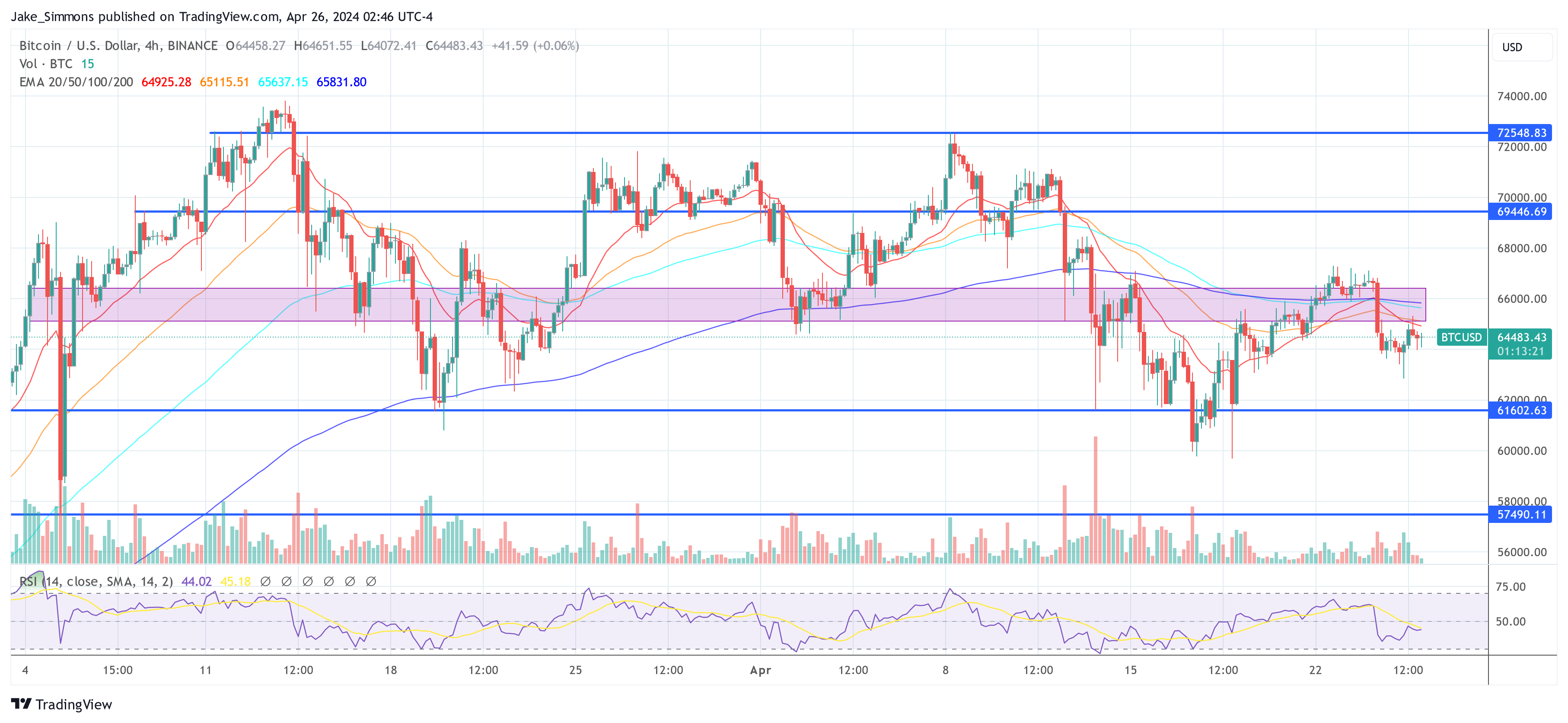

The current Bitcoin price behavior and its deviations from expected cyclical patterns remain a central theme of analysis. Crypto analyst Rekt Capital (@rektcapital) recently shared new insights on X concerning Bitcoin’s potential peak during the ongoing bull run, which is progressing at an atypical pace compared to historical data.

When Will Bitcoin Peak This Cycle?

In a detailed post, Rekt Capital pointed out that as of mid-March 2024, Bitcoin had not only reached new all-time highs but had done so approximately 260 days ahead of its traditional halving-induced cycles. This marked a significant acceleration. “When Bitcoin rallied to new All Time Highs in mid-March 2024, Bitcoin was accelerating in its cycle by 260 days compared to traditional Halving Cycles,” stated Rekt Capital.

