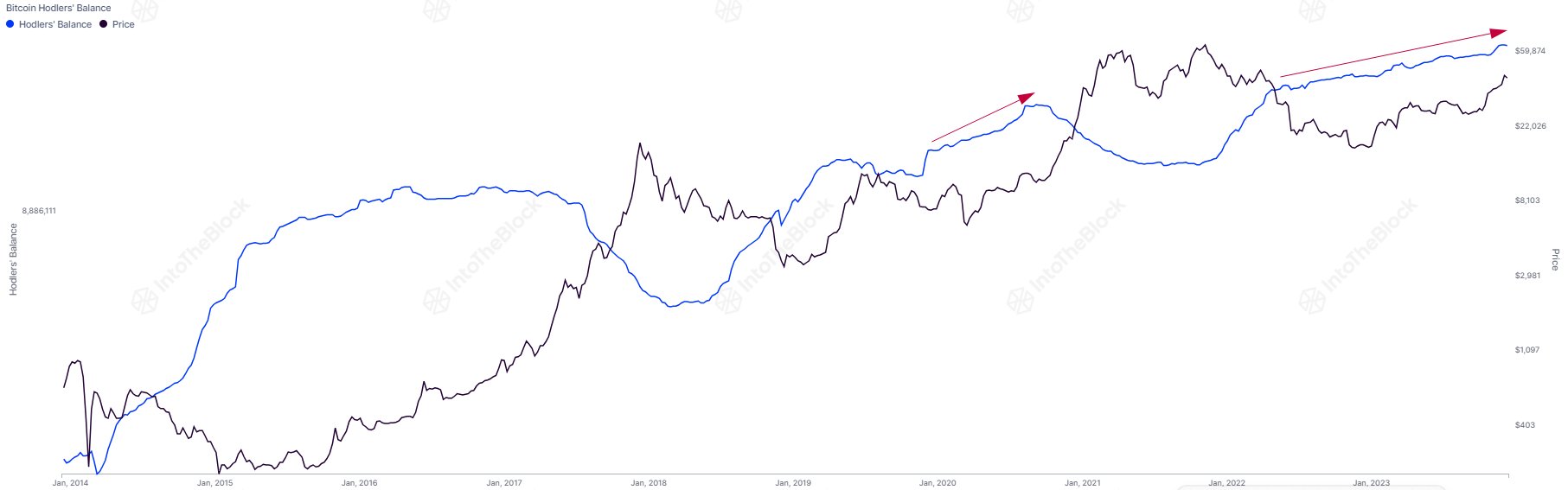

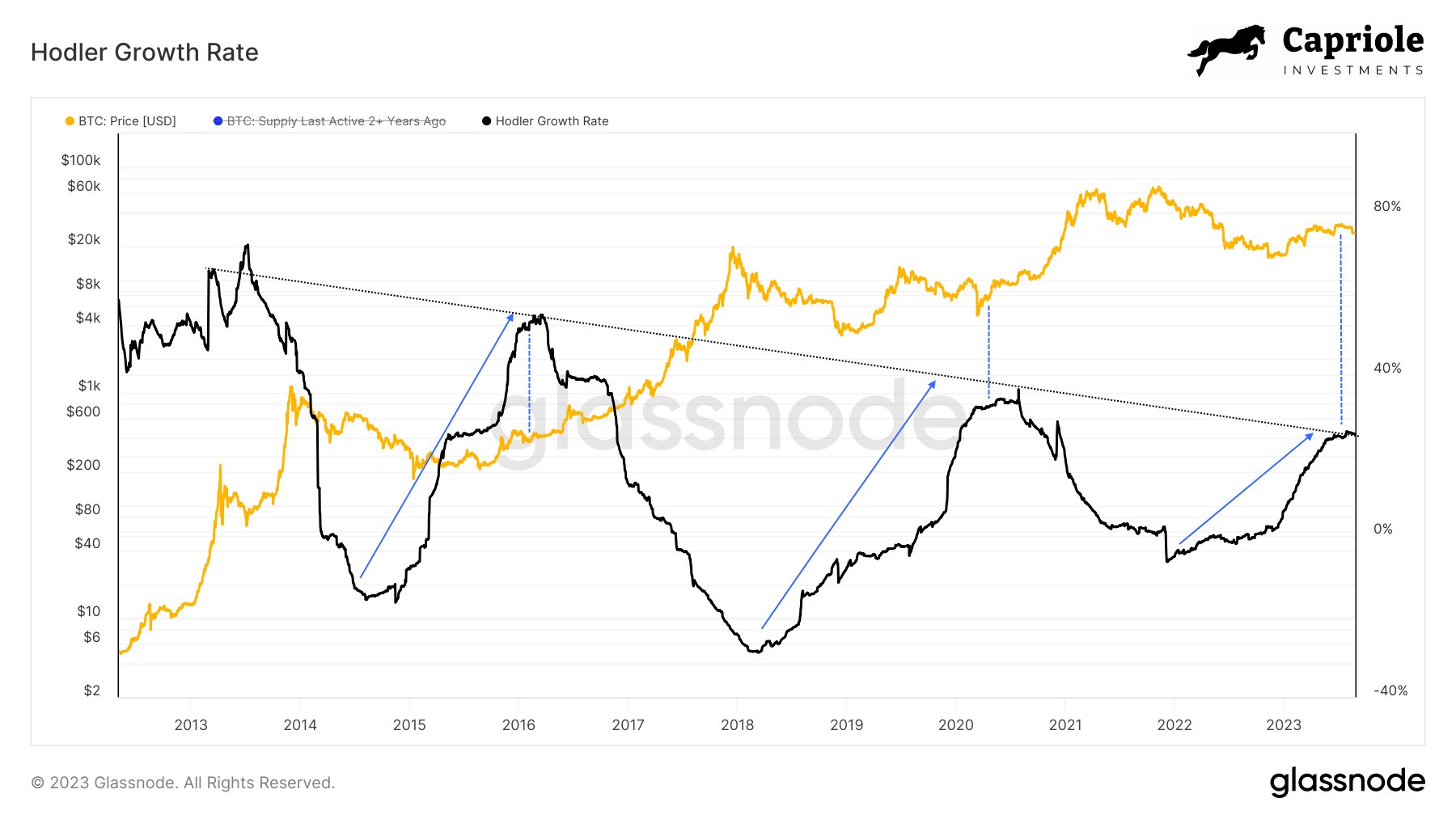

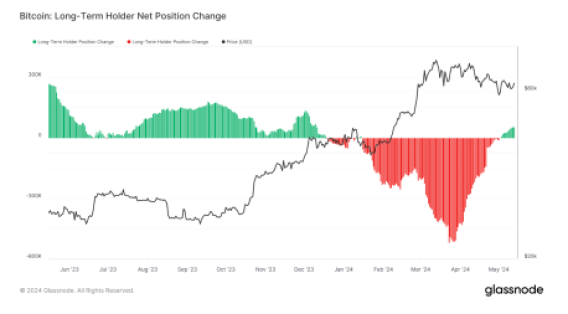

Glassnode data has revealed that Bitcoin long-term holders are taking advantage of the cryptocurrency’s lower price to significantly increase their holdings. This accumulation further strengthens the belief that this group of Bitcoin investors anticipate a potential upside for Bitcoin despite its recent volatility.

