The country’s financial regulator AMF has “enhanced” registration requirements for digital asset service providers set to take effect on Jan. 1, 2024.

Shiba Inu Investors Jubilate As Meme Coin Jumps 18% Ahead Of Shibarium Debut

Amidst a more extensive revival in the cryptocurrency market, the value of Shiba Inu has witnessed a significant upward trend today, giving investors of the meme coin a reason to be happy. The surge in its value can be attributed not only to the prevailing favorable feeling in the cryptocurrency industry, but also to a fundamental reason that is bolstering its worth.

According to data from the crypto market tracker Coingecko, as of the time of writing, the trading price of SHIB reached $0.00000974, reflecting a notable increase of nearly 3% within the past 24 hours. Furthermore, the data reveals that SHIB has demonstrated a commendable upward trend of 18.2% over the course of the previous seven days.

On Wednesday, the cryptocurrency SHIB experienced a significant increase of approximately 5.75%, reaching a value of $0.00001005. This upward movement is part of an ongoing pattern of recovery that commenced two days prior. In aggregate, the price has undergone a reversal of nearly 15% from its most recent nadir of $0.0000947.

As the situation progressed, it can be observed from an on-chain standpoint that a significant number of the wealthiest addresses associated with Shiba Inu had acquired a notable quantity of SHIB tokens during its recent price recovery over the course of the previous two days.

Within the realm of cryptocurrency, specifically in relation to canine-themed currencies, Shiba Inu has garnered substantial interest due to its remarkable surge in popularity. Through a dedicated pursuit of diverse advancements, the network strives to emancipate itself from being narrowly categorized as a mere cryptocurrency associated with memes.

One notable example that deserves attention is Shibarium, which distinguishes itself as an innovative layer-2 scaling solution. The diligent endeavors devoted to its creation are approaching the point of realization, with a prospective launch scheduled for the current month.

The imminent technological milestone is eliciting increased enthusiasm among the community, not just because to the development in technology it represents, but also because of the wider ramifications it may entail.

Simultaneously, this positive advancement corresponds with a dominant sense of expectation of a significant change in the direction of the asset’s value. The confluence of Shibarium’s launch and the anticipated fluctuation in price intersect to generate a juncture of considerable prospective metamorphosis for the ecosystem.

The convergence of technological innovation and market dynamics is being closely observed by stakeholders, who are eager to assess the collective influence on the project’s progress and its market value.

Meanwhile, according to the principal inventor of the pseudonymous memecoin, Shytoshi Kusama, Shiba Inu’s forthcoming blockchain-based digital identity initiative is expected to offer a wide range of applications that will contribute to the preservation of decentralization.

The official Twitter account of Shib, an ecosystem within the cryptocurrency space, has made an announcement stating that Kusama intends to incorporate Self-Sovereign Identity (SSI) into all Shiba Inu enterprises.

SSI refers to a blockchain-driven identification solution that bears resemblance to digital passports. This solution empowers users with absolute authority over the storage and utilization of their personal identity information.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from VectorStock

BNB Chain hard fork to improve security and compatibility with EVM chains

Binance’s BNB Chain is set for two upgrades aimed at improving the finality of the network and compatibility with other EVM blockchains.

Biden administration launches AI cybersecurity challenge to ‘protect Americans’

With an allocation of nearly $20 million in rewards, the AI Cyber Challenge brings together prominent AI enterprises such as Anthropic, Google, Microsoft and OpenAI.

