A key element of the upgrade is to enable a new place for storing data on the blockchain – referred to as “proto-danksharding,” which gives room for a dedicated space that is separate from regular transactions, and at a lower cost.

Ethereum Plans For Dencun Upgrade: Is This The End Of Roll-Ups?

Ye Zhang, the co-founder of Scroll, a layer-2 project using zero-knowledge proof, is cautiously optimistic about the upcoming Dencun upgrade. In a post on X, Zhang pointed out Dencun’s potential benefits, particularly the low transaction fees.

However, in the same post, the co-founder highlighted the likely challenges it could present for existing layer-2 scaling solutions using roll-ups.

Dencun Introduces EIP-4844 In Ethereum: What It Means

Ethereum developers plan to implement Dencun in mid-March. Implementing the Ethereum Improvement Proposal (EIP)-4844 is a big part of this hard fork. With this execution, the proposal will introduce a new “blob-carrying transaction” feature.

What’s unique about these transactions is that they allow users to cheaply attach blobs, which are large amounts of data, compared to traditional Ethereum transactions.

Based on observations from the Goerli testnet, Zhang anticipates blobs to be 3-5 times cheaper than traditional call data on Ethereum. Accordingly, the vast difference means innovative developers can come up with blob-inscriptions. These inscriptions will effectively compete with layer-2 solutions like Arbitrum or Optimism leveraging roll-ups.

This possibility cannot be discounted because, in essence, EIP-4844 aims to reduce layer-2 transactions through blob transactions. Effectively, the proposal means the foundation of Blob inscriptions.

This solution takes a different approach but could take on roll-up platforms if widely adopted. It will be the case if users transacting large chunks of data realize the advantage of going the blob inscription route.

Even so, roll-ups will carry distinct advantages over blob inscriptions. A notable one is the superior scalability of roll-ups. These solutions can inherently process more transactions every second. Additionally, they are secure since they inherit security from the Ethereum mainnet.

ETH Prices Steady Above $3,800

Still, until after Dencun is implemented, the impact of EIP-4844 will be thoroughly measured. Overall, the Ethereum and layer-2 communities are ecstatic for the upgrade, expecting it to thrust ETH even higher in the current bull run.

Ethereum is trading above $3,800. It has been up by double digits in the past week, and experts are predicting even more gains in the days ahead.

Related Reading: Analyst Cites Key Indicators That Signal Bitcoin Correction

In the medium term, bulls target $5,000, around the all-time high.

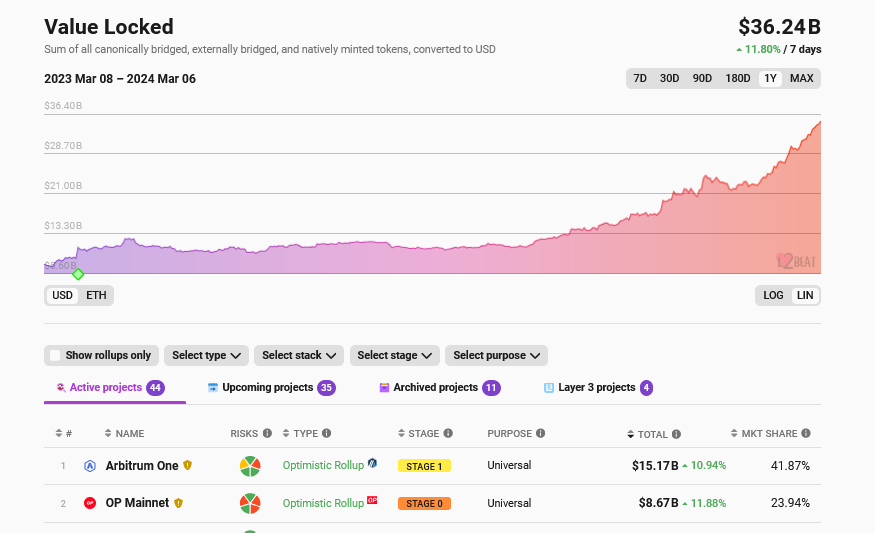

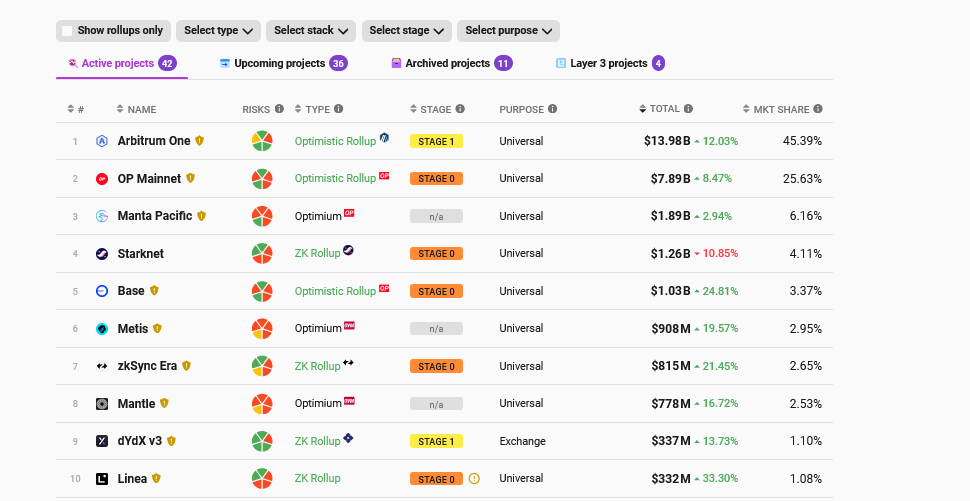

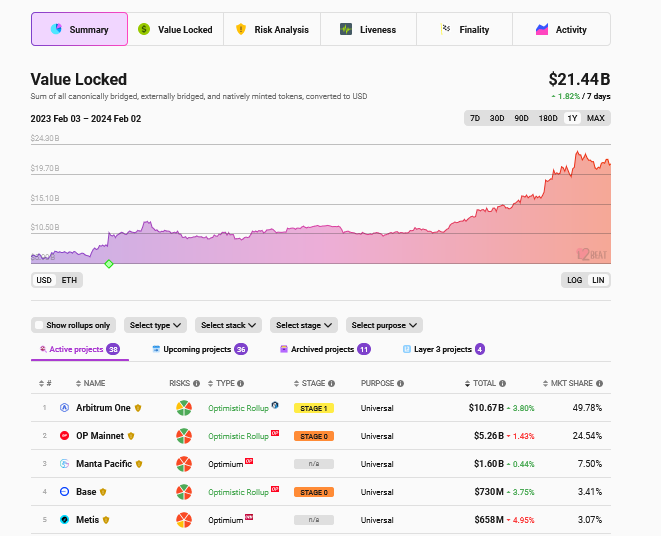

Amid the boom in ETH and crypto prices, interest in Ethereum layer-2 solutions continues to expand. The latest L2Beat data shows that Arbitrum, Optimism, and other alternatives manage over $36 billion. Arbitrum, enjoying its first-move advantage, manages nearly $16 billion.

Ethereum Fees Set to Drop for Arbitrum, Polygon, Starknet, Base. But How Much?

Leading figures behind layer-2 teams told CoinDesk how Ethereum’s upcoming Dencun upgrade will affect their networks.

