Resolving recent systemic failures in the cryptocurrency ecosystem and the prospect of spot Bitcoin ETF approvals could drive Bitcoin to $100,000 in 2024.

Cryptocurrency Financial News

Resolving recent systemic failures in the cryptocurrency ecosystem and the prospect of spot Bitcoin ETF approvals could drive Bitcoin to $100,000 in 2024.

History shows there’s likely a bright year ahead for BTC’s price.

Several macro events are contributing to increased interest in Bitcoin and its price and a knock-on effect on the wider markets.

On December 1, dYdX, the layer-2 decentralized exchange, will unlock 150 million DYDX worth roughly $478 million to early investors and core team members. This substantial unlock has raised concerns among investors, who fear the influx of fresh tokens could substantially increase supply.

If this is not matched by high demand, DYDX prices will likely pull back, reversing recent gains posted over the past few trading weeks.

According to Bubblemaps data, out of the $478 million worth of DYDX, over 50% is allocated to venture capitalists (VCs), including Paradigm and Polychain. Zooming back and looking at their data, VCs seeded $100 million to the layer-2 decentralized exchange.

These tokens were distributed to private investors through five wallets, including Coinbase Custody, Investor Distribution, and the Foundation Wallet.

Currently trading at over $3, DYDX is at February 2023 levels and technically bullish. However, the upcoming token unlock casts a shadow over the token’s positive momentum.

Notably, dYdX, postponed its token unlock by ten months. According to data, the humongous DYDX unlock was initially postponed from February to December 2023. Following this move, DYDX prices edged higher.

Even so, prices pulled back before consolidating in the better part of Q2, Q3, and early Q4 2023. There was a pronounced rally in late October 2023 as DYDX rose, riding the optimism across the crypto board.

At spot rates, DYDX is up 82% from October 2023 highs. However, looking at price action, bears are retesting the 20-day moving average of the BB. A break below this level might trigger a sell-off, pushing prices back to October 2023 highs.

While it is likely that prices could contract ahead or after the unlocking event, the team has devised a way of mitigating the expected selling pressure. To illustrate, the initial unlock will release 30% of the total amount. Afterward, there will be monthly equal releases over the next three years.

For optimists, however, that a significant portion of these tokens will go to the team, and investors could end up supporting prices. Team members and venture capitalists trade less frequently than retail investors, meaning the expected liquidation pressure, if any, could be limited.

Moreover, some team members and even early investors might consider re-staking DYDX from their infrastructure, giving them more control.

Even with this release, crypto participants are upbeat, anticipating Bitcoin prices to track higher ahead of the expected spot Bitcoin ETF approval by the Securities and Exchange Commission (SEC). More tailwinds could result from the Bitcoin halving event in early Q2 2024.

Bitcoin experienced its first-ever halving 11 years ago today, and since then, its price has soared from $12 to its current price of $37,000.

In a recent statement, Dennis Porter, the co-founder and CEO of Satoshi Action Fund, expressed his belief that the year 2024 will mark a crucial turning point in the history of Bitcoin.

Porter’s remarks amidst growing anticipation surrounding the approval of spot Bitcoin exchange-traded funds (ETFs) and the highly anticipated halving event scheduled for April 2024.

According to Porter, these events, combined with the efforts of the Satoshi Action Fund, have the potential to impact the price and adoption of Bitcoin significantly.

Satoshi Action Fund, a non-profit organization dedicated to informing policymakers and regulators about Bitcoin, has actively shifted the narrative surrounding the world’s leading cryptocurrency.

The fund aims to promote “hyper-Bitcoinization,” a term coined to describe the widespread adoption of Bitcoin as a global currency.

One of the primary goals of the Satoshi Action Fund is to advocate for the passage of pro-Bitcoin legislation in 10 different US states by 2024. According to Porter, these proposed laws would protect individuals’ rights to self-hold and mine Bitcoin, positioning the United States as a global leader in Bitcoin adoption and mining.

Interestingly, Porter envisions a future where bipartisan legislation empowers Bitcoin and fosters the growth of an emerging digital asset industry.