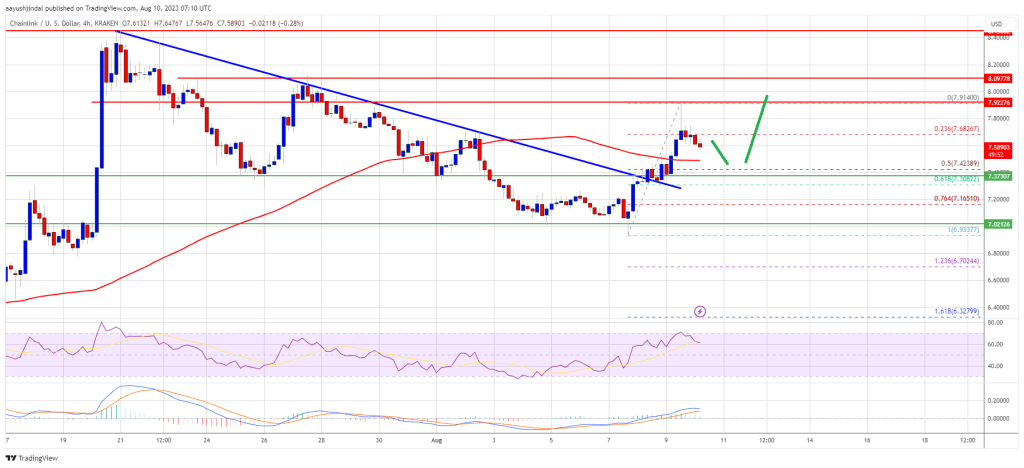

LINK Price Prediction: Chainlink Turns Attractive On Dips

Chainlink’s LINK price is showing positive signs pace above $7.20. The price could rise further if it stays above the $7.30 support zone.

- Chainlink token price is showing positive signs and rising from $7.00 against the US dollar.

- The price is trading above the $7.30 level and the 100 simple moving average (4 hours).

- There was a break above a major bearish trend line with resistance near $7.35 on the 4-hour chart of the LINK/USD pair (data source from Kraken).

- The price could gain bullish momentum above the $7.35 resistance zone.

Chainlink (LINK) Price Eyes More Gains

After a short-term downside correction, LINK price found support near the $6.95 level against the US Dollar. A low was formed near $6.933 and the price started a fresh increase, unlike Bitcoin and Ethereum.

There was a clear move above the $7.10 and $7.20 resistance levels. Besides, there was a break above a major bearish trend line with resistance near $7.35 on the 4-hour chart of the LINK/USD pair. Finally, the pair traded close to the $8.00 zone.

A high is formed near $7.914 and the price is now correcting gains. There was a move below the 23.6% Fib retracement level of the upward move from the $6.933 swing low to the $7.914 high.

Source: LINKUSD on TradingView.com

LINK price is now trading above the $7.30 level and the 100 simple moving average (4 hours). It is now facing resistance near the $7.80 level. The first major resistance is near the $7.95 zone. A clear break above $7.95 may possibly start a fresh increase toward the $8.20 and $8.255 levels. The next major resistance is near the $8.50 level, above which the price could revisit $8.80.

Dips Supported?

If Chainlink’s price fails to climb above the $7.95 resistance level, there could be a downside correction. Initial support on the downside is near the $7.50 level and the 100 simple moving average (4 hours).

The next major support is near the $7.30 level and 61.8% Fib retracement level of the upward move from the $6.933 swing low to the $7.914 high, below which the price might test the $7.10 level. Any more losses could lead the price toward the $7.00 level in the near term.

Technical Indicators

4 hours MACD – The MACD for LINK/USD is losing momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for LINK/USD is now above the 50 level.

Major Support Levels – $7.50 and $7.30.

Major Resistance Levels – $7.80 and $7.95.

Aptos Token Surges on Microsoft Partnership Ahead of APT Supply Unlock

Some $33 million worth of the tokens are set to be unlocked and tradeable on the open market.

SEC use of Terraform ruling hints Coinbase dismissal motion attack plan

The SEC claims a court ruling gives it authority over crypto, setting up a possible counter-argument in dismissal motions brought against it.

Ethereum Price Prints Bullish Technical Pattern, Why Close Above $1,880 Is Critical

Ethereum price is aiming for a fresh increase above the $1,880 zone against the US Dollar. ETH could rally unless there is a close below the $1,830 support.

- Ethereum is facing major resistance near $1,875 and $1,880.

- The price is trading above $1,830 and the 100-hourly Simple Moving Average.