Analyst: OP Is Undervalued But Will Skyrocket Because Of Coinbase And Base

Adam Cochran, a partner and professor, is bullish about OP, the native token of Optimism, the layer-2 scaling solution for Ethereum.

Taking to X, Cochran is convinced OP is undervalued, pointing to the significance of Coinbase and the brand it has created over the years as a crypto exchange and investor in multiple products. In 2023, Coinbase backed the development of Base, a layer-2 scaling solution for Ethereum that uses Optimism infrastructure for its optimistic roll-up.

OP Will Rocket Because Of CoinBase And Base

In coming up with this assessment, the investor highlights Coinbase’s vast user base and ability to drive retail adoption towards Base potentially. And, as aforementioned, since Base uses Optimism, the expected adoption spike will significantly boost OP from current spot levels.

Cochran argues that the “power of discoverability” associated with Coinbase, a brand that facilitates billions of dollars in daily trading, will be crucial to Optimism’s success. This is particularly relevant when looking at OP prices when writing.

When writing, OP is stable but up 220% from October lows. The token has been trending higher, benefiting from the broader crypto rally. Even so, though in an uptrend, OP has not reclaimed 2023 highs of around $4.2.

To drive the point home, Cochran compares how the BNB Chain blew up in the number of active users. In the last bull run, the chain had an active decentralized finance (DeFi) and non-fungible token (NFT) ecosystem. The BNB Chain’s popularity and soft landing is because the smart contracts platform is associated with Binance, the world’s largest cryptocurrency exchange.

Further to the point, the success of Solana, the partner argues, lends its success to the now-defunct FTX. At its peak, FTX injected billions to fund the development of Solana. It was also actively involved in financing some of Solana’s active protocols.

The Great Convergence Of Supportive Events

Presently, Coinbase is streamlining its operations, recently stopping support for Bitcoin, Litecoin, and other UTXO tokens via Coinbase Commerce. Their focus is on Ethereum-compatible tokens, which could provide hints that Coinbase Commerce might soon be integrated into Base.

From the protocol level, Ethereum plans to implement upgrades to make transacting on layer-2 platforms even cheaper. The Dencun Upgrade is scheduled for March and will see Ethereum enhance as part of its long-term scaling roadmap.

L2Beat data on March 1 shows that Optimism has a total value locked (TVL) of $7.8 billion, roughly half that of Arbitrum. Meanwhile, Base has been rising up the rankings, commanding a TVL of approximately $1 billion.

Trading Platform Robinhood, Layer-2 Arbitrum Team Up To Offer Swaps To Users

Users of Robinhood’s self-custody wallet will have access to Arbitrum swaps in the next coming months.

Arbitrum Beats Ethereum and Solana With 119% Surge In NFT Sales, NFT Resurgence On The Horizon?

Arbitrum (ARB), the Ethereum Layer 2 scaling solution, has been facing a bearish week after failing to establish a new price floor and falling below the $2 level. Additionally, the unlocking event scheduled for March could negatively impact the token’s price.

Despite ARB’s recent drop, the blockchain has seen a greater performance in the non-fungible token (NFT) market, surpassing Ethereum and Solana.

Arbitrum: Top Gainer In The Last Day

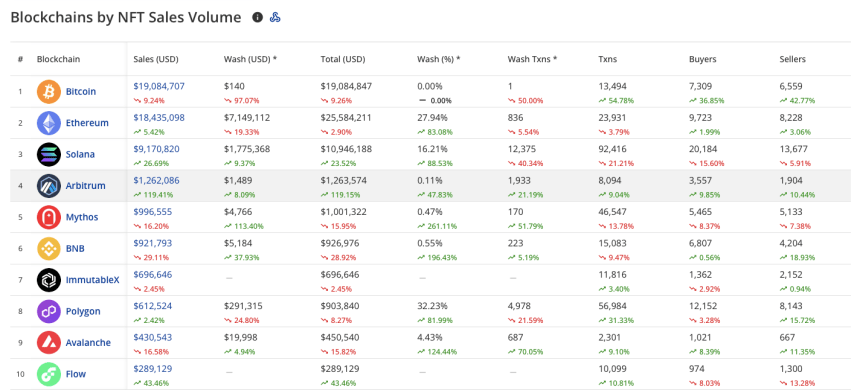

Data from Crypto Slam shows that the daily NFT sales volume in the Arbitrum blockchain recovered in the last 24 hours. The blockchain is the fourth largest by total NFT volume sales, showing a recent performance larger than Ethereum or Solana.

The chart above shows that Arbitrum is the top gainer after seeing a 119.41% surge in sales volume, over $1.26 million, during the last 24 hours. The blockchain also registered an 8.09% increase in wash sales from the day prior. Despite the rise, it only accounts for 0.11%, or $1,489, of the total sales volume.

Wash trading is a practice used to inflate an asset’s value artificially. As a form of market manipulation, the trader buys and sells the same asset, usually through a third party, to create the impression of a higher market activity of said asset.

Wash sales in the NFT market can happen through a single seller creating multiple accounts to trade the NFT or two sellers scheming to buy and sell each other’s digital assets.

The Arbitrum blockchain had 8,094 transactions during the last day, which accounts for a 9.04% increase. Its demand and offer of NFTs also rose by approximately 10%, with 3,557 buyers and 1,904 sellers in the previous 24 hours.

Solana and Ethereum saw a milder increase in their daily volume sales, with 26.69% and 5.42% respectively. Solana had a total sales volume of $10.9 million, divided by $9.17 million in authentic sales and $1.77 million in wash sales, which is 16.21% of the total volume and a 9.37% surge from the day prior.

Despite the sales volume being worth almost eleven million dollars, the demand and offer saw a significant 21.21% transaction drop and a 15.6% buyer decrease on the last day.

On the other hand, the NFT sales in the Ethereum blockchain saw a 2.9% drop in its total daily sales volume. Similarly, the number of transactions faced a slight 3.79% decline, with 23,931 transactions.

However, it’s worth noting that wash sales in the Ethereum blockchain saw a significant 19.33% decrease, with $7.14 million in the last 24 hours.

Is An NFT Resurgence In The Horizon?

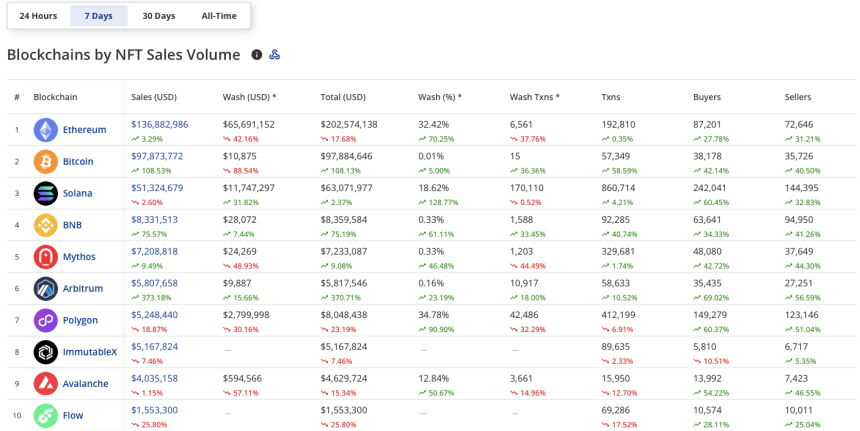

The daily sales volume suggests a recent interest in some of the NFTs offered in the Arbitrum and other top blockchains. However, said interest could be a momentary thing in this ever-changing market. To paint a bigger picture, let’s look at what the 7-day time frame data suggests.

