Bitcoin is facing a critical juncture as it has entered a ‘danger zone,’ according to prominent gold advocate Peter Schiff. This investor, known for his skepticism toward Bitcoin, suggests that the cryptocurrency is entering a “do or die” phase, potentially marking the end of its bullish run if current trends continue.

Breaking Points And Bearish Signals

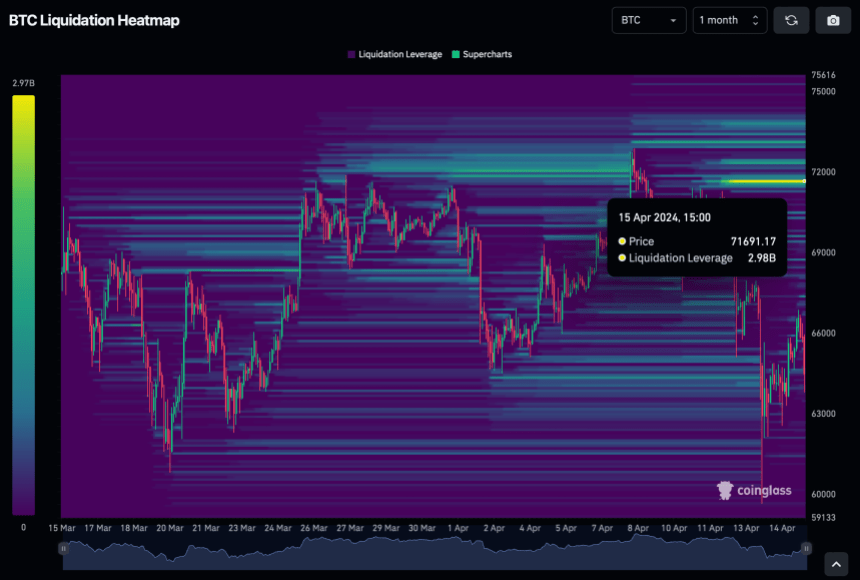

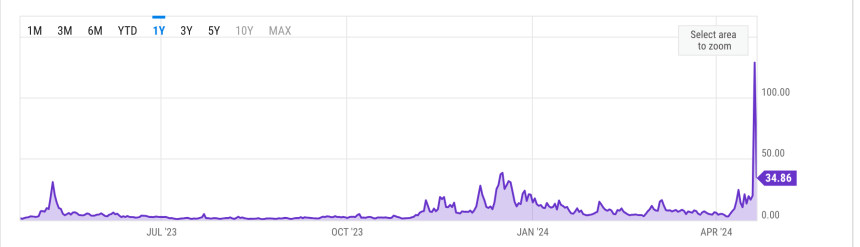

Peter Schiff has often voiced his bearish outlook on Bitcoin, and his latest comments come as Bitcoin has just slipped below the crucial $60,000 mark.

This level had previously served as strong support during the short-term bull run, and its breach has intensified the bearish sentiment among investors. Schiff warns that staying below this threshold could spell doom for the bullish fervor, potentially derailing Bitcoin’s momentum.

At the time of writing, Bitcoin is trading at approximately $57,054, teetering close to its 100-day Exponential Moving Average (EMA). Schiff points out that remaining below this EMA could confirm a bearish trend, signaling an end to the rally.

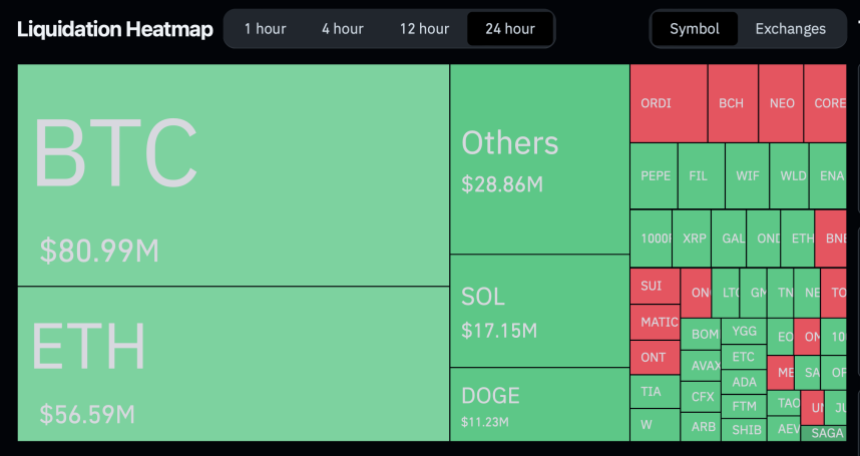

Amidst these developments, the market has seen an increase in trading volume, coupled with the price drop, indicating strong selling pressure.

