Spotted by veteran analyst Peter Brandt, the classic technical pattern can result in ADA price losing almost 90%.

Cryptocurrency Financial News

Spotted by veteran analyst Peter Brandt, the classic technical pattern can result in ADA price losing almost 90%.

Cardano has announced that Rwanda’s Save the Children foundation had become the latest charity organization to embrace cryptocurrencies. The partnership came to fruition when Cardano had successfully installed a payment gateway that allowed the NGO to receive donations using Cardano’s native currency ADA.

The statement released on the Save the Children website explained that thousands of Rwandan children would now be able to receive help through donations via cryptocurrency, which in this case is ADA.

Related Reading | Cardano (ADA) Demand Rises Amongst Retail And Institutional Investors, Why This Is Happening

Using the partnership with Cardano will enable the NGO to source funds directly from donors without having to rely on third parties or intermediaries to process the donations. In which case the charity ends up losing a good percentage of the donated funds to fees.

Save the Children is not new to working with digital assets. The charity has been accepting bitcoin donations since 2013. This initiative had started in response to the Typhoon Haiyan that had struct Southeast Asia that year and had completely devastated the Philippines.

This move saw Save the Children become the first global NGO to accept donations in cryptocurrency.

ADA price currently down at $1.236 per coin | Source: ADAUSD on TradingView.com

Save the Children had begun receiving donations in digital assets in order to provide fast and effective aid to the people affected in the area and several initiatives involving cryptocurrencies and blockchain have spun off from there. One of these is MicroWorks, a Save the Children initiative that helps refugee youths earn a living by paying them for collecting data with their mobile phones.

Cardano (ADA) is now the latest to join the line of digital assets accepted by the organization. Save the Children can now accept multiple digital assets using its cryptocurrency wallet widget.

So far, donors can donate funds in Bitcoin, Ethereum, Dogecoin, Litecoin, BAT, and a host of others.

Save the Children received over 22,000 ADA donations just hours after it announced the launch of the feature. Amounting to almost $30,000 donated through ADA alone.

The news of the partnership has so far been well-received in the Cardano community. With investors applauding Cardano’s scalability for allowing this to happen.

Related Reading | How Cardano’s Catalyst Circle Will Improve Its Governance Model

Cardano had announced earlier in the year that about half a billion dollars worth of ADA would be delegated to mission-driven stake pools on its network and this would help to fund more than 100 charities around the world. Save the Children is set to be one of the key beneficiaries of this initiative.

Speaking on the partnership, Eva Oberholzer, the Chief Growth Officer at the Cardano Foundation, said that this was only the start of an exciting partnership.

“People are often confused by cryptocurrency and baffled by blockchain. Through this pilot with the Kumwe Hub, we aim to demonstrate the power of decentralized finance (DeFi) and the global community when applied to supporting projects outside of the world of financial services and token trading.” – Eva Oberholzer.

Featured image from Crypto News Flash, chart from TradingView.com

Recently, both institutional and retail investors have shown an increasing interest in Cardano. It is fast becoming the coin of choice for investors who are in crypto for the long term. Good news trots behind the coin as Cardano released a roadmap for the Alonzo hard fork that is scheduled to take place in the second quarter of the year 2021.

Staking volumes have increased tremendously as the hard fork draws near. And so far, there has been over $31 billion worth of ADA staked ahead of the hard fork. Cardano is a proof of stake blockchain and thus requires less energy to mine than the other top coins in the market.

Related Reading | Cardano (ADA) Becomes The Latest Addition To Grayscale Digital Large Cap Fund

The energy footprint of Cardano is negligible in this regard and thus individuals and institutions who are worried about the mining footprint that the mining of coins like bitcoin and ethereum leaves seem to find safe haven in this coin. Cardano boasts of the highest number of staked coins, ahead of Ethereum, with over 70 percent of the entirety of ADA supply currently staked.

Cardano has so far drawn in over $24 million in institutional investments. Data shows that Cardano investment funds have attracted more investment funds than most other digital assets in the crypto space. With Bitcoin and Ethereum leading the charge of where institutional investors choose to empty their pockets.

The interest in the coin from institutional investors comes with the rising popularity of Cardano amongst retail investors. The project’s coin which is named ADA is currently ranked as the number 5 coin in the crypto space.

Grayscale, a known leader of crypto investors, announced earlier that they had included Cardano in their crypto trusts. The coin became the investment’s firm third-largest crypto holding. Making up about 4.26 percent of their entire crypto holdings.

ADA price trading at $1.30 | Source: ADAUSD on TradingView.com

The coin has a current circulating supply of 32 billion and a 24-hour daily trading volume of $1.2 million. The price of ADA currently sits at $1.30 per coin.

The relatively low price of the coin has been one of the driving factors of interest in the coin so far. The coin which trades for a little over a dollar shows tremendous purpose and if speculations are right, then Cardano would see investors getting returns in the thousands once the coin takes off.

The continuous work being done on the coin shows the commitment of the team to the project. The efforts of the team have been enough to impress Ethereum founder Vitalik Buterin, who commended the project for the interesting ideas that are being implemented.

Popular crypto exchange earlier in the month released stats that showed that Cardano’s coin ADA has become the most held coin on the cryptocurrency exchange. Beating out bitcoin and ethereum to claim the top spot on the exchange.

This showed a 51 percent increase in the amount of ADA being held on the exchange by users. Pushing top coin bitcoin from first place to second place.

Related Reading | How Cardano’s Catalyst Circle Will Improve Its Governance Model

This increase was attributed to the increased growth and use case potential for Cardano’s coin ADA, and this had clearly provided plenty of attraction and motivation for investors to move into the project.

A lot of this is attributed to investors searching for the next bitcoin. This search has led to more interest in smaller and cheaper coins like ADA where the investors see a lot of potential and what could possibly be the next coin to replicate bitcoin’s success in the market.

Featured image from Investing.com, chart from TradingView.com

Cardano Founder Charles Hoskinson shared his damning thoughts on the legacy financial system, concluding that cryptocurrency will take over because it offers a better way.

