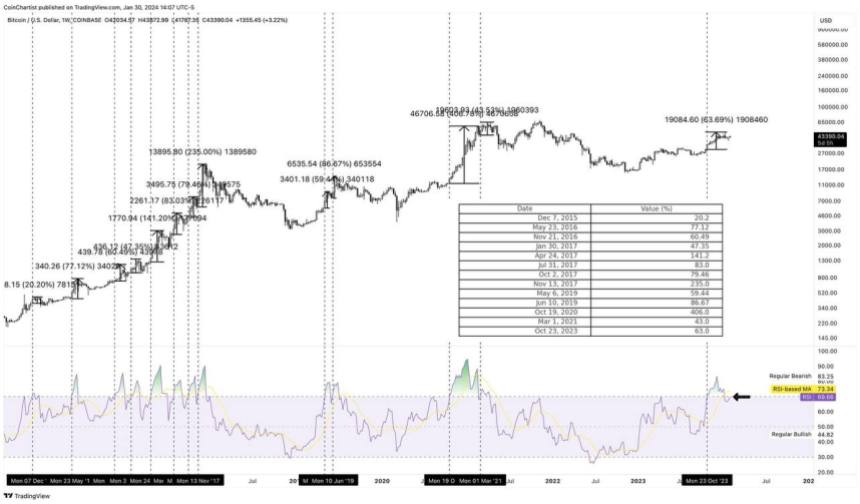

Using historical and future Bitcoin halving events, the Bitcoin Stock to Flow (S2F) live data chart model has pointed toward a BTC surge to unprecedented highs during the 2028 to 2032 halvings.

Bitcoin To Hit $5 Million After 2028 Halving

Crypto analyst Bit Harington recently shared insights in a post on X (formerly Twitter) about the potential surges in the price of Bitcoin during the next halving stages. Using data from the Bitcoin S2F chart, Harington predicted the price of Bitcoin would reach $500,000 by the fourth halving, which is taking place in April.

His predictions were based on the distinctive trend observed in BTC’s price, where the first to third halving phases exhibited a consistent 10x price increase for each successive halving.

Responding to the post, the creator of the S2F model, Plan B, made a bold prediction, suggesting that the average price of Bitcoin during the 2028 and 2032 halving events could potentially reach an impressive $5 million.

The cryptocurrency has consistently experienced bullish rallies following each halving event, from the first Bitcoin halving in November 2012 to the third in May 2020. Due to this, many investors and crypto analysts foresee a similar surge in BTC’s price during 2024 halving.

These expectations could be attributed to the events that typically occur during a Bitcoin halving event. In each halving phase, BTC mining rewards are cut in half, and the supply of the token is reduced, thereby inducing scarcity and increasing the token’s value.

While these price projections about Bitcoin are made to keep investors alert, it’s important to note that they remain speculations, and models like S2F can be subject to wide margins of error.

