Binance is on the move once again with new special listings for Dogecoin, Cardano, and Chainlink, among others. The exchange has announced brand new crypto trading pairs for these cryptocurrencies which would bring advantages to traders.

Binance Adds New Dogecoin, Cardano, And Chainlink Pairs

In a new development that was revealed on Christmas Day, the Binance crypto exchange has expanded its list of pairs available for both Cross Margin and Isolated Margin users. The announcement revealed that it will be adding 11 new pairs across these two products.

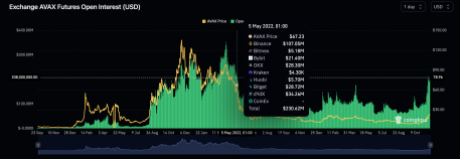

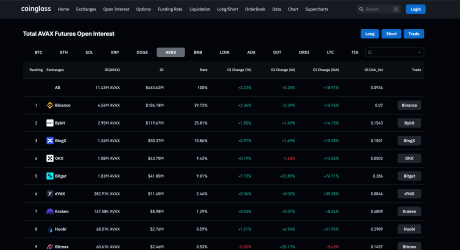

The new pairs are mainly denominated in the FDUSD pair, a stablecoin that the exchange adopted after Paxos was ordered to stop issuing BUSD tokens. The new pairs in the Cross Margin feature include “ ADA/FDUSD, AEUR/USDT, AVAX/FDUSD, DIA/USDT, DOGE/FDUSD, IOTX/ETH, LINK/FDUSD, MATIC/FDUSD, OM/USDT, POLS/USDT.” Meanwhile, only a single new pair was added to the Isolated Margin feature which is IOTX/ETH.

Binance’s move to add new trading pairs across these products shows a move toward providing further liquidity for traders. “Binance Margin strives to enhance user trading experience by continuously reviewing and expanding the list of trading choices offered on the platform, allowing for greater diversification of user portfolios and flexibility with trading strategies,” the crypto exchange said in the announcement.

The move comes only two days after the exchange had announced the removal of multiple spot trading pairs which affected the likes of Dogecoin, Cardano, and Solana, among others. There were no specific reasons for the removal, although the exchange explained that trading pairs can be delisted due to multiple factors.

Crypto Exchanges Cleaning Up Shop

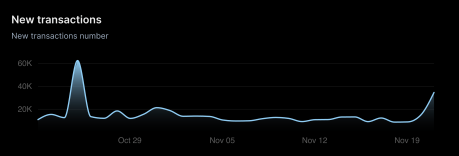

In the last week, there have been multiple instances of crypto exchanges delisting cryptocurrency pairs from their platform. The most prominent delistings for the week came from the Uphold exchange which delisted a number of cryptocurrencies in an effort to keep up with Canadian regulations.

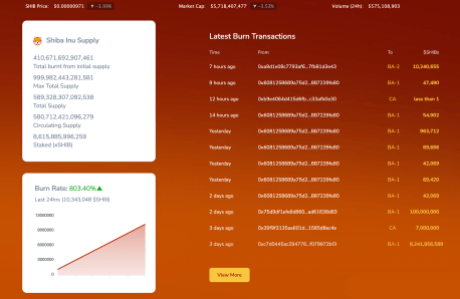

As Bitcoinist reported, Uphold emailed its customers in the region to reveal that it will be desolating 10 Tier 3 cryptocurrencies from the exchange. Those mentioned in the email included Dogecoin (DOGE), Cardano (ADA), Shiba Inu (SHIB), XDC Network (XDC), Kaspa (KAS), Hedera (HBAR), Stellar (XLM), VeChain (VET), Injective (INJ), and Casper (CSPR). Additionally, the crypto exchange revealed it will be delisting all Tier 4 cryptocurrencies as well.

However, unlike Binance’s delisting which only affected some pairs of different cryptocurrencies, Uphold’s move is a total delisting. “Maintaining a healthy ecosystem of digital assets for our customers is one of our top priorities – occasionally delisting assets forms part of this process,” the exchange said.

JUST IN:

JUST IN: (@_Crypto_Barbie)

(@_Crypto_Barbie)