Much is said about the enmity between cryptocurrency and banking. While the banking system towers above cryptocurrency in terms of both capitalization and the number of users, Hoskinson believes this is a situation that will change.

“You can’t go back; you can’t change that. You can’t put that genie back in the bottle. Central banks will fade away, it’s just going to happen. Your conventional legacy banks are going to fade away.”

His reason for thinking this comes down to the nepotism and profiteering embedded within the banking system. All of which conspire to squeeze the “little guy,” often in circumstances of desperation and lack of choice.

“It wasn’t us who charged 15% to some of the poorest people in the world to move their money home to take care of their parents. It was the people who ran the old system. It wasn’t us, in this industry, who charge 85% interest to lend $100 to a subsistence farmer, desperately trying to survive after a drought.”

Hoskinson further laid scorn on the banking system’s complicity with criminal activity. Referencing general instances of laundering drug money and oil for food programs, Hoskinson turned the tables by saying cryptocurrency is the remedy to fix this.

“Never allow them to say ours is the industry that’s the risk. Ours is the industry that’s the antidote to the excesses, corruption, and nepotism that we’ve found. This is an industry of frustration that has now been replaced by an industry of creativity and innovation. We’re going to change the world.”

In terms of leading the charge against the banking system, Cardano is up there as a project capable of rising to the challenge. But, like the whole of the cryptocurrency industry, it is a work in progress.

Nonetheless, last week saw developers Input Output Global (IOG) reveal its progress on shipping the final phase of Cardano’s smart contract rollout.

Currently, the firm is working on the “Alonzo Blue” stage which involves Plutus pioneers and some “alpha partners” working on the first-ever Alonzo testnet.

The “alpha partners” have been drafted to build a range of dapps including oracles, DEXs, lending and borrowing, stablecoins, NFTs, and DeFi tools.

During this stage, the goal is to uncover and fix bugs to stabilize the code environment. The remaining “Alonzo White and Purple” stages will see the testnet open up a wider group of testers. At the “Alonzo Purple” stage, the protocol is almost ready for public rollout, which is expected in August.

As Hoskinson alluded to, change is coming, and thanks to smart contracts, Cardano will be one of the cryptocurrency projects eating away at the legacy system.

Source: ADAUSD on TradingView.com

The Africa Special event aired on Thursday, showcasing Cardano developments on the continent. At the time of writing, the show has hit over 120k views, with IOG CEO Charles Hoskinson calling it the most popular show they’ve done to date.

Although the response was largely positive, with a wide range of mainstream and crypto publications covering the event, Hoskinson spoke about a distinct lack of coverage from CoinDesk. The Executive Editor at CoinDesk, Marc Hochstein, said they are still waiting on a response from Ethiopia’s Ministry.

“media response was incredible as well, we were interviewed by the Financial Times, Cointelegraph, my lord they actually covered it, CityAM, New York Times, and dozens of others. More news will come trickling out. Notably absent, I can’t see it right now, I don’t know if it’s covered or not. I didn’t check my media list, was CoinDesk.”

Cardano has been plugging away at blockchain adoption in Africa for many years now.

Hoskinson said he founded IOG with the goal of equalizing the developed and developing worlds. Adding that developed nations take for granted many things such as payments, insurance, credit, etc. In contrast, poor infrastructure in developing nations makes even simple tasks, such as getting paid, a laborious process.

“I started my company in February 2015 with the dream of delivering economic identity to those that don’t have it. The reality is, the world lives still in two different configurations. One for the developed and one for the developing.”

News of Ethiopia’s Ministry of Education partnering with Cardano via the Atala PRISM solution broke before the Africa Special event. The deal aims to boost education and employment prospects through a blockchain-based student-teacher attainment recording system. It will digitally verify grades and allow for the monitoring of school performance.

The most prominent announcement during the Africa Special event was news of infrastructure development in Tanzania. It will see a tie-in with World Mobile to provide mobile internet access and financial inclusion infrastructure to enable banking, loans, insurance, etc.

Despite the monumental achievements made by IOG in Africa, Hoskinson highlighted the lack of coverage from CoinDesk on the matter.

Various representatives from the publication have skirted the issue, with its Executive Editor, Hochstein, asking for evidence of the claims directly “from the horse’s mouth.”

That’s an embassy which isn’t the ministry. It would be weird to rely on a tweet from a US embassy in another country for confirmation of what HUD or DOD is supposedly doing. We need to hear it from the horse’s mouth.

— M a r c H o c h s t e i n (@MarcHochstein) April 29, 2021

Hoskinson felt this degree of fact-checking is an extreme request considering the multiple sources of evidence already available, including directly from Ethiopia’s Minister of Education, Dr.-Ing. Getahun Mekuria, who spoke during Thursday’s show.

“Apparently, having the Minister appear on camera talking about the relationship, the official government channels tweeting about the relationship, and major publications like the New York Times is not good enough for this editor at CoinDesk for an official announcement.”

Hoskinson labeled the response bizarre and claimed there’s more to the snub than waiting for confirmation of facts.

Source: ADAUSDT on TradingView.com

In distinguishing real-world use versus speculative investing, IOG CEO Charles Hoskinson said he derides DeFi in its current state. The comments come as Cardano announced securing a contract with Ethiopia’s Ministry of Education for a blockchain-based ID system.

This accomplishment is part of Cardano’s pan-African strategy that intends to improve lives by providing new systems. By tapping into real-world use for everyday laypeople, Cardano hopes to differentiate itself from the competition. But is this a strategy that will prevail?

“We look to our industry and we think about things like DeFi. I laugh at DeFi at the moment. Not because I think the projects are bad, or the products are bad, or the teams are not motivated. But because they don’t have real markets.”

After months of teasing, and even before the Africa Special event, the bird has finally landed. Yesterday, Hoskinson took to social media announcing a partnership deal with the Ethiopian government.