As seen in the chart below, five of the top ten blockchains by NFT sales volume have increased in this timeframe. Arbitrum, Bitcoin, and BNB Chain are among the top gainers in the last week.

Arbitrum remains the biggest winner with its massive 373.18% surge. The number of buyers and sellers also increased exponentially, with a 69% surge (approximately 35,000 buyers) and a 56% increase (27,000 sellers) in the past week.

Ethereum takes the first spot as the blockchain with the largest NFT sales volume of $202.5 million. However, Solana remains the winner in the transaction and the user’s metric. The blockchain saw 860,714 transactions in the past week, with over 242,041 buyers and 144,395 sellers.

Besides the sales volume, the transactions and buyer/seller numbers shone some light on the NFT market in the past week. These numbers, green in the top ten blockchains by NFT sales, undoubtedly suggest an increase in interest in the 7-day time frame. However, these numbers are significantly below the NFTs market performance shown in the 30-day metric.

Arbitrum In Freefall, Dips Below $2 As Experts Analyze Recovery Timelines

Arbitrum (ARB), the Ethereum Layer 2 scaling solution, has experienced a recent price drop, falling below the $2 mark after a brief attempt to establish a new price floor. This decline, attributed to several factors including increased selling pressure and bearish technical indicators, raises questions about the token’s short-term trajectory while highlighting long-term potential.

Selling Spree Triggers Downward Spiral

The price decline began with a surge in selling pressure, most notably from Convex Finance. Over the past 24 hours, the DeFi giant offloaded 901,392 ARB tokens, valued at $1.63 million, at an average price of $1.8 per token.

This move, representing a profit of over $400,000 since acquiring the tokens in an airdrop last year, triggered a domino effect, with other investors following suit.

$ARB price dropped ~9% in the past 24 hours!@ConvexFinance further deteriorates the price by selling 901,392 $ARB ($1.63M) for 559.4 $ETH at ~$1.812 in the past 45 minutes.

They received those $ARB from the DAO airdrop in Apr 2023, which was then worth only $1.2M.

Token flow:… pic.twitter.com/09al0a71Oj

— Spot On Chain (@spotonchain) February 22, 2024

Bearish Indicators Reinforce Downtrend

Technical indicators on the daily timeframe chart further paint a bearish picture. The short-term moving average (SMA), previously acting as support around the $2 mark, has flipped to resistance. The Relative Strength Index (RSI) dipped below the neutral line, suggesting a dominant downward trend, albeit a weak one.

Despite the decline, signs of resilience emerge. The token experienced a slight recovery of 0.2%, currently trading around $1.88. Additionally, the Funding Rate on derivatives platforms like Coinglass remains positive at 0.014%, indicating that buyers still hold some control, albeit with less aggressiveness compared to before.

Low Derivative Interest: A Point Of Caution

However, the derivative market paints a less optimistic picture. Open Interest, a metric reflecting the total amount of capital locked in futures contracts, stands at around $254 million, indicating relatively low interest in ARB compared to other tokens. This lack of engagement could potentially limit upward momentum and price stability.

Long-Term Prospects Remain Promising

Despite the recent price dip, Arbitrum boasts strong fundamentals and long-term potential. Its fast and affordable transactions, coupled with growing developer adoption and ecosystem development, continue to attract interest. Recent partnerships like ApeCoin’s ApeChain launch on Arbitrum further solidify its position as a leading Layer 2 solution.

While the current price movement suggests a period of consolidation, Arbitrum’s long-term prospects remain promising. Investors should carefully consider market trends, technical analysis, and fundamental factors before making any investment decisions.

Featured image from Kamil Pietrzak/Unsplash, chart from TradingView

Arbitrum (ARB) Faces Potential Selling Pressure As 1 Billion Tokens Become Unlocked In March

Arbitrum, the cryptocurrency network designed as a scalability solution for the Ethereum blockchain, has recently experienced a notable price correction, resulting in a drop in its native token, ARB. Over the past 24 hours, the token’s value dipped to $1.84, marking a retracement of 5%.

As February draws to a close, attention is now turning to the potential downside price action expected in March as a substantial number of ARB tokens are set to be unlocked.

Major Unlock Event Looms For Arbitrum

According to a recent announcement on X (formerly Twitter), more than 1.11 billion ARB tokens, estimated at $1.24 billion, are scheduled to be released on March 16, 2024.

This unlocking event signifies the beginning of a four-year phased unlocking process, which will gradually release a certain number of tokens every four weeks until 2027.

The total number of tokens in circulation for Arbitrum currently stands at 1.275 billion, meaning the unlock will release an equivalent of 87% of the circulating supply, nearly quadrupling it to 2.375 billion tokens.

Token unlocks, especially when they exceed the average daily trading volume, can act as bearish catalysts for token prices as they introduce additional liquidity into the market. This influx of tokens can create inflationary pressures, leading to increased volatility and speculative trading.

However, to fully understand the potential impact on ARB, it is crucial to examine historical data that sheds light on the token’s price performance following previous unlocks.

According to Token Unlocks data, there has been only one cliff unlock event for ARB tokens in the past. Analyzing the price impact that followed this unlock provides valuable insights.

On the first day after the unlock, the price of ARB experienced a 3% increase, indicating positive market sentiment and initial demand. Subsequently, the token’s price gradually declined, reaching a low of -21% approximately 21 days after the unlock event.

However, at around the 25-day mark, the price began to recover significantly, skyrocketing by 19% above the unlock-day level.

These historical patterns suggest that while ARB may face initial downward pressure following the upcoming unlock, there is a potential for recovery and positive price movement in the following weeks. Nevertheless, it is important to note that market conditions and investor sentiment can vary, and past performance may not necessarily indicate future outcomes.

ARB Price Analysis

In the event of a potential 20% price decline from the current level of $1.84, ARB may face selling pressure and a lack of demand. To safeguard its current all-time high (ATH) of $2.4, bulls must defend major support walls.

Forecasting a potential dip to around $1.44, the next crucial support level for bulls to monitor is $1.42. This support level would be the last line of defense before a potential further decline to the subsequent support line at $1.25. If both levels fail to hold, the $1 mark would be at risk, with the last support for bulls at the $1.102 level.

It is important to note that the token unlock event’s outcome and ARB’s subsequent price action remain uncertain.

Additionally, the crypto market is bracing itself for the Bitcoin (BTC) halving event, which could introduce additional volatility to the overall market as the event draws nearer.

Featured image from Shutterstock, chart from TradingView.com

Developer Explains Why Meme Coins Are Shifting Base From Ethereum

Foobar, a code builder, criticizes Ethereum, accusing its developers of neglecting crucial improvements. Because of this shift, projects, including meme coin issuers, are adopting alternative protocols, including layer-2s and modern blockchains like Solana, which boast more features, mostly higher scalability.

