Following the cyber breach of non-sensitive data, bankrupt cryptocurrency exchange FTX has reactivated account access to its customer claims portal.

Cryptocurrency Financial News

Following the cyber breach of non-sensitive data, bankrupt cryptocurrency exchange FTX has reactivated account access to its customer claims portal.

Paxos makes a mistake, pays $500k in Bitcoin transfer; FTX receives court approval for token sales, and Gemini Earn users receive plan for fund recovery.

During a panel moderated by Cointelegraph editor-in-chief Kristina Lucrezia Cornèr at Swiss Web3 Fest, industry experts provided insights into how tokenization is enabling solutions never seen before.

According to an analysis from investment manager firm VanEck, exchange volume across DeFi protocols declined to $52.8 billion in August, 15.5% lower than in July.

Bitcoin has had an eventful week, gaining by over 5% to trade above the $26,000 price. Even following the release of the US Consumer Price Index, which showed an inflation rise of 0.6%, the premier cryptocurrency remained resilient with little to no price drops.

As BTC now hovers around the $26,500 price mark, market analysts and crypto enthusiasts continue to speculate on the token’s next movement.

Notably, co-founders of market intelligence platform Glassnode Jan Happel and Yan Allemann have plotted a possible path through which Bitcoin may return to $30,000 in the coming weeks.

Through a post on their shared account on X, known as Negentropic, the Glassnode co-founders stated that Bitcoin is currently targeting a move above $27,000, having reclaimed its support at $26,000 in the past week.

According to the analysts, the Bitcoin Risk Index has now dipped into the 60s, indicating there is an ongoing shift to a positive sentiment around the asset. This means that more investors are beginning to view Bitcoin as a favorable investment.

The US Consumer Price Index (CPI) jump by 0.6% was expected to stir the BTC price, and it has.

Reclaiming support above $26k, BTC's now eyeing a breakout past $27k, potentially exiting a multi-week range.

Risk Signal's nosedive into the 60s signifies this attitude shift. Profit… pic.twitter.com/BgrMq5Rb62

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) September 15, 2023

If these sentiments translate into buying pressure, Bitcoin could embark on an upward trend. However, the Glassnode co-founders predict the token will face significant resistance at $27,400 and $28,200, as traders could opt to take profit at these price levels.

However, the analysts predict BTC will eventually overcome these barriers, pushing through to the $30,000 price mark, which they described as a “psychology barrier.”

The last time Bitcoin traded above $30,000 was back in July. Since then, the world’s largest cryptocurrency has seen its price decline by over 17% due to multiple events, most notably, the massive Bitcoin sell-off by aerospace company Space X.

In other news, data from Into The Block shows that Bitcoin’s transaction fees for this week were valued at $6.3 million, representing a 40% increase on the last week.

While a rise in transaction fees could represent network congestion, which is known to drive network users away, it could also mean there is a high level of adoption.

Furthermore, Into The Block also reported that Bitcoin recorded exchange inflows of $10 million and outflows of $70 million.

The high level of Bitcoin being moved off exchanges indicates rising investors’ interest in the cryptocurrency, which could also translate into a notable price gain.

However, it is worth stating that these are only predictions and should not be counted as investment advice.

At the time of writing, Bitcoin trades at $$26,537 with a 0.33% loss in the last day based on data from CoinMarketCap. The token’s daily trading volume is also down 12.86% and valued at $11.25 billion.

Base, the Coinbase-incubated Ethereum layer 2 (L2) network, has seen rising adoption since opening its door to the public barely a month ago. While the blockchain platform has gained significant traction, its pool of users and protocols has also witnessed substantial expansion.

In a testament to this rapid growth, Base recently registered its highest number of transactions in a single day.

According to data from IntoTheBlock, Base has seen its daily transactions soar to a new all-time high. The blockchain platform registered a total of 1.88 million transactions on Thursday, September 14.

Lucas Outumuro, head of research at IntoTheBlock, revealed that Base recorded more transactions than the sum of Arbitrum and Optimism transactions (780,000 and 370,000, respectively) on the same day.

The network fees is another metric that reflects the apparent surge in Base’s on-chain activity in recent days. Data from TokenTerminal showed that the blockchain generated more network fees than Arbitrum and Optimism.

Furthermore, Base notched its peak transaction throughput in the past week. According to L2beat, the network recorded a significant 21.29 transactions per second (TPS) on Thursday, September 14.

This figure placed Base above other L2 chains and Ethereum in terms of transaction throughput. Nevertheless, the network remains in the top spot, with a current TPS of 19.58.

