In the past month, the Bitcoin price has experienced a significant decline after reaching a 22-month high of $49,000. Currently, the largest cryptocurrency has fallen below the crucial $40,000 mark, raising concerns about the prospects of the ongoing bull run and the overall bullish market structure.

However, there are indications that the bottom of the current downtrend may be near, potentially setting the stage for a potential price reversal.

Bitcoin Price To Avoid Plummeting To Low $30,000s

Market analyst Marco Johanning sheds light on the situation, offering insights into the Bitcoin price movement. Johanning suggests that it won’t be long until Bitcoin reclaims the $41,500 level or potentially rises from a lower level if a specific scenario unfolds.

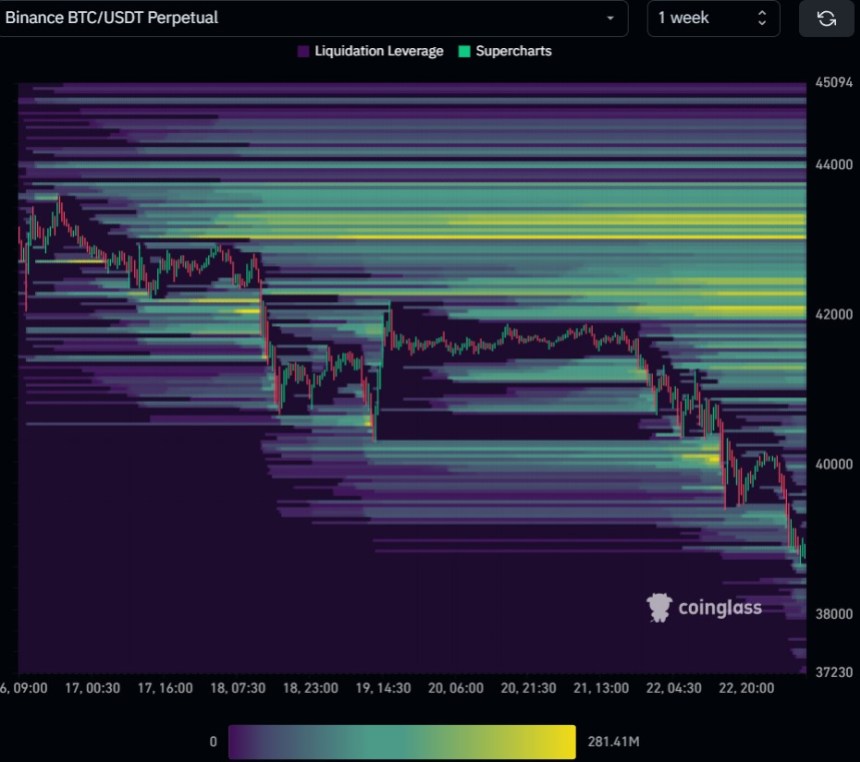

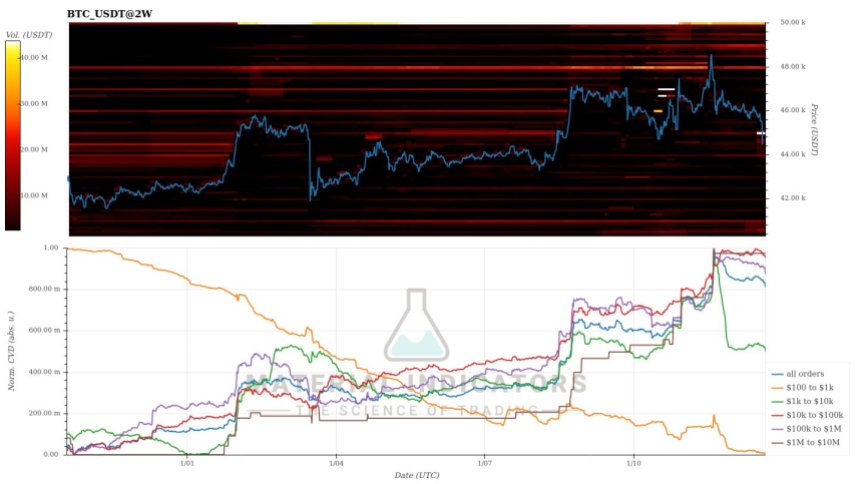

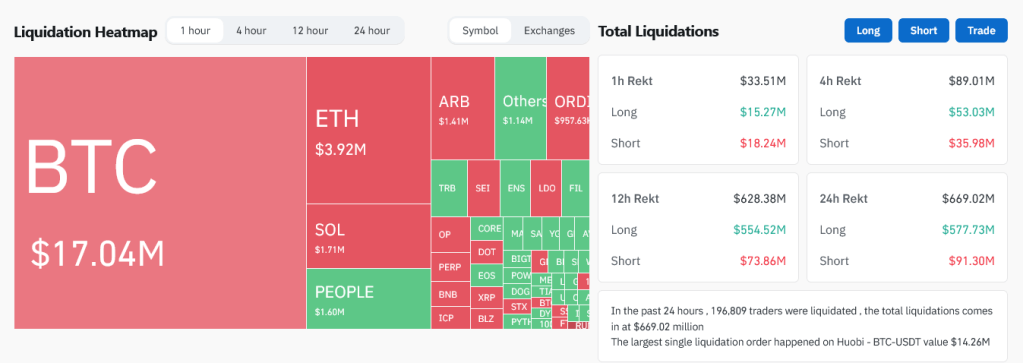

According to Johanning, Bitcoin will finally encounter significant liquidity on the downside. Notably, the price has touched around below $39,000 multiple times, indicating the presence of substantial liquidity at these lows.

Moreover, Johanning addresses the skepticism surrounding the price of around $37,800, arguing against widespread expectations of a drop into the low $30,000 range.

Johanning emphasizes that the primary liquidity lies below $40,000 and is not in the low $30,000 range. Traders profited from the low $30,000 range have likely adjusted their stop orders to protect their gains, creating a layer of support below the recent equal lows.

