Ethereum has been notably underperforming Bitcoin through this latest rally. Here’s why this is so, according to a CryptoQuant analyst.

Ethereum Net Taker Volume Has Been Mostly Negative Recently

In a new post on X, CryptoQuant Netherlands community manager Maartunn has pointed out what the “net taker volume” for Ethereum is looking like.

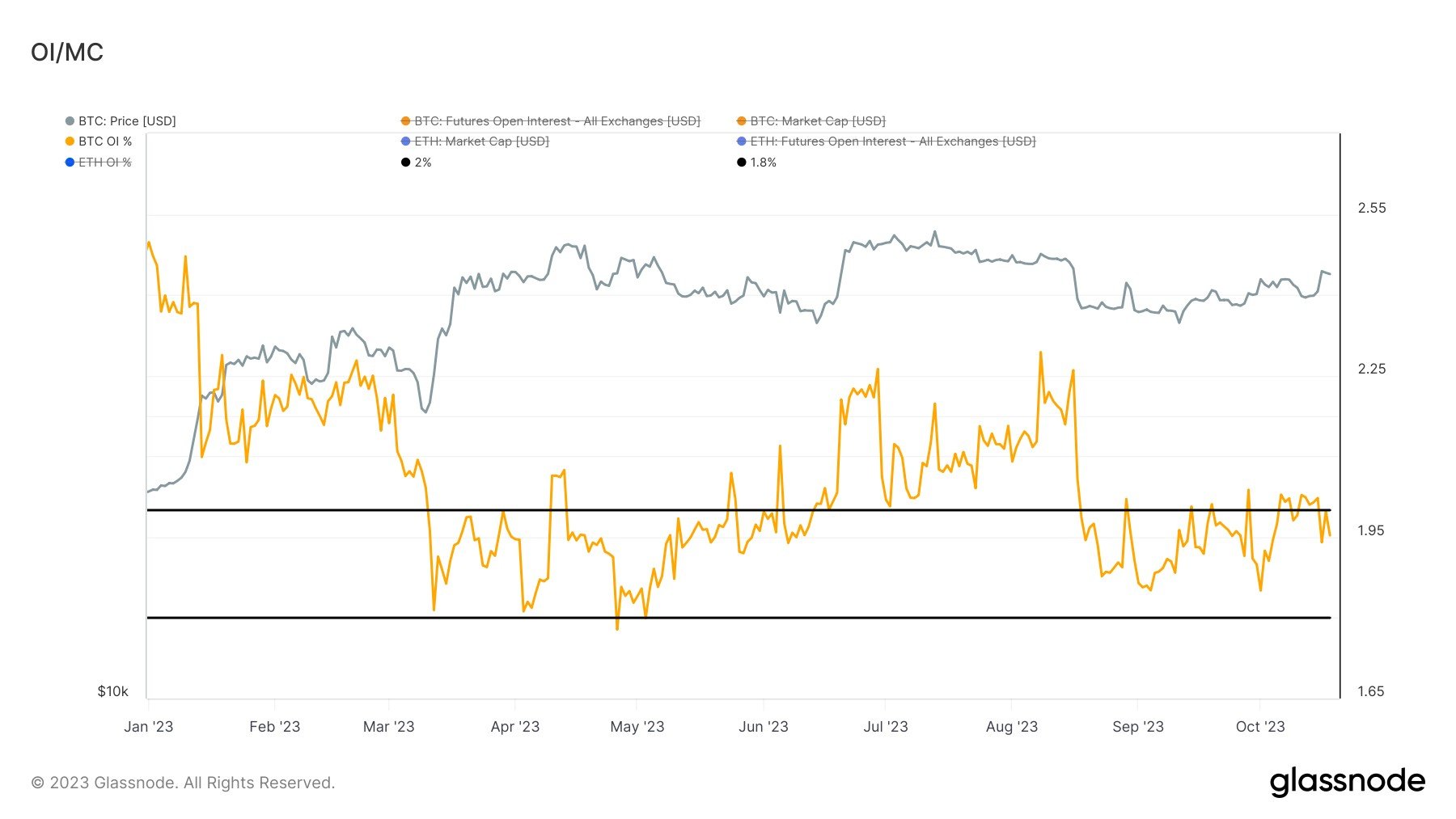

The net taker volume here is an indicator that keeps track of the difference between the taker buy volume and taker sell volume on the Bitcoin futures market.

