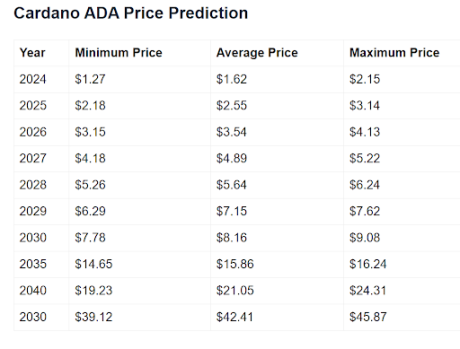

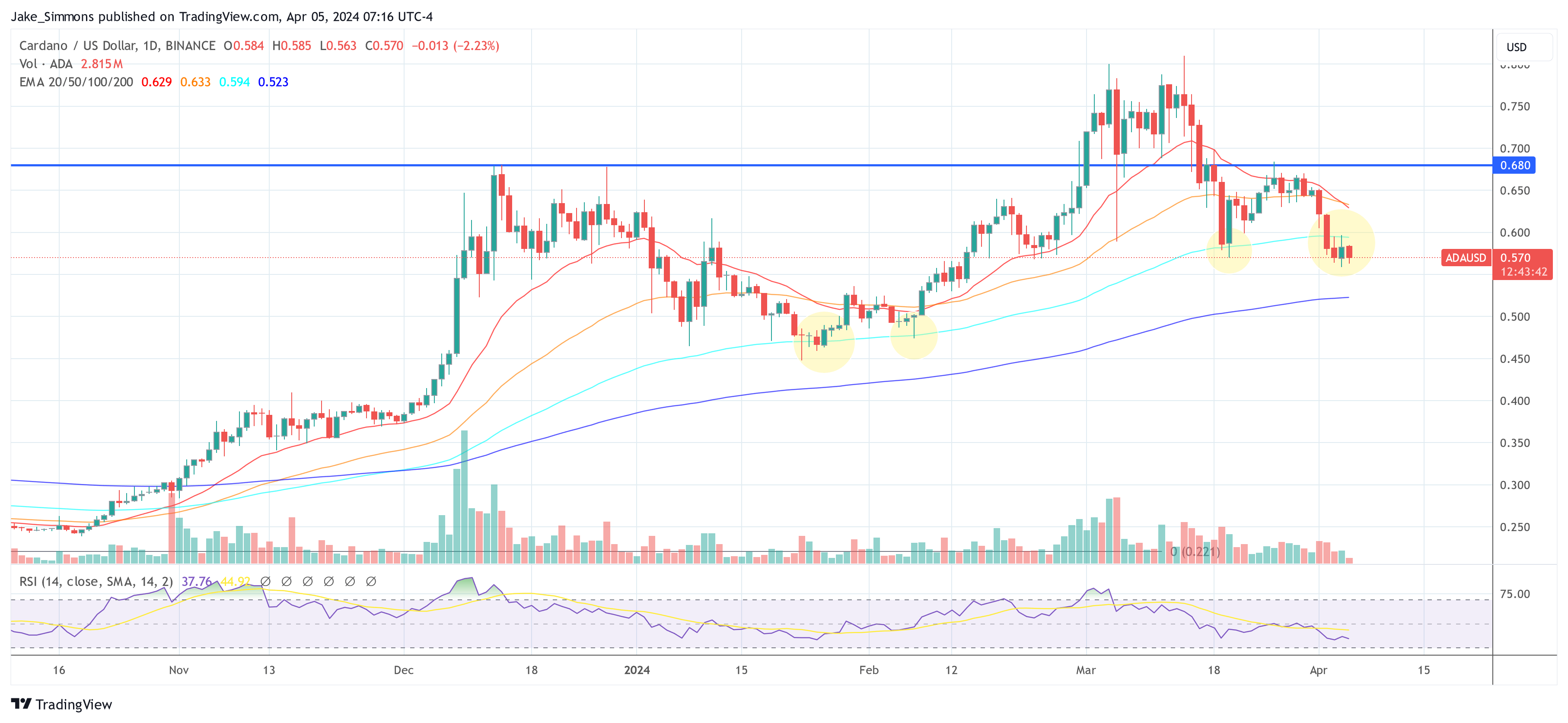

Cardano is currently in a downtrend, continuing to show bearish tendencies as its price trends below $0.5. However, where many have seen an altcoin that does not have many prospects, crypto analyst FieryTrading believes that the digital asset is giving investors an opportunity to get in for cheap.

Cardano Can Break Out Of Parallel Channel

In an analysis on the TradingView website, crypto analyst FieryTrading alludes to Cardano’s ability to break out and go on a massive bull run. The analysis draws from a previous analysis where the analyst had pointed out that the Cardano price had entered a parallel channel.

This parallel channel emerged with the last cycle’s top going into the current cycle top with a line drawn from the last cycle’s bottom when the lockdown had sent crypto prices crashing. Despite the crypto analyst first pointing out this parallel channel back in 2023, they believe that it continues to remain valid, especially as the price continues to rtend low.

Back then, the crypto analyst had predicted that the ADA price, if it were to break out of this parallel channel, could rise as high as as $35. This bullish expectation continues with the most recent analysis, albeit with a price adjustment.

In the Wednesday analysis, FieryTrading notes that There is still the possibility for the altcoin’s price to reach the top of the channel. In this case, the price would fully complete the move toward $30. However, the crypto analyst’s chart carries a $25 target, which would be a 5,600% rally from its current level.

ADA Bears Maintain Control

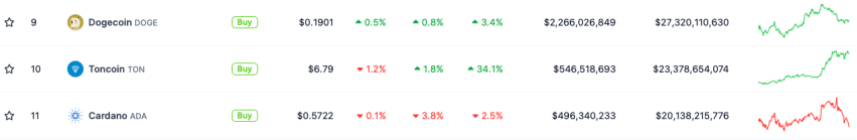

Despite the bullish outlook maintained by the crypto analyst, Cardano has succumbed to the bears. The price has dropped as low as $0.44 in the last day, indicating a 1.38% decline. On a wider timeframe, the ADA price looks even worse, with an almost 28% drop in one month.

However, despite this trend, the analyst still believes that investing in Cardano right now is a risk worth taking. FieryTrading refers to it as “the entry of a lifetime” that could guarantee good returns. Moreover, the analyst gives it a R/R (risk/reward) ratio of 116, which is a good number.

For now, the ADA price is still struggling to hold up in the market. This is not helped by the decline in market sentiment, leading to a nasty 22% drop in its daily trading volume, according to data from Coinmarketcap.