Injective’s “inEVM,” which connects the Ethereum, Cosmos, and Solana networks, will rely on Arbitrum’s Orbit toolkit.

Vested crypto tokens worth over $3B to be unlocked in May

Sui, Pyth Network, Avalanche, Arbitrum and Aptos are set to release vested crypto tokens in May, according to data tracker Token Unlocks.

Pike Finance clarifies ‘USDC vulnerability’ statement on $1.6M exploit

Pike highlighted that the exploit occurred due to their team’s inadequate integration of third-party technologies such as the CCTP or Gelato Network’s automation services.

The Protocol: EigenLayer’s ‘Intersubjective Forking’ Is Objectively Not Done

Much-hyped restaking project EigenLayer’s 43-page whitepaper about its now-revealed EIGEN token has raised lots of questions. They may not matter initially, because much of the promised functionality won’t be ready when the token launches.

Uniswap On Arbitrum Nears $150 Billion In Swap Volume

Uniswap, one of the world’s largest decentralized exchanges (DEX) by total value locked (TVL), is approaching a major milestone on Arbitrum, the largest layer-2 by TVL on Ethereum.

According to data from Dune Analytics shared by Uniswap Labs, Uniswap on Arbitrum is on the cusp of surpassing a staggering $150 billion in total swap volume.

Riding The DeFi Boom

As of April 25, Uniswap had facilitated over $146 billion in cumulative swap volume on Arbitrum alone. The number has gradually increased over the past three years since June 2021, when it was deployed on Arbitrum, looking at on-chain data.

By August 2021, Uniswap was processing less than $5,000 in swap volume. After that, they steadily picked up momentum throughout the crypto bear run of 2022. Notably, a sharp uptick from October 2023 coincided with the start of the crypto boom that eventually propelled Ethereum to over $4,000 in Q1 2024.

The rising swap volume on Arbitrum reflects the increasing preference for Decentralized Finance (DeFi) solutions. As Uniswap on Arbitrum nears $150 billion, more users are increasingly turning to the popular DEX to trade, all without giving up control of their assets.

The surging popularity of Uniswap on Arbitrum can be partly attributed to significantly lower transaction fees compared to the Ethereum mainnet.

Through Arbitrum, the optimistic roll-up solution, swappers enjoy low transaction fees. They can also trade from a scalable environment secured by the Ethereum mainnet.

Ethereum developers recently implemented Dencun, introducing a new transaction format called “blobs.” Because of this, layer-2 solutions can store large chunks of data off-chain, reducing the mainnet bloat. Subsequently, fees have been lowered, drastically enhancing the user experience for Arbitrum and other layer-2 users like Base and Optimism.

Uniswap V4 And United States Wells Notice

Following Dencun’s activation, Uniswap Labs plans to deploy v4. This iteration introduces features like Hooks that developers say will make the DEX even more efficient and flexible. The launch is set for this year.

Though Uniswap V4 is huge for the DEX and DeFi as a whole, the United States Securities and Exchange Commission (SEC) ‘s decision to issue a Wells notice is a setback.

The regulator intends to sue. However, the founder, Hayden Adams, responded in a post on X that they are ready to fight.

Blockaid says it caused crypto drainer to shut down, defends against claims of 'false positives'

The team defended itself against claims of excessive false positives, suggesting it was so effective that it caused a crypto drainer to give up in frustration.

Avail Data Availability Integrated by Arbitrum, Optimism, Polygon, StarkWare, ZkSync

The chains’ users will be able to opt in or out to use Avail for data availability, to stash the reams of data produced for all their transactions taking place.

Arbitrum Launches Fraud Proofs In Testnet: Why Is ARB Down?

Arbitrum, the largest Ethereum layer-2 scaling solution by total value locked (TVL), is taking steps towards decentralization. In an update on April 16, Offchain Labs–Arbitrum developers–said they have deployed the permissionless version of their fraud proofs, dubbed Bounded Liquidity Delay (BOLD), to testnet.