When the value of this metric is positive, it means that the taker buy volume is dominating the taker sell volume right now. Such a trend implies buying pressure may be strong in the market currently.

On the other hand, negative values could suggest the presence of a bearish sentiment among the investors, as selling pressure is higher than the buying pressure.

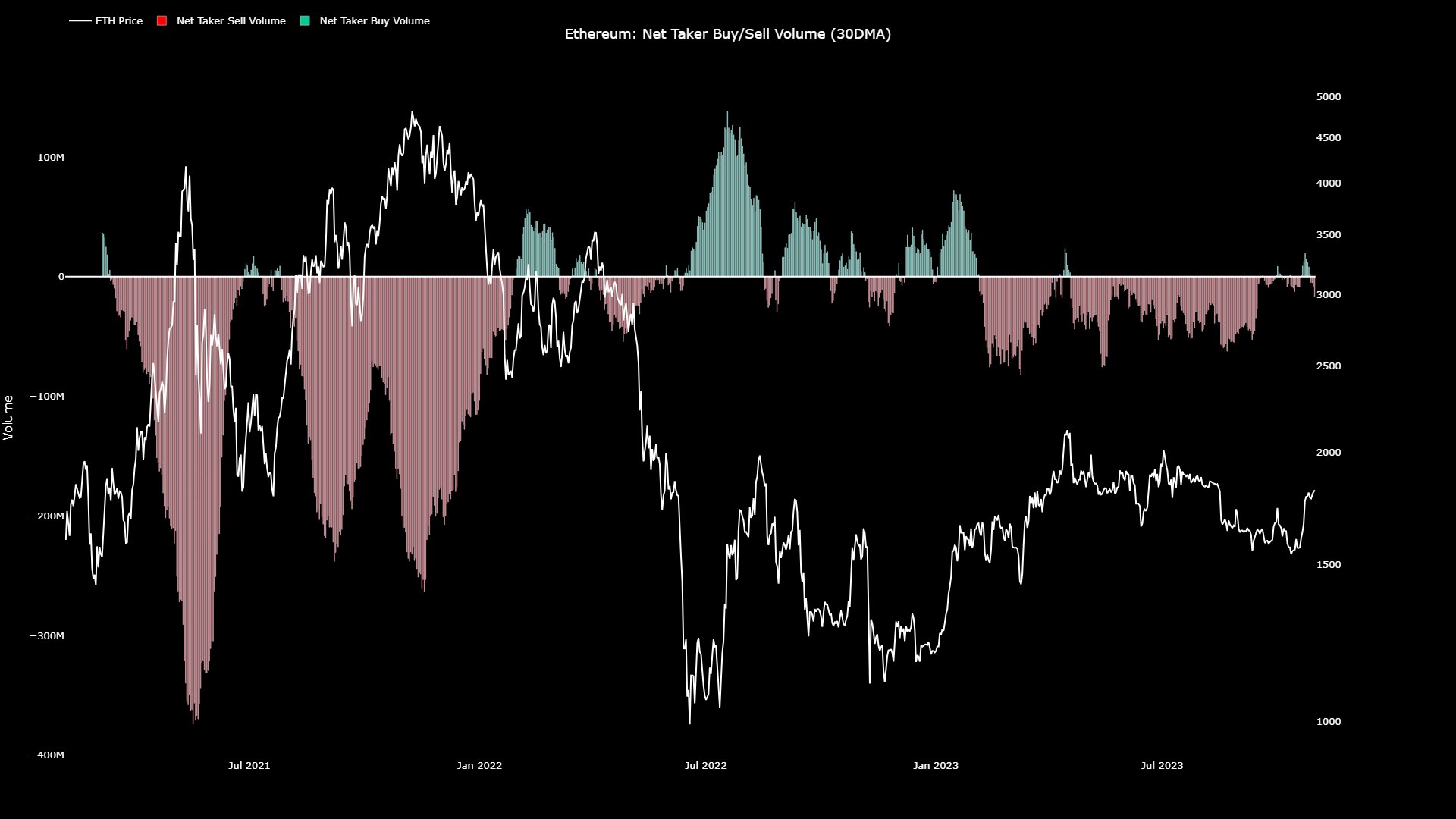

Now, here is a chart that shows the trend in the 30-day moving average (MA) Ethereum net taker volume over the past few years:

As displayed in the above graph, the Ethereum net taker volume has been mostly negative during the past few months, implying that sentiment around the asset has remained bearish.