Ethereum Developers Are Blocking Mainnet Updates

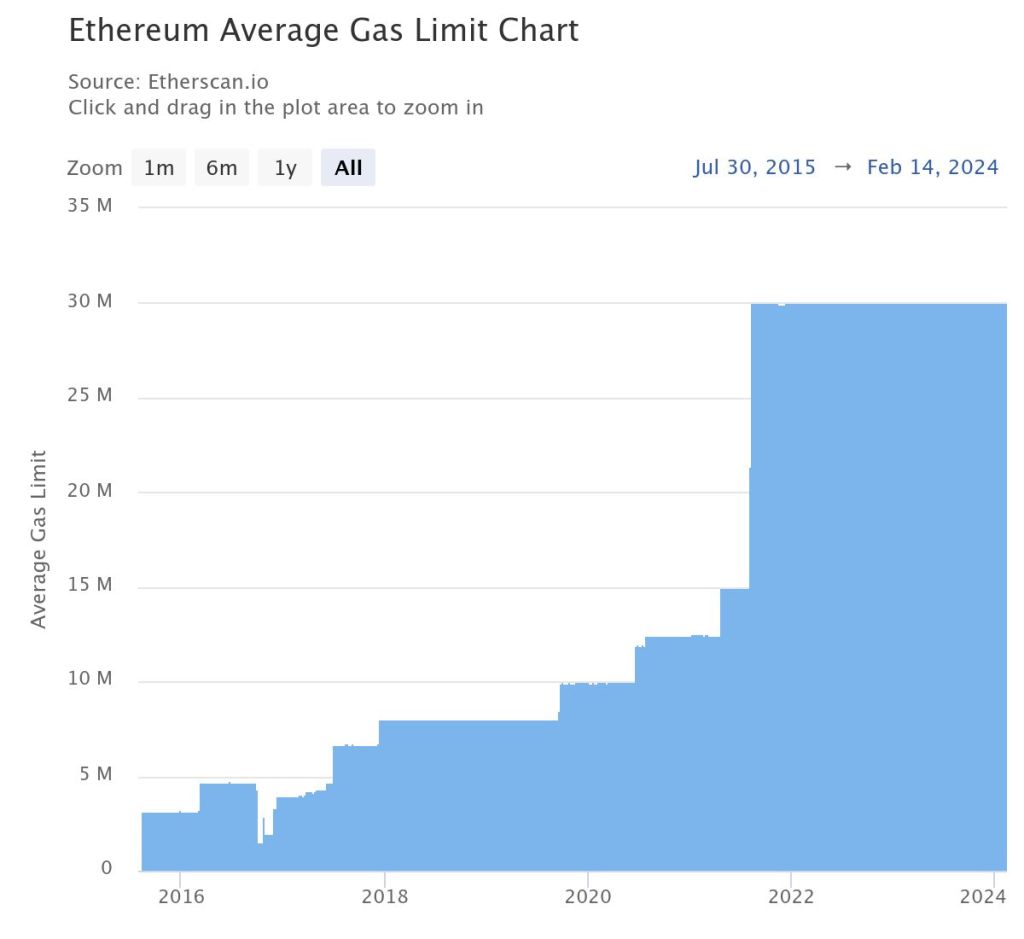

Taking to X, the developer claims that there have been no major mainnet improvements chiefly because such upgrades are being blocked by core and client developers. Specifically, Foobar cites the long-standing delays for features like Trie State Storage Optimizations (TSTORE) and Externally Owned Account (EOA) batch transactions. The developer also noted the lack of block gas limit increase since 2021.

The developer adds that the absence of main net updates and opcode improvements leading to the implementation of these proposals could be why decentralized apps (apps) launching on Ethereum are “bleeding tremendous value” due to high fees and limitations.

TSTORE and EOA batch transactions are proposals that, if they see the light of day, could see Ethereum scale better. Specifically, proposers of TSTORE forwarded a solution to address storage bloat to improve performance. On the other hand, EOA will enable the bundling of transactions from the same sender, reducing gas fees.

Meanwhile, Etherscan data shows that the block gas limit has been capped at around 30 million since August 9, 2021. Subsequently, Ethereum throughput remains low, and gas fees are higher, considering the high on-chain activity.

The failure of clients to integrate these proposals, the developer continues, makes Ethereum unusable for “any interesting app requiring moderate complexity.” Subsequently, many projects are migrating to layer-2s like Base, Arbitrum, Optimism, or entirely different blockchains like Solana and Avalanche due to limitations on the Ethereum mainnet.

Meme Coins Find Home In Solana And Others

As of mid-February 2024, more meme coin developers, reading from the popularity of emerging projects, are deploying from high throughput and low-fee platforms like Solana, Avalanche, and even Base. Meme coins like Bonk, Honk, and even the successful Bald on Base are examples.

Meanwhile, meme coin projects on Ethereum, like Pepe Coin (PEPE), appear to be losing market share as Shiba Inu, for example, launched Shibarium to offer its users lower transaction fees.

Foobar thinks the lack of improvements on the Ethereum mainnet is why Uniswap v4 has yet to launch. The new iteration of Uniswap, a popular decentralized exchange (DEX) powering Ethereum token swapping, is yet to release its latest version.

Based on existing documentation, v4 will include new features and functionalities, including Hooks. Supporters claim this tool will make the DEX more flexible, drawing more users once it goes live.

If ZK Is The ‘End Game,’ Is Polygon (MATIC) Ready For $3?

With zero knowledge (ZK) proofs expected to be a game changer for blockchain scaling, Polygon may be on the brink of a major rally. Taking to X on February 2, crypto market commentator Polynya, asserts that ZK technology is the “endgame” as its “1,000x efficiency upside is irresistible for networks.”

Will “ZK” Technology Be The “End Game”?

This forecast on ZK adoption is massive for Polygon and its native token, MATIC, which has been under significant selling pressure in the past few trading months. As it is, Polygon Labs, the developer of the Ethereum sidechain, has been at the forefront, advocating for the development of ZK scaling solutions.

In 2021, Polygon began assembling a team to develop zkEVM, a technique relying on zero knowledge to scale Ethereum cheaply while being compatible with the EVM. Recent Polygon Labs documentation shows that their zkEVM is in beta and being tested.

However, this hasn’t stopped the team from striking deals with layer-1 protocols interested in harnessing this technology.

In mid-January, NEAR Protocol’s Data Availability (DA) solution was integrated with Polygon’s custom blockchain development kit (CDK). The goal was to make it easier for developers to create ZK rollup solutions suitable for their needs while leveraging NEAR Protocol‘s infrastructure. All this is when ensuring the integration lowers cost and improves performance.

Polygon Labs has also partnered with other platforms, including Immutable–a layer-2 web3 solution for NFTs; Ankr–an infrastructure provider; and QuickSwap–a decentralized exchange (DEX). Most of these platforms plan to operate as layer-2s for Ethereum.