Long-Term Holders Pay $4.3 Billion For 70,000 BTC

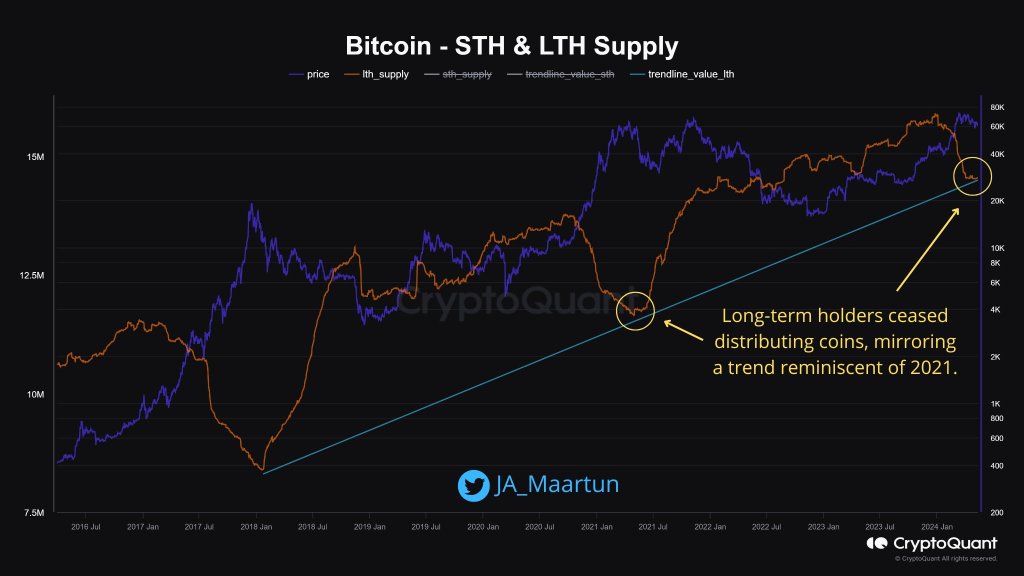

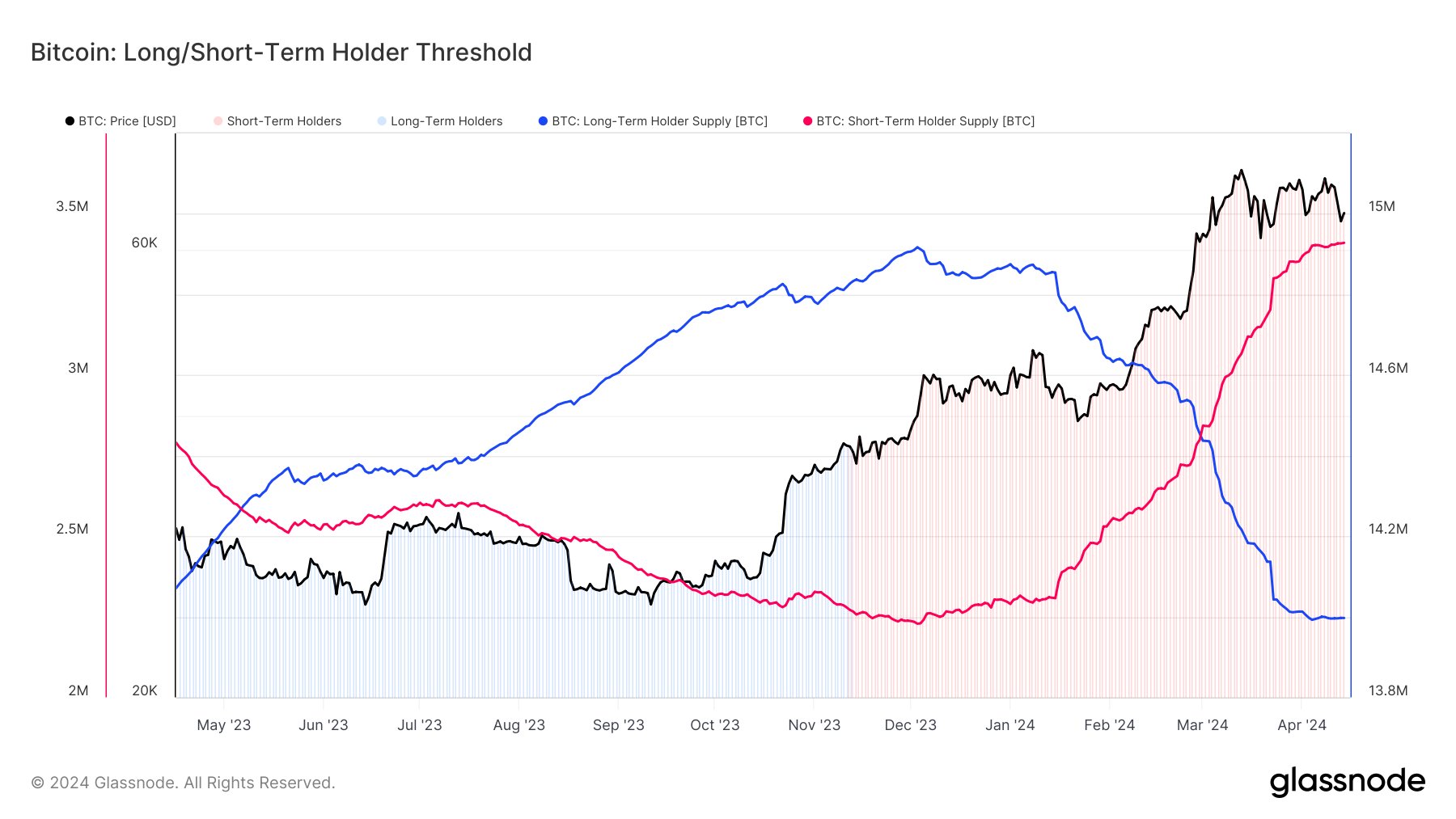

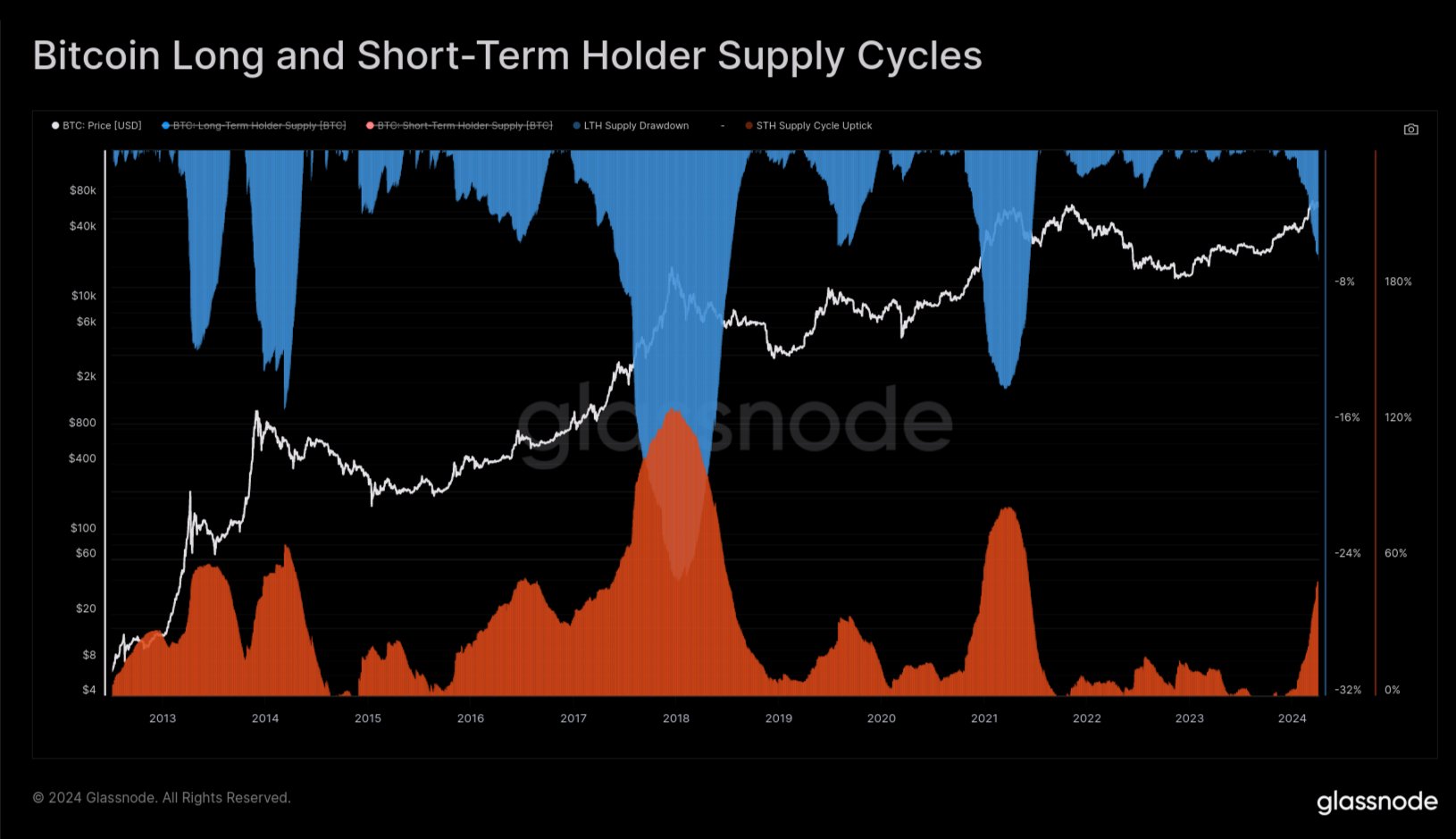