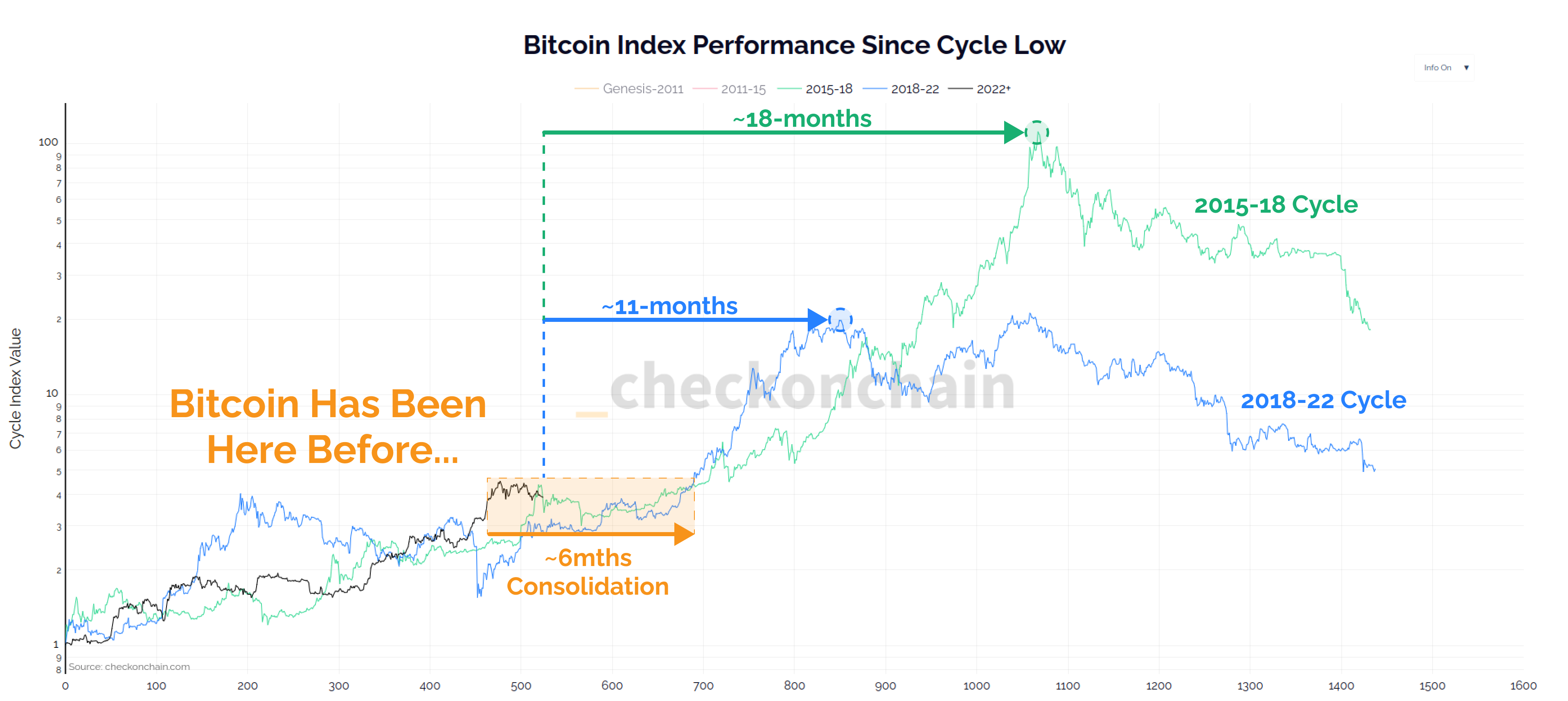

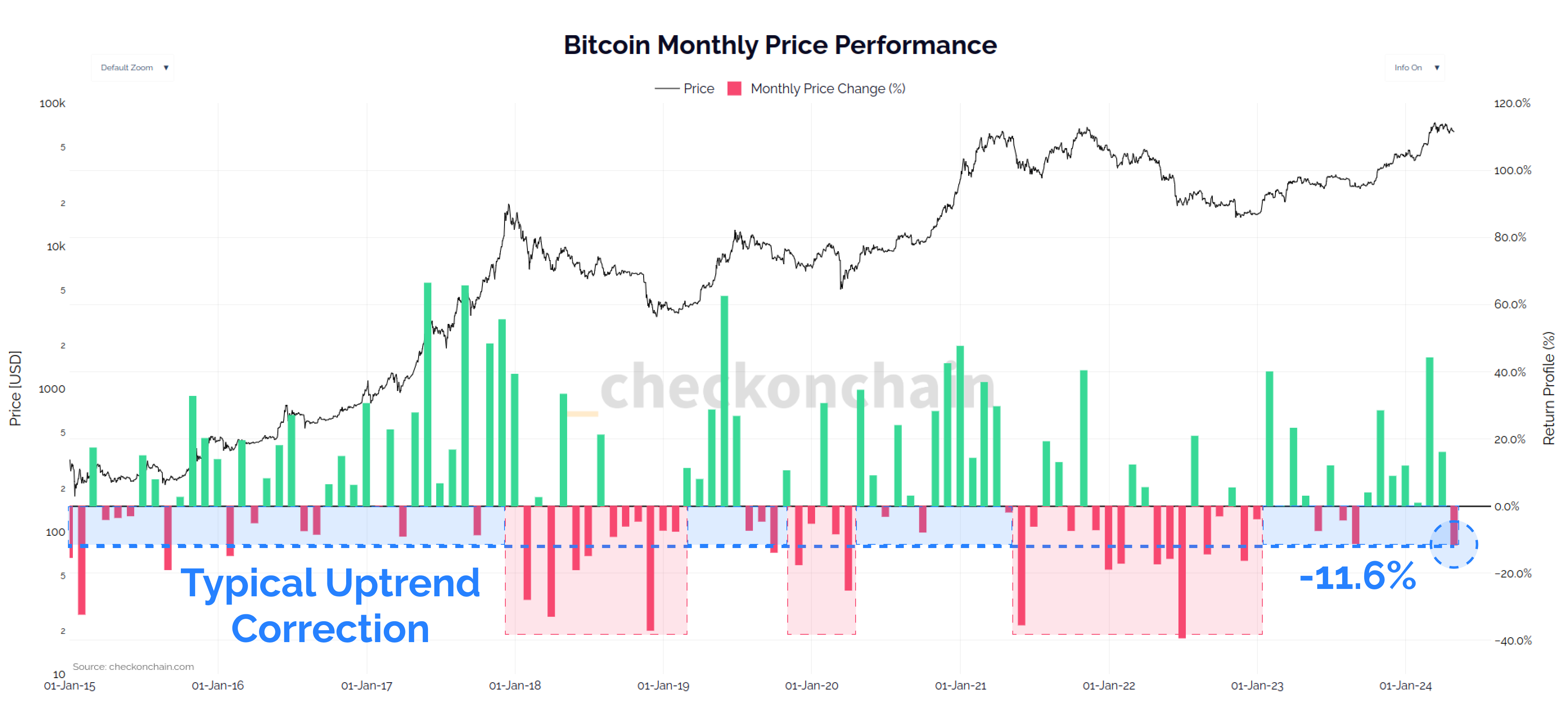

However, this rapid pace has not been sustained. Over the past two months, Bitcoin has been in a phase of consolidation, which has altered its trajectory. The acceleration advantage has decreased to about 210 days compared to previous cycles. This deceleration is a critical factor, as it could lead to a re-synchronization with the typical halving cycle. Typically, BTC peaks 518-546 days after a halving event.

