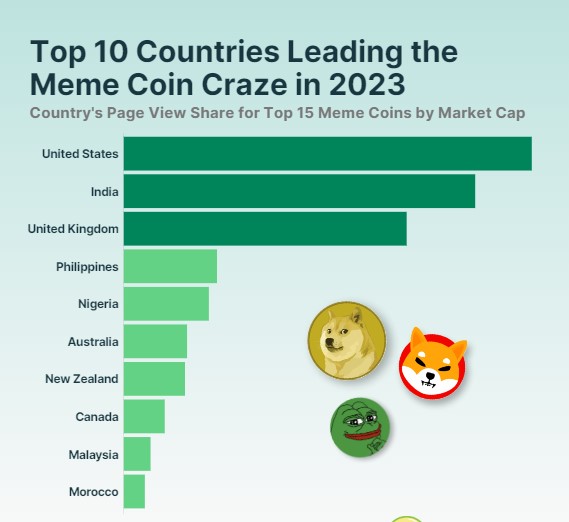

The rise of the meme coin mania in 2023 has taken the cryptocurrency world by storm, and a new report by CoinGecko shows that the trend is most popular in the United States, India, and the United Kingdom. These countries account for over 50% of all meme coin fans this year, indicating a strong interest in these assets.

But the appeal of meme coins continues beyond there. The report also highlights the popularity of these coins in other regions, including Southeast Asia’s Philippines and Malaysia, Nigeria and Morocco in Africa, Oceania’s Australia and New Zealand, and Canada. This diverse mix of countries suggests that meme coins have a global appeal.

From the US to India, The Global Phenomenon Of Meme Coins Takes Hold

The top 10 countries leading the meme coin craze in 2023 make up the majority of interest in these assets, representing 82.9% of all fans. This indicates that even though meme coins may have started as a niche trend, they have quickly gained a following worldwide.

According to the report, the United States is at the forefront of the meme coin craze in 2023, accounting for a whopping 23.6% of the global interest in these speculative assets. With over 2 million views on the top meme coin pages, it is clear that Americans are embracing this new type of cryptocurrency.

The report shows that the most popular meme coin in the US this year is Shiba Inu, which generated 60.7% of all US interest in meme coins. This is not surprising given the coin’s recent surge in popularity due to celebrity endorsements and high-profile listings on major cryptocurrency exchanges.

Following closely behind Shiba Inu is Pepe, a trending crypto that recently drove 11.8% of meme coin interest in the US. Other popular meme coins in the country include Bonk and Volt Inu, which generated 5.7% and 4.9% of US interest, respectively.

Moreover, India will be the second-largest driver of the meme coin hype in 2023, accounting for 20.3% of all interest across the countries. Shiba Inu is the most popular coin in India, generating 55.8% of the country’s interest in these speculative assets. Baby Doge Coin also received a relatively high share of interest, with 29.9% of India’s meme coin interest.

Floki is the most popular meme coin in the Philippines, generating 26.7% of the country’s interest in these assets. Shiba Inu and Bonk also received similar interest levels at 18.3% and 17.8%, respectively. Baby Doge Coin and Pepe were close behind, with 12.7% and 10.2% share of Philippines meme coin interest, respectively.

Shiba Inu Reigns Supreme

According to the report, Shiba Inu is the most popular meme coin among investors in 2023, driving 46.7% of interest among the top meme coins.

Baby DogeCoin is the second most popular, generating 12.3% of investor interest. This is followed by more recent coins, Pepe (9.4%), Floki (8.6%), and Bonk (8.2%). Furthermore, Pepe captured the most interest in Canada, accounting for 26.9% of all interest in the country.

Interestingly, while Dogecoin pioneered the meme coin space, it generated only 61.1% of interest in Morocco and received only minor interest in the other countries surveyed.

Overall, the report by CoinGecko shows that meme coins continue to gain popularity and are a force to be reckoned with in the cryptocurrency market. As new coins emerge and gain traction, it will be interesting to see how this market evolves and whether meme coins will continue to be a dominant trend in the cryptocurrency world.

Featured image from Unsplash, chart from TradingView.com

New Perpetual Market on

New Perpetual Market on  Trading opens at 4:00 am UTC on May 3

Trading opens at 4:00 am UTC on May 3

Margin trading

Margin trading