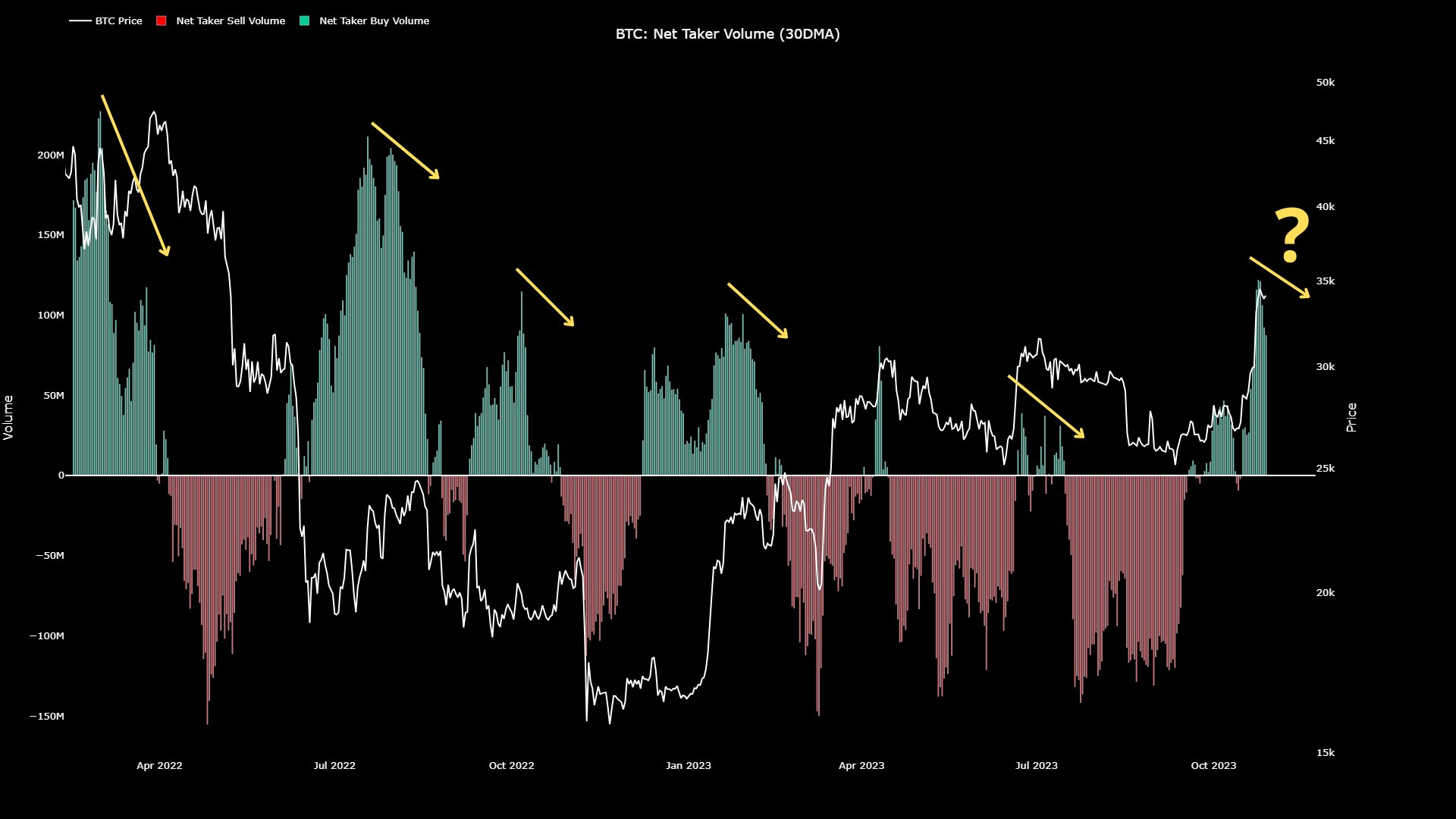

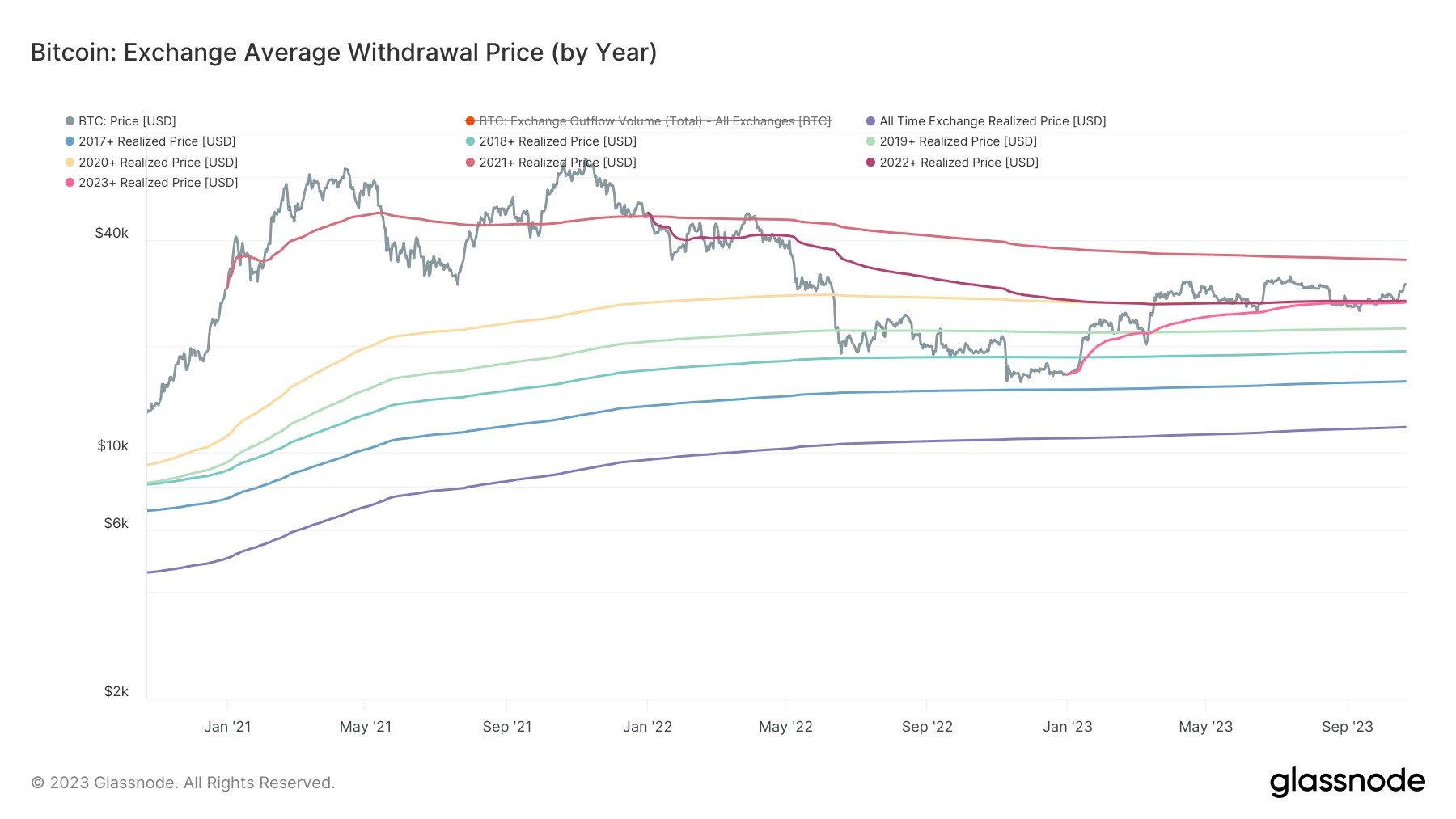