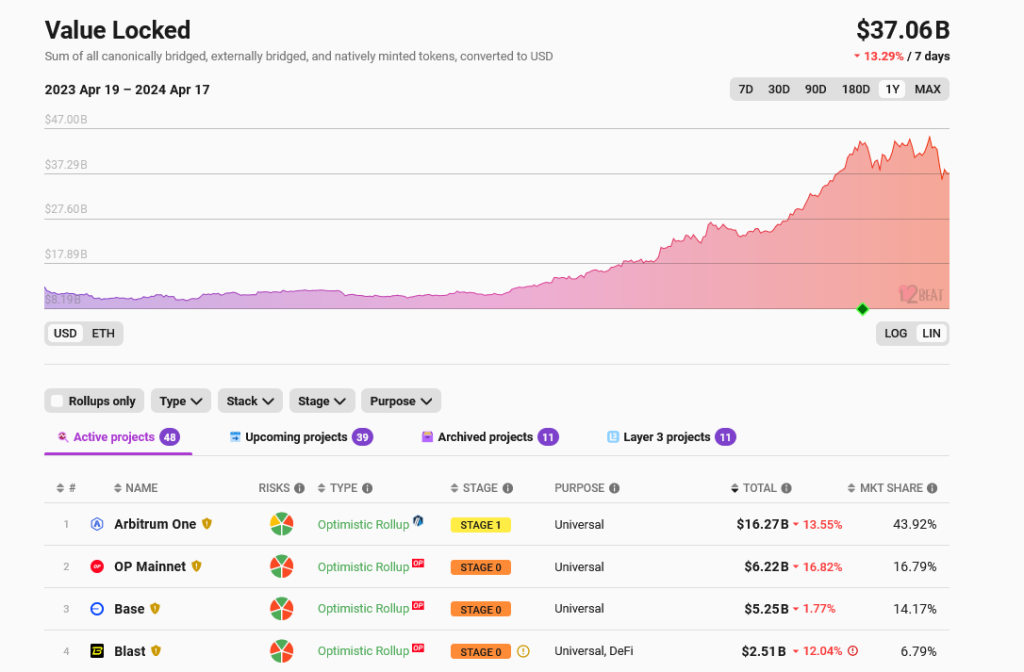

Ethereum Layer-2s Are Popular, But There Is A Big Problem

Ethereum layer-2 solutions have been gaining prominence over the years. According to L2Beat data on April 17, these platforms control over $37 billion of assets. Protocol developers and users can send transactions cheaply through Arbitrum, Optimism, Base, and other alternatives.

However, while they are popular and command billions in TVL, most of these platforms’ fraud proofs are being developed. Typically, when users transact all chains, all transactions must be confirmed by a web of miners or validators, depending on the consensus mechanism.

This differs in layer-2 options, which must reroute transactions and process them off-chain. There is no way of proving whether queued transactions are valid before being batched and confirmed on-chain.

The fraud proofs, such as those presented by Arbitrum and other optimistic rollup solutions, are designed to address a critical issue in layer-2 solutions. Specifically, once live and integrated into Arbitrum, BOLD will serve as a safety net, ensuring the validity of transactions processed off-chain. This mechanism is crucial in maintaining the integrity of transactions while enabling efficient off-chain processing.

In compliance with blockchain principles, BOLD will be decentralized. As such, the community will run nodes, which differs from the current setup. As it is, transaction validation in Arbitrum is centralized, and only a few validators are tasked with this.

Arbitrum Deploys BOLD In Testnet, ARB Prices Falling

With BOLD in the testnet, Arbitrum is opening up its rails so that anyone can participate in network security and validate withdrawals back to Ethereum. This move will be critical in building a more decentralized ecosystem and making the platform more robust.

Arbitrum becomes the first Ethereum layer-2 to launch its fraud proofs in testnet. In a post on X, Ryan Watts of Optimism also notified the community that plans are underway to create a decentralized fraud-proof system for the second-most largest layer-2 by TVL.

Even with this major milestone, ARB prices are stable and under pressure.

Related Reading: Crypto Analyst Says Don’t Buy Altcoins Just Yet – Here’s Why

The token is down 50% from March 2024 highs at spot rates and remains under immense selling pressure. If buyers reverse the April 12 and 13 sell-off, the token might recover strongly, racing towards $1.5.

Arbitrum’s Massive $107 Million Token Unlock Threatens To Send Price Below $1

Arbitrum (ARB) runs the risk of a significant price decline due to its upcoming token unlock on April 16. These token unlock events are known to be a recipe for high volatility because of what could happen in the aftermath of their occurrence.

$107 Million Arbitrum Tokens Set To Be Unlocked

Data from TokenUnlock shows that 92.65 million Arbitrum tokens (3.49% of its circulating supply) are set to be unlocked on April 16. 56.13 million ($65.10 million) of these tokens will be distributed to the team, future team, and advisors, while the remaining 36.52 million ($42.36 million) will be distributed to investors.

