As part of his Cardano price prediction, crypto analyst CobraVanguard has revealed what needs to happen for ADA to never drop below the $0.8 level again. This comes amid the US SEC’s acknowledgment of Grayscale’s Cardano ETF filing, providing a bullish outlook for the crypto.

How The Cardano Price May Never Drop Below $0.8 Again

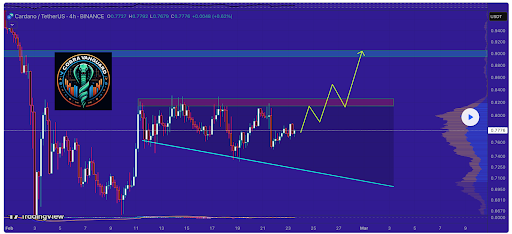

In a TradingView post, CobraVanguard noted that the Cardano price continues to move well within the wedge. The analyst claimed that if this wedge is broken, then market participants will no longer see ADA below $0.80. The analyst’s accompanying chart showed that a break above could see Cardano reclaim the $1 psychological price level.

This bullish outlook for the Cardano price comes as the US Securities and Exchange Commission (SEC) acknowledged Grayscale’s Cardano ETF filing. An ETF is bullish for the ADA price as it will attract institutional investors and drive more inflows into the coin’s ecosystem, which could spark a rally to new highs.

However, in the meantime, the Cardano price looks to be in bearish territory, as it has declined alongside the broader crypto market. ADA is currently below the $0.8 price level, which could represent a great buying opportunity, especially if the crypto eventually never sees this price level again, as CobraVanguard predicted.

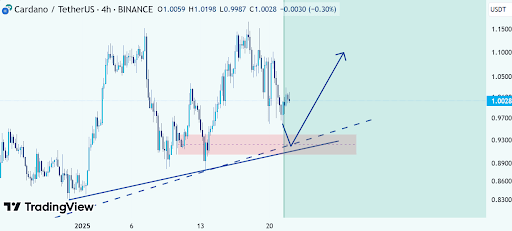

Regarding the short-term bearish outlook for the Cardano price, crypto analyst CryptoBusy also noted that ADA is barely clinging to its 0.5 Fibonacci support level. The analyst added that a breakdown below this Fib support could lead to a straight drop to the $0.618 price level. CryptoBusy suggested that this breakdown will likely happen as ADA is facing significant selling pressure.

A Mega Bounce Is Coming For ADA

In an X post, crypto analyst Sebastian told market participants to get ready for a mega bounce for the Cardano price after this market downtrend. In another post, he remarked that the worst time to sell is right now. He added that in a month, market participants will wish they had bought more. According to him, the market is a game of emotions and the more people capitulate, the higher prices will go eventually.

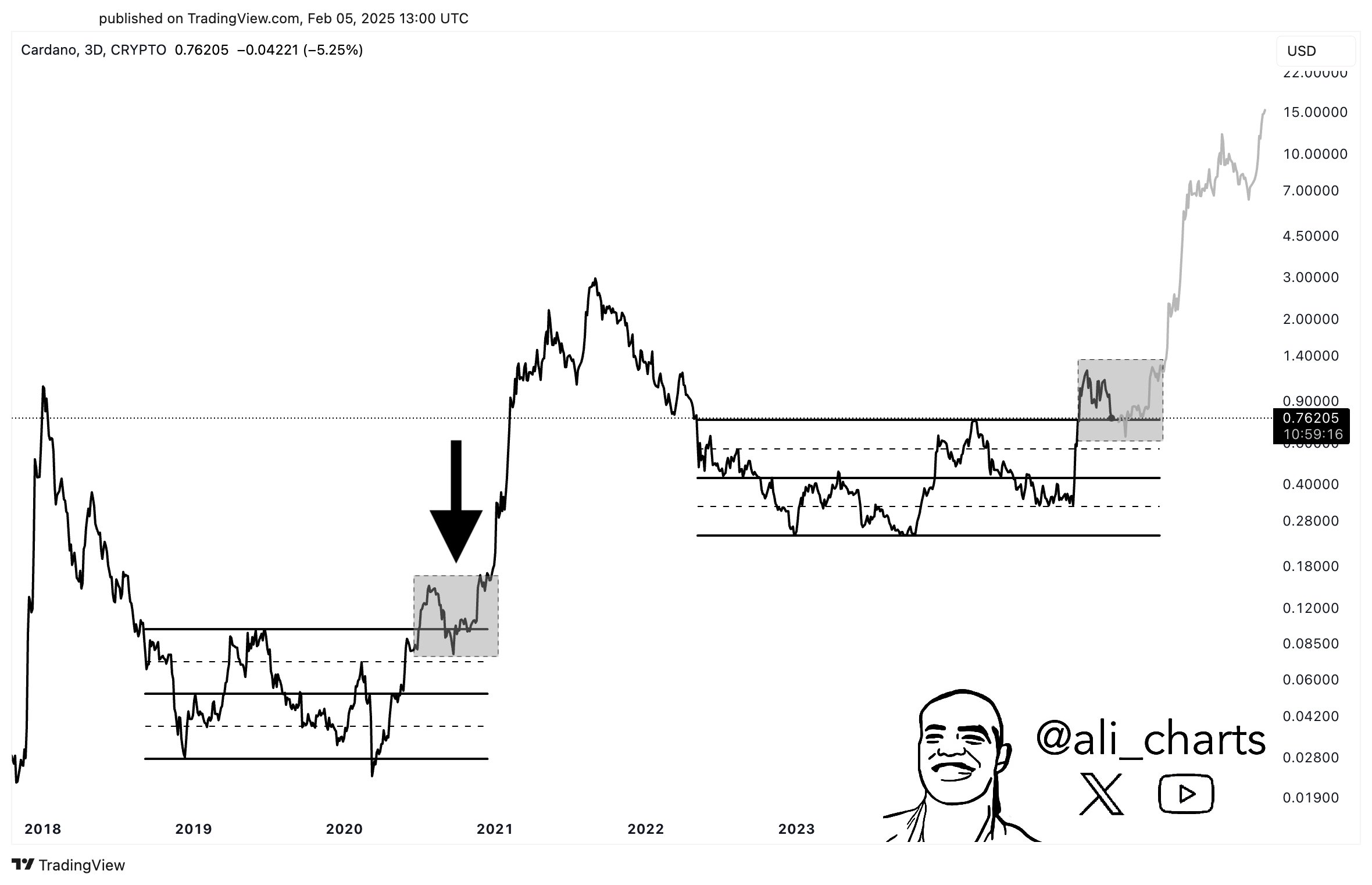

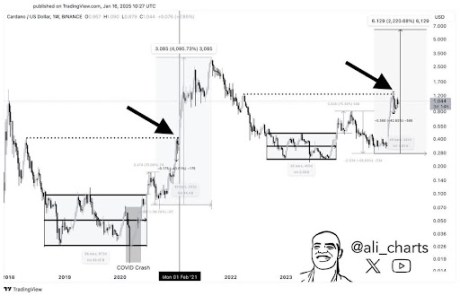

Meanwhile, crypto analyst Ali Martinez recently noted that the most critical support zone for the Cardano price is between $0.67 and $0.80. He remarked that as long as this level holds, ADA’s bull run remains intact. His accompanying chart showed that ADA could still reach its current all-time high (ATH) of $3.10 and possibly surpass this price level in this market cycle.

At the time of writing, the Cardano price is trading at around $0.65, down over 12% in the last 24 hours, according to data from CoinMarketCap.