Analyst Reveals Key Factors To Consider In 2024 Halving

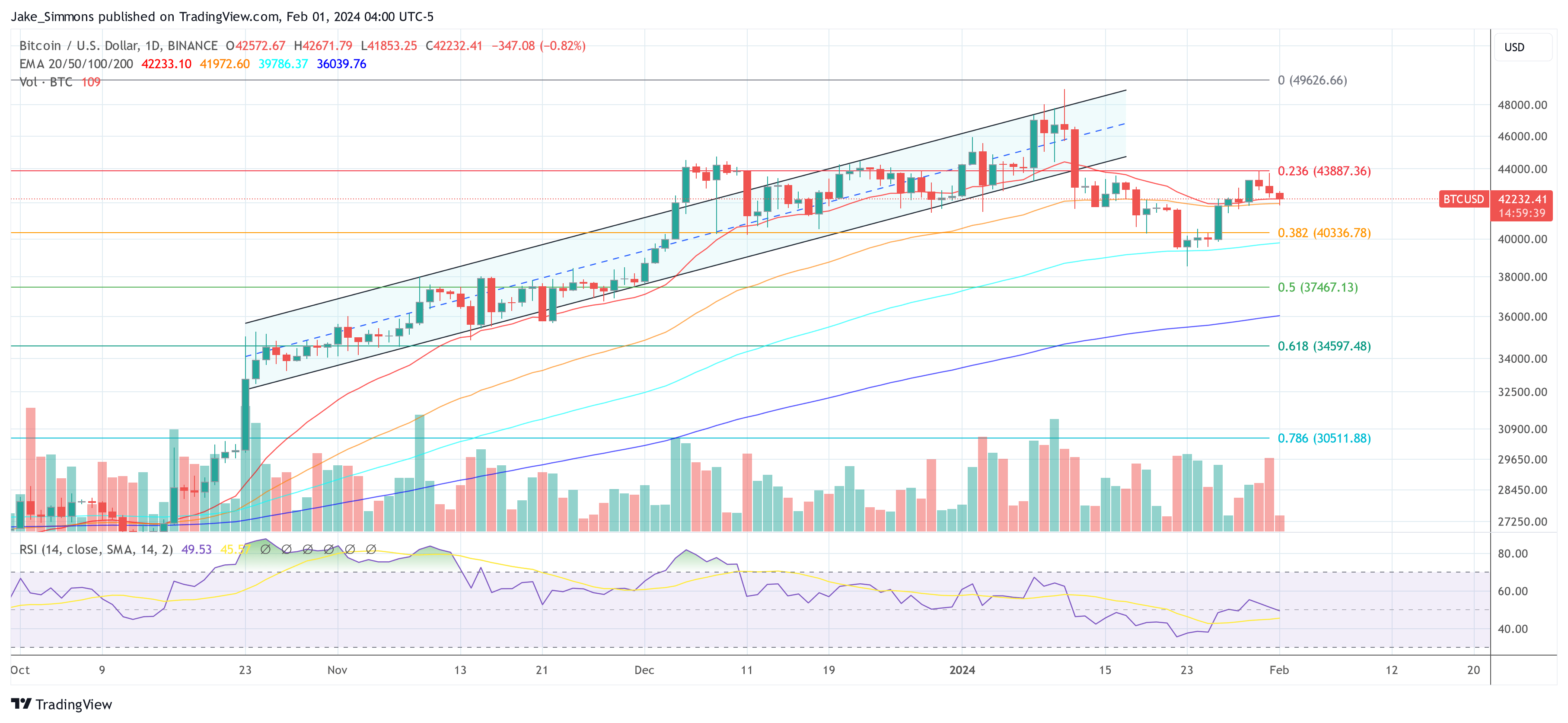

Another crypto analyst, Ali Martinez, has disclosed four crucial factors to keep in mind as the 2024 April Bitcoin halving approaches. Martinez highlighted the significance of the post-halving price corrections in the 2016 and 2020 Bitcoin halving, emphasizing that BTC declined by 30% to 70% within a month after the halving phases.

He also mentioned BTC’s post-halving rallies, where the cryptocurrency experienced significant surges to 700%, 2,850%, and 11,000%, respectively, during the 2012, 2016, and 2020 halving events. The crypto analyst delved into bull market durations after each halving, which lasted about a year or more.

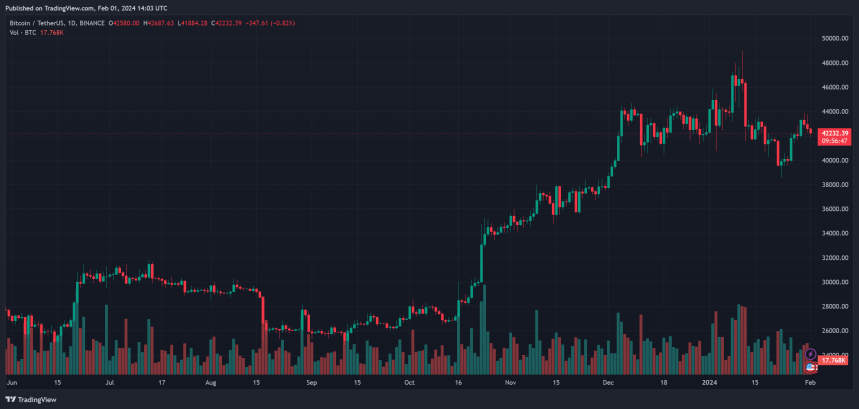

He concluded his analysis by predicting that the next Bitcoin market top would occur around April or October 2025. At the time of writing, the price of BTC was $42,110, according to CoinMarketCap.