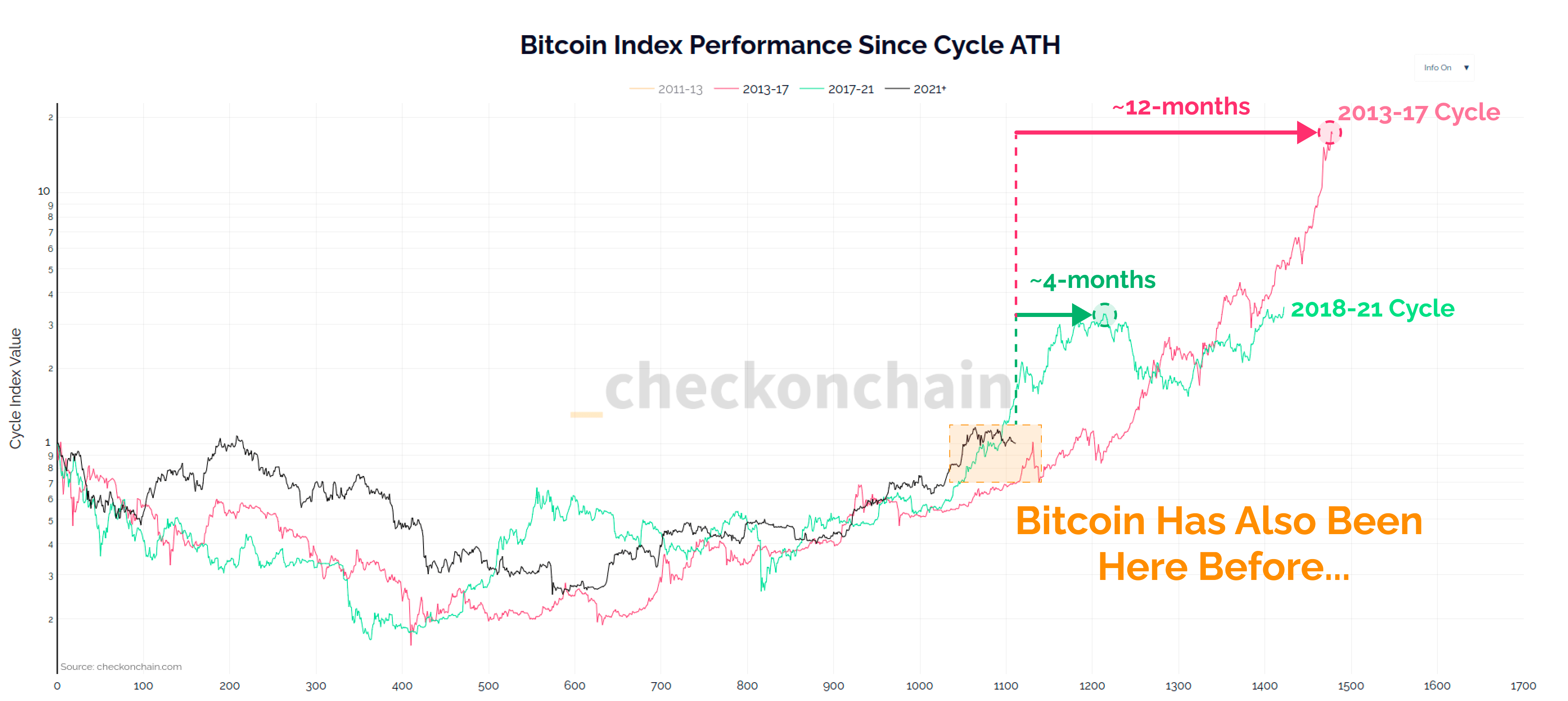

The analyst suggests shifting the predictive focus from just halving events to the periods after Bitcoin surpasses its previous all-time highs. Historically, BTC price tends to reach a bull market top within 266 to 315 days after breaking these thresholds. Given that this milestone was achieved again in mid-March 2024, the projected window for the next bull market peak could be set between late November 2024 and late January 2025.

Nevertheless, a notable trend is the increasing duration for which Bitcoin maintains levels beyond its old highs. In 2013, this period lasted 268 days, in 2017 it extended to 280 days, and by 2021, it had increased to 315 days.

This pattern suggests an incremental extension of approximately 14 to 35 days per cycle. “Historically, the amount of days that Bitcoin has spent beyond old All Time Highs has increased by approximately 14 days to 35 days,” explained Rekt Capital.

Adding these increments to the initial range of 266 to 315 days post-old highs, the peak could potentially extend to between 280 and 350 days post-breakout. This adjustment shifts the expected peak time frame to between mid-December 2024 and early March 2025.