Token unlocks are usually followed by a wave of massive sell-offs from the beneficiaries, which causes the token’s price to drop. As such, Arbitrum’s price could also suffer the same fate once these tokens are distributed. However, this won’t be the first time, considering Arbitrum suffered a significant price decline during its last token unlock on March 16.

Data from CoinMarketCap shows that Arbitrum’s price, which closed the previous day at above $2, dropped to $1.8 on March 16. However, it is worth noting that the magnitude of this month’s token unlock is nothing compared to last month’s, when 1.11 billion Arbitrum tokens (41.89% of its circulating supply) were unlocked.

Therefore, the impact of any potential sell-off on the market might not be as severe as the last time. Despite that, Arbitrum still risks dropping below the $1 support level for the first time in a long while, as it is currently hovering around that price range.

Other Token Unlocks To Watch Out For

$76.96 million worth of Axie Infinity (AXS) tokens (7.6% of circulating supply) will also be unlocked this week on April 17. 3.10 million of these tokens will be distributed as staking rewards, while 6.08 million and 1.69 million tokens will be distributed to the team and ecosystem fund, respectively.

Meanwhile, like Arbitrum, Apecoin (APE) is another token that risks dropping below $1 with its upcoming token unlock on April 17. $18.57 million worth of Apecoin tokens (2.48% of circulating supply) will be unlocked, with most of these tokens going to the Yuga Labs founder. A significant drop in Apecoin’s price could further compound the bearish outlook of the Yuga Labs ecosystem, as the Bored Ape NFT is already down 90% from its peak.

Arbitrum (ARB) Poised For Resurgence: Downtrend Reaching Climax?

Generally, the crypto market has been experiencing a pullback after Bitcoin and many other coins like Ethereum have recorded a new all-time high of which Arbitrum (ARB) was not left behind.

Arbitrum, which has a lot of potential with a market cap of over $3.8 billion and a circulating supply of 2,653,939,384 ARB has been trading below the 100-day Moving Average (MA) for some time now. However, recently the price of ARB has been showing some signs of reversing.

As of the time of writing, Arbitrum was trading around $1.45, indicating an increase of 1% in the last 24 hours. There are currently two major resistance levels of $1.799 and $2.278 ahead of the price.

Technical Indicators Show Signs Of Upward Movement In Arbitrum Price

4-hour RSI Indicator: Looking at the Relative Strength Index (RSI) indicator from the 4-hour timeframe, we can see that the RSI line is rising above the oversold zone and is heading toward the 50 level. This indicates a rise in the price, and if the RSI line rises above the 50 level, it might trigger the start of a new trend.

The image below reveals more:

4-hour MACD: looking at the formation of the MACD indicator from the 4-hour timeframe in the above image, we can also see that both the MACD line and the signal line having trended for a while below the MACD zero line have both crossed and are heading towards the MACD zero line.

On the other hand, the MACD histogram is already trending above the MACD zero line. This suggests that a change in direction might soon happen from its downward movement to an upward movement.

1-hour bull power vs bear power histogram indicator: lastly, taking a good look at the chart from the 1-hour time frame with the help of the bull power vs bear power indicator, it shows that the histograms are already trending above the zero level. This suggests that buyers are gradually taking over the market from sellers as seen in the image below.

In conclusion, if the price of Arbitrum manages to change its direction from downward to upward direction, it is possible that ARB could retest its previous major resistance levels of $1.799 and $2.278 and even move further to create a new peak. Nonetheless, if Arbitrum fails to move upward, the crypto asset’s price might move further downward to create a new low.

Are Arbitrum Investors Still Selling Off? Analysts Remain Bullish On ARB As Price Surges 5.2%

Arbitrum (ARB), the Ethereum Layer 2 (L2) scaling solution, recently went through an unlocking event as part of its 2024 roadmap. However, the event raised concerns about how the token’s price would react amid the market slowdown.

It’s been a week since Bitcoin’s price started to dip. Despite BTC’s recovery, the market still exhibits red numbers. Crypto analysts remain optimistic about ARB and the market’s bullish run.

Are Arbitrum Whales Still Dumping On Exchanges?

The event on March 16 unlocked 1.1 billion ARB tokens. These tokens were distributed among the team, advisors, and investors, who received 438.25 million ARB, approximately 40% of the total tokens unlocked.

Since then, Arbitrum whales have dumped millions of ARB on exchanges. As reported by NewsBTC, eleven whales recently sent over $58 million worth of the token to different trading venues.