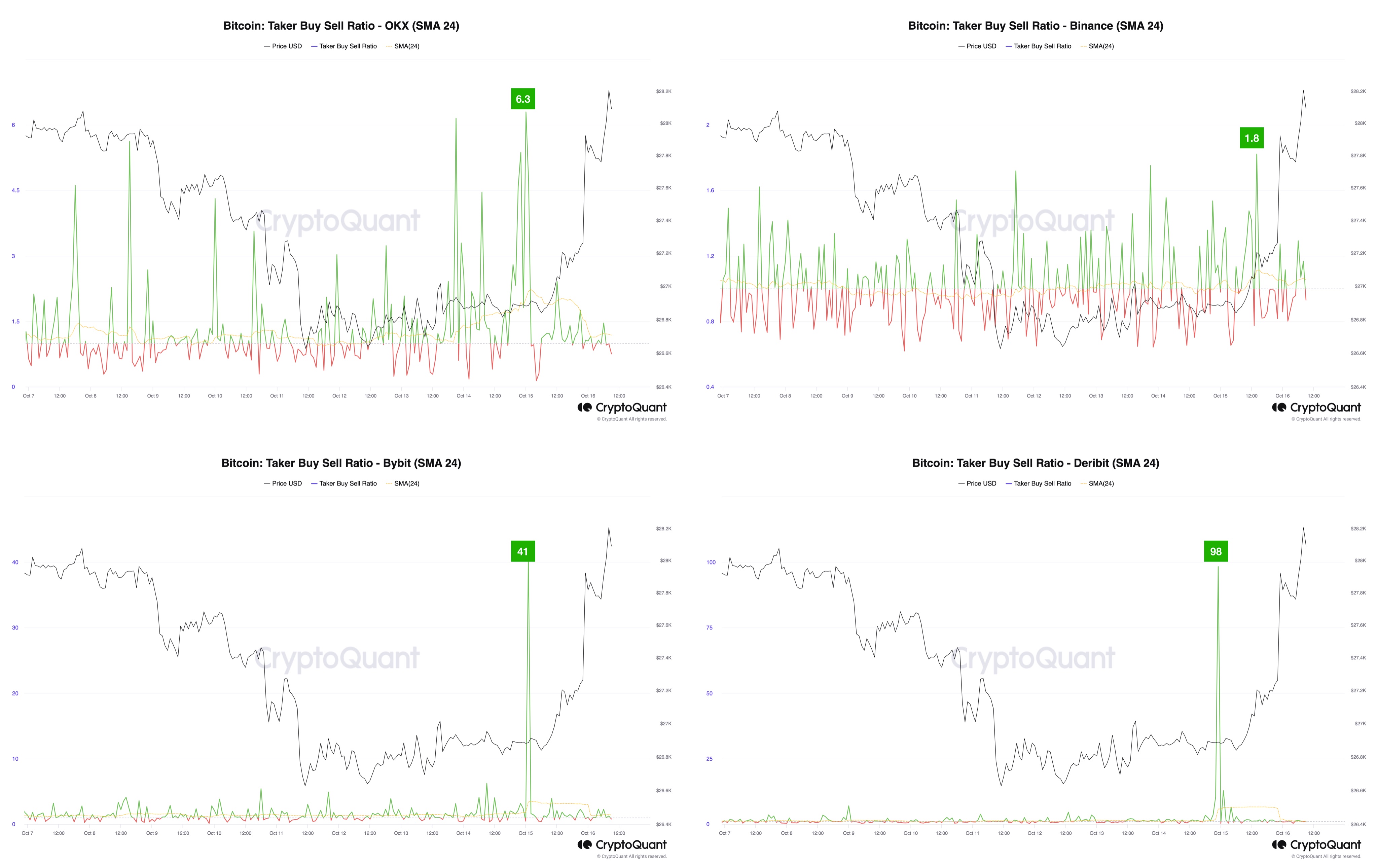

Bitcoin, on the other hand, has enjoyed periods where the taker buy volume has surpassed the taker sell volume, as the chart shared by the analyst a few days back showed.

