Bitcoin, the leading cryptocurrency, has recently been scrutinized by several analysts and traders as it struggles to maintain its market position.

Michaël van de Poppe, a recognized figure in the crypto analysis sector, has recently expressed his concerns regarding Bitcoin’s current price trajectory.

Bitcoin Risks Dropping to $52,000, Why?

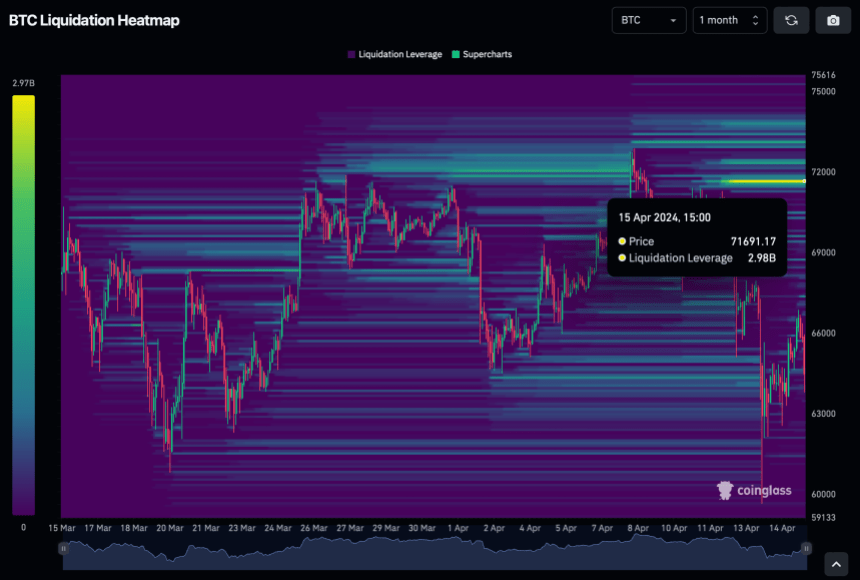

Taking to Elon Musk’s social media platform X, Van de Poppe pointed out that Bitcoin is at the lower end of its current range, a crucial area for maintaining upward momentum.

Van de Poppe warned that if Bitcoin fails to hold this level, the market could see a downturn, with prices potentially falling as low as $52,000 to $55,000.

This prediction comes as Bitcoin attempts to stabilize above the $61,000 mark. Despite efforts to sustain this level, recent market behavior suggests a bearish trend could be looming.

Van de Poppe’s analysis indicates that failing to maintain the lower range could lead to significant corrections, affecting investor sentiment and market dynamics.

#Bitcoin is at the range low. This is technically the area where you’d prefer to see it hold, so the upward momentum continues, and the range holds.

If this doesn’t hold, then we might expect $52-55K as a potential low on this correction. pic.twitter.com/j4rWI0Ti7G

— Michaël van de Poppe (@CryptoMichNL) May 9, 2024

Meanwhile, recent data from the analytics firm IntoTheBlock reveals a noticeable decline in BTC whale accumulation volumes over the past month. These large investors, holding over 1,000 BTC, have been a stabilizing force in the market, particularly during price dips.

However, the trend of diminishing whale purchases, especially during recent market corrections, suggests a decrease in their market influence and potentially a broader loss of appetite for Bitcoin at current levels.

This pattern could indicate a shift in whale strategy or a broader market sentiment change, possibly leading to less support for Bitcoin prices during downturns.