These feats underscore the positive performance of the Coinbase-incubated network in the past few weeks. Base has managed to stake a strong claim for a place amongst the top L2 blockchains, as demonstrated by its surging on-chain activity.

However, it is worth noting that Base still lags behind Arbitrum and Optimism regarding total value locked (TVL). According to DefiLlama, Base has a TVL of nearly $373 million, while Arbitrum and Optimism boast roughly $1.7 billion and $650 million, respectively.

The latest surge in on-chain activity on the Base network has been linked primarily to the renewed hype of the decentralized social network, Friend.tech.

IntoTheBlock made this connection in a report, saying, “Interestingly, it is not DeFi applications nor NFT marketplaces driving the surge in Base’s activity. Instead, a significant portion of usage can be attributed to a new social application, FriendTech.”

Friend.tech is a decentralized social media platform built on Base. It allows users to trade “keys” of X (formerly Twitter) accounts and interact with social media personalities in a closed, group chat format.

The Friend.tech platform, once pronounced dead by critics, sprung back to life in the past week. The decentralized application seems to be enjoying renewed user interest, with its TVL surpassing $30 million in the last few days.

Friend.tech has been experiencing an uptick in activity, shattering its trading volume record two days in a row. Meanwhile, the platform has seen an increase in capture fees, which reached an all-time high of about $2 million on September 14.

NFT marketplace Magic Eden believes that lowering the costs in NFT production creates an “easy access point” for new users to try NFTs.

It has been a year since the Merge took place, and as expected, the world’s second largest cryptocurrency, Ethereum, has experienced many changes since then. What are some of them? Let’s take a look.

According to a prominent figure in the Ethereum community, Sassal, 980,000 ETH have been burned since Ethereum transitioned from a proof-of-work (PoW) consensus to proof-of-stake (PoS).

Ahead of the Merge, Ethereum had implemented a significant upgrade known as the London hard fork. This introduced a fee-burning mechanism with transaction base fees being burned immediately after a transaction is processed.

This move was geared towards making Ether deflationary, considering that some tokens are removed permanently from circulation. Ethereum supply is down by 0.25% since the Merge took place.

Furthermore, the Merge resulted in the network being secured by validators who stake their ETH as against Miners, who were the backbone of the network under the PoW consensus. In line with this, over 11.6 million ETH (since the Merge) has been staked to secure the network and also earn passive income in return.

The top stakers include the staking platform Lido DAO which has a market share of 22.64%, according to data from Dune Analytics. Other top stakers include exchanges like Coinbase, Binance, and Kraken.

Meanwhile, the number of validators on the network has significantly increased since the Merge, with 362,000 new validators joining the network.

Ethereum’s price has increased by close to 11% from a year ago. However, many may consider this insignificant for a token that hit an all-time high of $4,891 the previous year. Nevertheless, there are positives to take from the Merge, as Ethereum has undoubtedly become more valuable since it occurred despite the current bear market woes.

A crypto analyst noted that ETH’s annual inflation rate has decreased since the Merge, and trading activity on Ethereum’s layer-2 chains has also increased significantly. That would suggest that more people are being onboarded into the Ethereum ecosystem.

According to him, Ethereum’s fundamentals are also at an all-time high, as there are factors that show that the ecosystem is stable and healthy. One of them happens to be the fact that traditional financial (TradFi) institutions are taking an interest in ETH.

Cathie Wood’s ARK Invest recently filed to offer an Ethereum Spot ETF (a first of its kind). This is alongside other institutions that have filed to offer an Ethereum futures ETF (of which ARK Invest happens to be among them).

Featured image from WAYA Media

Address poisoning attacks involve tracking, misusing or compromising cryptocurrency addresses.

Brushfam founder Markian Ivanichok claimed that the Polkadot ecosystem “doesn’t care about users” and expressed frustration on the governance process.

Toncoin has seen a noteworthy 20% price increase over the past week, rising from $1.75 on September 9 to $1.95 on September 15, 2023. With a current market valuation of $6.72 billion, this rise has elevated the altcoin to the No. 22 position.

Within the cryptocurrency arena, there’s an unmistakable buzz among market participants as they eagerly seek out the next standout digital asset. This quest is leading to a fascinating shift in the top 20 rankings, as a fresh wave of cryptocurrencies enters the fray.

While established tokens appear to be caught in a somewhat static trading pattern, a select group of digital currencies is demonstrating remarkable resilience and assertiveness, positioning themselves as formidable contenders capable of potentially supplanting their more renowned counterparts.

Notably, Toncoin (TON) has emerged as a front-runner in this battle for prominence, boasting a noteworthy surge of over 50% in value over the last 30 days.