It will see the implementation of a blockchain-based national student and teacher ID system to record and digitally verify grades and remotely monitor school performance. The idea behind it is to boost nationwide education and employment.

African Operations Director at IOG, John O’Connor, believes the partnership could be the beginning of Africa’s revival as a global economic powerhouse. A time not seen since the Mali and Songhai Empires around the 14th and 15th centuries.

“Ethiopia’s blockchain-based education transformation is a key milestone on IOHK’s mission to provide economic identities and employment, social and financial services for the digitally excluded”

Developed nations have a legacy infrastructure in place, making blockchain technology an unnecessary luxury in the west. For most western people, cryptocurrency is primarily being used as a speculative investment.

Hoskinson reiterated this point by describing the frivolity of cryptocurrency through a western lens.

“No-one in America wakes up at the moment, or Germany, or France, and England, and says, “Oh boy, I just can’t wait to get a car loan on a decentralized peer-to-peer lending network.””

He added that most people don’t know what peer-to-peer lending, or DeFi, is, let alone how to access it. The reason why comes down to the existence of legacy infrastructure. But in regions with no infrastructure, the demand for blockchain-based services is much greater out of necessity.

“The vast majority of people use things out of necessity or convenience. When we look to people who have no access to credit, the reality is their first loan is likely going to come from a peer-to-peer marketplace, and likely be denominated in a cryptocurrency-based asset, not a local currency.”

Hoskinson believes DeFi demand will come from people who need it the most. Not those who use it speculatively to become relatively more wealthy. In turn, it’s the overwhelming demand that will drive value, not the technology itself.

Source: ADAUSD on TradingView.com

2021 will prove a pivotal year for Cardano, Polkadot, and Ethereum. While each has its merits, competition between the trio starts to heat up as we head into mid-year.

Alonzo is on track for an August release, bringing smart contracts to Cardano. Polkadot is racing to finish parachain rollouts to enable on-chain governance. At the same time, Ethereum is working on Proof-of-Stake, with its proposed sharding scaling solution scheduled to arrive sometime next year. But which project has the mass-market appeal to come out in top?

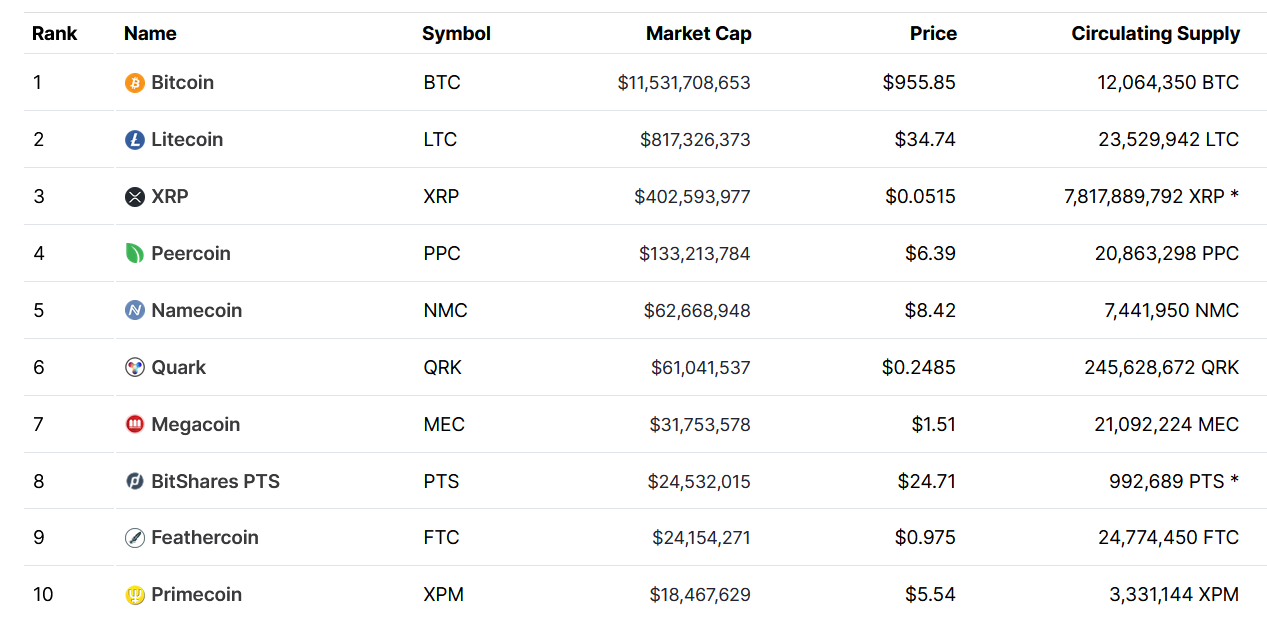

Cryptocurrency is a fickle affair. A look back at the top ten from December 2013 shows a list of predominantly unfamiliar tokens. In eight years, seven out of the ten have dropped into obscurity, substantiating the statement that most cryptocurrencies, even top ten heavy hitters, will fade away over time.

Source: coinmarketcap.com

When it comes to which smart contract platform will get to stick around, IOG CEO Charles Hoskinson remains philosophical, saying, who knows? He added that this is a question for the market to decide. And in any case, it isn’t necessarily a zero-sum game.

Having said that, he prefers to broach the topic from a different angle. Instead of looking at which platform will win, Hoskinson focuses on actively working towards solving problems. In that sense, Hoskinson believes success is about making a difference, especially in developing countries.

Cardano has a significant presence in Africa, which is a major differentiator between it and the competition. Speaking on the problems in Africa, Hoskinson said:

“[people in the developing world] are shafted because their systems are terrible. They live in capital controls, and corrupt governments and they live in areas where there’s not good rule of law. And they don’t have stable currencies, and as a consequence no real good banking infrastructure, no good risk management infrastructure, and so forth, so they can’t build wealth.”

Sharing his motivation to keep plugging away, Hoskinson said he doesn’t care if that infrastructure runs on Polkadot or Ethereum, or even Bitcoin. But he created Cardano because no one else was addressing wealth inequality on a global scale.