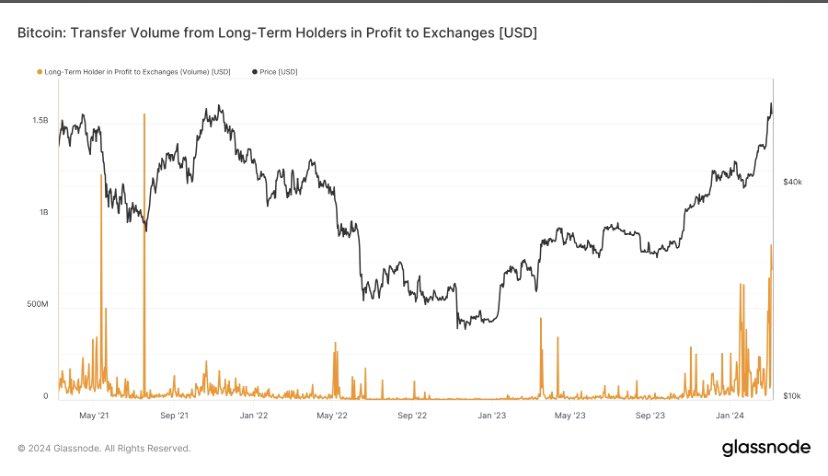

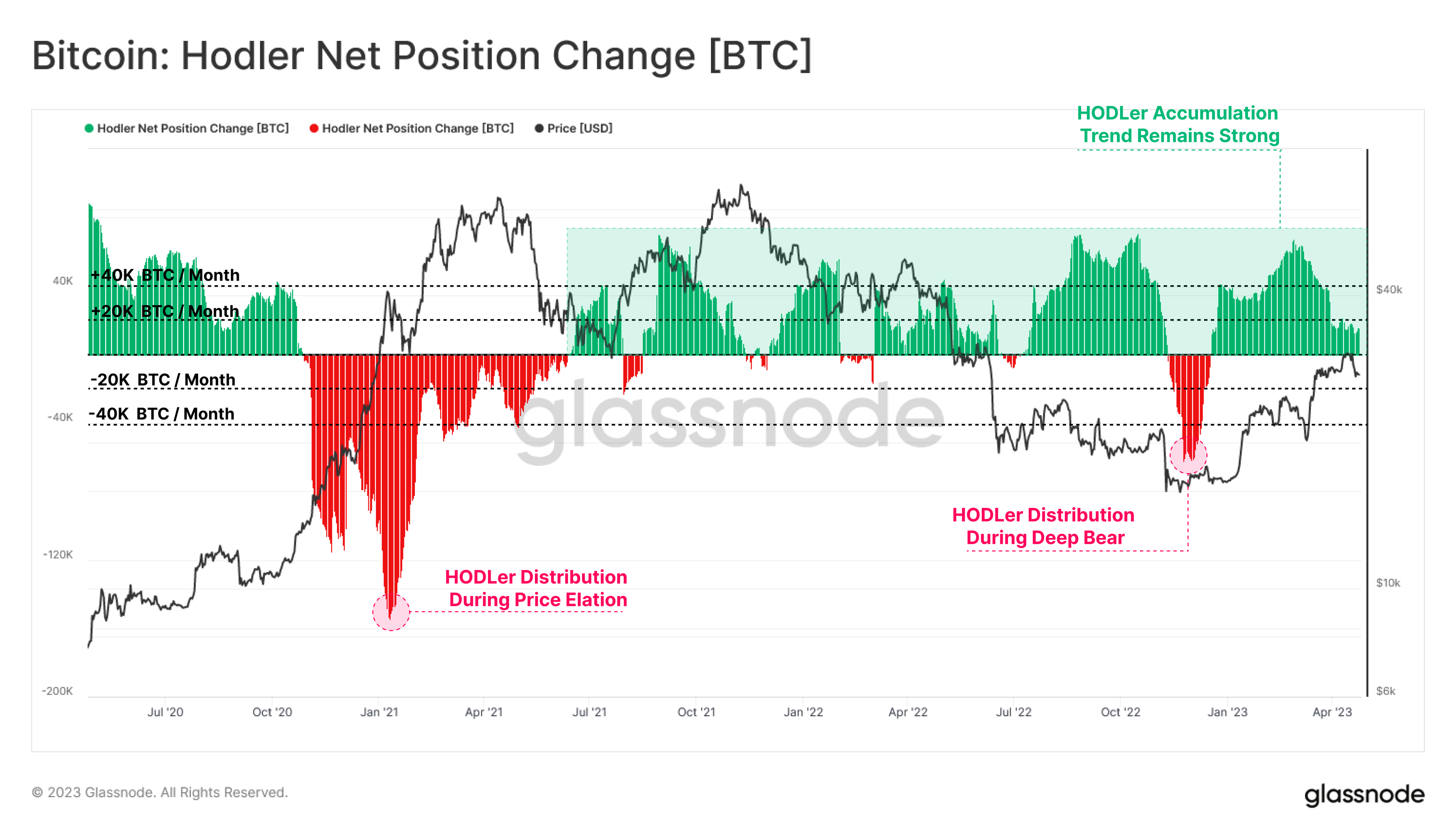

According to Glassnode, long-term Bitcoin holders who had previously sold 1 billion BTC in the latter part of 2023 are accumulating once again. This buying activity could be interpreted as a potential bullish signal for Bitcoin.