- There is a bullish flag pattern forming with resistance near $1,860 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it clears the $1,860 and $1,880 resistance levels.

Ethereum Price Holds Support

Ethereum’s price started a decent increase from the $1,800 zone. ETH climbed above the $1,850 and $1,860 levels. However, the bears are still active near $1,880, similar to Bitcoin.

A high was formed near $1,876 and the price saw a downside correction. There was a move below the $1,860 level. The price declined below the 23.6% Fib retracement level of the upward move from the $1,800 swing low to the $1,876 high.

Ether is now trading above $1,830 and the 100-hourly Simple Moving Average. There is also a bullish flag pattern forming with resistance near $1,860 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

On the upside, immediate resistance is near the $1,860 level and the trend line. The first major resistance is near the $1,875 level. The next key resistance is near the $1,880 level, above which the price might rise toward the $1,920 zone. Any more gains might send the price toward the $2,000 hurdle. A close above the $2,000 level could set the pace for a larger increase.

Fresh Decline in ETH?

If Ethereum fails to clear the $1,880 resistance, it could start another decline. Initial support on the downside is near the $1,845 level and the 100-hourly Simple Moving Average.

The first major support is near the $1,835 zone or the 50% Fib retracement level of the upward move from the $1,800 swing low to the $1,876 high, below which the price might test the $1,820 support zone. The next major support is near the $1,800 support level. Any more losses might start a strong decline to $1,720.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $1,830

Major Resistance Level – $1,880

SEI Token Could Reach Nearly Half a Billion Market Cap on Binance Debut

Decentralized exchange Aevo rolled out a new product on Wednesday that allows traders to express bullish/bearish view on tokens awaiting an exchange listing.

‘No fucking way’ — Joe Rogan, Post Malone slam US government CBDC

Central bank digital currencies have turned out to be a popular talking point among the American public, garnering takes from comedians, rappers and presidential candidates alike.