Most notably, the net taker volume of Bitcoin is significantly positive right now, suggesting the strong buying pressure present in the market. Unsurprisingly, BTC’s sharp rally has come alongside these positive values of the metric.

Ethereum has no such buying pressure present at the moment. Maartunn believes this is why the ETH price has been performing considerably poorly against BTC recently.

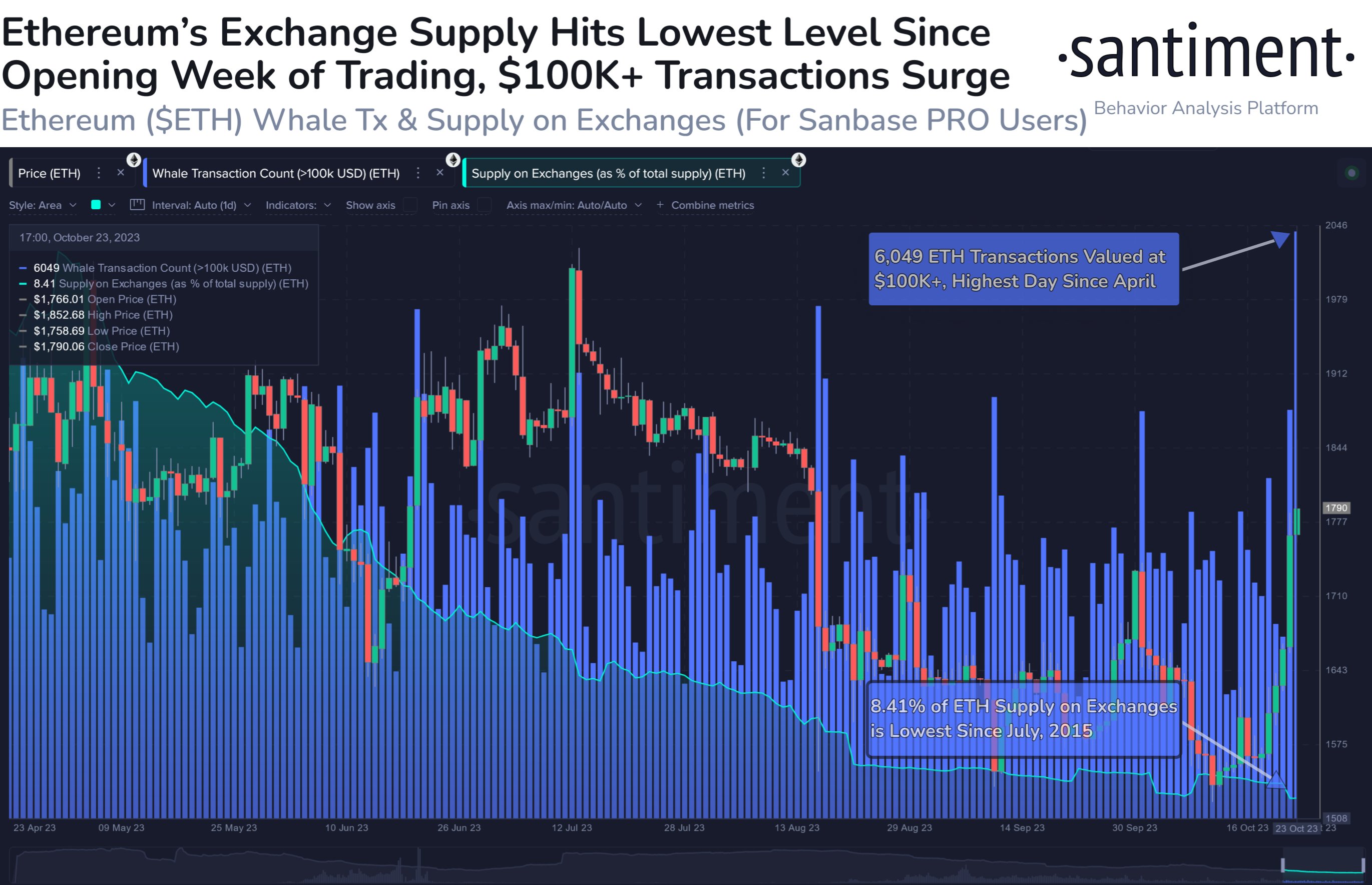

Ethereum Has Still Not Touched The Highs Set Earlier In The Year

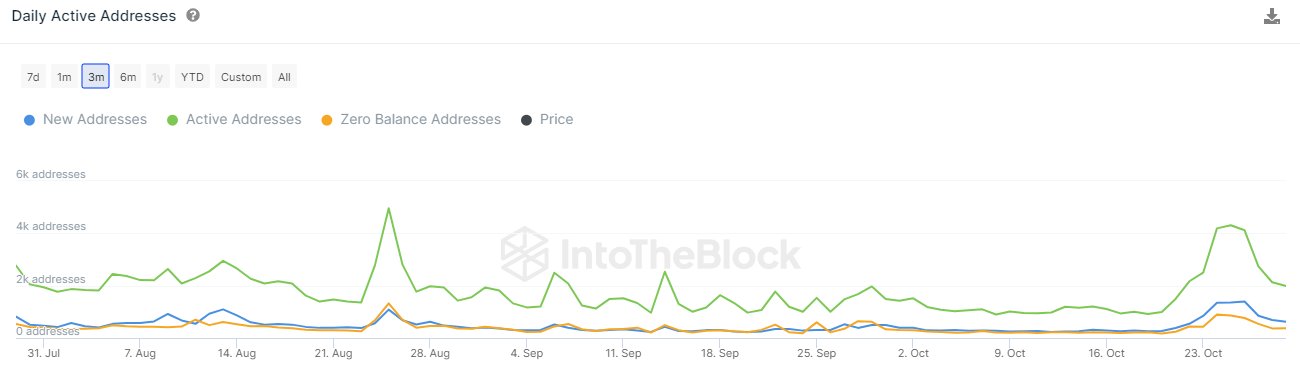

Ethereum’s underperformance against Bitcoin is easily visible in the asset’s year-to-date chart.