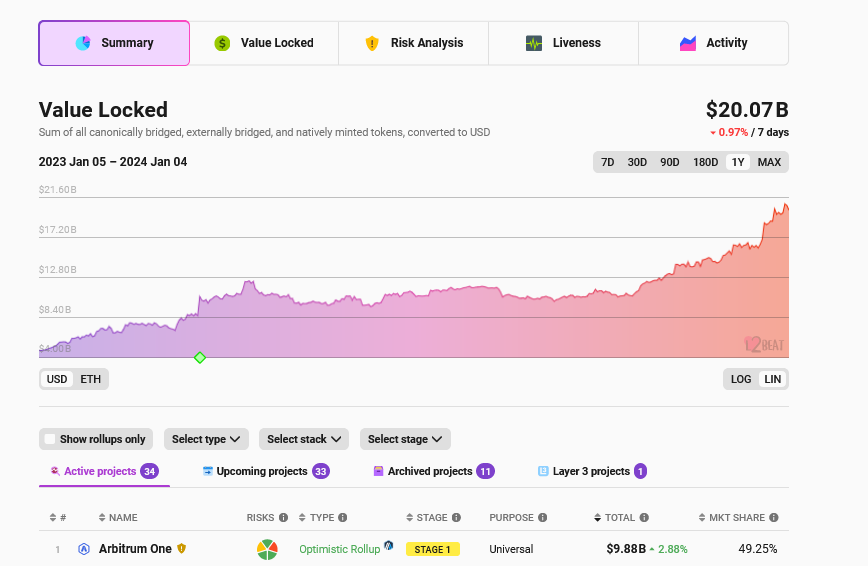

The total value locked (TVL) in layer-2 protocols remains in an uptrend, according to L2Beat. These platforms command over $21 billion. So far, the largest layer-2 protocols, Arbitrum, Optimism, and Base, use Optimistic Rollups.

Is Polygon (MATIC) Ready For $3?

This is a bullish development for Polygon. Moreover, at this pace, it is likely to cement Ethereum, the pioneer layer-1 and smart contract platform, as a dominant settlement layer despite on-chain scaling concerns and relatively high fees.

From a price point perspective, MATIC will likely benefit as more platforms adopt Polygon’s zkEVM solutions. So far, MATIC is stable but firm when writing on February 2. From the daily chart, MATIC has support at around $0.70. On the upper end, the immediate resistance level is at $1.

Spurred by partnerships as more platforms use zkEVM, fundamental developments might drive MATIC even higher in the coming sessions. If MATIC finds momentum, the medium- to long-term target will be $3, or a 2021 high.

Renowned Crypto Expert Reveals Top 3 Altcoins Ready To Breakout In February 2024

A prominent crypto analyst and Bitcoin enthusiast, Michael Van de Poppe, has shared insights on the future trajectory of several altcoins in the space. The crypto analyst’s predictions highlight crucial moments for investors as they watch out for opportune times to buy and sell cryptocurrencies in this dynamic market.

Altcoins Set To Rise In 2024

Following the approval of Spot Bitcoin ETFs, Bitcoin experienced a substantial surge, rallying to overcome the $45,000 price mark. During this bullish momentum, the prices of several altcoins, including Ethereum (ETH) and Solana (SOL), also witnessed significant increases.

In a recent X (formerly Twitter) post, Poppe revealed major altcoins to buy or sell in 2024. The crypto analyst shared a chart illustrating the historical price movements and corrections of Solana, Polygon (MATIC) and Chainlink (LINK).

Poppe revealed that Solana’s consolidation phase appears to have ended after it experienced a major decline from its 2023 peak of over $123 to $95.81 at the time of writing. His analysis suggests that Solana is poised for a higher time frame support test at $80 and is anticipated to surge to new highs, potentially reaching $140.

Subsequently, the crypto analyst presented a historical performance chart of MATIC, the native token of Polygon. Noting that the cryptocurrency has maintained higher time frame support levels with established liquidity, Poppe predicts an upcoming upward movement despite MATIC’s recent underperformance.

He forecasts that MATIC’s next rally could propel its price to a range between $1.25 and $1.50. As of now, the price of MATIC is trading at $0.789, reflecting a 2.39% decline in the past 24 hours, according to CoinMarketCap.

The Bitcoin enthusiast also anticipates a substantial price increase for Chainlink’s native token, LINK. The crypto analyst revealed that the cryptocurrency has consistently held crucial price levels and is positioned for an upward momentum towards $25. At the time of writing, the price of LINK stands at $14.65, representing a 0.12% increase in the last 24 hours.

Underperforming Crypto In 2024

In his X post, Poppe unveiled a roster of altcoins that has been struggling to surge and maintain crucial resistance levels. The crypto analyst pointed out that Ethereum’s recent slow growth has adversely impacted many altcoins, causing them to experience further declines.

He mentioned Synthetix (SNX), which is currently depreciating primarily due to Ethereum’s lagging performance. Additionally, there is Arbitrum (ARB) and Polkadot (DOT), which Poppe predicts would have a significant price increase in the future.

The Bitcoin enthusiast stated that if ARB can return to a price level of around $1.40 and $1.60, it could open up new entries into a more sustainable position. Subsequently, Poppe predicts a rise in the price of Polkadot to $15 despite its current price trading at $6.80.

The crypto analyst revealed that DOT is currently showcasing a “great weekly candle”, and its previous price corrections present a great opportunity for investors in the ongoing bull market.

As Blockchains Push Toward Decentralization, These People Serve as Ultimate Guardians

The goal of these “protocol councils,” sometimes called “security councils,” is to nudge these nascent networks toward increasing decentralization, by gradually removing them from under the control of their original developers. How are they different from boards of directors?

As Blockchains Push Toward Decentralization, These People Serve as Ultimate Guardians

The goal of these “protocol councils,” sometimes called “security councils,” is to nudge these nascent networks toward increasing decentralization, by gradually removing them from under the control of their original developers. How are they different from boards of directors?

Celo, Shopping for Blockchain Partner, Turns to the Delicate Issue of Money

A standalone blockchain, Celo is looking to migrate to become a layer-2 network atop Ethereum. The months-long selection process has started to look like “The Bachelorette,” with teams behind the Arbitrum, Optimism, Polygon and zkSync networks all vying to win the technology mandate.

How To Buy Sell and Trade Tokens On The Arbitrum Network

The Arbitrum (ARB) network is a Layer 2 scaling solution for Ethereum that aims to address the scalability and high transaction fees. It is developed by Offchain Labs and utilizes a technology called Optimistic Rollups to achieve its objectives.

Optimistic Rollups work by processing most transactions off-chain and then periodically submitting a summary of those transactions to the Ethereum mainnet. This approach reduces the transaction costs significantly and increases the throughput of the network while maintaining the security guarantees of the Ethereum mainnet.

In other words, the optimistic rollup feature allows Ethereum smart contracts to scale by passing messages between smart contracts on the Ethereum main chain and those on the Arbitrum second layer chain. Much of the transaction processing is completed on the second layer, and the results of this are recorded on the main chain — drastically improving speed and efficiency.

One of the key features of the Arbitrum network is its compatibility with existing Ethereum smart contracts. Developers can deploy their contracts on the Arbitrum network with minimal modifications, allowing for easy migration of decentralized applications (dApps) from Ethereum to Arbitrum.

Also, the arrival of the Ethereum network introduced a groundbreaking transformation in the realm of blockchain technology, providing a platform for the creation of decentralized applications (dApps) and propelling the growth of decentralized finance (DeFi). Nevertheless, as Ethereum’s preeminence soared, it encountered hurdles related to scalability and exorbitant transaction fees.