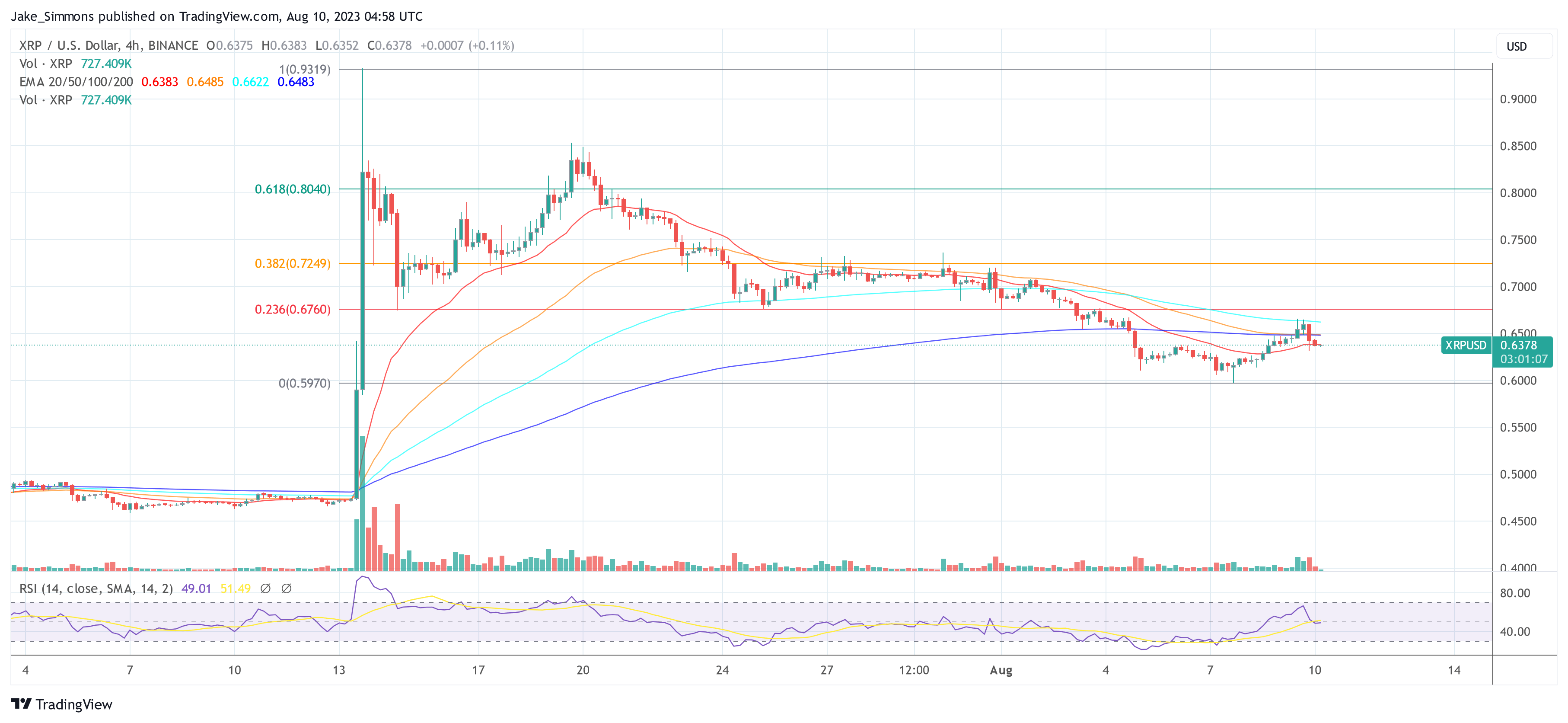

SEC Asks Court To File Interlocutory Appeal Vs. Ripple, XRP Price Stable

In a meticulously detailed letter to Judge Analisa Torres of the Southern District of New York, the US Securities and Exchange Commission (SEC) has delineated its grounds for seeking an interlocutory appeal against Ripple Labs Inc. This move, which has sent ripples (pun intended) through the XRP community, focuses on the intricate legalities surrounding Ripple’s sales and distributions of XRP.

Ripple Vs. SEC: Interlocutory Appeal Incoming

The SEC’s primary contention revolves around Ripple’s “programmatic” sales to XRP buyers over crypto asset trading platforms and Ripple’s “other distributions” in exchange for labor and services. The regulatory body asserts that these transactions should be classified as offers or sales of securities, drawing upon the precedent set by the Howey case.

The SEC’s letter states, “Specifically, the SEC seeks to certify the Court’s holding that Defendants’ ‘Programmatic’ offers and sales to XRP buyers over crypto asset trading platforms and Ripple’s ‘Other Distributions’ in exchange for labor and services did not involve the offer or sale of securities under SEC v. W.J. Howey Co., 328 U.S. 293 (1946).”

Delving deeper into the document, the SEC underscores the existence of an intra-district split (Judge Jed Rakoff’s ruling in the SEC vs. Terra case) indicating that there are substantial grounds for differences in legal opinion. The letter points out, “Interlocutory review is warranted here. These two issues involve controlling questions of law on which there is substantial ground for differences of opinion, as reflected by an intra-district split that has already developed.”

The SEC further draws attention to the potential implications of the court’s previous order, suggesting that it could influence a multitude of pending litigations. The document reads, “The Programmatic Sales and Other Distributions rulings concern issues that may arise in various pending cases, including many in this Circuit where the alleged investment contracts were offered and sold by issuers – like Ripple – on crypto asset trading platforms or for non-cash consideration.”

Jeremy Hogan, a legal luminary in the XRP community, weighed in, noting, “AND… the SEC continues making questionable decisions, requesting an interlocutory appeal. Note that it is NOT appealing whether XRP itself is a security – just its losses on the programmatic and individual sales issues.”