Yesterday, the trend continued as two ARB whales sent around $12.72 million worth of ARB to the Binance exchange. These whales are seemingly investors who received around 28.43 million ARB tokens during the unlock.

::on-chain insights::$ARB investors are selling their tokens:

two wallets which potentially belong to $ARB investors several hours ago sent their tokens to @binance

wallet 0x1dc firstly sent 3 $ARB to be sure that they will arrive to his binance account and then sent… pic.twitter.com/L8yfKnOnvK

— Catakor

(@Catakor) March 21, 2024

As reported by an X user, the first wallet received 19.845 million ARB on March 16. This whale sent 3 ARB to Binance as a test before offloading 3.9 million tokens worth $6.9 million.

The second whale sent 3.424 million ARB tokens to Binance yesterday in two transactions, accounting for $5.79 million. Out of the 28 million tokens these investors received during Arbitrum’s unlock, the wallets now only hold 804,000 ARB, worth around $1.42 million.

Analysts Foresee Leg Up For ARB

Arbitrum’s most recent downward trajectory started right before the unlocking event. After ARB’s price failed to maintain the $2 support level, the token dropped over 30% to trade around $1.48 on March 19.

Since then, ARB has started to rise and retest its resistance levels again. According to crypto analyst World Of Charts, ARB broke a bullish flag on March 20.

Successfully retesting the $1.64 price range could potentially bring a “40-45% Bullish Wave,” per the analyst.

Finally #Arb Has Already Started As Expected Send It Now https://t.co/6RouflzapC pic.twitter.com/zGE6KFtIpk

— World Of Charts (@WorldOfCharts1) March 20, 2024

ARB’s retest above the suggested price range succeeded in the following hours. The token rose to the $1.8 mark in the early hours of today before returning to the $1.75 price range.

Crypto analyst Bluntz projected a leg up for Arbitrum after the price neared the $1.8 resistance level. As the analyst highlighted, ARB’s price performance shows an a,b, and c zigzag pattern that could suggest an upward trajectory for the token. Additionally, he expressed optimism about the market’s health based on the token’s performance.

you know the market is healthy when even eth and eth beta is looking good again$arb pic.twitter.com/gjn4zduLW7

— Bluntz (@Bluntz_Capital) March 21, 2024

ARB is trading at $1.76 at writing time, representing a 5.2% increase in the last 24 hours. Although it shows a 14% and 12% decrease in the weekly and monthly timeframes, its current price still represents a 29.4% surge since the year began.

Altcoins Shows Buy Signals, Massive Opportunity Beckons: Analyst

As the price of Bitcoin (BTC) continues to demonstrate a major fall in valuation, indicating a gloomy attitude toward the crypto asset, the bulls in the market are hopeful that the market will soon enter another Season for Altcoins.

Altcoins Showing Massive Buying Opportunity

Bitcoin’s recent dip signaled the beginning of the decline in the cryptocurrency market, causing several altcoins to drop significantly. However, many cryptocurrency analysts believe that the drop in these altcoin prices might serve as an opportunity for future gains since the alt-season is on the horizon.

Popular cryptocurrency expert and trader Michael Van De Poppe has revealed his optimism in the altcoin market, highlighting the significant opportunities of getting into these tokens before the alt-season begins.

According to Michael Van De Poppe, “some altcoins have now dropped by over 40%” in comparison to their past all-time high. As a result, Poppe believes that this is the right time for investors to purchase these digital assets to position themselves for future gains.

Poppe noted he normally invests in these tokens “during bull cycles when they are about 25% to 60% less expensive.” This demonstrates the crypto expert’s confidence in the assets to rally in the coming months.

While pointing out the massive opportunities in the market, Poppe has underscored Arbitrum (ARB) as one of the altcoins investors should watch out for. He believes that ARB could realize substantial gains in time, as the token is down and poised for a new leg UP.

Recently, there have been notable advancements in the crypto asset’s price, demonstrating momentum for an upward movement. As of the time of writing, ARB was trading at $1.70, indicating an over 10% increase in the daily timeframe.

However, in the weekly and monthly timeframe, ARB is down by 22% and 15%, respectively. Meanwhile, Arbitrum’s market capitalization has increased by roughly 10% to exceed the $4.5 billion threshold.