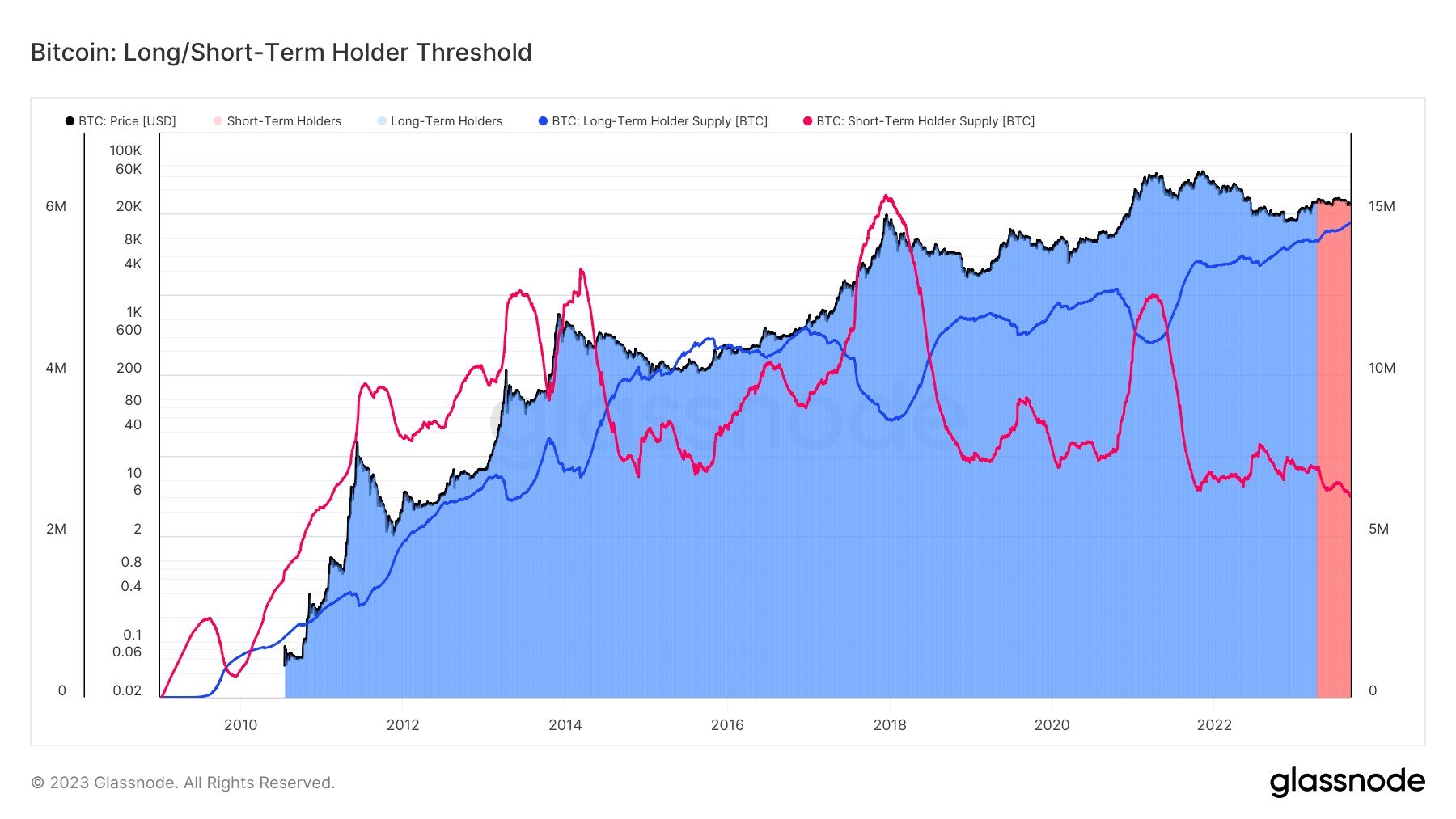

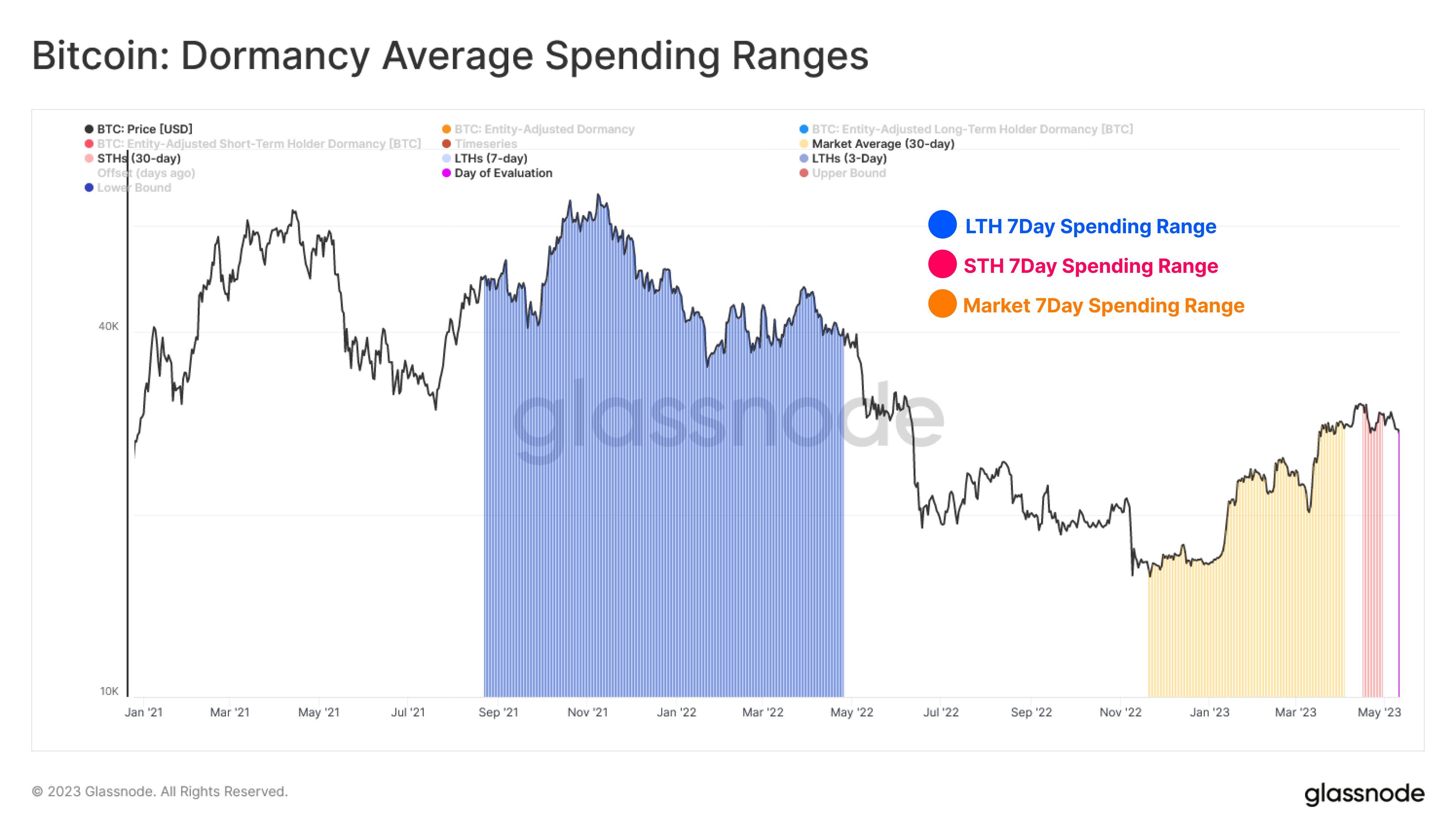

Traditionally, Bitcoin long-term holders sell their holdings during peak prices and buy new tokens during periods of correction or substantial declines. When these seasoned investors buy cryptocurrencies during market lows, it usually indicates their expectations of a potential rebound, leading to profits.