Stuart Alderoty, Ripple’s Chief Legal Officer (CLO), clarified the SEC’s intent, emphasizing that the regulatory body is in the preliminary stages of seeking the court’s permission for the appeal. He stated, “The SEC does not have the right to appeal just yet which is why they are asking permission to file an interlocutory appeal. Ripple will file its response with the Court next week.”

XRP Price

Despite the intricate legal maneuvers and the potential ramifications, XRP’s market price has remained notably stable, suggesting a mature market response to the ongoing legal developments. At press time, XRP actually saw a slight uptick, trading at $0.6378.

NFT project y00ts to return $3M grant as it ditches Polygon for Ethereum

DeLabs has promised to return the $3 million grant initially provided by Polygon Labs to support y00ts from Solana to Polygon.

Bitcoin Price Trims Gains But Resistance Turned Support Intact

Bitcoin price started a downside correction from $30,200. BTC is now trading near the previous breakout resistance at $29,400.

- Bitcoin is correcting gains and trading below the $29,800 level.

- The price is trading above $29,400 and the 100 hourly Simple moving average.

- There was a break below a key bullish trend line with support near $29,840 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $29,400 support zone.

Bitcoin Price Holds Support

Bitcoin price started a decent increase above the $29,400 and $29,500 resistance levels. BTC even broke the $30,000 level but there was no daily close. A high was formed near $30,190 and the price started a downside correction.

There was a move below the $30,000 and $29,800 levels. The price dipped below the 23.6% Fib retracement level of the upward move from the $28,628 swing low to the $30,190 high. Besides, there was a break below a key bullish trend line with support near $29,840 on the hourly chart of the BTC/USD pair.

Bitcoin price is now trading above $29,400 and the 100 hourly Simple moving average. It is also holding the key pivot zone at $29,400. It is close to the 50% Fib retracement level of the upward move from the $28,628 swing low to the $30,190 high.

Immediate resistance is near the $29,680 level. The first major resistance is near the $29,800 level. The next major resistance is near the $30,000 level, above which the price could revisit $30,200.

Source: BTCUSD on TradingView.com

A close above the $30,200 resistance might start another steady increase. In the stated case, the price could test $31,200 or even $32,000 in the coming days.

More Losses In BTC?

If Bitcoin fails to clear the $29,800 resistance, it could start a fresh decline. Immediate support on the downside is near the $29,400 level.

The next major support is near the $29,300 level or the 100 hourly SMA. A downside break below the $29,300 level might spark bearish moves. In the stated case, the price could revisit $29,000. Any more losses might call for a move toward the $28,680 level in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $29,400, followed by $29,300.

Major Resistance Levels – $29,800, $30,000, and $30,200.

Apple’s 30% tax rules will stay for now, crypto and NFTs may have to wait

A Supreme Court judge has rejected a request from Epic Games that would’ve immediately loosened Apple’s App Store payment rules, to the potential benefit of crypto and NFT apps.

Litecoin Hash Rate Steady Despite Dismal Price Action: Will This Change?

One week after the highly anticipated Litecoin halving event on August 2, on-chain data reveals that the network’s hash rate, a key measure of computing power channeled to the network, is steady but erratic.

As of August 9, trackers indicate that the Litecoin network’s hash rate is hovering around 760 TH/s, a notable decrease from the all-time peak of 816 TH/s recorded in late July 2023.

Litecoin Prices Steady But Lower, Rally Incoming?

Litecoin prices, on the other hand, are firm but down in the previous week of trading. CoinMarketCap data on August 9 shows that LTC is changing hands at $83, down 5% over the past week. What’s clear is that prices are moving tightly inside a consolidation range.

Despite this dip, LTC is relatively resilient, up 17% from June 2023 lows. However, from a top-down preview, the coin is down 26% from the 2023 highs. In the medium term, LTC remains bullish since bears have failed to unwind gains posted from mid-June to mid-July 2023. Whether bulls will maintain control after halving, however, is also unclear.

If past performance guides, there is a glimmer of hope for bulls. The previous Litecoin halving in August 2019 was several months before LTC ripped to $400 in 2021. Even so, before this spike, LTC prices nearly halved from $66 to $35 in December 2019.