Recent developments in the Bitcoin ecosystem further bolster Porter’s optimism. The halving event occurs approximately every four years and is anticipated to reduce the rate at which new Bitcoins are created, potentially leading to increased scarcity and upward price pressure.

Additionally, the long-awaited approval of Bitcoin ETFs by the Securities and Exchange Commission (SEC) has the potential to attract institutional investors and facilitate mainstream adoption.

Renowned crypto expert Charles Edwards has boldly proclaimed that the recent liquidation of fear, uncertainty, and doubt (FUD) surrounding the crypto market will pave the way for a significant price rebound.

Edwards believes that the culmination of recent developments, particularly the Binance news, will eliminate sources of FUD accumulated over the past two years.

The market has been gripped by panic triggered by headlines associating the term “guilty” with cryptocurrencies. However, Edwards suggests that the recent news concerning Binance should be viewed more as a settlement rather than a detrimental event.

Edwards points out that five years ago, exchanges were not compliant with know-your-customer (KYC) and anti-money laundering (AML) regulations, whereas now, they have implemented these practices. Consequently, Edwards believes that the lingering FUD surrounding Binance can finally be restored.

Looking ahead, Edwards highlights several positive catalysts on the horizon for BTC. These include the potential approval of ETFs, the upcoming Bitcoin halving event, expectations of lower interest rates, and the possibility of a recession leading to increased quantitative easing (QE).

Edwards concludes by envisioning a “Bitcoin liquidity atomic bomb” waiting to explode. With the elimination of FUD and a series of positive triggers aligning, the market is poised for a substantial rebound.

The convergence of ETF approvals, the halving event, accommodative monetary policies, and a potential recession are expected to propel Bitcoin to new heights.

At the time of writing, Bitcoin (BTC) is trading at $36,500, experiencing a slight decline of 2.2% over the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Binance CEO CZ and BTC analysts are among those who have started to draw attention to the halving event as the crypto community looks to the bullish event with hope after a cruel crypto winter.

The anticipation around the next BTC halving is palpable among investors and cryptocurrency enthusiasts alike. This process, which slashes the reward for mining Bitcoin transactions in half, is a pivotal event for the economy of the flagship cryptocurrency.

The next BTC halving date is not just a mark on the calendar; it’s a beacon for potential shifts in value and market dynamics, making the question “when is the next BTC halving” all the more critical for market participants. This comprehensive guide dives deep into the concept of Bitcoin halving, its historical impact, and what the future holds as we approach the next halving.

Bitcoin Network 101: The Basics Explained

The next BTC halving is a seminal event in the Bitcoin blockchain’s timeline, marking the point at which the reward for mining new blocks is halved. This event is not just a technical adjustment, but a significant milestone that historically has had profound implications for Bitcoin’s economics and market sentiment. Since the 2020 halving, miners have been receiving 6.25 Bitcoins (BTC) per successfully mined block, a reward that incentivizes the decentralized security of the network.

Looking ahead, the next BTC halving is projected to take place in early-to-mid 2024, a moment when the mining incentive will decrease to 3.125 BTC per block. This editorial delves into the intricacies of the next BTC halving, examining its anticipated date, the countdown to the event, and the broader implications for Bitcoin’s supply and valuation. We will also explore the historical context of past halvings to understand the potential future trajectory of Bitcoin as the reward continues to halve towards the smallest unit of a Bitcoin, one Satoshi.

The Bitcoin network is a triumph of cryptographic achievements and economic incentives that create a trustless system for value transfer. At its core, the network is a distributed database, known as the blockchain, that maintains a continuously growing list of transaction records hardened against tampering and revision. It employs a consensus algorithm called Proof of Work (PoW) to ensure network synchrony and security.

Bitcoin Mining 101

Miners, who are network participants with specialized hardware, compete to solve cryptographically hard puzzles. The solution to these puzzles requires a significant amount of computational power and energy. The first miner to validate a block of transactions by solving the puzzle is granted the right to append that block to the blockchain. This process is referred to as ‘mining’ a block, and it is through this mechanism that transactions are confirmed and the network is secured.

