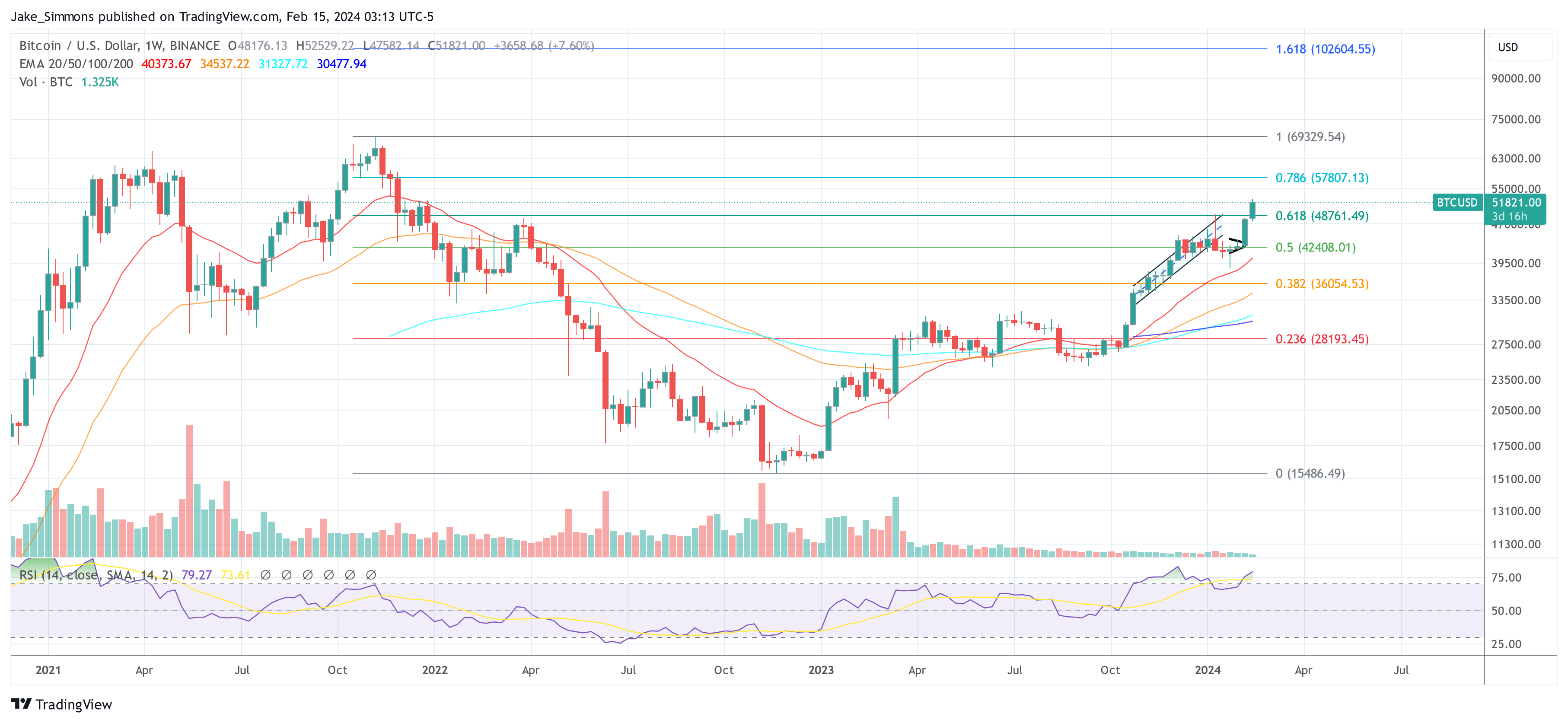

According to a recent report from Spot On Chain, Bitcoin might be on the edge of a notable plunge. So far, the flagship cryptocurrency has recently broken through the $52,000 mark and traded above it for the first time since December 2021.

However, Spot On Chain reveals that Bitcoin faces potential challenges that could affect its immediate market performance. Two significant sell-off events loom on the horizon, potentially influencing Bitcoin’s price dynamics in the short term.

These developments have sparked speculation, prompting a closer examination of their possible impacts on the cryptocurrency market.

Major Bitcoin Sell-Off Events On The Horizon

The first of these events involves Genesis, a prominent crypto asset manager authorized to offload a significant portion of its Grayscale Bitcoin Trust (GBTC) shares. The second event is marked by the US government’s announcement to sell some of its Bitcoin holdings acquired from the Silk Road platform.

Genesis has received approval to sell 35 million GBTC shares, estimated to be worth around $1.3 billion. This occurrence mirrors an earlier liquidation event involving FTX, which notably impacted Bitcoin’s market price, illustrating the potential volatility such moves can introduce.

It is worth noting that the upcoming Genesis sell-off represents a significant moment for Bitcoin, as it tests the resilience of its recent price gains against the backdrop of large-scale disposals.

The #Bitcoin price has been on the rise for the past 7 days and finally broke the $52K mark again after 2 years!

However, there are two impending big threats to the short-term $BTC price. Can it overcome?

1. #Genesis was approved to sell 35M Grayscale Bitcoin Trust shares… pic.twitter.com/Qn7wbQXaDa

— Spot On Chain (@spotonchain) February 15, 2024

The US government’s decision to auction off 2,875 BTC, valued at $150.6 million, adds to the market’s cautious outlook. With the government holding one of the largest Bitcoin reserves globally, its actions have a marked influence on market perceptions and the cryptocurrency’s price stability.

Spot On Chain highlighted historical instances, such as the sale of 8.2K BTC through Coinbase, which have shown that government sell-offs can temporarily lead to fluctuations in Bitcoin’s price.

Optimism Amid Uncertainty

Despite these concerns, certain segments of the crypto community view these events as minor hurdles in the broader trajectory of Bitcoin’s growth.

Non event… ETFs buying in 300-500m a day lol

— Cryptamurai

I County Capital (@cryptamurai) February 15, 2024

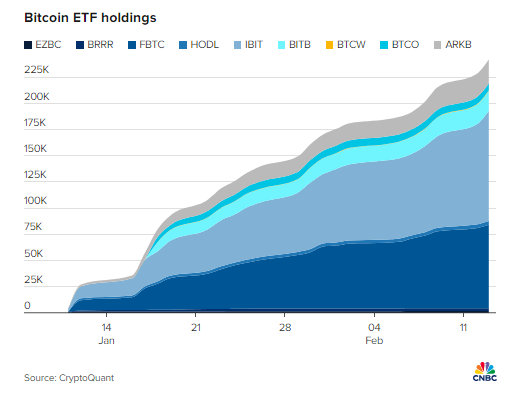

Notably, the increasing involvement of Bitcoin spot exchange-traded funds (ETFs) in the Bitcoin market suggests a growing institutional interest that could offset the effects of the sell-offs.

CryptoQuant has recently highlighted that roughly 75% of new investments into Bitcoin are coming from spot ETFs. This is quite evident as BitMex research reported that the Bitcoin spot ETF market saw an inflow of over $340 million yesterday.

Bitcoin Spot ETF Flow – 14th Feb 2024

All data in. Another strong day, with +$340m net flow for all the Bitcoin ETFs pic.twitter.com/xy7t1hGhyw

— BitMEX Research (@BitMEXResearch) February 15, 2024

Featured image from Unsplash, Chart from TradingView