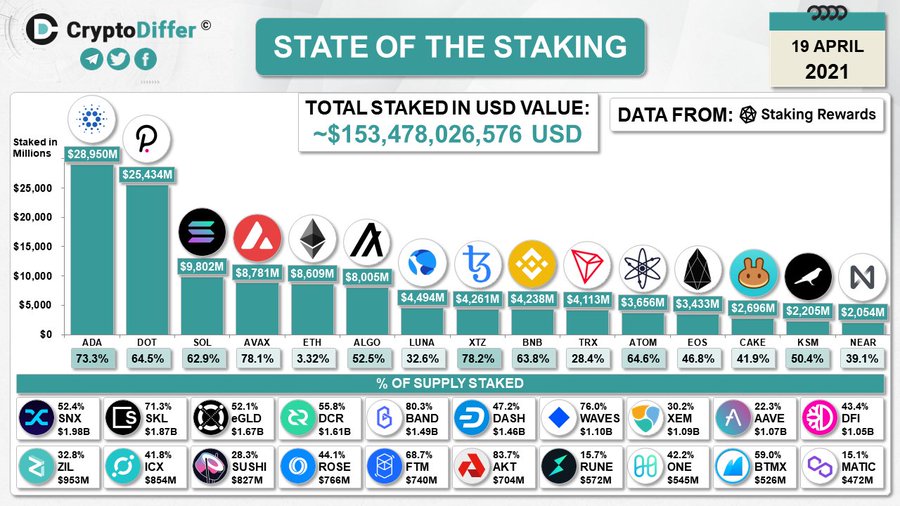

Data analytics firm CryptoDiffer released figures yesterday showing the state of staking. Almost $153.5 billion is staked across all platforms, with Cardano and Polkadot being the most prominent with $28.95 billion and $25.43 billion staked.

Meanwhile, just $8.6 billion is staked on Ethereum, accounting for 3% of its supply. This is likely because staking, in its current guise, requires users to lock up their Ether for an indefinite period. Developers expect withdrawals available around Phase 2 of ETH 2.0, which could be two years away.

Source: @CryptoDiffer on Twitter.com

Nonetheless, as a barometer of which platform has the public’s support, Cardano nudges just ahead of Polkadot.

Cardano founder Charles Hoskinson said he chose Wyoming to base Input Output Global (IOG), and not Silicon Valley, because of the Valley’s “unhealthy” environment.

The comments dispel the notion that tech firms need Silicon Valley to “make it.” What’s more, his candid account of trying to integrate into that culture delivers a humbling that some say is long overdue.

Work Life Balance and the Valley https://t.co/RSGSLnjADb

— Charles Hoskinson (@IOHK_Charles) April 14, 2021

Silicon Valley is found in the San Francisco Bay Area’s southern region and acts as a global center for technology and innovation.

It’s home to many established high-tech companies, including Google, Apple, and Adobe, to name a few. As well as thousands of startups looking to benefit from proximity to these giant megacorps. In particular, the venture capital money that’s flush in the region.

“In 2020, $156.2 billion of venture capital was raised in the U.S., PitchBook reports. Of the total, 22.7% of the dealmaking occurred in the Bay Area, and 39.4% of deal value was invested in Bay area-headquartered companies.”

Having said that, Silicon Valley, and the VC industry, have not been immune to the panic situation. A report by Pitchbook on the VC outlook for 2021 states the Bay area’s share of total VC count will fall below 20% for the first time in history.

Add to that the rise in remote working and the subsequent exodus from the high cost of living cities, and there are fewer reasons why tech firms would want to set up base in Silicon Valley.

When asked why IOG, formerly IOHK, didn’t locate in Silicon Valley, Hoskinson said he felt the pull when starting as an entrepreneur. But having spent a week there integrating into the culture, his experience was far from positive.

“… What I saw over eight years ago was a very, for the lack of a better term, unhealthy environment. There was copious drug use, a lot of people were sleep-deprived. And there was this endless desire to be something. And most of the people I met were so thoroughly fake, there was just no notion of a genuine person…”

IOG relocated its headquarters from Hong Kong to Wyoming in 2018. The state economy of Wyoming is heavily tied to mineral extraction, tourism, and agriculture, especially cow and sheep farming.

But in 2019, Wyoming enacted 13 blockchain laws making it the only U.S. state with a welcoming legal framework for blockchain companies to flourish.

Speaking on why Wyoming is preferred over Silicon Valley, Hoskinson said the lifestyle and work-life balance are more in line with his way of being, which can be summed up in one word, authentic.

“What’s so magical about that lifestyle I have is that after my workday ends, I go to my farm. A farm is like the ultimate truth factory. There is no bullsh*t when you’re in agriculture.”

The panic situation has forced many to reconsider what is wanted and important in life. And living in nature is a lifestyle trend that’s gaining favor among those done with big city living.

Source: ADAUSD on TradingView.com

Charles Hoskinson teases the Cardano community with more talk of birds, this time in a tweet featuring an image of an exotic bird pictured next to John Hancock. The text accompanying it read:

“For some reason, I have this strong desire to tweet these two pictures. Must be the blending of my ornithological endeavors with my love of 18th century American history….“

Source: @IOHK_Charles on Twitter.com

The IOHK boss has been tormenting the community with cryptic bird messages since February. After those birds failed to land, Hoskinson explained that changing the world is an uphill task, to say the least. He called for patience.

Although there’s been no official announcement from Cardano, many observers speculate it relates to a contract to run an African country’s municipal infrastructure. Which country and in what capacity are questions that remain the subject of even greater speculation.

Two years ago, Hoskinson spoke about signing a Memorandum of Understanding with the Ethiopian government to develop a token system for the residents of its capital Addis Ababa.

“we signed an MoU with the government of Ethiopia, the Ministry of Innovation and Technology, to create a cryptocurrency for them, that will be used as a utility token for the city of Addis Ababa… Should this be successful we’ve brought six million people into our space with a real product that has real demand and need.”