The reward for mining is twofold: miners collect transaction fees from each transaction included in the new block, and they are also awarded a block subsidy. This subsidy is composed of newly created bitcoins and is the mechanism through which new bitcoins are introduced into circulation. The block subsidy is predetermined by the Bitcoin protocol and undergoes a halving event every 210,000 blocks, which historically occurs approximately every four years.

The Bitcoin protocol is designed to be a self-regulating market system. The difficulty of the cryptographic puzzles adjusts approximately every two weeks (“Bitcoin Difficulty Adjustment”), ensuring that the time between each block found remains close to ten minutes, despite the fluctuating amount of computational power dedicated to mining. This difficulty adjustment is critical to the network’s stability and the predictability of Bitcoin issuance.

Definition And Rationale Behind BTC Halving

The BTC halving is an event that is deeply embedded in the Bitcoin protocol, serving as a deflationary mechanism by design. It is a deliberate algorithmic adjustment that occurs every 210,000 blocks, which historically equates to roughly every four years. During this event, the block subsidy awarded to miners for each block mined—comprising new bitcoins created and added to the circulating supply—is cut in half.

This halving process is a critical component of Bitcoin’s economic model, which is characterized by a capped supply limit of 21 million coins. The halving serves to enforce a synthetic form of inflation that is programmatically decreasing over time, ensuring that the issuance of new bitcoins follows a predictable deceleration curve akin to the extraction of a finite resource.

Key Narrative Behind The Bitcoin Halving

The rationale behind this process is multifaceted:

Brief History Of Past BTC Halving Dates And Their Impact

The history of Bitcoin halving dates back to November 28, 2012, when the first halving occurred at block 210,000. Prior to this event, the block reward was 50 BTC. Post-halving, it was reduced to 25 BTC. The impact was significant, with the price of Bitcoin increasing from approximately $12 in November 2012 to over $1,100 in November 2013, marking an increase of over 9,000%. This price surge is attributed to the reduced supply of new bitcoins and increased media and investor attention.

The Second and Third BTC Halving

The second BTC halving took place on July 9, 2016, at block 420,000, further reducing the block reward to 12.5 BTC. The price at the time of the halving was around $650, and over the next 18 months, Bitcoin experienced unprecedented growth, reaching an all-time high of nearly $20,000 in December 2017. This represented an approximate 3,000% increase from the halving date to the peak of the market cycle.

The most recent, third Bitcoin halving occurred on May 11, 2020, at block 630,000, cutting the block reward down to the current 6.25 BTC. The price of Bitcoin on the halving date hovered around $8,600. Following this halving, Bitcoin entered another bull market, reaching a peak of around $64,000 in April 2021, which corresponds to an increase of roughly 644% from the halving date to the peak.

Each BTC halving has been followed by a period of increased Bitcoin prices, though the extent and duration of these bull markets have varied. The halvings are believed to have a direct impact on the price due to the reduced rate of new Bitcoin creation, which, if demand remains constant or increases, can lead to a higher price per Bitcoin.

The Fourth Bitcoin Halving

It’s important to note that while the Bitcoin halvings are significant, they are not the sole drivers of Bitcoin’s price. Other factors such as regulatory changes, technological advancements, macroeconomic trends, and shifts in investor sentiment also play crucial roles in the cryptocurrency’s valuation.

The next BTC halving is estimated to occur on April 24, 2024, at block 840,000, where the block reward will be reduced to 3.125 BTC. As with previous halvings, there is considerable speculation about the potential impact on the price and mining dynamics of Bitcoin. Historical patterns suggest a potential increase in Bitcoin’s price, but the actual outcome will depend on a complex interplay of market forces at the time.

List Of The Next BTC Halving Dates

Bitcoin halvings occur every 210,000 blocks, which, with an average block time of roughly 10 minutes, translates to approximately every four years. Given that the last halving occurred in May 2020, we can project the next BTC halvings by adding four years to the previous halving date, keeping in mind that variations in actual block times can cause slight deviations from these estimates.

