Renowned finance author Robert Kiyosaki has once again made a bullish price prediction for the flagship cryptocurrency, Bitcoin. This time, he predicts that Bitcoin will hit $100,000 and mentions when exactly this will happen.

When Bitcoin Will Hit $100,000

Kiyosaki mentioned in an X (formerly Twitter) post that Bitcoin will hit $100,000 by June 2024. However, he didn’t mention what will propel this massive price surge. The finance expert is known to be a huge advocate of the foremost crypto token and, at different times, given his opinion on its potential.

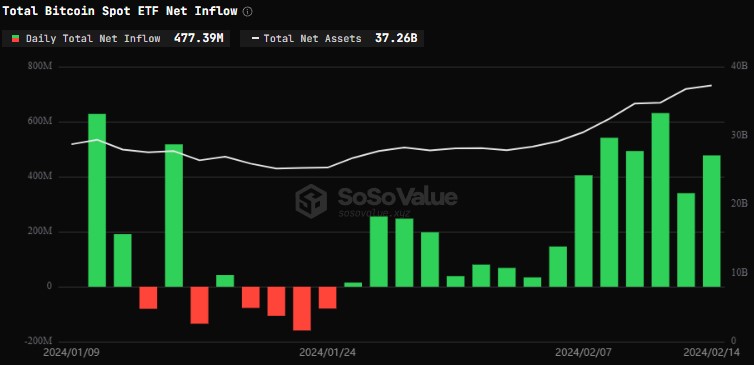

Before now, Kiyosaki, who authored the best-selling book ‘Rich Dad, Poor Dad,’ said that Bitcoin was going to rise to $150,000 and singled out the Spot Bitcoin ETFs as what would drive this parabolic move. He had also once identified the Bitcoin Halving as being pivotal for BTC’s growth.

Interestingly, the author is believed to be a ‘crypto OG’ as he previously shared his excitement about investing in BTC “years ago.” He also continues to urge others to do the same, claiming that it is the way to avoid becoming poorer due to the actions of the government. Kiyosaki doesn’t shy away from criticizing the government and recently went as far as branding the Federal Reserve “a criminal organization.”

According to him, the “Fed has destroyed the economy, made the poor and middle class poorer, and bailed out their rich banking friends.” Instead of trusting the Fed (possibly to fight inflation), Kiyosaki stated that he would rather put his trust in Bitcoin and other assets like Gold and Silver.

BTC Will Hit $100,000 But How Soon?

There seems to be a consensus among several crypto analysts that Bitcoin will no doubt hit $100,000 in the next bull run. However, the ultimate question remains when exactly this will happen. Just like Kiyosaki, crypto analyst Kevin Svenson believes that this price level isn’t far off.

Tom Dunleavy, Partner and Chief Investment Officer (CIO) at MV Capital, also predicted that Bitcoin will hit $100,000 this year, although he didn’t give a more precise timeframe like Kiyosaki. While some predictions remain devoid of a specific timeframe, the belief is that this parabolic price surge will happen after Bitcoin Halving.

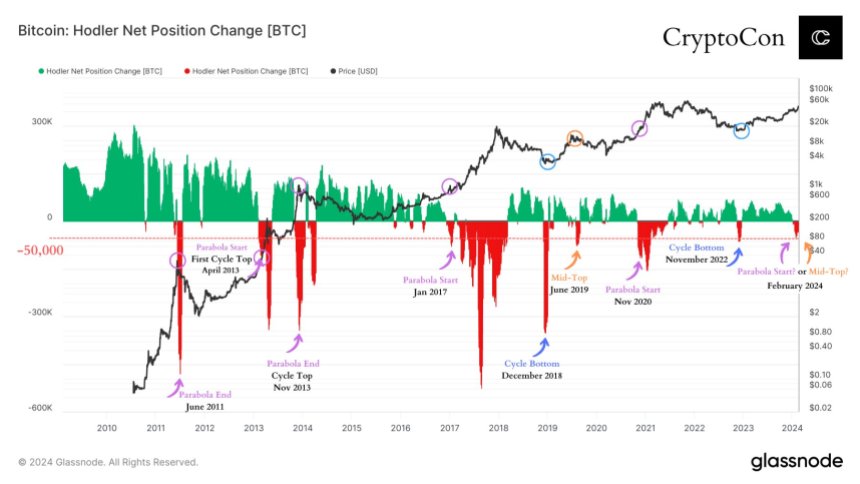

The Halving event has been projected to be what kickstarts the next bull run. That isn’t surprising, considering that Bitcoin is known to claim a new all-time high (ATH) after miners’ rewards are cut in half. One of the most bullish post-halving price predictions is Anthony Scaramucci’s prediction that BTC will hit $170,000 in 2025.

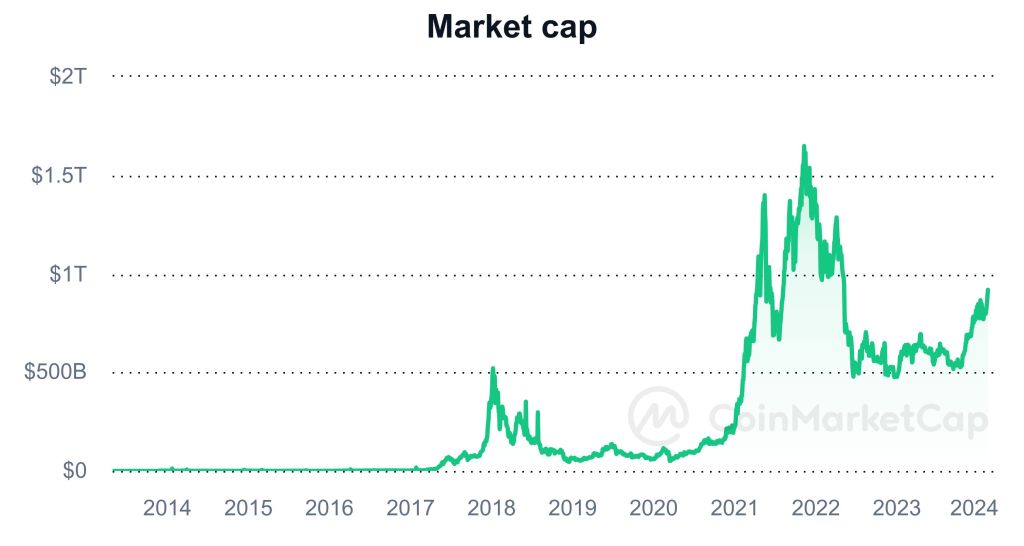

At the time of writing, Bitcoin was trading at around $52,300, up over 1% in the last 24 hours, according to data from CoinMarketCap.

Independent from the impressive volume happening with

Independent from the impressive volume happening with  1K-10K

1K-10K  100-1K

100-1K