The significant price increase in such a short period of time implies increased momentum and interest in this coin. If Toncoin can sustain its steady ascent, it should be able to hit the vaunted $3 mark this weekend or in the coming days.

Meanwhile, the current market sentiment is predominantly bearish, marked by a general consolidation within a constrained price range. Recent price declines have somewhat subdued earlier optimism.

However, Toncoin has managed to attract positive attention in the face of these conditions. It’s worth noting that there might be a short-lived negative correction anticipated after the coin breached the $2 mark.

At the time of writing, TON was trading at $2.14, up 12% in the last 24 hours and climbed by an impressive 20% in the last seven days, data from crypto market tracker Coingecko shows.

A notable factor contributing to Toncoin’s price surge is its remarkable trading volume. In the last 24 hours alone, Toncoin recorded a trading volume of $27 million, surpassing its 20-day average volume of $19 million by a significant margin.

An increase in trade volume is indicative of growing interest in and use of a cryptocurrency. The increased number of TON buyers and sellers has led to better market transparency and more efficient price formation. Recent high trading volume has provided the necessary impetus to drive the token’s price higher.

On September 14, the Toncoin Foundation and Telegram jointly announced the introduction of TON Space, a novel cryptocurrency wallet designed specifically for Telegram users. TON Space facilitates connectivity to The Open Network ecosystem, which is overseen by the native token of Toncoin.

With this move, Telegram hopes to add more than 30% of its users by 2028. It’s interesting that around 700 million people use the leading messaging app for cryptocurrency fans every month.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from GetBlock.net

3LAU noted that there risks were necessarily high, but that he has a “responsibility” to avoid any regulatory gray areas.

Mark Cuban confirmed that he was hacked, but doesn’t appear to know exactly how it happened as of yet.

Mark Cuban confirmed that he was hacked, but doesn’t appear to know exactly how it happened as of yet.

Ethereum might be the king of smart contracts and the world’s primary hub for decentralized finance (DeFi) and non-fungible tokens (NFTs) activity but onchain data suggests that Bitcoin is ahead in user engagement, interpreted by the number of daily active users, and network activity is at acceptable, healthy levels, reading from the number of daily transactions confirmed.

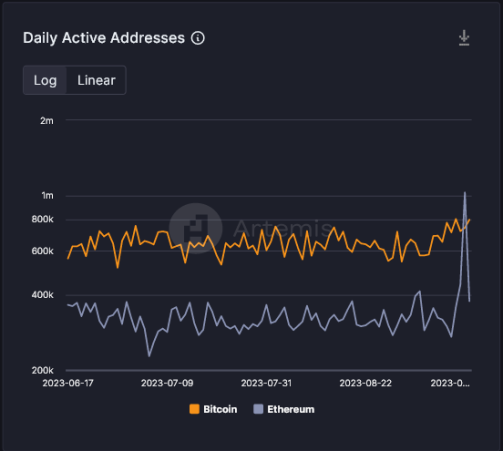

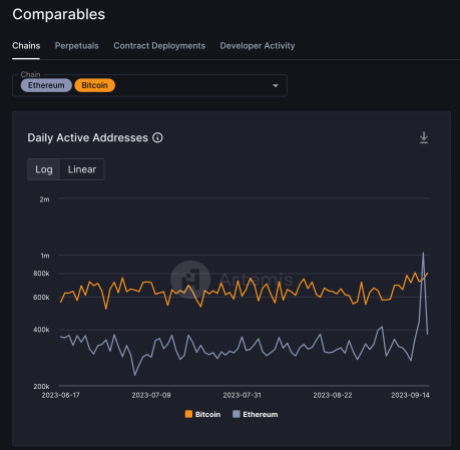

According to Artemis Terminal data on September 15, Bitcoin, despite being predominantly a transactional layer, enabling the peer-to-peer (P2P) transfer of value between addresses, has more daily active users than Ethereum.

This observation is even as Ethereum serves as a conduit of value since assets can be moved, just like in Bitcoin, and a smart contract platform for deploying trustless and automated decentralized applications (dapps). Some, like Uniswap, a decentralized exchange (DEX), process billions worth of transactions every month.

On September 15, Bitcoin had over 800,000 daily active addresses (DAA), more than twice those in Ethereum, which stood at slightly over 378,000. The only time there was a slight change was on September 13, when over 1 million addresses were activated on Ethereum.

Then, the number of DAA on Bitcoin also fell to around 743,000. However, the DAA on Ethereum has fallen sharply while Bitcoin has maintained an upward trajectory since late August. During this time, Ethereum’s DAA has been fluctuating heavily, as evidenced by the rise and fall on Sep 13 and through to today.