Here is a projected list of the next BTC halving dates until the emission of new bitcoins reaches zero:

The process will continue until the maximum supply of 21 million bitcoins has been reached, which is estimated to occur by the year 2140. After the final Bitcoin has been mined, miners will no longer receive block subsidies and will rely solely on transaction fees as compensation for their contribution to the network’s security.

When Is The Next BTC Halving Date

The next BTC halving is projected to occur when the Bitcoin blockchain reaches block 840,000. Based on the average time it takes to mine a block, the halving events have historically taken place approximately every four years. Given the current block height and the average block time, the next BTC halving is estimated to happen in April 2024.

Current Data And Prediction Of The Next BTC Halving Date

As of the latest data, the next BTC halving is anticipated to occur in April 2024. However, the exact date cannot be predicted with absolute certainty due to the variable nature of block times; it could potentially occur in late March or extend into May 2024. The most precise estimates suggest that the event will likely take place on April 20, 2024, at 10:24:52 AM UTC, according to CoinWarz.

These predictions are based on the current hashrate, or the total computational power, being used to mine and process transactions on the Bitcoin network. Fluctuations in hashrate can affect block times and thus could slightly alter the expected date of the halving. It’s important to note that while these predictions are made with the best available data, they should be considered as estimates rather than exact timings.

How To Track The BTC Halving Countdown

To track the BTC halving countdown, enthusiasts and investors can use specialized tools that monitor the current block height and calculate the estimated time until the next BTC halving event based on the average block time.

List Of Reliable Countdown Tools

Here are the estimated dates and times for the next BTC halving according to various countdown tools, providing a range of perspectives on when the event is expected to occur:

Historically, Bitcoin has exhibited significant price movements both in anticipation of and following halving events. The halving tends to create a bullish sentiment as the supply of new bitcoins entering the market slows down.

Crypto analyst Rekt Capital has delineated the Bitcoin market cycle into five distinct phases surrounding the next BTC halving event, based on historical patterns:

What Is The Bitcoin Network?

The Bitcoin network is a decentralized digital ledger that records all Bitcoin transactions across a network of computers. It is powered by blockchain technology, which ensures security and transparency by allowing multiple copies of the data to be stored on nodes across the network.

When Is The Next BTC Halving Date?

The next BTC halving is estimated to occur on April 24, 2024, but the exact date may vary based on the network’s hashrate and block time.

Are There Websites For The Next BTC Halving Date?

Yes, there are several websites that provide countdowns to the next BTC halving, including NiceHash, Bitcoinsensus, CoinWarz, and Blockchair.

What Is The Bitcoin Halving?

The Bitcoin halving is an event that halves the rate at which new bitcoins are generated by miners. It occurs every 210,000 blocks, roughly every four years, as a part of Bitcoin’s deflationary monetary policy.

What Is The BTC Halving Countdown?

The BTC halving countdown is a timer that counts down to the next BTC halving event, indicating how much time is left until the block reward for miners is halved.

Why Are BTC Halvings Occurring Every 4 Years?

BTC halvings are scheduled to occur every 210,000 blocks, which roughly translates to every four years. This is designed to create a predictable and decreasing supply of new bitcoins, mimicking the extraction curve of a finite resource like gold.

What Will Happen After The Last BTC Halving?

After the last Bitcoin halving, no new bitcoins will be created, and miners will be compensated solely with transaction fees for their role in processing transactions and securing the Bitcoin network. This is expected to occur around the year 2140.

JPMorgan analysts have cast a skeptical eye over the recent crypto rally, indicating it may be built on sand rather than solid ground. Their latest report conveys a guarded stance, suggesting that the market’s exuberance may be outpacing the underlying fundamentals.

As the market’s enthusiasm swells, fueled by pivotal developments such as the US Securities and Exchange Commission’s (SEC) potential green light of the spot Bitcoin exchange-traded fund (ETF), these financial experts are urging caution, advocating a closer examination of the elements at play.

Within the crypto sphere, JPMorgan analysts disclosed that two significant events have captured investor interest and driven prices upward.