This is where the Arbitrum network enters the picture as a Layer 2 scaling solution, poised to tackle these challenges while ensuring seamless integration with Ethereum’s ecosystem. In this article, we will explore the core features of the Arbitrum network and examine its immense potential in the Ethereum ecosystem.

Features Of Arbitrum Network

The promise of Scalability:

Scalability has long been a bottleneck for Ethereum, causing network congestion and skyrocketing transaction fees during times of high demand. Arbitrum tackles this challenge by implementing Optimistic Rollups, a technology that allows for most transactions to be processed off-chain. By aggregating multiple transactions into a single summary, ARB achieves significant scalability improvements, enabling faster confirmation times and a higher throughput. This scalability boost unlocks the potential for a more efficient and seamless user experience on the Ethereum network.

Ecosystem and Adoption:

The Arbitrum network has garnered significant attention and interest within the Ethereum ecosystem. Several prominent projects and protocols have announced plans to deploy on Arbitrum or explore integrations. This growing ecosystem includes decentralized exchanges (DEXs), lending platforms, gaming applications, and more.

The increased adoption of Arbitrum provides users with a wider range of options for interacting with decentralized applications (DApps) and accessing various DeFi services.

Smart Contract Execution:

Arbitrum Network makes use of a technique called optimistic execution to process smart contracts. It assumes that most transactions are valid and executes them off-chain. This enables the network in providing fraud proofs, which allows anyone to challenge invalid transactions by submitting evidence to the Ethereum mainnet. This approach enables efficient and secure smart contract execution.

Decentralization and Security:

While Arbitrum relies on the Ethereum mainnet for final settlement and security, it maintains a high level of decentralization and security. By leveraging Ethereum’s robust consensus mechanism, Arbitrum benefits from the security guarantees of the Ethereum network. The periodic submission of transaction summaries to Ethereum ensures that any potential fraudulent activity can be detected and resolved.

Seamless User Experience:

Using the Arbitrum(ARB) network is designed to be seamless for users. They can continue using their existing Ethereum wallets, such as MetaMask, to interact with the Arbitrum network. This familiarity and compatibility make it easier for users to transition from Ethereum to Arbitrum and enjoy the benefits of improved scalability and reduced transaction fees without significant changes to their workflows.

What Makes Arbitrum Unique?

The Arbitrum (ARB) network is designed to provide an easy-to-use platform developers can use to launch highly efficient and scalable Ethereum-compatible smart contracts. It offers a range of exciting possibilities for developers and users alike. Some examples of what can be done on the network include:

High EVM compatibility

Arbitrum(ARB) is considered to be one of the most EVM-compatible rollups. It’s compatible with the EVM at the bytecode level, and any language that can compile to EVM works out of the box — such as Solidity and Vyper. This makes it easy to build on since developers do not need to get to grips with a new language before building on Arbitrum.

Decentralized Finance (DeFi) applications:

The Arbitrum (ARB) network can be used to build and run DeFi applications, such as decentralized exchanges (DEXs), lending and borrowing platforms, and stablecoin systems. These applications can benefit from the network’s fast transaction processing times and low gas fees, enabling efficient and affordable transactions.

Low transaction fees

As a Layer 2 scaling solution for Ethereum, Arbitrum isn’t just designed to boost Ethereum’s transactional throughput, it also minimizes transaction fees at the same time.

Thanks to its extremely efficient roll-up technology, Arbitrum is able to cut fees down to just a tiny fraction of what they are on Ethereum, while still providing sufficient incentives for validators.

Well-developed ecosystem

Arbitrum is already working with a wide variety of Ethereum DApps and infrastructure projects, including the likes of Uniswap.

Cross-Chain Interoperability

The Arbitrum (ARB) network can also be used to enable cross-chain interoperability between different blockchains. This could allow for the seamless transfer of assets and data between different blockchain ecosystems, enabling greater interoperability and connectivity across the entire blockchain space.

The Arbitrum network’s fast transaction processing times, low fees, and security and decentralization features make it a compelling choice for a wide range of use cases.

How To Get Started on The Arbitrum Network

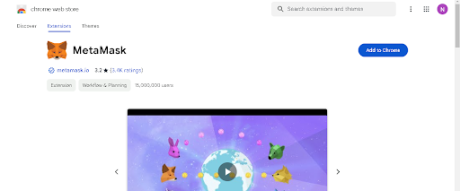

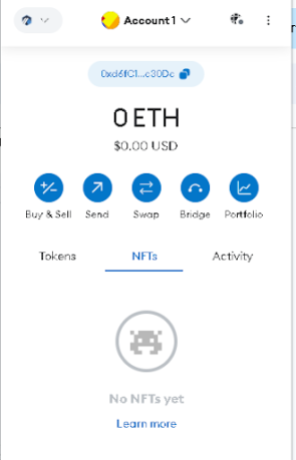

To buy and sell tokens on the Arbitrum (ARB) network, you must first get a metamask wallet. MetaMask is a popular browser extension wallet commonly used for interacting with blockchain networks like Ethereum. It is available as a browser extension for popular browsers such as Google Chrome.

Ensure your Metamask Wallet has been added to your browser as an extension by clicking on the ‘Add to Chrome” icon on the top right as shown below:

Once installed and set up, MetaMask allows users to manage their cryptocurrency wallets, interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks directly from their browsers. (Make sure to write down your seed phrase on a piece of paper and keep it in a safe place. Do not store it online or on your device).

Next, add the ARB network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On the Arbitrum (ARB) Network

In order to execute trades on the ARB network, you will need to fund your wallet with Ethereum (ETH) so as to enable you to cover gas fees even though the majority of the trading activity takes place on the Arbitrum layer 2 solution. This is because the Arbitrum network periodically submits transaction summaries and proofs to the Ethereum mainnet, which requires paying Ethereum gas fees.

You can buy ETH on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the ETH from Binance to your Metamask wallet.

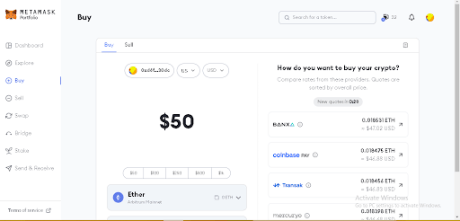

You can also purchase ETH directly within the Metamask wallet using traditional payment methods such as credit or debit cards, etc.

Just click on the “Buy/Sell” button within Metamask to open the interface. Here, you can put how much ETH (or any other token) you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your ETH to arrive in your wallet. Once the ETH arrives, you are all set to begin trading tokens on the ARB network. So, head over to UniSwap to get started on your trading journey.

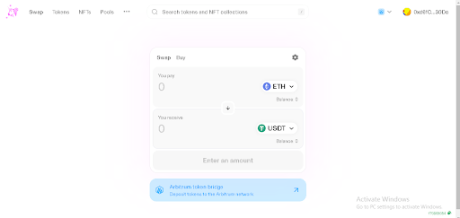

How To Trade Tokens On The ARB Network Using UniSwap

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain. It allows users to trade Ethereum-based tokens directly from their wallets without the need for intermediaries or traditional order books. Uniswap offers users a simple and straightforward way to buy and sell a wide variety of tokens.