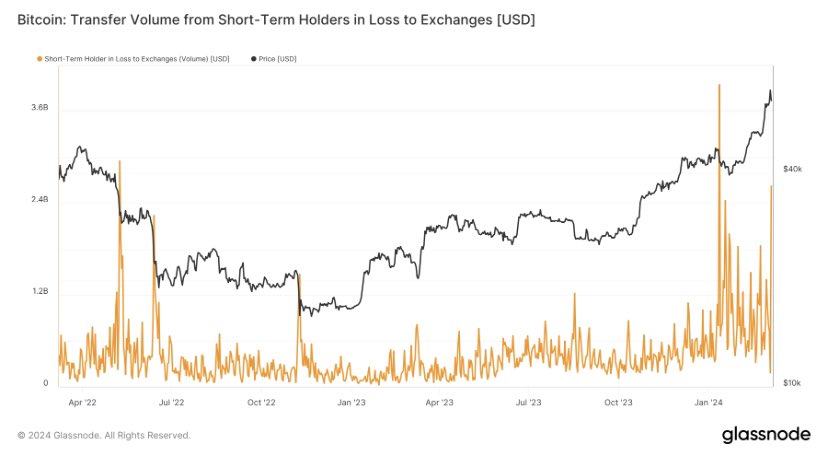

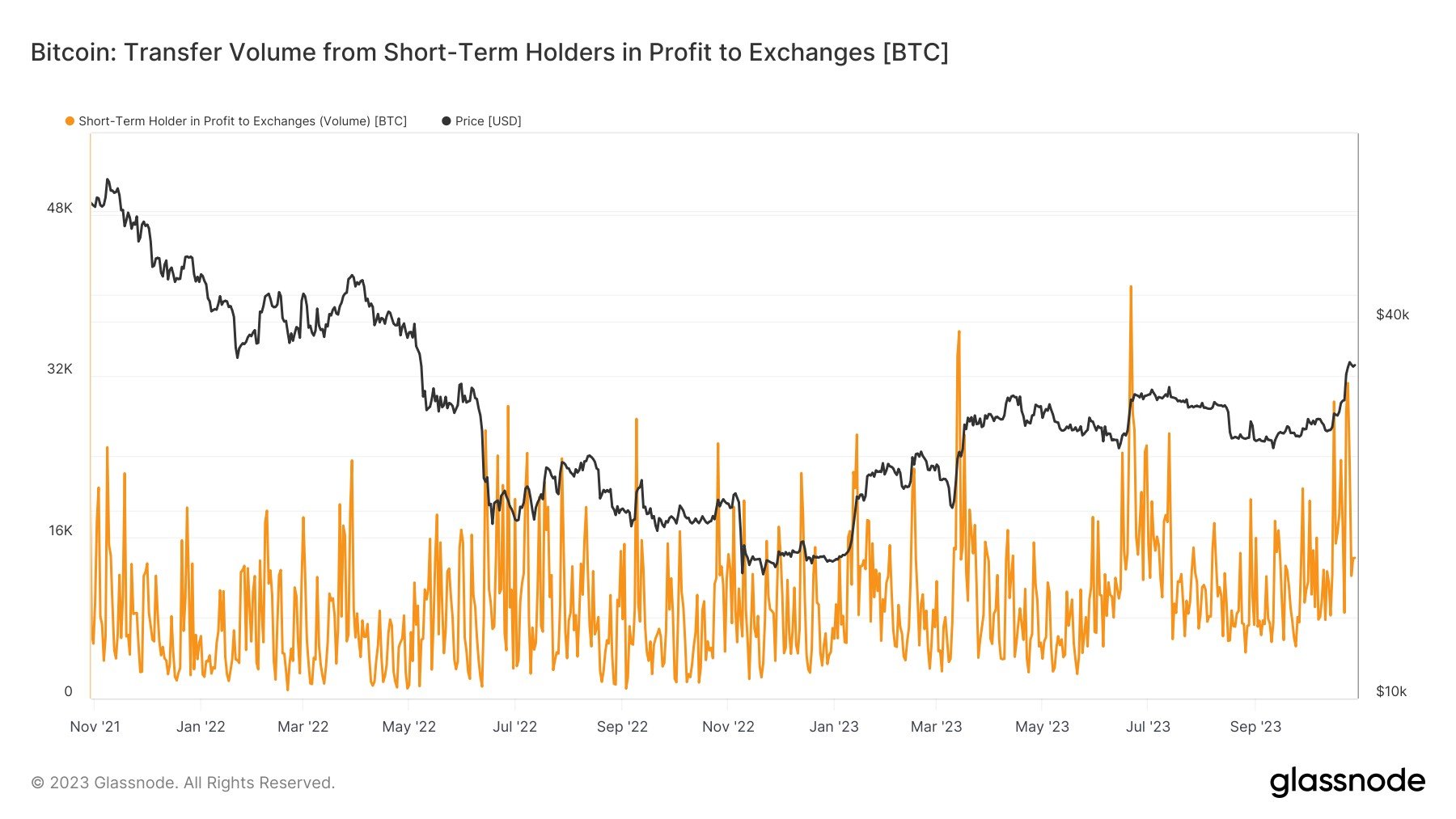

On the other hand, short-term holders are known to buy cryptocurrencies during sporadic price surges, often signaling that a cryptocurrency is nearing its peak.

With Bitcoin presently stabilizing above $61,000, long-term Bitcoin holders probably see the cryptocurrency’s value as a prime buying opportunity. They have recently added a staggering 70,000 BTC valued at over $4.3 billion to their holdings.

This sentiment for Bitcoin’s potential rally is also shared by a few crypto analysts who have predicted that the cryptocurrency would surge to new all-time highs during the approaching bull market. Earlier in March, before Bitcoin’s halving event, the cryptocurrency skyrocketed above $73,000, marking a new historic all-time high.

With the bull market still on the way, Bitcoin could see further upsides as market conditions improve and investor demand rises. This could potentially lead to profits for long term holders who had purchased the cryptocurrency earlier.

Moreover, the upcoming United States inflation report, set for release on May 15, could also be another primary factor driving long-term investors’ substantial BTC accumulation. With the US Consumer Price Index (CPI) remaining historically high, and the Federal Reserve (FED) unchanged rates, Bitcoin is seen as a possible hedge against inflationary pressures, protecting investors’ wealth against decline.