These events include anticipating a US-approved spot Bitcoin ETF, which has ignited hopes of new capital inflows. At the same time, recent legal tussles involving the SEC have raised expectations for a more permissive regulatory environment.

However, the JPMorgan team, led by analyst Nikolaos Panigirtzoglou, presents a contrarian view, deconstructing these drivers and their probable impact on the market. They argue that an ETF approval would usher in fresh capital, which might be misleading.

The analysts propose that rather than attracting new investment; the approval could redirect existing funds from current Bitcoin investment products into the new ETFs. The JPMorgan team noted:

First, instead of fresh capital entering the crypto industry to be invested in the newly-approved ETFs, we see as a more likely scenario existing capital shifting from existing bitcoin products such as the Grayscale bitcoin trust, bitcoin futures ETFs and publicly listed bitcoin mining companies, into the newly-approved spot bitcoin ETFs.

This shift, they assert, would not necessarily expand the market’s capital base. JPMorgan’s team points to the tepid response to similar products in Canada and Europe as evidence, suggesting that a US spot Bitcoin ETF might encounter the same lukewarm reception.

Legal victories against the SEC in high-profile cases like Ripple and Grayscale are also interpreted as potential precursors to a regulatory softening. Yet, the analysts remain unconvinced, citing the lingering aftereffects of the FTX scandal and the inherent risks of an under-regulated market.

They further disclosed that these factors will likely keep the regulatory tightening trend intact, with little room for significant easing.

The report delves into the much-discussed Bitcoin halving, which traditionally stokes bullish forecasts. However, JPMorgan’s analysts believe the market has already factored in the halving’s supply-squeeze implications. They noted:

This argument seems unconvincing as the Bitcoin halving event and its effect are predictable and in our opinion are well factored into Bitcoin price.

They calculate that based on current data, the production cost of Bitcoin post-halving should double, particularly from the current $ $21,000 to $43,000.

Their analysis concludes with a sobering outlook, anticipating a potential “buy the rumor, sell the fact” scenario post-ETF approval. Such a dynamic could see prices climb on anticipation and plummet once the event materializes, a pattern familiar to seasoned market observers.

Echoing similar sentiments, financial commentator Peter Schiff has cast doubt on the longevity of Bitcoin’s price surges driven by ETF speculations.

Schiff warns that post-approval, Bitcoin might face a shortage of positive triggers, potentially culminating in a market sell-off as the ‘buy the rumor, sell the news’ phenomenon unfolds.

How many times can #Bitcoin rally on the same ETF rumor? Once a U.S. Bitcoin EFT is approved, or $GBTC is able to convert into an ETF, there will be no more “good” news for Bitcoin to rally on. After years of buying the rumor, everyone will finally be able to sell the news.

— Peter Schiff (@PeterSchiff) October 16, 2023

Meanwhile, Bitcoin has seen quite a significant move in the past few hours. The asset has now marked a new high for 2023, surging above $37,000, up by nearly 10% in the past day.

Featured image from Unsplash, Chart from TardingView

The argument for the Bitcoin price to reach above $200,000 has been going on for a few years now with a number of crypto pundits maintaining their stance. This has not changed, especially with the most recent prediction from one crypto analyst who puts the BTC price above $200,000. But what’s most interesting is the timeframe in which this analyst expects the leading crypto to reach this level.

Crypto analyst TradingShot posted another eye-catching prediction on the TradingView website, putting the Bitcoin price as high as $200,000. The analysis focuses on the Bitcoin Vortex bullish cross as well as the Bollinger Bands Width (BBW) bottoms to gauge when BTC might go on its next parabolic rally.

TradingShot explains that a parabolic rally for the cryptocurrency often starts after a Halving Event. Now, a BTC halving event takes place roughly every four years and it’s an event in which the block rewards for miners are cut down in half, thereby reducing the rate at which new coins are being brought into circulation.

The crypto analyst’s prediction in this instance uses the next Bitcoin halving event which is expected to take place sometime in Q2 2024. As the analyst explains, this is an event that “starts the (final and most aggressive) Parabolic Rally sequence of the Bull Cycle.”