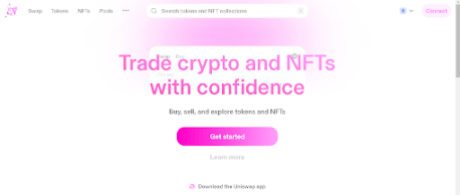

Endeavour to be on the right Uniswap website to protect your wallet from any fraudulent activity. The first step is clicking on the “launch app” button at the top right corner, as shown in the image below:

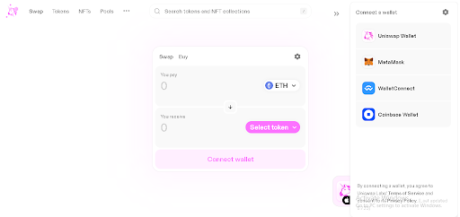

The next step is clicking on the connect wallet option on UniSwap at the top right corner, as shown in the image below:

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

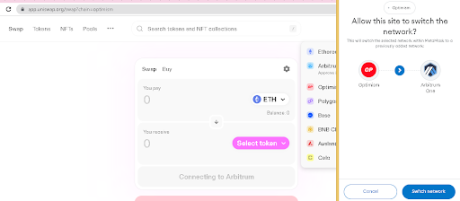

Once connected, switch Metamask to the ARB network. (If you’re already on the ARB network, you do not need to switch):

After connecting MetaMask to the ARB network, go to UniSwap, and then you can start trading on the ARB network using UniSwap.

The next step is to select your preferred tokens on the UniSwap interface and since Uniswap operates on a token to token trading model, click on the “select token” button to select the trading pair you want to trade against.

For example, if you want to buy USDT using ETH, select ETH – USDT, enter the amount, then click on “swap” or “trade now” and confirm the transaction in your Metamask wallet. You can view the tokens in your wallet’s asset list.

Buying and Selling Tokens with the Metamask Wallet

ARB Network users can also buy and sell tokens using the Metamask extension wallet already connected to the ARB network.

To do this, make sure you’re connected to the ARB network and have ETH to swap and pay for gas fees. Then, navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on UniSwap. Input the amount of ETH you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

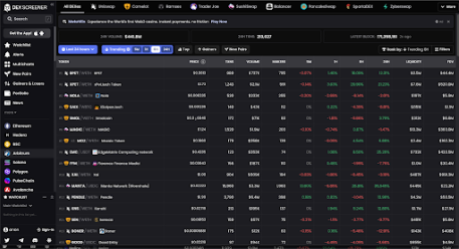

Tracking Token Prices on The Arbitrum Network

Users of the Arbitrum (ARB) network can take advantage of on-chain tools like Dexscreener to gain access to comprehensive market insights for specific tokens. These insights include price data and contract information, empowering users to make well-informed trading decisions based on reliable and up-to-date information.

With Dexscreener on the Arbitrum network, users can stay informed about token metrics and market dynamics, enhancing their trading strategies and overall trading experience.

Dexscreener offers a variety of advantageous features tailored to users on the Arbitrum network. Among these features, an exceptional one is the charting functionality, which delivers both real-time and historical price data for a wide range of tokens.

By utilizing these charts, users gain valuable insights into price trends, trading volumes, and other pertinent metrics. This enables them to pinpoint potential entry or exit points for their trades with precision and confidence.

Take a look at the example below:

Conclusion

In conclusion, the Arbitrum network offers a compelling ecosystem for buying, selling, and trading tokens, providing several notable advantages over other platforms. With its seamless integration of on-chain tools like Dexscreener, users gain access to detailed market insights, real-time price data, and historical charts, enabling them to make informed trading decisions with confidence.

Additionally, Arbitrum’s scalability and low transaction fees enhance the overall trading experience, ensuring quicker and more cost-effective transactions. By leveraging the power of the Arbitrum network, traders can enjoy a secure, efficient, and feature-rich environment that empowers them to navigate the world of token trading with ease.

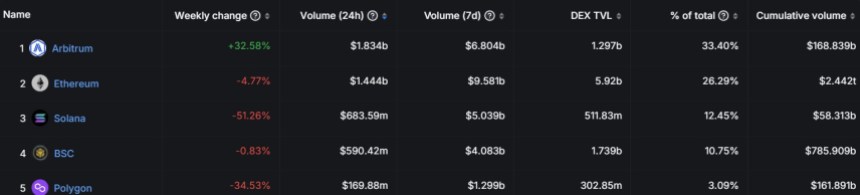

Arbitrum (ARB) Rise: Daily DEX Volume Surges, Outpacing Ethereum By $400 Million

Arbitrum, a prominent Layer-2 (L2) scaling solution, has been on a remarkable upward trajectory since the launch of its native token, ARB, in March 2023. The past 30 days witnessed a staggering 74% surge in ARB’s value, underscoring the growing market interest in the protocol.

Notably, Arbitrum’s daily decentralized exchange (DEX) volume has experienced a significant surge, propelling the protocol to surpass Ethereum (ETH) for the first time in this key metric.

This milestone highlights Arbitrum’s increasing adoption and recognition for its scalability within the decentralized finance (DeFi) ecosystem.

Arbitrum Sets New DEX Records

According to data from DefiLlama, Arbitrum’s daily DEX volume reached an impressive $1.834 billion over the past 24 hours, surpassing Ethereum’s volume of $1.444 billion. Analyzing DefiLlama’s data, it becomes evident that Arbitrum’s growth extends beyond daily DEX volume alone.

The weekly change in ARB’s value soared by 32.58%, showcasing the token’s strong performance in the market. Moreover, Arbitrum’s seven-day volume reached an impressive $6.804 billion, indicating robust trading activity on the protocol.

In terms of total value locked (TVL) in DEX, Arbitrum accounted for $1.297 billion, constituting 33.40% of the total TVL. In comparison, Ethereum’s TVL stood at $5.92 billion, making up 26.29% of the total. This demonstrates Arbitrum’s growing prominence as users increasingly recognize its potential for efficient and secure decentralized trading.

ARB’s Financial Metrics Soar

Further demonstrating the growth of the protocol’s ecosystem, token terminal data shows that Arbitrum’s market capitalization (in circulation) has increased by an impressive 83.84% to $2.56 billion.

The revenue generated by Arbitrum over the past 30 days has also experienced remarkable growth, with a 79.82% increase to reach $11.66 million.

Furthermore, looking at the fully diluted market capitalization, Arbitrum has witnessed an identical 83.84% rise to reach $20.07 billion.

Arbitrum’s revenue on an annualized basis has seen a significant boost, surging by 101.67% to reach $141.81 million. This figure represents the projected revenue for a full year based on the current monthly revenue, underscoring the protocol’s sustained growth.

In terms of fees generated, Arbitrum’s 30-day figures have surged by 79.82% to reach $11.66 million, demonstrating the protocol’s ability to capture a significant share of transactional fees within its ecosystem.

On an annualized basis, fees have soared by 101.67% to reach $141.81 million, further validating the protocol’s revenue growth and economic potential.

Nevertheless, the protocol’s native token, ARB, is trading at $1.8962, down over 8% in the past 24 hours and below its all-time high (ATH) of $2.11 set on Thursday. Despite this pullback, it is still up 36% over the past 14 days, demonstrating the token’s bullish momentum.