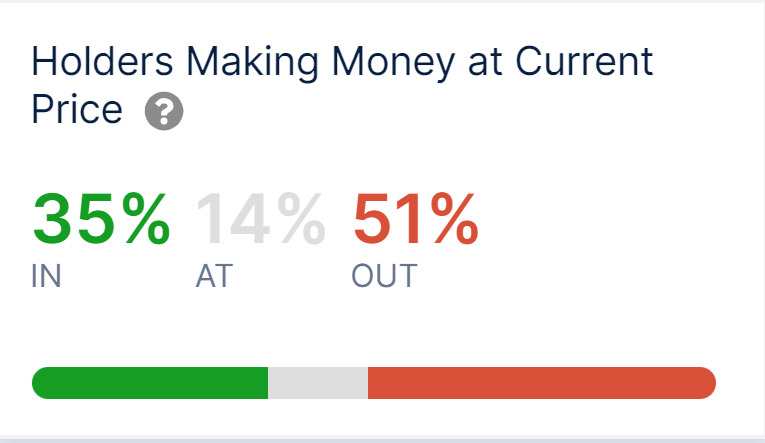

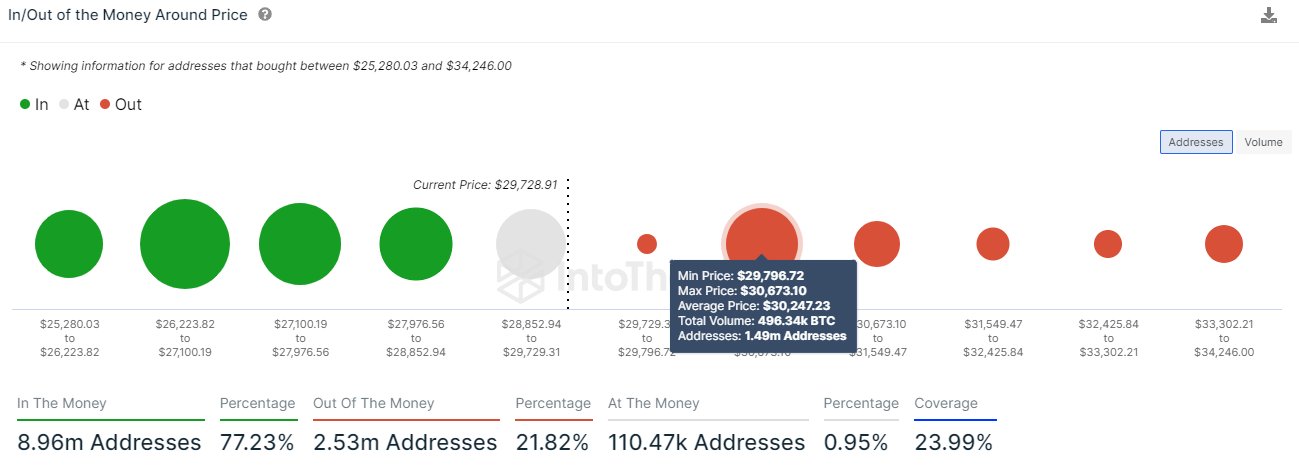

At the same time as Bitcoin observed its rally off the back of the highly positive net taker volume, Ethereum also saw a surge of its own. This rise, though, has been nowhere near as sharp as that of the original cryptocurrency, as ETH is still just trading around $1,800, which is notably less than the top of around $2,100 that the asset set back in April.

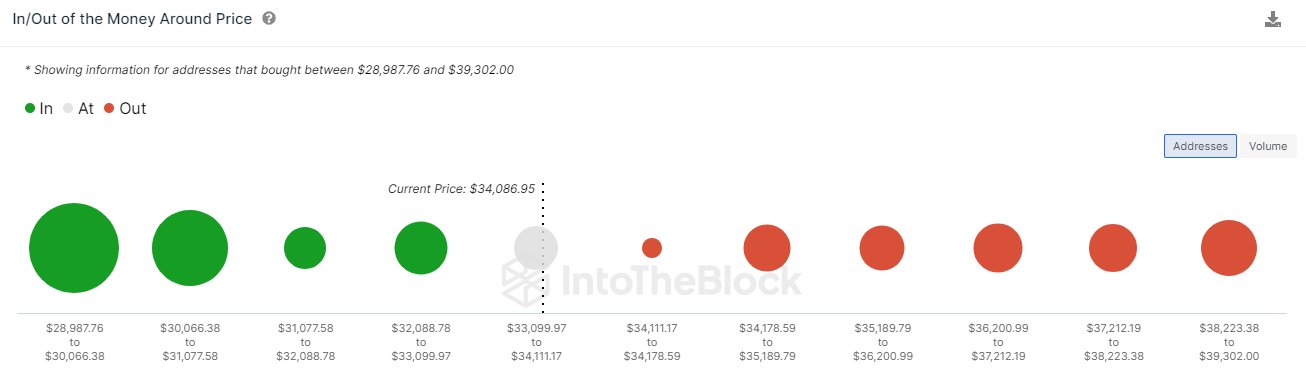

Not only has Bitcoin surpassed the $31,000 top it set back in July, it has also done so in spectacular fashion, as it’s now trading above the $34,000 level, which is significantly higher.

If the net taker volume is anything to go by, the second largest cryptocurrency may continue to underperform versus the largest, so long as investor sentiment around it remains negative.