One other important event that happens after the halving takes place is the BBW which bottoms once the halving is completed. This often marks the end of a short downtrend, and “may have as a Support a (dotted) Lower Lows trend-line,” as TradingShot explains.

The expectation for the BBW to bottom out in early 2024 carries the basis for a Bitcoin parabolic rally above $200,000. Once it does this, there is only a short timeframe that the crypto analyst sees before the asset is able to reach this level.

A Bullish Cross formation as has been the case historically, is expected to trigger “a long-term sequence of straight green candles (Parabolic Rally) straight to the Bull Cycle’s peak.” This marks the beginning of the bull market.

TradingShot explains that if this happens, then the Bullish Cross would appear on the 2-Month (2M) candle. This will put the timeframe in the vicinity of January 2024. If this analysis is correct, then BTC could be only a few months away from making a new all-time high.

At the upper band of this parabolic rally, Bitcoin sits above $650,000. Given that BTC is currently trading just above $35,300, it would mean an over 1,700% rally.

Robert Kiyosaki has predicted that Bitcoin’s price is going to reach $100,000. Michael Saylor is aiming for $1 million. Is it a good time to start buying?

In this week’s issue of Crypto for Advisors, learn why direct ownership of crypto may be in the best interest of the client.

ETH price continues to lose ground against Bitcoin. Cointelegraph takes a closer look at the factors behind the weakening ETH/BTC pair.

The CEO of Dutch cryptocurrency exchange Bitvavo believes market dynamics will cater to the potential skyrocketing demand for Bitcoin in 2024.

Historically, the cryptocurrency market has benefited from the rise in global money supply, as the majority of bull runs in the past coincided with the rise in fiat supply.

Bitcoin price (BTC) is currently displaying a significant uptrend, showing no signs of slowing down. The cryptocurrency has already begun its fifth bull run, with impressive price targets anticipated in the coming year.

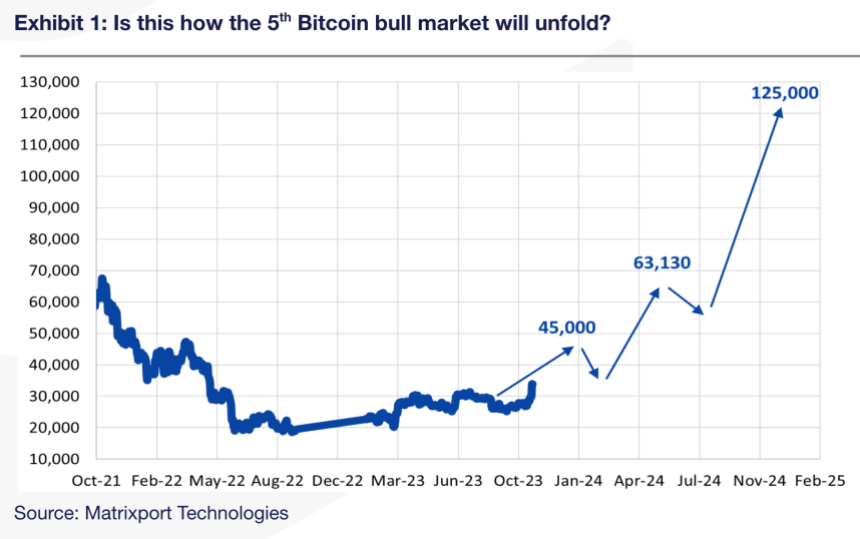

A recent report from Matrixport highlights BTC’s history of four distinct bull market cycles, each driven by a unique narrative. However, the latest bull market, which started on June 22, 2023, stands out due to its primary driving force: institutional adoption.

Per the report, this surge in institutional interest can be attributed to Bitcoin’s characteristics, traditionally associated with safe-haven investments like Gold, as well as mounting concerns over the United States debt-to-GDP ratio. Matrixport’s report predicts that Bitcoin’s price could reach an impressive $125,000 by December 2024.

Matrixport suggests its emergence as a new payment mechanism propelled the first Bitcoin bull market in 2011. The second cycle was driven by China, where Bitcoin gained recognition as an alternative form of money.