As the price starts hitting these stop orders, automatic selling occurs, further down the price until it encounters significant buy pressure. The analyst points out a daily order block at $37,700 and high timeframe (HTF) support at $38,5000, indicating the potential for notable buy pressure in these price regions.

Johanning also highlights the likelihood of filling Chicago Mercantile Exchange (CME) gaps and Imbalances, with the next imbalance anticipated below $33,000.

Short Squeeze Rally Imminent?

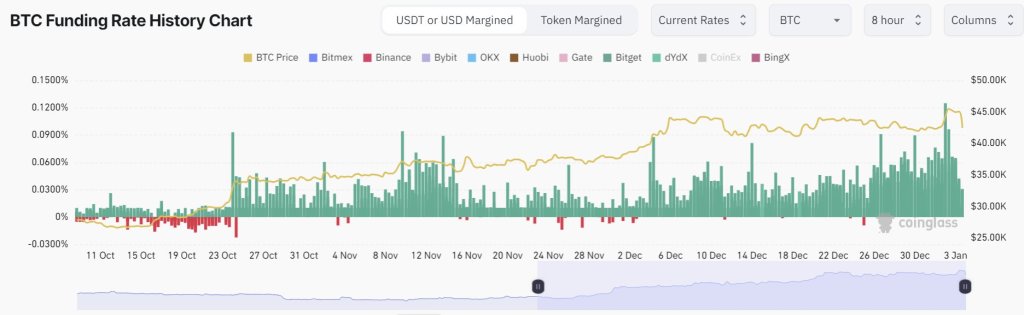

According to Johanning, the prevailing sentiment reveals many bears waiting to short a market dump. Johanning predicts that a short squeeze could occur once the price reverses, leading to a rapid price increase.

In terms of Fibonacci retracement levels, Johanning suggests that since the Bitcoin price has already lost the $40,200 level, it could potentially fall to the 0.5% Fibonacci level, which coincides with those above the $37,800 level.

Johanning speculates that the price may briefly touch $37,800 before closing above the HTF support level of $38,500, setting the stage for a potential upward movement.

The recent downtrend in Bitcoin’s price has raised concerns about continuing the bull run. However, market analyst Marco Johanning presents several key arguments supporting the possibility of a price reversal.

With Bitcoin’s current price at $38,900, there is a possibility of increased buying pressure in this region. The support wall at $38,5000 has demonstrated resilience thus far, and its performance will be closely observed.

If the support wall fails to hold, the market will observe how the $37,800 price level performs and whether it aligns with the analyst’s thesis.

Featured image from Shutterstock, chart from TradingView.com