Potential Synchronization With Halving Cycles

Despite the current accelerated cycle, there remains a possibility that further deceleration could align Bitcoin more closely with its halving cycle. In past cycles, such as those between 2015-2017 and 2019-2021, Bitcoin peaked at 518 and 546 days post-halving, respectively. If Bitcoin’s rate of acceleration continues to decrease, the cycle may eventually resynchronize, potentially delaying the peak to between mid-September and mid-October 2025.

Rekt Capital elaborates, “But if Bitcoin continues to reduce its current acceleration in the cycle, it would resynchronize with traditional Halving cycles.” This could result in a peak more aligned with historical patterns, diverging from the current accelerated timeline.

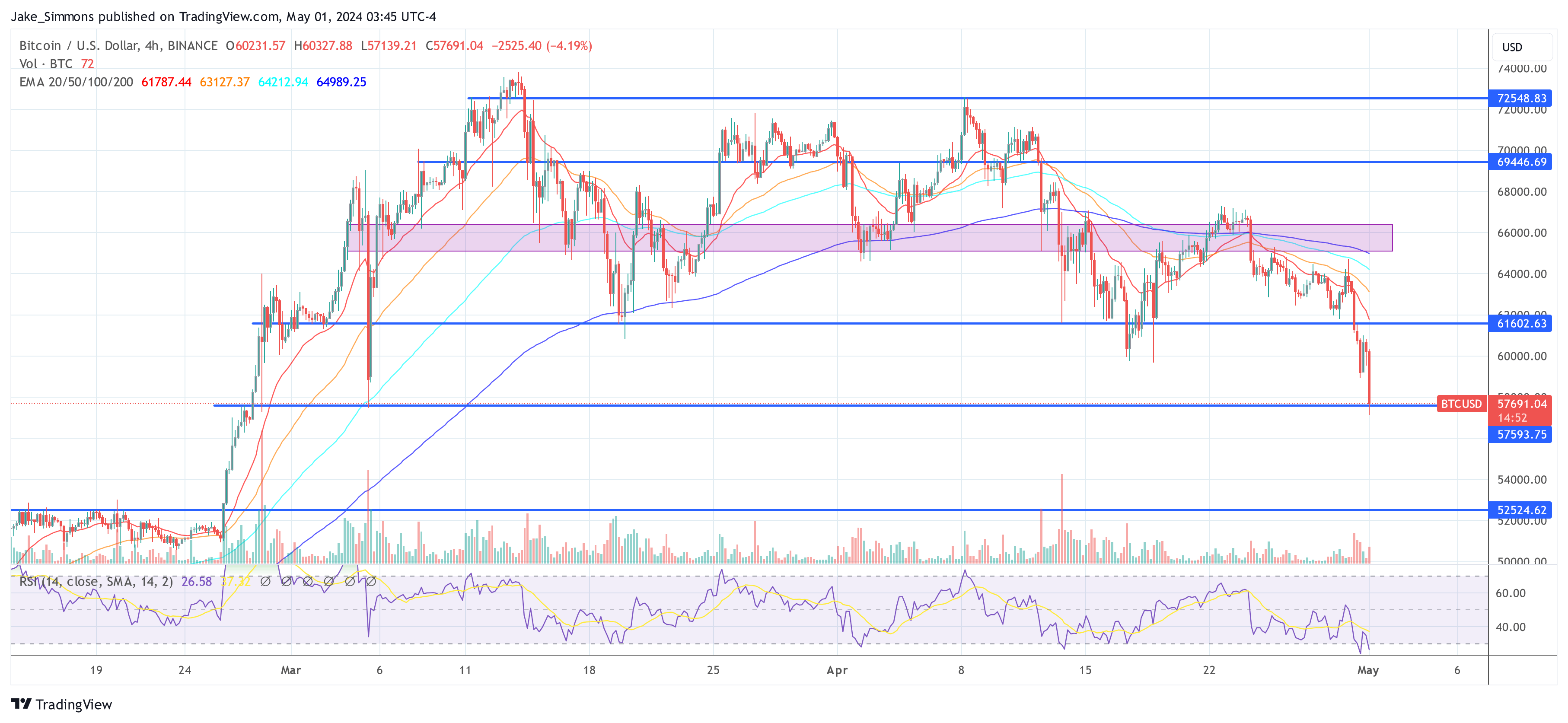

At press time, BTC traded at $64,262.

(@EmperorBTC)

(@EmperorBTC)