The rise of initial coin offerings (ICOs) marked the third cycle, providing a novel means of establishing and funding companies. The fourth cycle saw the decentralized finance (DeFi) summer and the NFT craze dominating the market.

However, per the report, Bitcoin’s current bull market is driven by institutional adoption. Institutions are considering Bitcoin for diversifying their asset allocation due to its characteristics akin to safe-haven investments.

Notably, the surge in Bitcoin’s value coincides with the United States’ escalating debt-to-GDP ratio, making it an attractive choice for institutions seeking to hedge against potential economic instability.

Based on historical price signals, Matrixport estimated that Bitcoin price could reach $125,000 by December 2024.

Interestingly, the report suggests that the onset of this bull market was officially recognized when BTC reached a new one-year high on June 22, 2023.

Furthermore, Matrixport advises that the optimal entry point to buy Bitcoin is ideally 14-16 months before the next halving event. The report suggested that the end of October 2022 was an opportune time to enter the market when Bitcoin traded at $17,000.

Despite the hype surrounding the current uptrend experienced by most cryptocurrencies on the market, crypto analyst “Crypto Soulz” presents a contrasting view on the future of Bitcoin price.

In a recent analysis of X (formerly Twitter), the analyst provides several reasons for considering a short position on BTC. According to Crypto Soulz, the next significant resistance level is at $37,330, but Soulz doubts the possibility of retesting it in the current market conditions.

Bitcoin recently reached a local top at $35,300, leading Crypto Soulz to believe a price decline may follow. The analyst emphasizes retesting the $31,500 level as crucial support, which Bitcoin did not revisit during the recent price surge.

Crypto Soulz notes that spot and perpetual contracts rose during the pump, indicating potential market instability. Additionally, the futures market experienced significant liquidations during the rally, similar to previous wipe-outs in January and August.

Upon examining the liquidation heatmap, Crypto Soulz identifies liquidity below the current price, implying a potential downward movement. Soulz targets specific liquidity pools at $32,300 and $30,800 as potential areas for the price decline.

Based on its analysis, Crypto Soulz expects Bitcoin to “cool off” from its current levels and target lower prices.

At the time of writing, the price of Bitcoin is currently at $34,000, experiencing a 2.5% retracement in the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Bitcoin started the week with a bang, but the real question is, what is driving the move and is it sustainable?

In a recent CNBC report, Coinbase, the largest cryptocurrency exchange in the United States, expressed confidence in the approval of a US-based Bitcoin (BTC) exchange-traded fund (ETF) by the Securities and Exchange Commission (SEC).

Paul Grewal, Coinbase’s Chief Legal Officer, highlighted that the SEC’s recent court setback in the case of Grayscale’s proposed Bitcoin ETF has paved the way for a potential approval in the coming months.

Grewal emphasized that Coinbase is hopeful about the approval of ETF applications due to their compliance with existing laws governing financial services. Grewal noted that prominent financial institutions have submitted robust proposals, indicating progress in the regulatory landscape.

The recent court ruling against the SEC stated that the regulator lacked a valid basis to deny Grayscale’s request to convert its GBTC Bitcoin fund into an ETF.

The SEC chose not to appeal the ruling within the specified deadline, further increasing the likelihood of a BTC-related ETF gaining approval shortly.

However, Grewal acknowledged that the ultimate decision rests with the SEC, and he refrained from providing a specific timeline for the approval process.

Nevertheless, Grewal expressed confidence in the SEC’s obligation to fulfill its responsibilities, particularly in light of the court’s decision and the requirement to apply the law impartially.

The introduction of a Bitcoin ETF would offer investors an alternative means to gain exposure to BTC without directly purchasing the cryptocurrency from an exchange.

This could be particularly attractive to retail investors seeking Bitcoin exposure without the complexities of owning the underlying asset.

Per the report, Coinbase, being the largest crypto exchange in the United States, stands to benefit from the potential approval of a BTC ETF. The company’s common stock is held in portfolios designed to provide investors with crypto exposure.

While the recent court ruling has bolstered prospects for a BTC ETF, it is important to note that Grayscale’s bid to convert GBTC into an ETF is not without its challenges.