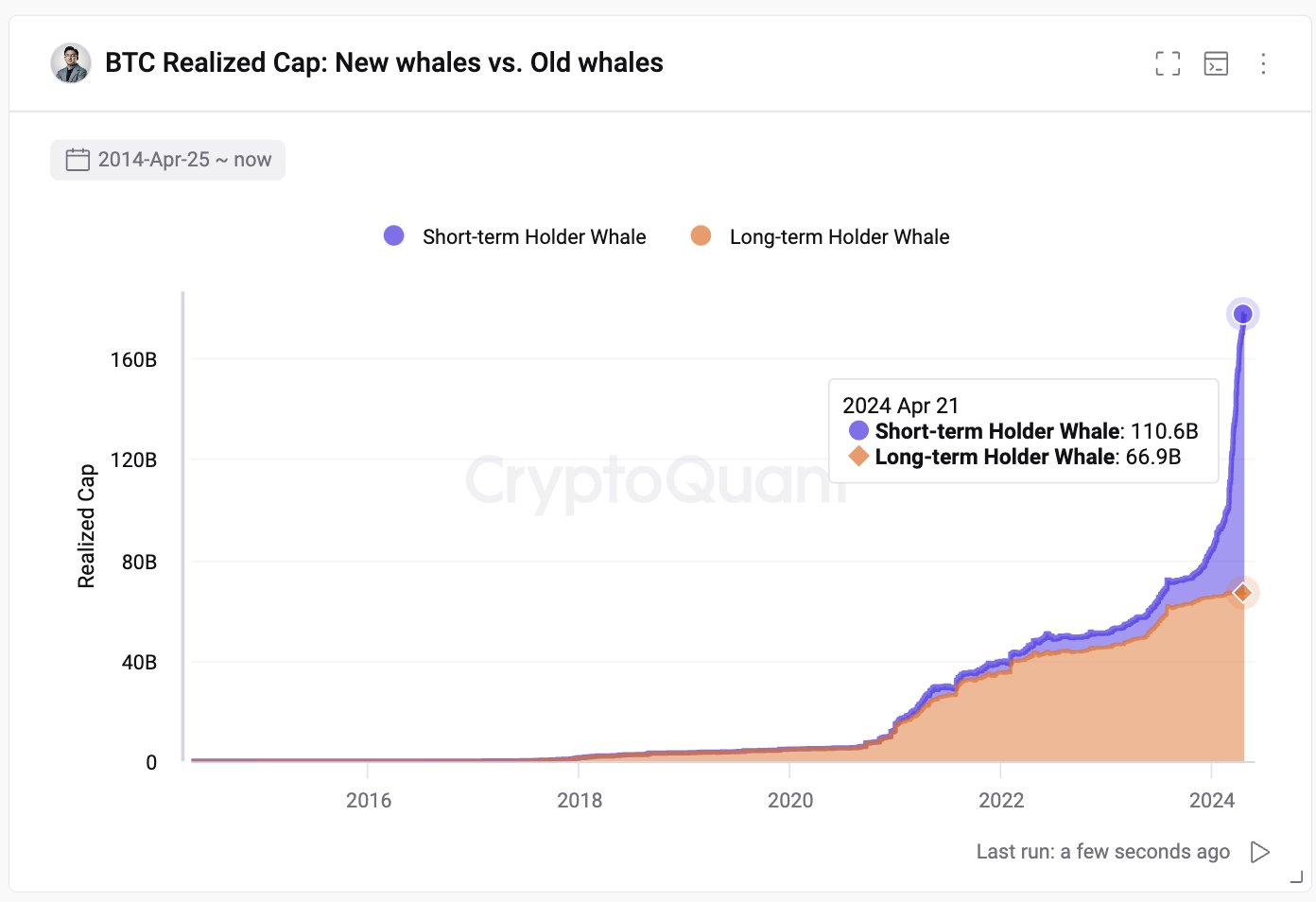

Bitcoin Whales Display Opposite Trend

Reports from blockchain analytics platform Santiment reveal that Bitcoin whales are showing an opposite trend from long-term holders.