Over the last 24 hours, Bitcoin’s trading volume has dropped from $45 billion to $48 billion, coinciding with a 6.3% price dip during the same period. This heightened activity is a traditional bearish indicator, lending weight to Schiff’s prediction of a downturn.

Moreover, investor sentiment is treading thin ice with significant outflows from Bitcoin spot ETFs, hitting a weekly high of $162 million. This departure of funds is particularly poignant as it unfolds just before the FOMC meeting, where potential interest rate hikes are on the agenda.

These outflows reflect a broader market trend, with the Grayscale Bitcoin Trust (GBTC) experiencing a substantial daily outflow of $93.23 million.

According to SoSoValue, total net outflows from Bitcoin spot ETFs yesterday, April 30, were as high as $162 million. GrayscaleETF GBTC had a single-day net outflow of US$93.2277 million, and the current historical net outflow of GBTC is US$17.303 billion. The total net asset… pic.twitter.com/jSCtfVrW8l

— Wu Blockchain (@WuBlockchain) May 1, 2024

The Bitcoin ETF Conundrum And Market Forecasts

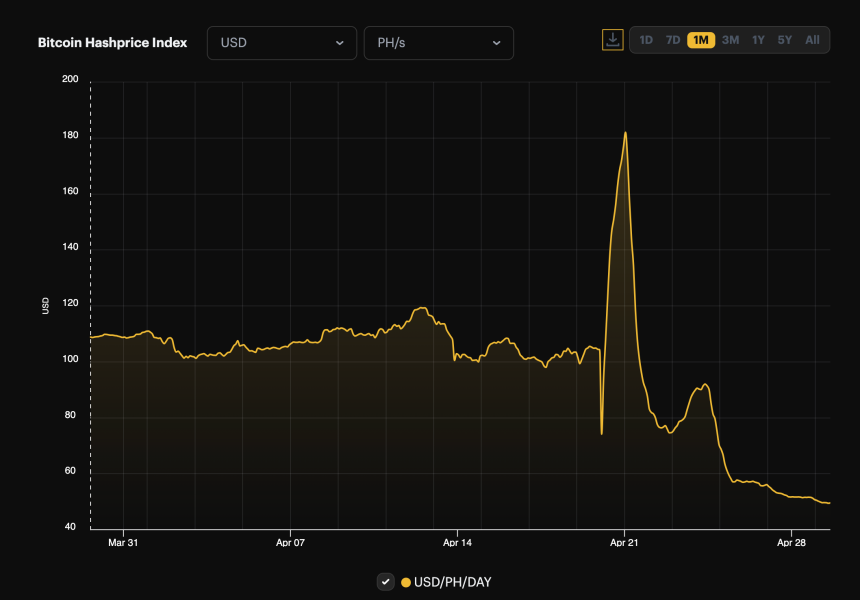

It is worth noting that last month was quite challenging for US Bitcoin ETFs. After a promising start with positive inflows in the initial months following their launch, April witnessed collective outflows amounting to $182 million across all active spot Bitcoin ETFs in the US.

This pullback is attributed to macroeconomic concerns and geopolitical tensions, which have clouded the investment landscape.

As the market braces for further turbulence, analysts such as Micheal Van de Poppe are forecasting an additional correction, potentially pushing Bitcoin’s price down to $55,000 before any sign of recovery.

Monthly close approaching for #Bitcoin and FOMC day tomorrow.

I think we’ll see that sweep beneath $60K and potentially cascade towards $55-58K from which we’re finding the low and rotate back upwards.

From there: Ethereum ETF hype in May to pick up momentum. pic.twitter.com/Iki4De9mSF

— Michaël van de Poppe (@CryptoMichNL) April 30, 2024

Featured image from Unsplash, Chart from TradingView

(@el_crypto_prof)

(@el_crypto_prof)

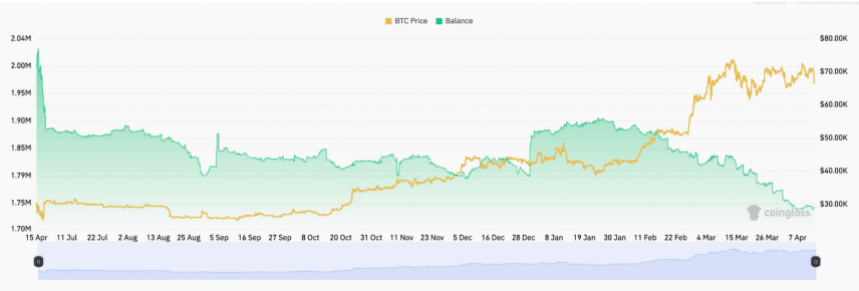

According to our model, the mid-term gains and losses by average wallets indicate heavy realized losses across most

According to our model, the mid-term gains and losses by average wallets indicate heavy realized losses across most

MARKS (@JavonTM1)

MARKS (@JavonTM1)