Digital Currency Group (DCG), Grayscale’s parent company, along with crypto exchange Gemini and DCG subsidiary Genesis, face a lawsuit from the New York Attorney General, accusing them of defrauding investors of over $1 billion.

Despite the ongoing legal issues, Grewal remained positive about the approval of additional Bitcoin ETFs in the future as the SEC adheres to the law and evaluates pending applications neutrally.

The report also touched upon the recent performance of BTC, which has experienced a resurgence in 2023. With a 72% year-to-date increase, Bitcoin has rebounded from significant declines in 2022.

Factors such as anticipation surrounding the upcoming BTC halving event and investor reactions to the Federal Reserve’s potential interest rate policy changes have contributed to increased demand for the digital currency.

Ultimately while trading volumes have declined recently, attributed partly to retail investors’ reduced engagement in response to low volatility and industry players’ challenges, Grewal expressed optimism that various developments, including criminal trials and rigorous regulatory actions, will restore investor and consumer interest in the crypto market.

As the landscape for Bitcoin ETFs evolves, market participants will closely monitor the SEC’s stance and any potential regulatory developments that shape the future of cryptocurrency investment products.

Featured image from Shutterstock, chart from TradingView.com

While the halving event is considered one of the main catalysts for Bitcoin bull markets, it may play out differently next year.

Bitcoin (BTC) has retraced to the $28,400 level following a failed breakout above $30,000, resulting in a high rate of liquidations for both long and short positions.

Additionally, the recent fake news surrounding the approval of Blackrock’s spot Bitcoin Exchange-Traded Fund (ETF) by the US Securities and Exchange Commission has disrupted the upward trend and introduced new bearish indicators in the Bitcoin market.

Renowned trader and crypto analyst Ali Martinez suggests selling BTC based on its 4-hour chart Relative Strength Index (RSI) indicator. His simple trading strategy advises selling BTC when the RSI exceeds 74.21 and buying when the RSI dips below 30.35.

As seen in the chart above, BTC’s RSI stands at the 74 level, which is notably high considering that on October 16, after the spread of the fake news on various platforms, including X (Formerly Twitter), the RSI reached as high as 82.83.

While this indicator may seem straightforward, it has proven effective on BTC’s 4-hour chart. For instance, on October 1st, Bitcoin peaked at $28,500, but after the RSI climbed above 80, the leading cryptocurrency swiftly dropped to $27,150 within hours.

Although the effectiveness of these indicators is not always guaranteed, the combination of the recent false pump, the ongoing retrace evident in all BTC charts, the lack of bullish momentum, and the prevailing market sentiment of fear, doubt, and uncertainty could create the perfect storm for BTC to retest lower support levels before potentially embarking on another upward movement.

To further support Ali Martinez’s bearish thesis, renowned crypto analyst Rekt Capital recently shed light on Bitcoin’s historical retracements approximately 180 days before halving events.

According to Rekt, in 2015/2016, approximately 180 days before the halving, Bitcoin experienced a retracement of -25%. Similarly, in 2019, around the same timeframe before the halving, Bitcoin retraced by -38%.

While Rekt Capital identifies as a macro bull, he acknowledges that historical data favors bearish trends before halving events.

This observation raises the question of whether history will repeat itself in 2023. Will Bitcoin witness a significant retracement similar to previous cycles, or will the market dynamics 2023 deviate from historical patterns?

What is certain is that as the crypto community eagerly anticipates the 2023 halving, uncertainty looms regarding Bitcoin’s price behavior leading up to the event.

As of the current market conditions, BTC is trading at $28,400, indicating a profitable position across all time frames. In the past 24 hours, Bitcoin has experienced a modest increase of 1%.

Over the seven, fourteen, and thirty-day periods, BTC has recorded profits of 3.7%, 4%, and 7%, respectively, despite the earlier bearish factors. The sustainability of Bitcoin’s current price level remains uncertain, as it remains to be seen whether it will withstand potential retracements soon.

Featured image from Shutterstock, chart from TradingView.com