In five short days, three Bitcoin whales have activated addresses with thousands of BTC. The community is concerned that the quick activation of these big BTC wallets might be due to a security flaw affecting wallet private key generators and would adversely affect prices.

Old Bitcoin Wallets Awakening

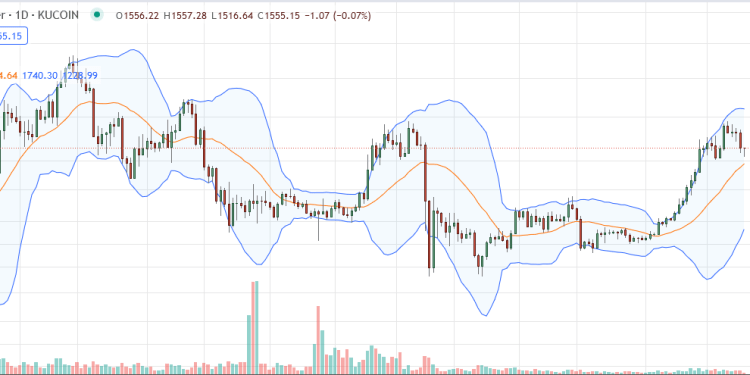

The large BTC movements notably coincide with a sharp retracement of prices from recent peaks of $31,000.

Over the last week, prices have dumped, moving down towards $27,000 and retesting critical support levels. Typically, how whales move coins between addresses and sometimes to centralized exchanges can impact sentiment, subsequently affecting prices.

According to WhaleAlert, 6,071 BTC worth over $178.1 million was transferred on April 20. The sending address still holds 3,999.99999789 BTC and the last time it was active was on October 10, 2021.

A day later, on April 21, another wallet holding 1,128 BTC holding coins worth over $31.5 million moved 278 BTC. While big, the sending address was last activated on June 1, 2021.

The latest movement, though recently moved as early as 15 months ago in mid-December 2021, saw 1,000 BTC valued at more than $27.5 million transferred.

A dormant address containing 1,000 #BTC (27,456,958 USD) has just been activated after 12.0 years!https://t.co/lHrgCNWpbY

— Whale Alert (@whale_alert) April 24, 2023

It has yet to be verified whether the 7, 349 BTC, worth over $201 million at spot rates, moved were transferred to centralized exchanges.

Often, when coins are moved to centralized exchanges like Binance or Coinbase, the community believes they will be liquidated; influencing sentiment.

Old Wallet Private Key Generator Cracked? Will BTC Prices Fall?

One analyst observed that the sudden transfer of huge chunks of BTC could be because of a flaw in an old wallet’s private key generator that has now been exploited. If an unauthorized third party gets a private key, they can recover the wallet and take charge of all coins held by the vault.

If that happens, then old dormant wallets, including Satoshi Nakamoto’s, the founder of Bitcoin; can be compromised. Satoshi Nakamoto is believed to hold 1 million BTC, which he mined in the early days of Bitcoin before disappearing.

There is a general belief that if the identity of Nakamoto is revealed and his coins moved, BTC prices may fall due to the fear of expected liquidation. However, that has not been verified, and none of his coins have been moved.

Unless these wallets are somehow related to Mt Gox cold storage, then some old wallet generator has to have been cracked.

We’re now at waay too many 10+ year wallets springing to life on multiple assets all of a sudden…

— Adam Cochran (adamscochran.eth) (@adamscochran) April 24, 2023

The situation making the rumor a possibility is that it is currently impossible to verify the true owner of the wallet.

The pseudonymous nature of the Bitcoin network means it until the “victim” reveals their true identity and admits that their wallet had been compromised and their stash stolen, there is no way to verify if this was an exploit or if it was the actual owner moving the coins.

Presently, on-chain data direct attention to another key dormant wallet holding 79,957.25 BTC. The wallet was inactive from 2011 until April 24, when it began sending dust transactions. The address has not transferred any amount when writing.

is a crypto whale.

is a crypto whale.