Featured image from Shutterstock, chart from TradingView.com

Solana Co-Founder: The Blockchain Doesn’t Need Layer-2s Like Ethereum

Solana co-founder Anatoly Yakovenko has expressed confidence that their blockchain can handle the growing demand for decentralized applications (dapps) without needing layer-2 solutions like those employed by Ethereum.

Solana Doesn’t Need Layer-2 Solutions

In a post on X, Yakovenko argued that Solana’s design, which utilizes a hybrid consensus mechanism, enables it to scale efficiently without relying on additional layers. The co-founder explained that their goal is to eventually synchronize a global atomic state machine “as fast as the laws of physics allow.” With this stance, Yakovenko appears to be downplaying the role of layer-2 off-chain options like Arbitrum and Base.

“Solana aims to synchronize a global atomic state machine as fast as the laws of physics allow,” Yakovenko said on X. “In this end state, any layer-2, side chain, or zero-knowledge proof Valadium amounts to the same thing. They are external execution environments that cannot ensure atomic composition with the rest of the layer-1 state.”

Despite the position Yakovenko takes, the co-founder said the floor is open for developers to create layer-2 solutions. However, it won’t be necessary because the network can handle such demand without such workarounds.

Ethereum Is Confident Layer-2s Will Be Key To Scaling

This stance contrasts Ethereum’s approach, which increasingly relies on layer-2 solutions to alleviate congestion and high transaction fees. Layer-2 options such as Optimism and Arbitrum have gained popularity for their ability to offload transactions from the mainnet while maintaining compatibility with existing smart contracts.

To quantify their role in scaling Ethereum, L2Beat data shows that the layer-2 solutions have a combined total value locked (TVL) of over $20 billion. The largest of them is Arbitrum, which manages $10 billion of assets when writing on January 5.

Though Yakovenko’s comments reflect Solana’s focus on providing a high-performance, low-cost environment for apps, there have been instances when the network froze, calling its reliability into question. To resolve this, the platform plans to upgrade its client, adding the Firedancer for increased node reliability and performance.

On the other hand, Ethereum seems to be going the layer-2 route. During their developer call, it was decided that Ethereum’s gas limit won’t be increased further from the 30 million gwei level. This, analysts concluded, meant the delay of on-chain scaling ambitions for off-chain methods, specifically off-chain and sidechain rails.

Arbitrum Is Trending On Social Media, Time For ARB To Rip Higher?

There is an upswing in social media mention of ARB, the native token of Arbitrum, a layer-2 scaling solution for Ethereum, suggesting growing interest and potential for price gains.

According to AlphaScan data on January 4, ARB had the “best sentiment” in the last 24 hours, with more than 40% of all weekly mentions occurring within this timeframe. Notably, ARB was the most mentioned token, right behind Bitcoin. This surge in positive sentiment shows in the weekly timeframe, where over 30% of all monthly mentions occurred in the last week of December.

ARB Is Trending As Prices Rise To 2024 Highs

Social media mentions can be a good metric for tracking sentiment. As such, with ARB trending, only trailing Bitcoin, it could show that the crypto community is taking note of the project and tracking its progress. Since there was no hack or steep losses on January 3, the ARB social media count spike is a net bullish for the project.

Interestingly, ARB is trending across social media platforms when token prices are at an all-time high and decentralized finance (DeFi) activity is recovering. From the daily chart, ARB is changing hands at around $2, the highest price point for the token, according to Binance data.

In 2023 alone, ARB surged roughly 300% from March 2023 lows, peaking in late December. The uptrend remains, and bulls are pressing on, absorbing any attempts for lower lows.

Arbitrum plays a key role in addressing the scaling limitations of Ethereum. The layer-2 roll-up option re-routs transactions from the mainnet, relieving the base layer. This helps keep gas fees low, enhancing the overall user experience.

Based on L2Beat data on January 4, Arbitrum is the largest layer-2 scaling solution with a total value locked (TVL) of over $9.8 billion. Of note, Arbitrum has implemented a permission fraud-proof system that overly enhances transaction transparency, allowing for the effective monitoring of its sequencer’s activities.

Arbitrum Orbit Supports Custom Tokens For Gas Payment

The uptick in social media activity also follows the recent enhancements to Arbitrum Orbit. Launched in Q1 2023, the platform allows developers to build layer-3 protocols on Arbitrum.

Protocol developers have now added support for custom gas tokens. This feature relieves Orbit chain deployers from using ETH to pay gas fees and, instead, opt to select ERC-20 tokens, including ARB.

With Arbitrum Orbit evolving, developers and projects launching on layer-3 solutions will have more flexibility. This move will also likely enhance the utility of their respective tokens, boosting demand and even prices since they are not tied to using ETH or, expressly, ARB to pay gas fees.

Arbitrum Token Sets Record High as Value Locked Crosses $2.5B

Transaction volumes on the network overtook those for Solana-based applications, which boomed after a meme coin-led frenzy in December.

Arbitrum (ARB) Maintains Impressive 30% Price Uptrend, Analyst Predicts Breakout Above $2

Arbitrum (ARB), a prominent Layer 2 (L2) protocol, has emerged as one of the top gainers in the past month, experiencing a remarkable surge of 59%. Over the past 7 days, the token has grown substantially over 31%, propelling it to reach a new all-time high (ATH) of $1.8391 on Monday.

Arbitrum’s Market Capitalization Surges To $2.21 Billion

The impressive price surge of ARB reflects the growing interest in the protocol and its native token within the Layer 2 ecosystem. This surge is evident when examining the data provided by Token Terminal, a leading analytics platform.

According to Token Terminal’s data, Arbitrum’s market capitalization (circulating) is $2.21 billion, marking a significant increase of 56.18%.

Additionally, the revenue generated by the protocol over the past 30 days amounts to $11.31 million, representing a substantial surge of 87.74%.

The fully diluted market capitalization is $17.33 billion, reflecting the market’s positive sentiment toward the protocol’s potential. The revenue on an annual basis reaches $137.63 million, exhibiting an impressive growth of 106.63%.

Moreover, the strong performance of the market indicators, such as the P/F ratio (fully diluted) at 125.95x and the P/S ratio (fully diluted) at 125.95x, indicate robust investor confidence.

The fees generated by the protocol over the past 30 days amount to $11.31 million, representing a significant increase of 87.74%. Additionally, the annualized fees reached $137.63 million, demonstrating a substantial growth of 106.63%.

Furthermore, the data reveals that Arbitrum has a strong user base, with an average of 153,3100 active daily users over the past 30 days, highlighting its popularity and adoption. Even more encouraging is that a prominent crypto analyst foresees continued growth in price action for ARB.

Clear Uptrend In ARB Signals Potential Breakout

Renowned crypto analyst Michael van De Poppe has identified a clear and promising uptrend in the cryptocurrency ARB.

Through his technical analysis, van de Poppe observes that the token has been consistently experiencing “beautiful retests” of previous resistance levels, which have now transformed into strong support zones.

If the current price trajectory continues, Michael van De Poppe suggests that investors should keep an eye on a potential optimal “go-to zone” for ARB between $1.50 and $1.60.

This zone represents a strategic level where the token may experience a retest before deciding to break the psychological barrier of $2.

It remains to be seen if this prediction will come true and how ARB’s price action will develop through the first half of 2024.

Featured image from Shutterstock, chart from TradingView.com