He went on to say that the token could be compulsory for utility payments and transportation costs. Meaning there will be demand due to it operating under a “government-sponsored monopoly.”

Zehabesha, an Ethiopian news source, reported that Addis Ababa would provide a significant test case for the project’s feasibility. It’s likely the scheme will roll out to other cities in the country.

On an even grander scale, a continent-wide rollout could be on the cards. Hoskinson has previously said he sees real-world crypto adoption happening in Africa before anywhere else in the world. His reasoning comes down to Africa’s desire to build infrastructure, which is not something developed nations require, given the legacy systems already in place.

With the recommencement of bird talk, many presume an announcement is close. At the same time, others have used this opportunity to slam the “announcement of an announcement” approach taken by Hoskinson. More so, the failure of birds to land in February/March, as Hoskinson had initially mentioned.

Critics argue that this strategy was a departure from Cardano’s unassuming approach. Adding it’s a style more reminiscent of a hype project with “nothing under the hood.”

Regardless of that, one thing’s for sure; bird talk has generated a lot of intrigue and attention. While announcements of an announcement are a novel course for Cardano, the project has never made false statements.

John Hancock is best known as the statesman who first signed the Declaration of Independence from Great Britain, and in large text front and center. Perhaps Hoskinson’s tweet intended to hint at a done deal that’s been signed off?

While the use of birds may be an uncommon strategy for Cardano, dishonesty is an improbable one. In that case, a little more patience won’t hurt.

Source: ADAUSD on TradingView.com

Cardano Founder Charles Hoskinson has announced the formation of an internal action force aimed at countering scammers. This comes as a report from fraud prevention firm Bolster showed cryptocurrency scams almost doubled in 2020.

“One of the things we’ve been thinking about is setting up some sort of dedicated body in the Cardano ecosystem that does nothing but builds tools to help people report scams and propagate the knowledge that a scam has occurred.”

Last month, a frustrated Hoskinson hosted a live stream in which he warned the Cardano community of giveaway scams. He reiterated the point, one made many times before, that he nor Cardano will ever giveaway ADA.

“If you fall for this, you will lose your ADA, these are criminals, these are scammers, these are people who are trying to steal from you. Use common f*cking sense. You don’t get something for free. You don’t get something for nothing.”

Cardano is now taking an active role in combating the fraudsters with the newly formed anti-scam task force. Not only is it tasked with reporting and spreading awareness of scams, but Hoskinson also spoke about an investigative element to their operations as well.

“… do some targetted investigations into ventures that have entered into the Cardano space, that we feel may be fraudulent.”

Without going into specifics, Hoskinson said, following complaints raised by community members, the task force has investigated a fund suspected of fraud. Initial results indicate the fund in question may be a scam. However, he did not disclose the name of the fund at this time.

“We started conducting an investigation and the preliminary results indicate that that fund may actually be a scam. So in two weeks time, we’re going to release our first output of this internal working group.”

Fraudsters are flocking to crypto as markets continue booming. Research conducted by Bolster confirms that cryptocurrency fraud is on the rise. The firm points out that this is one of the most significant barriers to mainstream success.

Co-Founder and CTO of Bolster Shashi Prakash said crypto scams are the fastest-growing category of scams. He warned that this is just the start of a “new wave of digital theft campaigns.”

We continue to see scammers being opportunistic and designing campaigns focused on real-time, surging trends when people are likely not to be on guard because it’s so new.”

By analyzing 300 million websites, Bolster found more than 400,000 related to crypto scams over the last year. The firm predicts this figure will go up by 75% for this year.

Other key findings note that fake prizes, giveaways, or sweepstakes were the most prolific type of scam, with Bitcoin, Chainlink, and Ethereum being the top three most targetted tokens.

The Cardano anti-scam task force is a step in the right direction. However, as Hoskinson mentioned, it’s no substitute for common sense.

Source: ADAUSD on TradingView.com

Cardano’s price recovered sharply from the $1.050 support zone. ADA is likely to continue higher if it clears the main $1.220 resistance zone in the near term.

After a steady decline, cardano’s price remained stable above $1.000. ADA price traded as low as $1.038 before it started an upside correction. There was a decent increase above the $1.080 and $1.110 resistance levels.

The price even surged above the $1.150 level and the 100 simple moving average (4-hours). The bulls pushed the price above the $1.220 resistance. A high was formed near $1.287 and the price is currently correcting lower.

There was a break below the $1.220 and $1.200 support levels. ADA even traded below the 23.6% Fib retracement level of the upward move from the $1.038 swing low to $1.287 high. It is now trading nicely above $1.165 and the 100 simple moving average (4-hours).

Source: ADAUSD on TradingView.com

It seems like there is a major support forming near $1.165. The 50% Fib retracement level of the upward move from the $1.038 swing low to $1.287 high is also near $1.165. Besides, there is a key bearish trend line forming with resistance near $1.218 on the 4-hours chart of the ADA/USD pair.

If there is an upside break above the $1.200 and $1.220 resistance levels, the price could start a strong increase. In the stated case, the price could rise steadily towards the $1.280 and $1.335 levels.

If cardano’s price fails to clear the $1.200 and $1.220 resistance levels, it could start a fresh decline. The key breakdown support is forming near the $1.165 and $1.150 levels.

A downside break below the $1.150 level could open the doors for a fresh decline towards $1.050. The next major support is near the $1.000 level.

Technical Indicators

4-hours MACD – The MACD for ADA/USD is slowly losing momentum in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for ADA/USD is now approaching the 50 level.

Major Support Levels – $1.165, $1.150 and $1.050.

Major Resistance Levels – $1.200, $1.220 and $1.280.

At yesterday’s Cardano 360 event, IOHK CEO Charles Hoskinson gave an update on the long-awaited Alonzo upgrade. Due to stress testing and exchange integration, Hoskinson expects a rollout in mid-August.

