Crypto analyst Javon Marks has provided insights into the future trajectory of Solana (SOL) after it hit a 1,100% return. The analyst is known to have called the crypto token’s previous high correctly, which is one reason his latest prediction is worth keeping an eye on.

Solana Could Rise To As High As $453

Marks mentioned in an X (formerly Twitter) post that despite its recent pullback, Solana’s price may be getting ready for another price rally. He noted that a move of over 54% may already be in the pipeline and that such a price move could open up room for another run of over 93%, which would send Solana to $453.

Related Reading: Cardano Ready For 15x Move, Crypto Analyst Reveals The Major Drivers

Marks predicted last year that Solana would climb above $200, which it eventually did this year, peaking at a year-to-date (YTD) high of $202. Although the crypto token has dropped significantly from that price level, Marks’ recent prediction confirms that Solana’s run isn’t done yet and will still surpass its current all-time high (ATH) of $260.

Solana rising to $453 looks more feasible considering that crypto analysts like Altcoin Sherpa have predicted that the crypto token could rise above $500 by year-end. Crypto analyst Hansolar also predicted that Solana could climb to $600 in this market cycle. Meanwhile, Crypto YouTuber Jake Gagain predicted that Solana will rise to $750, although he mentioned that it will likely happen in 2025.

SOL Could Become The Third-Largest Crypto Token

Solana’s rise to as high as $500 could lead to the crypto token becoming the third largest crypto asset by market cap, only behind Bitcoin and Ethereum. This is possible, as a rise to $500 is almost double Solana’s current ATH. Crypto analyst Chris O also previously predicted that this would likely happen as he predicted Solana and ADA would battle for the position.

Meanwhile, asset manager Franklin Templeton also sounded confident in Solana’s potential to become the third-largest cryptocurrency. In a recent analysis, the asset manager highlighted the factors that could lead to this development. One is Solana’s technology, which they think will be perfect for the sectors that will drive the next wave of crypto adoption.

Franklin Templeton also alluded to the upcoming airdrops on the Solana network, which could bring more liquidity into the ecosystem and possibly cause a surge in Solana’s price, just like when the Jito and Pyth airdrops occurred. The asset manager also noted that meme coin activity on the network isn’t slowing, which could contribute to Solana’s rise to becoming the third-largest cryptocurrency.

Solana has become the foremost network for trading meme coins, which has led to an influx of new investors into the ecosystem. Therefore, a sustained network expansion will likely reflect positively on Solana’s price sooner or later.

At the time of writing, Solana is trading at around $144, up in the last 24 hours, according to data from CoinMarketCap.

Traders are showing weak

Traders are showing weak

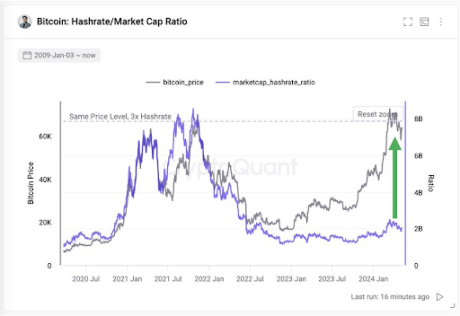

Addresses holding over 1000 BTC have accumulated strongly in recent months, especially during dips.

Addresses holding over 1000 BTC have accumulated strongly in recent months, especially during dips. Prices have increased shortly following every accumulation.

Prices have increased shortly following every accumulation.