Top ALTs To Purchase After Bitcoin’s Retracement

On-chain analyticS platform Santiment has also highlighted the drop in altcoins as a shot to garner profits in the upcoming months. Santiment pointed out several altcoins that offer a “possible bullish opportunity,” following Bitcoin’s crash today to a two-week low of $61,700.

Some of the tokens listed by Santiment are BOUNCE, LDO, OMG, STORJ, and SNX. The MVRV Opportunity and Danger Zone Model, according to Santiment, shows that many altcoins have now declined to the point where mid-term trading returns are in an “opportunity zone.” However, when an asset’s 30-day, 90-day, and 365-day average wallet returns add up to be negative, “this zone is breached.”

Even with the recent general correction, the altcoins market appears to be headed toward a favorable long-term picture. Consequently, this presents an excellent chance for investors to purchase these digital assets at a reduced cost.

Arbitrum Token Sell-Off: Whales Transfer $58M To Exchanges Following Unlock, ARB Price Reacts

On Saturday, March 16, the Layer 2 protocol Arbitrum (ARB) unlocked 1.1 billion ARB tokens as part of its 2024 roadmap. This event led to a significant decline in the native token’s value, with losses of up to 18% reported over the past week.

In the past 24 hours, more whales have been sending ARB tokens to exchanges for selling, indicating a potential further drop in the protocol’s prices. This token unlocking marks the beginning of a four-year phased process, releasing a specific number of tokens every four weeks until 2027.

11 Whales Dump $58 Million Worth Of ARB Tokens

Following the massive unlocking of ARB tokens, analysis firm Lookonchain revealed that 11 whales deposited 34 million ARB tokens (equivalent to $58 million) into exchanges.

Additionally, on-chain data provider “The Data Nerd” noted that trading firm Wintermute has been continuously depositing ARB tokens for the past 48 hours, potentially for selling purposes.

The data provider notes that digital asset trading firm Wintermute now holds only 7.22 million ARB tokens worth $12.35 million, indicating that they have already deposited or sold $18.12 million worth of ARB over the past few days.

The ARB token has been on a 29% downtrend since reaching its all-time high (ATH) of $2.39 on June 12, 2024. Following the unlock event, ARB traded as high as $1.96 but dipped to $1.61 within 48 hours.

The token has managed to reclaim the $1.68 level despite being in the red zone over the past 24 hours if the price drops further, ARB’s potential support walls are identified at $1.56, $1.46, and potentially as low as $1.32.

Arbitrum Post-Unlock Journey

NewsBTC reported that there has been only one previous unlock event for ARB tokens. On the first day after the unlock, ARB experienced a 3% increase, indicating positive market sentiment and initial demand.

However, the token’s price gradually declined, reaching a low of -21% approximately 21 days after the unlock event. Interestingly, around the 25-day mark, the price began significantly recovering, surging by 19% above the unlock-day level.

These patterns suggest that while Arbitrum may face initial downward pressure post-unlock, there is potential for recovery and positive price movement in the following weeks.

The future trajectory of ARB’s price action remains uncertain despite experiencing a 15% drop from its first unlock day. Drawing from the past unlock event, if historical patterns hold, there may be a further 6% decrease, aligning with the previous 21% drop observed 25 days after the first Arbitrum unlock event.

This hypothetical scenario would place Arbitrum at $1.57, indicating a favorable mid-term uptrend structure.

However, it is crucial to note that past patterns do not guarantee identical outcomes in current price trading. Nevertheless, analyzing historical data can provide valuable insights and help understand and assess potential price movements.

Featured image from Shutterstock, chart from TradingView.com

Reddit Community Token MOON Hits Record High Ahead of Celer’s Multidirectional Bridge Launch

From March 20, interoperability protocol Celer will allow MOON holders to move coins to Arbitrum One.

The Graph Expands Subgraph to More Than 40 Blockchains Including Arbitrum, Base

The indexing layer is also expanding to Avalanche and Celo.

Layer 2 Blockchains Become Cheaper After Ethereum’s Dencun Upgrade

The upgrade allows layer 2 solutions to store data in “blobs” instead of the expensive call data.

Debating Dencun: Will Ethereum’s Big Update Help or Harm the Network?

While Ethereum’s rollup-centric roadmap could help the ecosystem reach new levels of scale, some developers think relying on third parties to improve access to Ethereum could backfire.

Arbitrum’s ARB, Polygon’s MATIC Lead Gains as Ethereum’s Dencun Upgrade Goes Live

Ethereum’s Dencun upgrade enabled a new way of storing data that was forecast to dramatically cut costs for interacting with layer-2 networks.