IOHK had previously penciled in a date of the end of March 2021 for this to happen. A five-month delay hasn’t gone down well with some sections of the community.

The Goguen phase is the great equalizer in terms of bringing smart contracts to Cardano. It was split into three development stages.

First was Allegra, which enabled token locking; this laid the foundation for smart contracts by bringing metadata functionality to record the specific purpose of tokens. Then there was Mary, which introduced the ability to create user-defined tokens. The final piece is Alonzo, which integrates the extended UTXO model with the Plutus smart contract language.

During Cardano 360, Hoskinson gave a timeline for Alonzo’s completion. He said this process requires integration into the ledger and node code, which is happening now through to April. At the same time, “alpha partners” will be running acceptance criteria and tests.

“What’s occurring right now, all throughout March and all throughout April is that integration into the node to get a CLI. As that integration is happening, partners are being brought in, and these are alpha partners, so they’re very close and deep in court of company.”

Once done, by the end of April or early May, IOHK will be ready to launch the Alonzo testnet. Hoskinson mentioned that large cohorts of programming professionals and Plutus pioneers are ready to stress test the network.

As Plutus was built by an independent team, in parallel with Shelley, Hoskinson warned there could be some “rough edges” in that integration. Hence QA and user acceptance testing are needed to circumvent any problems in that respect.

All of the above is scheduled to finish by the end of June. At this point, the final stage involves bringing all of the stakeholders up to speed. Hoskinson gives this a four to six-week time frame, taking us into mid-August for the Alonzo hard fork.

“If that occurs, what we will do is wait four weeks minimum for our partners, the Coinbases, the Binances, Yoroi, all these other people, who have infrastructure that needs to upgrade that needs to upgrade, test, and modernize for Alonzo before we do the Alonzo hard fork.”

The feedback from the Cardano community has been mixed. On the one hand, some have expressed positivity over the thoroughness of work going into Alonzo. But others have slammed the delay.

On that, Hoskinson noted a surge in toxicity and trolling. But he puts this down to a realization that Cardano is on track.

I’ve noticed a massive surge in toxicity, FUD, trolling, and outright slander lately. It must mean Cardano is finally perceived as a threat to the status quo and we are on the right track. Stay focused everyone, the next six months are going to be a rough but rewarding ride

— Charles Hoskinson (@IOHK_Charles) March 26, 2021

Despite the delay to Alonzo, the market did not react badly. Today, ADA is up 8% to $1.17.

Source: ADAUSD on TradingView.com

Input-Output Global CEO Charles Hoskinson announced that he has prepared his segment for the highly anticipated Cardano 360 event. In the mysterious post, Hoskinson hinted at a bug that allowed a hacker to mint 184 billion Bitcoin.

Just finished recording my segment for Cardano 360 tomorrow. It’s going to be a fun one 🙂 See everyone tomorrow! pic.twitter.com/dG2vqOd5Mj

— Charles Hoskinson (@IOHK_Charles) March 24, 2021

Known as the “Value Overflow Incident”, the bug was recorded in August 2010 and forced Bitcoin creator Satoshi Nakamoto to fork Bitcoin’s blockchain to “delete” the generated BTC. These were sent to two separate addresses.

A few hours after the event, a new version of the Bitcoin client was released and the chain considered “good” overtook the “bug blockchain” at block height 74691. The BTCs created by the bad actor ceased to exist.

In the image presented by Hoskinson, other tabs are also visible in his browser. This refers to smart contracts and the platform that will support them on Cardano’s blockchain, Plutus. Some users speculate that the reference to the “Value Overflow Incident” is a nod to the “double-spending” accusation that “Cardano never had” a few days ago.

In an earlier post, Hoskinson told “Cardano fans” that the event would be full of important announcements:

Cardano Fans, you’re really going to want to tune in to March’s Cardano 360 Episode. It’s going to be action-packed!

Led by IOHK’s Director of Marketing and Communications, Tim Harrison, and Aparna Jue, Product Director at IOHK, Cardano 360 is a monthly event where they give news on the development of the ecosystem.

Bring yer own cushion and don’t worry. If you can’t stick around, we’ll be dicing and slicing it and serving it up throughout next week in bite-size chunks.

Bring yer own cushion 🙏 and don’t worry. If you can’t stick around, we’ll be dicing and slicing it and serving it up throughout next week in bite size chunks 👍 #Cardano360 #Cardano https://t.co/OIjBw7uXCF

— Tim Harrison (@timbharrison) March 24, 2021

In the comments section, the majority of the community asked for more news on the deployment of Alonso and Plutus. Harrison also announced the conclusion of his segment for the event, and stated: “that there will be lots coming down the line”. He also confirmed that there will be updates on Cardano’s DeFi capabilities.

The event will start at 17:30 UTC, Input-Output Global further confirmed that partners, team members, and the community will participate. In addition, it is expected that there will be an update on everything that has happened since the deployment of Hard Fork Combinator “Mary”.

ADA’s price is showing losses of 1.8% on the last day chart. In the last month, Cardano’s native cryptocurrency only registers gains of 1.6%, showing little reaction to its Coinbase listing and the hype of the event happening tomorrow.

Replying to remarks over the lack of dapps running on Cardano, IOHK CEO Charles Hoskinson responded by saying demand is so high his firm cannot handle the applications flooding in. In many cases, as a strategy to cope with the demand, applications are being rejected.

Some Thoughts on DApps https://t.co/0rHRxdblPP

— Charles Hoskinson (@IOHK_Charles) March 21, 2021

Speaking on a live stream, Hoskinson said criticisms of Cardano having no dapps are entirely unreasonable. He drew attention to sneaker and cattle authentication apps already run on the chain using just metadata features.

Although full programmability at the base layer is missing at present, he likened the fault-finding to criticizing attendance at a nightclub that hasn’t yet opened.

“Yet they say, what are the dapps running on Cardano? That’s like saying you’re opening a nightclub, you haven’t opened it yet, and you say, ‘how come no-one’s in your nightclub?’ It’s like, we’re still building it.”

