Initially tagged as a meme coin, Shiba Inu has been reinventing itself, aiming to break away from its meme coin status and step into the league of serious Decentralized Finance (DeFi) contenders, according to a new report.

A key step towards this transformation involves an innovation that is about to reshape the Shiba Inu ecosystem: Digital Identity Verification.

Embracing Digital Identity In The Shiba Inu Ecosystem

In a push to improve the platform’s credibility among users and governmental entities, the Shiba Inu project is said to integrate Digital Identity Verification into all its future developments. This includes the forthcoming Shibarium Layer 2 blockchain, an update eagerly anticipated by the community.

Related Reading: Whale Activity Spikes As Shiba Inu Preps For Shibarium Launch

Digital identities or Self-Sovereign Identities (SSI) are, in essence, the digital counterparts of traditional identification documents such as passports and driver’s licenses. In the digital realm, SSIs confer users greater control over their personal data and its distribution online.

Currently, Shiba Inu developers are reportedly collaborating with community projects that use SHIB or plan to build on the Shibarium blockchain to prioritize SSI deployment.

Shiba Inu’s lead developer, “Shytoshi Kusama,” was the one who revealed the project’s ambitious goals. He stated that they are currently “laying the groundwork for a new global standard in decentralized digital trust and international identity verification. In this way, Shibarium is the herald of a new digital age where faith in systems is restored and enhanced.”

Implications For Dogecoin (DOGE)

A shift in the crypto market dynamics may be on the horizon as Shiba Inu’s foray into DeFi may have ripple effects, most specifically on Dogecoin (DOGE). Both SHIB and DOGE started as meme coins, but Shiba Inu’s recent maneuvers may force a reconsideration of its stature.

With the rise of digital identities and data protection as hot-button topics in areas like Canada and the European Union, Shiba Inu’s move to integrate digital identities into its ecosystem could elevate its reputation.

This could lead to an increase in demand for SHIB tokens, which may exert upward pressure on the coin’s price. In contrast, Dogecoin, which remains firmly in its meme coin status, may find itself in an increasingly precarious position.

Although, DOGE still has its biggest fan and supporter, Elon Musk behind it, should Shiba Inu succeed in its DeFi transformation, it may establish a new benchmark for meme coins and, in turn, create additional pressure on DOGE to redefine its strategic direction.

Furthermore, currently, DOGE is recording more losses than Shiba Inu in the past 24 hours. Particularly, Dogecoin has dropped by nearly 4% in this period while SHIB has only seen a modest downtrend of just 0.4%

Meanwhile, as DOGE records losses of 7.4% in the past week, SHIB has gone in the opposite direction with an upward trend of 4.5%. At the time of writing, DOGE currently trades at a price of $0.073 while SHIB trades at $0.00000822.

It is worth noting that despite the noteworthy difference in both DOGE and SHIB price action, the former still remains at the top among the largest crypto by market cap with over $10 billion in market cap while the latter records $4.8 billion in market cap.

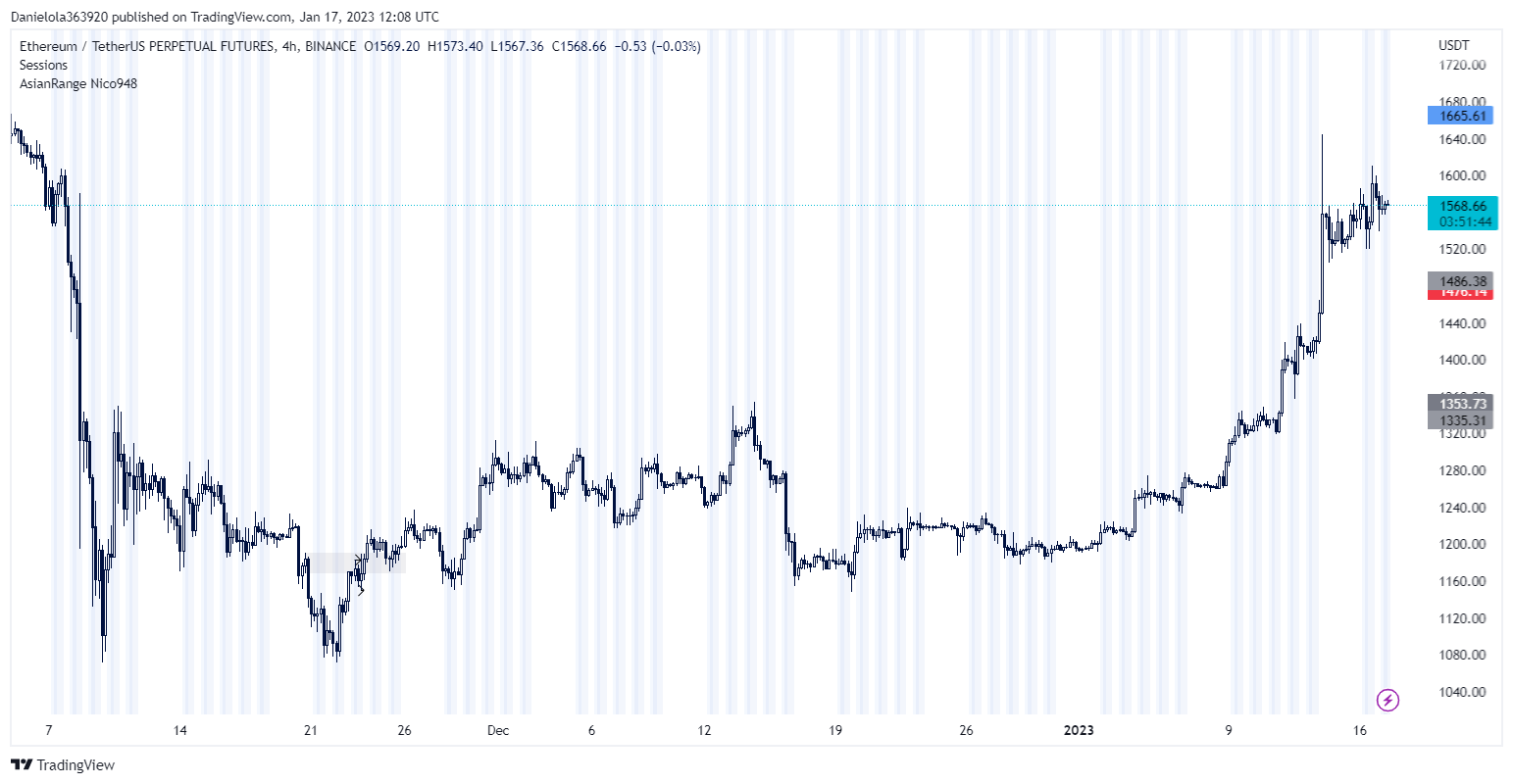

Featured image from CoinDesk, Chart from TradingView