the space and has also provided essential regulatory clarity for cryptocurrencies.

Additionally, the increase in applications for Bitcoin spot exchange-traded funds (ETFs) has also boosted its price considerably. World-leading financial services providers like Blackrock, Ark Investment, Hashdex, Grayscale, and others are already competing for a spot in Bitcoin ETF.

There are also reports of a potential collaboration between Bitcoin and Elon Musk’s SpaceX to enable cross-border payments for space-linked activities.

Overall, the crypto landscape is showing signs of stability as it navigates through major industry hurdles. Crypto investors are also eagerly anticipating the potential recovery of Bitcoin and other cryptocurrencies.

Google and other major platforms on the web will need to update their service policies in order to comply with EU standards in its Digital Services Act by Aug. 28.

OnlyFans, the well-known adult content subscription platform, has made a bold move into the world of cryptocurrencies. Its parent company, Fenix International, recently revealed its significant investment of nearly $20 million in Ether (ETH) in 2022.

According to official financial filings submitted to the UK corporate registry, Fenix International acquired nearly $20 million worth of ETH over a two-year period.

While the company’s investment in Ether demonstrates its progressive approach, it wasn’t immune to the market’s inherent volatility. By the end of November 2022, the value of Ether had plummeted by $8.5 million, leading to an impairment loss on the investment.

The remaining carrying amount of Ethereum stands at $11.434 million, reflecting the broader trends and uncertainties in the cryptocurrency market.

The move to invest in Ether aligns with OnlyFans’ broader strategy of diversification and technological innovation. Investing in intangible assets with an “indefinite useful life” showcases the company’s willingness to embrace emerging technologies like blockchain, positioning itself at the forefront of industry trends.

The disclosure about Fenix’s acquiring a substantial amount of Ether has not seemed to provide a lift yet to the price of the crypto. At the time of writing, ETH was trading at $1,636, down -0.8% in the last 24 hours, and sustaining a slight 2.2% loss in the last seven days, data from crypto market tracker Coingecko shows.

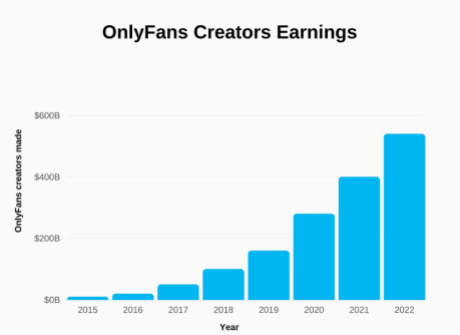

The financial filings offer a glimpse into OnlyFans’ multi-faceted performance. Despite the challenges posed by its cryptocurrency investment, the company reported impressive financial results for the year ending November 2022.

With revenue surpassing the $1 billion mark, driven by an influx of over 50 million new users and more than a million content creators, OnlyFans solidified its position as a revenue-generating powerhouse. Users collectively spent an astounding $5.5 billion on the platform.

Leonid Radvinsky, the visionary entrepreneur of Ukrainian origin who acquired OnlyFans in 2018, has reaped the rewards of the platform’s surging popularity.

The filings unveil that Radvinsky amassed dividends approximating $485 million since the inception of the previous year, in line with the escalating demand for OnlyFans’ offerings.

This recent crypto venture is not the company’s first stride into the digital asset domain. In early 2022, OnlyFans facilitated a pioneering move by enabling verified creators to replace their profile pictures with Ethereum-based non-fungible tokens (NFTs).

Moreover, in June of the same year, former OnlyFans executives unveiled Zoop, a celebrity trading card platform leveraging the Ethereum scaling solution Polygon. Zoop allowed users to trade 3D digital playing cards depicting their favorite celebrities.

The disclosure of Fenix International’s Ethereum holdings dovetailed with an industry-wide trend, as adult content creators began flocking to Friend.tech, a decentralized social media platform rooted in the cryptocurrency realm. This rush underscores how crypto’s recent surge has not only captured financial markets’ attention but also influenced sectors far beyond conventional investments.

Featured image from Verità e Affari

Explore the world of large language models and AI wonders designed to comprehend and generate human-like text.

From web development frameworks to machine learning libraries, Python’s versatility is driving innovation across the board.

Istanbul Blockchain Week made some necessary modifications this year to reflect the change in the overall crypto market.

Russian residents are now the only eligible users of Binance P2P that can use the Russian ruble, but they are also not allowed to use other currencies.