Hoskinson is more than confident that once Goguen is up and running, the ecosystem will fill out accordingly. However, right now, the firm cannot deal with the demand to build dapps on Cardano. He said the only thing to do under these circumstances is to turn down applications from developers.

“As if, smart contracts come and there’ll be no demand. We’re overwhelmingly subscribed. At the moment, our company has no more capacity to service deal flow that comes in for Cardano. People come to me, unless it’s a super high-value deal and some have jumped up the queue, we actually say no and turn them down…”

The Goguen era is expected to launch at the end of March. So far, IOHK hasn’t confirmed or denied that they will meet this deadline. Nonetheless, expectations are riding high. Once smart contracts are up and running, Cardano will be on even ground with its biggest rival, Ethereum.

Playing into the expectations, Hoskinson tweeted that this month’s Cardano 360 will be one to watch. The monthly program is scheduled to show on March 25 at 17:30GMT.

Cardano Fans, you’re really going to want to tune in to March’s Cardano 360 Episode. It’s going to be action packed!

— Charles Hoskinson (@IOHK_Charles) March 21, 2021

Although the “action” could refer to any number of things in the pipeline, a confirmed Goguen rollout date would be the best-case scenario for ADA holders.

With that, in the short term, what can the community expect with Goguen? Hoskinson referred to the projects making their way through the Catalyst program. He said a slew of NFT marketplaces, stablecoin offerings, oracles, and DEXes are on the way.

“If you look at Catalyst, there are six NFT marketplaces seeking funding, there are stablecoins seeking funding, some of which have already been deployed for example, on Emurgo. Oracles seeking funding, DEXes seeking funding….”

As such, accusations that Cardano is a ghost chain hold no merit. The only question remaining is, when will Goguen launch?

Source: ADAUSD on TradingView.com

Cardano gained some positive traction in the early European trading hours Friday after erasing more than half of its bullish breakout move in the previous session.

The blockchain asset, better known by its ticker ADA across markets, climbed more than 2.25 percent to $1.25 into the ongoing intraday session. Its move uphill started near a session low of $1.178. At its intraday high, ADA was changing hands for as much as $1.298. The $1.178-1.298 range pretty much made for the trading area on Friday.

Nonetheless, the area appeared way below ADA’s week-to-date high achieved on Thursday. The Cardano token surged to $1.498 in a bullish move that appeared after it broke out of a technically bullish pattern — a Descending Triangle with an upside target near $1.50 (NewsBTC discussed the bullish theory here).

A strong upside rejection near $1.50 triggered a cascade of selling orders, crashing ADA down by more than 21.50 percent. The downside correction nearly wiped out half the bullish breakout move, underscoring that ADA needs to rebuild its bullish momentum near lower levels or risks extending its bearish correction even further.

So far, Cardano as a blockchain project has everything working in its favor. The protocol has grown into the conscience of traders who see it as a viable alternative to Ethereum, another blockchain project loaded with smart contract functionalities but suffering high transaction and gas fees issues.

Its growing prominence has led ADA higher by more than 600 percent in 2021 and 4,000 percent on a year-on-year timeframe. Meanwhile, Cardano’s latest protocol upgrade to “Mary” has enabled users to issue their unique tokens, including the booming non-fungible tokens (NFT), which has added further fuel to ADA’s bullish bias.

But short-term—technically—the Cardano token flirts with the prospect of declining further. It is in the middle of creating a Head and Shoulder, a structure that appears as a baseline with three peaks, the outside two are close in height, and the middle is highest. ADA ticks all three factors but awaits further confirmation as it hopes to trend lower towards the baseline to attempt a bearish breakout.

Should a decline appear, the ADA price would risk crashing by as much as the middle peak’s height. The candlestick(s) is about 0.32 dollars long. That puts the head and shoulder pattern’s breakout target to near $0.85.

Cardano’s price gained over 25% this week and it broke the key $1.200 resistance zone. ADA is likely to continue higher above the $1.300 and $1.400 resistance levels.

After forming a support base above the $0.9980 and $1.00 levels, cardano’s price started a fresh increase. ADA price broke the $1.120 and $1.200 resistance levels to move into a positive zone.

There was also a break above a crucial bearish trend line with resistance near $1.050 on the 4-hours chart of the ADA/USD pair. The pair even cleared the $1.220 resistance zone. It is now trading nicely above $1.2000 and the 100 simple moving average (4-hours).

ADA climbed towards the $1.480 resistance and high is formed near $1.472. Recently, there was a downside correction below the $1.335 support zone zone. The price also spiked below the 50% Fib retracement level of the upward move from the $1.001 swing low to $1.472 high.

Source: ADAUSD on TradingView.com

However, the bulls are protecting the key $1.2000 support zone. The price is also holding the 61.8% Fib retracement level of the upward move from the $1.001 swing low to $1.472 high.

If there is a downside break below the $1.200 support and the 100 simple moving average (4-hours), there could be a trend change. In the stated case, the price could decline towards the $1.050 support.

If cardano’s price stays above the $1.200 support, it could start a fresh increase. On the upside, an immediate resistance is near $1.300 and $1.335.

The next major resistance is near the $1.400 and $1.405 levels. A clear break above the $1.400 resistance will most likely open the doors for a steady increase towards the $1.500 level in the near term.

Technical Indicators

4-hours MACD – The MACD for ADA/USD is slowly gaining momentum in the bearish zone.

4-hours RSI (Relative Strength Index) – The RSI for ADA/USD is now testing the 50 level.

Major Support Levels – $1.200, $1.180 and $1.050.

Major Resistance Levels – $1.300, $1.335 and $1.400.

Cardano’s ADA was among the best performers in the cryptocurrency market this week as traders assessed its bullish prospects against a stagnating top rival Bitcoin and an ongoing craze for non-fungible tokens, or NFTs.