Unlike previous halvings, the crypto space has matured, and regulatory clarity has improved, particularly concerning Bitcoin—the foundational protocol from which Litecoin emerged. For instance, while most US regulators consider Bitcoin a commodity, the Securities and Exchange Commission (SEC) is cautious toward other altcoins.

Tracking On-Chain Metrics To Gauge Interest

Considering the above challenges and regulatory uncertainty, the interconnection between hash rate and spot prices is actively monitored. Litecoin relies on decentralized miners for security and transaction confirmation.

The network’s security is evaluated via the hash rate metric, which risks crashing since miners must allocate more resources after the network halved rewards to 6.25 LTC. A potential price decline could trigger a corresponding reduction in hash rate, forcing the network to adjust the difficulty.

How this evolves remains to be seen, and the network remains stable at spot rates. Besides the hash rate near all-time highs, the network’s activity seems unaffected. According to IntoTheBlock data, the network’s average growth is steady despite sentiment on LTC being generally negative.

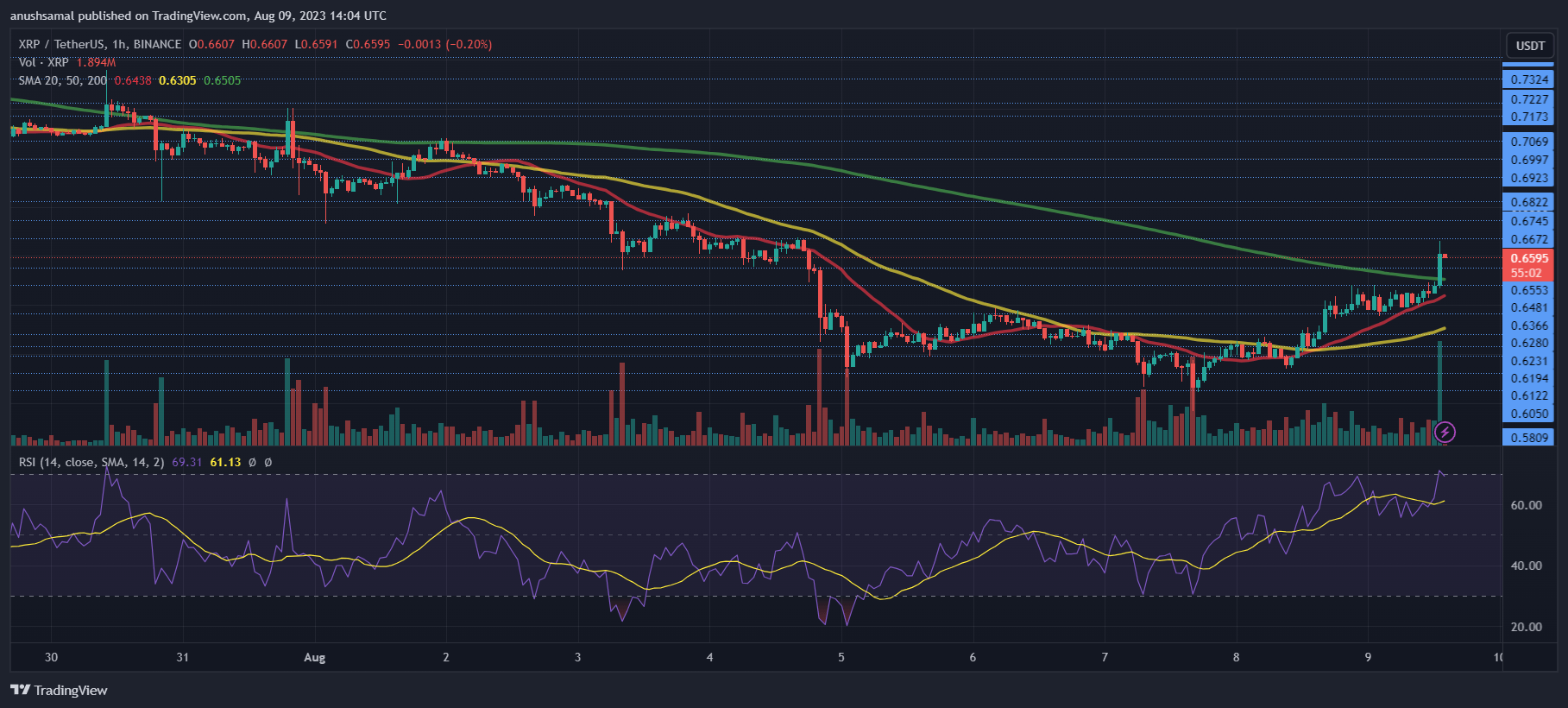

XRP Could Experience Nearly 10% Surge Upon Immediate Break Of These Key Levels

XRP has halted its decline by rising above the $0.60 price level. In the past 24 hours, its value increased by nearly 6%. However, XRP hasn’t yet shown significant gains on the weekly chart.

The technical analysis suggests a positive trend for XRP, but there’s a chance that the coin could face more downward movement in the upcoming trading sessions.

If buyers push the price higher, XRP might maintain its position above the current price level. Moreover, breaking through two crucial resistance levels could lead to a potential surge of over 9%. For XRP to keep rising, the broader market must provide support, particularly Bitcoin’s movement beyond the $30,000 zone.

If buying momentum doesn’t recover, XRP might experience a decline and drop below its local support line. The increasing market capitalization of XRP indicates active buyer participation at the present moment.

XRP Price Analysis: One-Day Chart

At the time of writing, the altcoin was priced at $0.65. This value has presented significant resistance for the altcoin in recent weeks. The upcoming trading sessions hold critical importance as XRP must effectively surpass this level.