Ethereum Activates ‘Dencun’ Upgrade, in Landmark Move to Reduce Data Fees

A key element of the upgrade is to enable a new place for storing data on the blockchain – referred to as “proto-danksharding,” which gives room for a dedicated space that is separate from regular transactions, and at a lower cost.

Ethereum Plans For Dencun Upgrade: Is This The End Of Roll-Ups?

Ye Zhang, the co-founder of Scroll, a layer-2 project using zero-knowledge proof, is cautiously optimistic about the upcoming Dencun upgrade. In a post on X, Zhang pointed out Dencun’s potential benefits, particularly the low transaction fees.

However, in the same post, the co-founder highlighted the likely challenges it could present for existing layer-2 scaling solutions using roll-ups.

Dencun Introduces EIP-4844 In Ethereum: What It Means

Ethereum developers plan to implement Dencun in mid-March. Implementing the Ethereum Improvement Proposal (EIP)-4844 is a big part of this hard fork. With this execution, the proposal will introduce a new “blob-carrying transaction” feature.

What’s unique about these transactions is that they allow users to cheaply attach blobs, which are large amounts of data, compared to traditional Ethereum transactions.

Based on observations from the Goerli testnet, Zhang anticipates blobs to be 3-5 times cheaper than traditional call data on Ethereum. Accordingly, the vast difference means innovative developers can come up with blob-inscriptions. These inscriptions will effectively compete with layer-2 solutions like Arbitrum or Optimism leveraging roll-ups.

This possibility cannot be discounted because, in essence, EIP-4844 aims to reduce layer-2 transactions through blob transactions. Effectively, the proposal means the foundation of Blob inscriptions.

This solution takes a different approach but could take on roll-up platforms if widely adopted. It will be the case if users transacting large chunks of data realize the advantage of going the blob inscription route.

Even so, roll-ups will carry distinct advantages over blob inscriptions. A notable one is the superior scalability of roll-ups. These solutions can inherently process more transactions every second. Additionally, they are secure since they inherit security from the Ethereum mainnet.

ETH Prices Steady Above $3,800

Still, until after Dencun is implemented, the impact of EIP-4844 will be thoroughly measured. Overall, the Ethereum and layer-2 communities are ecstatic for the upgrade, expecting it to thrust ETH even higher in the current bull run.

Ethereum is trading above $3,800. It has been up by double digits in the past week, and experts are predicting even more gains in the days ahead.

Related Reading: Analyst Cites Key Indicators That Signal Bitcoin Correction

In the medium term, bulls target $5,000, around the all-time high.

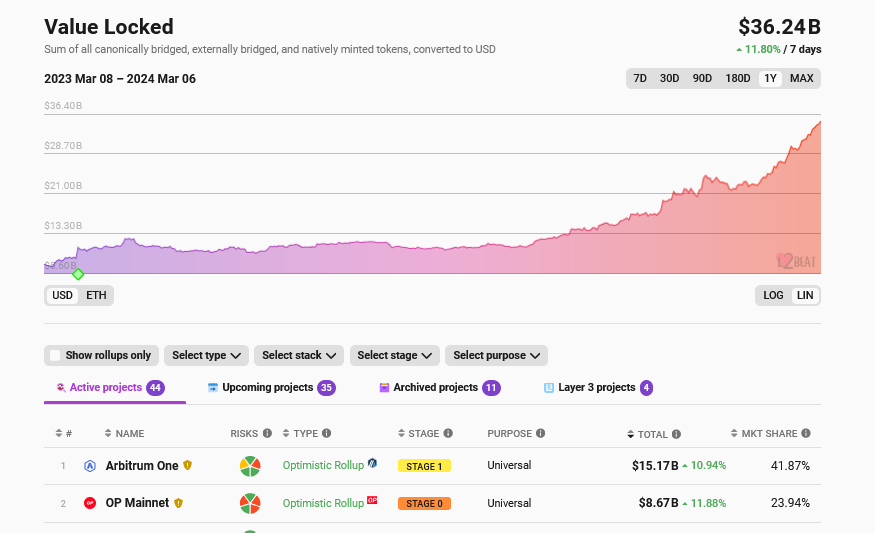

Amid the boom in ETH and crypto prices, interest in Ethereum layer-2 solutions continues to expand. The latest L2Beat data shows that Arbitrum, Optimism, and other alternatives manage over $36 billion. Arbitrum, enjoying its first-move advantage, manages nearly $16 billion.