The blockchain asset jumped to the third rank after undergoing a 19 percent price rally. As of 1057 GMT, the ADA/USD exchange rate was roughly $1.24. The pair opened the week at $0.95, according to data fetched by Binance.

ADA’s latest move uphill pushed its year-to-date gains up by approximately 600 percent. Meanwhile, its year-on-year returns surged to a massive 4,656 percent, beating Bitcoin, Ethereum, gold, and even the global stock market in the period that saw a massive injection of fiat money by local governments and central banks all across the world.

…the nature of the Cardano token’s rally was more speculative in nature. Nic Carter, the co-founder of research company Coin Metrics, expressed his disbelief with the ADA’s rally, stating that Cardano has not launched a single project on its blockchain that could attest to its popularity.

“I am truly mystified as to why it is enjoying a resurgence in popularity.,” Mr. Carter noted.

Many analysts believe that Cardano majorly cashed on its blockchain rival Ethereum’s limitations. Lately, the second-largest blockchain network has turned too costly for its users, including developers operating billions of dollars worth of decentralized finance projects atop its public layer. In some instances, users ended up paying a transaction fee of $30 to send just $5.

Cardano projected itself as a viable alternative. In retrospect, the project enables users to build smart contracts, decentralized applications, and protocols atop its blockchain. It projects itself as a more scalable and secure version of Ethereum via its underlying proof-of-stake algorithm that makes it simpler for users to conduct transactions cheaper and faster.

Ethereum operates on an energy-intensive proof-of-work protocol. However, the blockchain is scheduled to switch to proof-of-stake by the end of this year.

Overall, the growing rivalry helped Cardano’s ADA to surge exponentially in the recent months.

More tailwinds for the ongoing Cardano price boom came from a stagnating Bitcoin and an ongoing craze for NFT.

Bitcoin underwent a sharp correction after establishing its record high above $61,000 during the weekend session. Part of its correction appeared on higher profit-taking sentiment. Meanwhile, global market uncertainty led by the suspense over the outcome of the Federal Reserve’s two-day policy meeting further kept Bitcoin from extending its short-term bullish bias.

ADA jumped about 20 percent against bitcoin in the last 24 hours, showing that traders decided to park their funds in the Cardano market on the latter’s near-term bullishness. That could be due to Cardano’s “Mary” update, which enabled users to create their unique tokens, including NFTs. These are digital files that represent ownership of a certain asset.

It has become the latest crypto craze. In one instance, a creator sold his JPEG file for about $69 million. So it appears, Cardano benefited from its involvement in the NFT space.

Cardano’s price is struggling to clear the $1.200 resistance zone. ADA remains at a risk of more losses below the $1.050 and $1.020 support levels in the near term.

After a sharp rally, cardano’s price struggled to extend gains above $1.487. ADA price started a downside correction and traded below a key support near the $1.200 level.

The price even traded below the $1.100 support and settled below the 100 simple moving average (4-hours). A low is formed near $1.036 and the price is currently correcting higher. There was a break above $1.100 and $1.120 resistance levels.

There was a break above the 23.6% Fib retracement level of the downward move from the $1.487 high to $1.036 low. The price even spiked above the $1.150 resistance and the 100 simple moving average (4-hours).

Source: ADAUSD on TradingView.com

However, there was no upside break above the $1.200 resistance. There is also a major bearish trend line forming with resistance near $1.150 on the 4-hours chart of the ADA/USD pair. The pair is now trading well below the 50% Fib retracement level of the downward move from the $1.487 high to $1.036 low.

On the downside, the $1.050 level is a decent support. The main support is now forming near the $1.035 level. A downside break below the $1.035 level could open the doors for a move towards the $1.000 and $0.9500 levels in the near term.

If cardano’s price stays above the $1.050 support, it could make an attempt to clear the trend line resistance at $1.150. If the bulls succeed, the price could rally towards the $1.200 and $1.220 levels.

In the stated case, the price could even climb above the $1.250 level. Any more gains could lead the price towards the $1.450 level.

Technical Indicators

4-hours MACD – The MACD for ADA/USD is struggling to gain momentum in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for ADA/USD is currently below the 50 level.

Major Support Levels – $1.050, $1.035 and $1.000.

Major Resistance Levels – $1.150, $1.200 and $1.220.

Cardano’s price is struggling to clear the $1.200 resistance zone. ADA remains at a risk of more losses below the $1.050 and $1.020 support levels in the near term.

After a sharp rally, cardano’s price struggled to extend gains above $1.487. ADA price started a downside correction and traded below a key support near the $1.200 level.

The price even traded below the $1.100 support and settled below the 100 simple moving average (4-hours). A low is formed near $1.036 and the price is currently correcting higher. There was a break above $1.100 and $1.120 resistance levels.

There was a break above the 23.6% Fib retracement level of the downward move from the $1.487 high to $1.036 low. The price even spiked above the $1.150 resistance and the 100 simple moving average (4-hours).

Source: ADAUSD on TradingView.com

However, there was no upside break above the $1.200 resistance. There is also a major bearish trend line forming with resistance near $1.150 on the 4-hours chart of the ADA/USD pair. The pair is now trading well below the 50% Fib retracement level of the downward move from the $1.487 high to $1.036 low.

On the downside, the $1.050 level is a decent support. The main support is now forming near the $1.035 level. A downside break below the $1.035 level could open the doors for a move towards the $1.000 and $0.9500 levels in the near term.

If cardano’s price stays above the $1.050 support, it could make an attempt to clear the trend line resistance at $1.150. If the bulls succeed, the price could rally towards the $1.200 and $1.220 levels.

In the stated case, the price could even climb above the $1.250 level. Any more gains could lead the price towards the $1.450 level.

Technical Indicators

4-hours MACD – The MACD for ADA/USD is struggling to gain momentum in the bullish zone.

4-hours RSI (Relative Strength Index) – The RSI for ADA/USD is currently below the 50 level.

Major Support Levels – $1.050, $1.035 and $1.000.

Major Resistance Levels – $1.150, $1.200 and $1.220.