Failing to achieve this could trigger a subsequent decline in the price. Furthermore, overhead resistance levels are $0.67, followed by $0.69. Should XRP successfully breach the $0.69 mark, the altcoin might trade around the $0.72 range. Conversely, a local support level is positioned at $0.63.

Should the price dip below this threshold, it could potentially descend to $0.60, ultimately pausing the overall bullish sentiment.

Technical Analysis

For demand, XRP’s chart indicates its current state as overbought. The Relative Strength Index has reached 70, indicating buyers currently influence the price direction. This could imply the potential for a price correction in the upcoming trading sessions.

While such a correction might not be prolonged, any drop in XRP’s value below $0.63 might reduce buyer activity.

The asset’s price remained positioned above the 20-Simple Moving Average line. This observation signifies an increasing demand and emphasizes buyers’ role in steering the market’s price dynamics.

Furthermore, the altcoin has generated buy signals in response to the rising demand. These buy signals are represented by the emergence of green histograms in the Moving Average Convergence Divergence indicator, signaling a bullish sentiment.

Additionally, the Directional Movement Index presents a positive outlook, with the +DI (blue) line positioned above the -DI (orange) line, indicating a favorable price trajectory.

Moreover, the Average Directional Index (Red) has crossed the 40 mark, implying an increase in the strength of the price trend. This development suggests XRP could yield additional gains in the near-term trading sessions.

Y00ts NFT Collection is Migrating to Ethereum After Accepting $3M Grant From Polygon

DeGods project leader Rohun Vora, known as Frank, said that the move aims to “unite the DeGods and y00ts communities” on the same blockchain. Polygon said it would re-deploy some of the returned funds to support its native builders and creators.

Aptos token rises 11.6% after Microsoft deal to marry AI with blockchain

APT pumped 17.6% within the first 50 minutes before cooling off to $7.51 — still 11.6% above pre-announcement levels.

First Mover Asia: SEC Appealing XRP Ruling Isn’t Moving Markets

Fireblocks discloses massive vulnerability affecting crypto wallets

Fireblocks said the vulnerabilities affecting Coinbase, Binance, and Zengo have since been fixed and has reached out to more than 12 others still at risk.