In today’s episode of NewsBTC’s daily technical analysis videos we are examining Litecoin after a 10% intraday move to see if it will turn into a broader crypto market rally.

Take a look at the video below:

VIDEO: Litecoin Price Analysis (LTCUSD): November 2, 2022

Litecoin has been an altcoin that once regularly led the start of new crypto market bull runs. We are looking to find out if LTC will once again lead the way.

Weekly LTCUSD Chart Shows Tightest Bollinger Bands In Five Years

On daily timeframes (shown only in the video), Litecoin is outside of the upper Bollinger Bands, above the Ichimoku cloud, has tagged the Parabolic SAR, and given buy signal on the SuperTrend. LTCUSD daily also took out the 50– day and 100-day moving average and is flirting with the 200-day moving average.

Weekly technical indicators also support a larger bullish move. Litecoin has reclaimed the middle-Bollinger Band and then the Tenkan-sen on the Ichimoku.

How tight the Bollinger Bands are are especially notable, as they are the tightest in over five years, and the tightest since the last time Litecoin vastly outperformed Bitcoin.

The Bollinger Bands are the tightest in five years | Source: LTCUSD on TradingView.com

Related Reading: Trick Or Treat For Bitcoin On Halloween Night? | BTCUSD Analysis October 31, 2022

Litecoin Bottoms In Phase With Past Cycle Troughs

On monthly timeframes, LTCUSD is flipping bullish and turning green on the Fisher Transform. Pictured is the iFish Smoothed version, created by MoeMentum on TradingView. The Fisher Transform helps to pinpoint cyclical turning points in markets. Adding in cyclical timing tools shows that the cycle troughs are nearly perfectly in phase.

The Fisher Transform highlights a possible turning point | Source: LTCUSD on TradingView.com

Comparing LTC With Dogecoin: The Other Scrypt Altcoin

The LTCBTC trading pair looks very similar to the DOGE versus BTC trading pair, which saw an enormous breakout against Bitcoin already. Both LTC and Dogecoin utilize the Scrypt mining algorithm and the two coins can be merge-minded at the same time.

Will Litecoin experience a DOGE-like move? | Source: BTCUSD on TradingView.com

Related Reading: The Inverted Bitcoin Chart Bears Don’t Wanna See | BTCUSD Analysis October 27, 2022

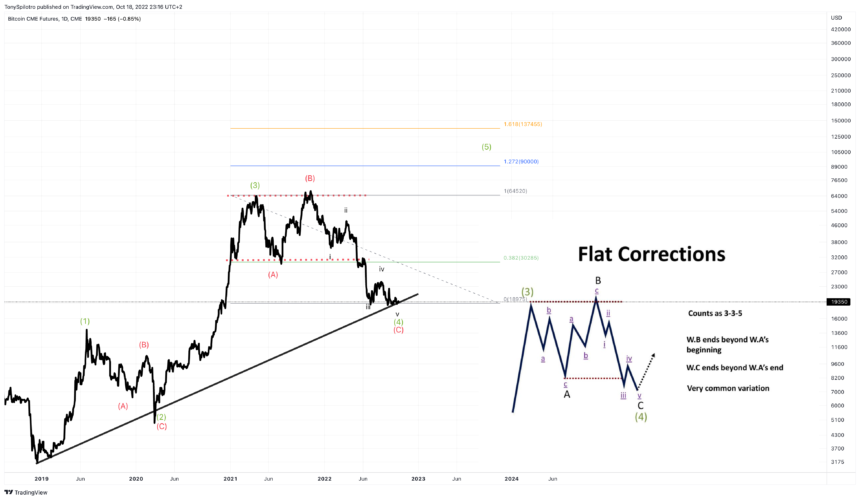

Elliott Wave Points To Grand Finale In Crypto Bull Market

The once top-ten cryptocurrency appears to have formed a long-term channel, and is bouncing from the very bottom of the upward sloping trend line.

Elliott Wave counting suggests that Litecoin could be about to embark on impulse Wave 5 of an expanding diagonal, after completing a Wave 4 correction back down to the lower trend line. Expanding diagonals alternate between impulse waves and corrective waves from the zig-zag family. Zig-zags are typical ABC corrections. Wave 2 would be more simple in structure, while Wave 4 was complex.

The last final wave up in Litecoin produced more than 9,000% ROI. It happened just as the Bollinger Bands on weekly timeframes were as tight as they are right now. While 9,000% won’t be possible again, the peak of Wave 5 could be somewhere around $1,500, or roughly 3,000% in ROI.

Is this the final wave up in crypto? | Source: BTCUSD on TradingView.com

Learn crypto technical analysis yourself with the NewsBTC Trading Course. Click here to access the free educational program.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.c