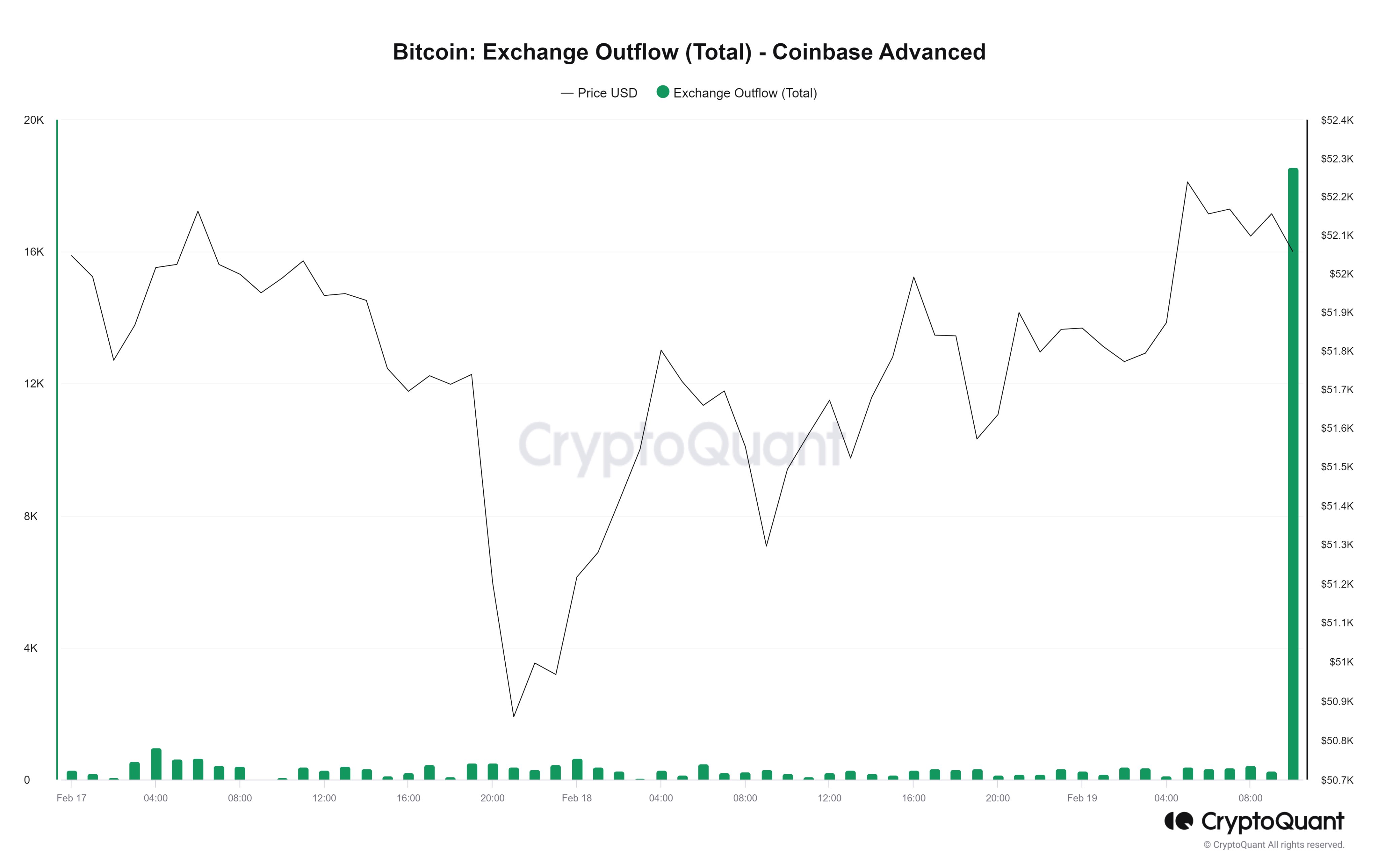

The analytics platform noted that Bitcoin whales appear to be taking a break from accumulating BTC, as the number of large-scale transactions has been decreasing significantly.

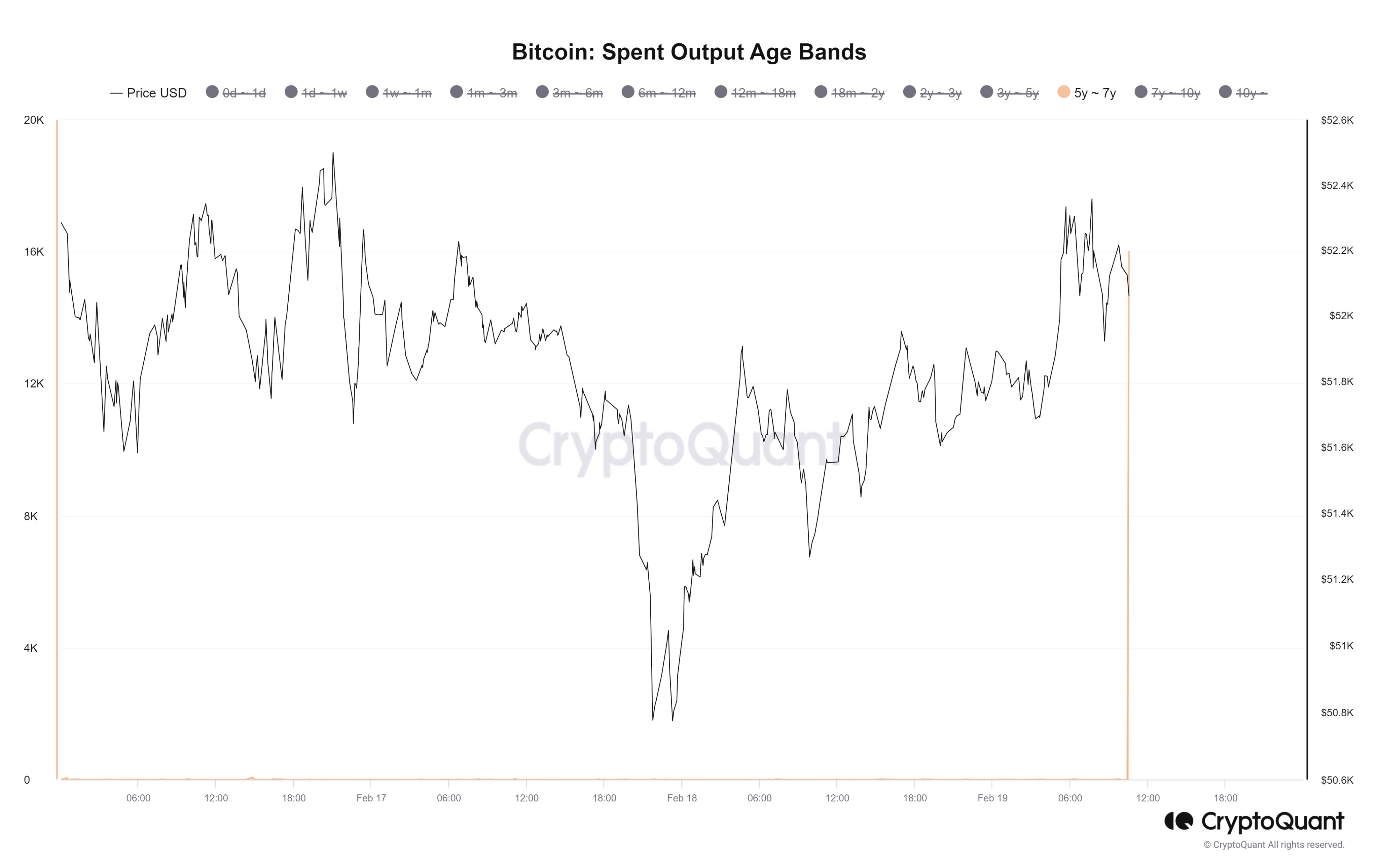

This trend coincides with the cryptocurrency’s reduced on-chain activities and its declining value over the past few weeks.

Crypto analyst Ali Martinez has also shared a similar report, emphasizing that Bitcoin’s accumulation trend score is currently displaying a value closer to zero, indicating that larger investors were distributing their holdings rather than buying.

Despite the downtrend, Martinez has disclosed that Bitcoin’s current TD sequential is signaling a buying opportunity and the cryptocurrency was poised for a rebound soon. At the time of writing, the cryptocurrency’s price is trading below $62,000, receiving a decrease of about 6.38% in the last month, according to CoinMarketCap.