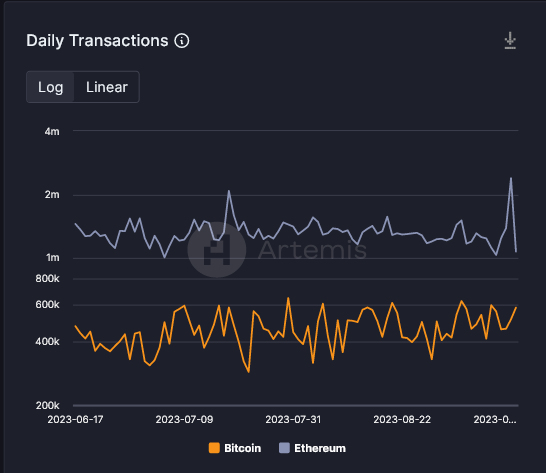

Ethereum shines in the number of daily transactions processed. When writing on September 15, the smart contract platform had processed over 1 million transactions while Bitcoin lagged, confirming less than 600,000.

Even at this level, Ethereum has processed less than half of what it did on September 13, when the network processed over 2.3 million transactions. On the other hand, Bitcoin’s daily transactions have been steady, while those of Ethereum have, on average, risen over the past three months, as Artemis Terminal data shows.

DAA and daily transaction count are important metrics that on-chain analysts use to analyze the level of engagement and health of public blockchains.

Over the past 18 months, activity has rapidly shrunk as asset prices fall in the crypto winter. Ethereum’s drop from around $5,000 in late November 2021 to as low as $1,500 in 2022 weighed negatively on DeFi and NFT activity.

According to DeFiLlama, the total value locked (TVL) of DeFi protocols has stabilized below $50 billion, down from around $180 billion in 2021. Meanwhile, trading volume has crashed by over 90%, dragging the value of NFT-related projects, including Immutable X and ApeCoin. To illustrate, APE is down 96% from peaks.

In a Friday 15 court filing, Gemini, the US-based crypto exchange platform, has accused Digital Currency Group (DCG) of engaging in “fraudulent activities” and attempting to evade responsibility for the harm caused to creditors.

The filing directly responds to a statement made by DCG regarding a proposed agreement between DCG, the debtors, and the Official Committee of Unsecured Creditors.

According to Gemini, DCG devised a $1.1 billion promissory note to conceal the significant financial losses caused by the collapse of Three Arrows Capital (3AC).

However, DCG allegedly kept the actual terms of the note “hidden,” leading to misleading representations to Gemini’s creditors. Furthermore, the company claims that DCG borrowed a substantial amount of Bitcoin (BTC) from the company instead of providing much-needed capital.

Gemini also highlights that DCG is now unwilling to repay the more than $630 million it borrowed from the company, which was due several months ago in May.

In response, as reported by NewsBTC, DCG has proposed a deal that would require Genesis creditors, including Gemini, to extend years of credit to DCG. However, Gemini intends to fight against this proposal, asserting that DCG should pay creditors a just and adequate amount.

Gemini argues that DCG has attempted to “wear down” creditors over the past ten months, hoping they would settle for a significant reduction in the amount owed.

According to the court filing, Gemini is determined not to succumb to these tactics and will continue to pursue a fair resolution.

In the filing, Gemini criticizes DCG’s proposed recovery rates, claiming they are “misleading and deceptive.” The company argues that receiving fractional shares of interest and principal payments over seven years from a risky counterparty is not equivalent to receiving the actual cash and digital assets owned by Genesis.

Gemini demands that DCG significantly improve the terms of the loans it provides if it wishes to gain the support of the harmed individuals.

Overall, Gemini accuses DCG of being the architect of its subsidiary’s insolvency and “sacrificing” the exchange and its creditors to shield itself from liability.

The company founded by the Winklevoss twins asserts that DCG’s delay tactics have hindered progress in distributing funds to Gemini Lenders, despite Gemini’s offer of a $100 million premium for a swift resolution.

It is worth noting that the court filing by Gemini comes after months of negotiations with the crypto lender and DCG and the collapse of the Gemini Earn program, which resulted in lawsuits and severed ties between Digital Currency Group and the crypto exchange.

Featured image from iStock, chart from TradingView.com

Despite Brian Shroder resigning as CEO of the exchange’s US wing amid SEC and CFTC lawsuits, Binance CEO Changpeng Zhao claimed that the departure was normal.