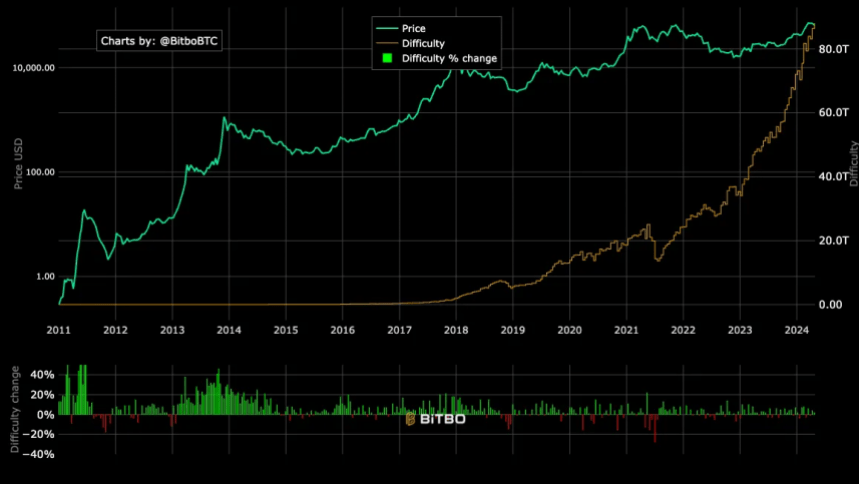

BTC Surging Demand vs. Limited Supply

Despite the potential price dip, other market activities suggest a robust demand for Bitcoin. Samson Mow, a well-known Bitcoin community figure and former Blockstream CSO, highlighted the continuous buying from American spot Bitcoin ETFs.

According to Mow, these US ETFs purchase 1,626 BTC daily. Additionally, MicroStrategy acquires 199 BTC daily, and Tether buys 70 BTC daily.

This significant daily demand, especially in the context of the reduced supply following the latest Bitcoin halving in April, where only 450 BTC are created each day, suggests that demand might significantly exceed supply.

Mow emphasized this imbalance, indicating that the aggregate demand could be outstripping the available supply by 5 to 10 times, hinting at a potential upward pressure on prices if this demand persists.

U.S. ETFs are buying 1,626 BTC per day.@MicroStrategy is buying 199 BTC per day.@Tether_to is buying 70 BTC per day.

There are only 450 #Bitcoin mined per day. Total aggregate demand is likely 5-10x supply.

Plan accordingly.

pic.twitter.com/fshInf0Jas

— Samson Mow (@Excellion) May 8, 2024

Featured image from Unsplash, Chart from TradingView

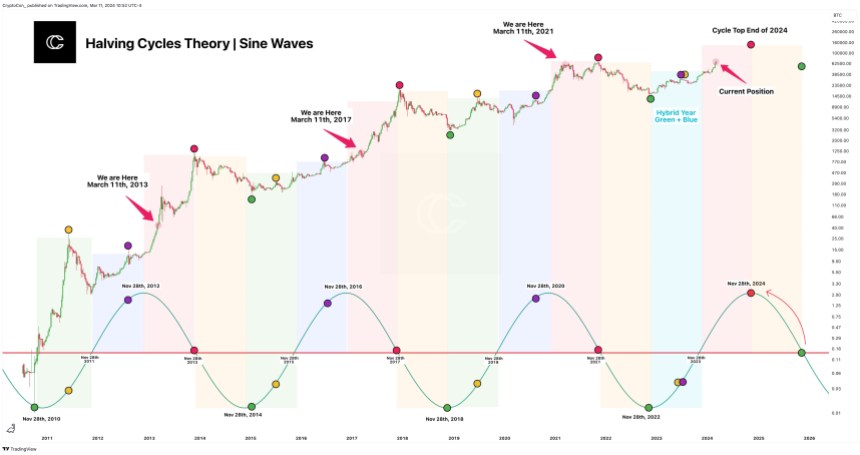

TA/LCA/Psychological Analysis: In last week’s Sunday report, we discussed an anticipated sideways movement in the larger timeframe. As observed, Bitcoin is perfectly moving in this sideways region as…

TA/LCA/Psychological Analysis: In last week’s Sunday report, we discussed an anticipated sideways movement in the larger timeframe. As observed, Bitcoin is perfectly moving in this sideways region as…  (@DrProfitCrypto)

(@DrProfitCrypto)