Since its inception, Ethereum has continuously been compared to Bitcoin with the former being hailed as a better option to the latter in some cases. As the years have flown by, the competition has gotten even fiercer, especially with ETH growing rapidly. Eventually, Ethereum seems to be catching up with Bitcoin, especially in terms of active addresses.

On Thursday, September 14, on-chain data tracker Santiment revealed a surprising update on the fierce rivalry between Bitcoin and Ethereum. In the X post, the tracker revealed that the number of unique addresses that were transaction on the network had reached its second-highest daily figure of all time.

While this is significant on the part of the blockchain alone, it is also significant in terms of the competition between the two largest assets in the space. To put this in perspective, the 1,089,893 figure reported by Santiment puts Ethereum ahead of Bitcoin in terms of this metric alone.

The last time that the daily unique active addresses on the network hit its new all-time high was back in December 2022. So it has been almost a year since the metric was this high, suggesting a unique driving factor behind it.

This report is also in line with the report from Artemis Terminal that shows that Ethereum was right in front of Bitcoin in terms of daily active addresses.

Artemis reports that on September 13, Ethereum saw a total of 1.03 million daily addresses compared to Bitcoin’s 743,800 addresses in the same time period. However, this figure has since retracted and Bitcoin has pulled in front of Ethereum once more as of September 14.

While Ethereum’s surge on Wednesday was impressive, it does not mean much since the network has been unable to sustain the growth. Also, the surge could be easily explained by the rise in the popularity of the Friend.Tech decentralized finance social media platform based on the Ethereum blockchain.

Friend.Tech had seemingly come back from the death to reach a new all-time high in its number of daily users. Since an ETH address is required to participate in the platform, it is no surprise there was an uptick in the number of ETH addresses active on the network.

The spike in the number of daily active addresses also seems to have had little impact on the price of the cryptocurrency itself. ETH’s price is still struggling to hold above $1,600, with small gains of 0.35% in the last day and losses of 1.15% in the last week.

Binance crypto exchange announced in late August that it is moving to end support for its beloved BUSD stablecoin. This move comes amid the stablecoin’s run-in with regulators, leading to a halt in its production. And now, the exchange has started moving to begin the end of support for the stablecoin.

Binance took to its official X (formerly Twitter) account on Thursday, September 14, to announce that it would begin burning a number of Binance-pegged tokens. Among the five tokens listed to be burned, four were BUSD tokens across different blockchains.

According to the announcement, the Binance-pegged tokens would be burned on the listed blockchains, and then the exchange would release the equivalent amount of tokens that were initially used as collateral on their native networks.

Later today, #Binance will burn a number of idle Binance-pegged tokens.

The equivalent amount of tokens on their native networks, which were used as collateral, will then be released.

Tokens:

TUSDOLD (BSC)

BUSD (MATIC)

BUSD (BSC)

BUSD (BNB)

BUSD (TRX)

— Binance (@binance) September 14, 2023

The BUSD tokens listed across four networks include BUSD on the Polygon (MATIC) network, BUSD on the Tron (TRX) network, BUSD on BSC, and BUSD (BNB). In addition to these, the exchange also revealed that the TUSDOLD on BSC would be burned as well, making it the only token on this list that is not BUSD.

The collateral in this case will be the equivalent of the Binance-pegged tokens that are burned. So if 1,000 BUSD on the MATIC network is burned, then the equivalent on the native blockchain will be released by the exchange.

The BUSD stablecoin first came under fire in early 2023 when the United States Securities and Exchange Commission (SEC) issued a Wells Notice to issuer Paxos alleging that the stablecoin was an unregistered security. The regulator, through this, made its intention to pursue legal action known.

Following the move by the SEC, the New York State Department of Financial Services (NYDFS) asked the issuer to stop printing new tokens. The NYDFS’s concern mainly bordered on Paxos’ relationship with Binance, and eventually, the BUSD issuer decided to cut ties with the crypto exchange.

Since the initial move by regulators, the stablecoin has suffered in terms of usage and market cap. The stablecoin which was once a top 10 crypto by market cap has since seen its market cap decline to $2.5 billion, making it the 26-largest cryptocurrency as of the time of this writing.

Binance has also announced plans to stop offering support for the stablecoin completely by 2024. Paxos also revealed that it will cease all BUSD redemptions in February 2024, and Binance’s complete withdrawal is expected to come shortly after this.

Nevertheless, the stablecoin continues to maintain its dollar peg quite well. It is still trading at a 1:1 parity with the United States dollar and has rarely dipped below $1 amid the regulatory storm.

The U.S. attorney sees no reason for potential jurors to discuss effective altruism or ADHD, among other things, before trying SBF.